The year 2024 has witnessed a breakneck pace of IPOs, indicating a thriving and dynamic market. In the first quarter, 21 companies raised nearly INR 15,500 crore through initial public offerings (IPOs).

This represents a significant increase over the same period last year when only four companies went public and raised INR 10,000 crore. To put this in perspective, only three companies collected INR 7,400 crore between January and March 2022.

Investors have seen an average listing gain of approximately 26% for IPOs this year. This is a slight decrease from 28% in 2023 but a significant improvement over the 10% increase in 2022. If this trend continues, 2024 is on. With the travel tech behemoth ready to hit the IPO floors, we have a few critical insights to consider before securing your share of the Ixigo IPO.

From comprehending the company’s innovative approach to decoding its financial foothold, these points will guide you through the complexities of the Ixigo IPO.

Le Travenues Technology IPO (Ixigo IPO) Details

Last year, Le Travenues Technology IPO (Ixigo IPO) filed for its IPO, which comprised new shares worth Rs. 750 Crores and an Offer for Sale (OFS) worth Rs. 850 Crores. However, the company did not proceed with the IPO despite SEBI approval.

According to the latest draft red herring prospectus (DRHP) submitted on February 14, ’24, the IPO comprises a combination of fresh issuance of shares valued at ₹120 crores and an offer-for-sale (OFS) of 6,66,77,674 equity shares by existing shareholders.

| IPO Status | Approved |

| IPO Date | 10 -12th June, 2024 |

| Total IPO Size | ₹740.10 Cr |

| No. of Shares for IPO | 79,580,900 shares |

| Issue Price Band | ₹88 to ₹93 per share |

| Lot size | 161 Shares |

| IPO listing at | BSE and NSE |

| Face Value per Equity Share | Rs. 1/- |

| Issue Type | Book Built |

| Listing At | BSE, NSE |

| IPO Lead Managers | • DAM Capital Advisors Ltd • Axis Capital Limited • JM Financial Limited |

Category-wise Shares Offered

| Category | % Offered |

| Qualified Institutional Investors | Min: 75 % |

| Non-Institutional Investors | Min: 15% |

| Retail Investors | Max: 10% |

The Objective of Launching Le Travenues Technology (Ixigo) IPO

The leading travel aggregator company is launching Le Traveneus Technology (Ixigo) IPO with the following significant objectives-

- Capital for Growth: To secure funds that are crucial for ixigo’s expansion and growth strategies.

- Working Capital: An allocation of ₹45 Crore is earmarked to bolster the company’s working capital.

- Technology and Infrastructure: To invest ₹25.8 Crore in enhancing cloud infrastructure and technology to support the growing user base and service offerings.

- Strategic Acquisitions: The remaining funds raised from the IPO will be utilized for inorganic growth through acquisitions, other strategic initiatives, and general corporate purposes.

Also Read: What is Paid Up Capital?

About the Company Launching the Le Travenues Technology IPO (Ixigo IPO)

La Travenues Technology, widely recognized as Ixigo, is at the forefront of the travel industry. It revolutionized how Indian travelers plan, book, and manage their journeys. This Gurgaon-based company was incorporated on June 3, 2006, with an authorized share capital of INR 50.17 crore and a strong paid-up capital of INR 37.30 crore.

The company’s EBITDA increased by 101.30% over the previous year, while its book net worth increased by 5.43%. Ixigo’s service offerings combine traditional travel assistance with cutting-edge technology.

The company offers a comprehensive mobile and online trip-planning platform where customers can book the best deals on flights, hotels, buses, taxis, trains, and travel packages to domestic and international destinations.

Ixigo’s growth is driven by its commitment to leveraging artificial intelligence (AI), machine learning, and data science. These technological advancements enable travelers to make better decisions, providing a more seamless and personalized experience.

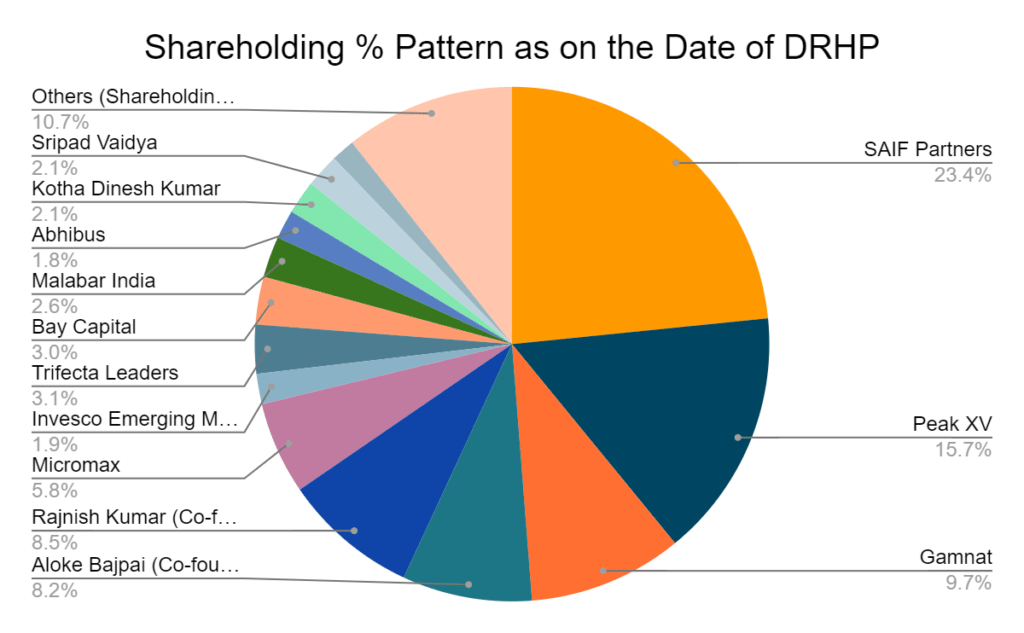

Shareholding Pattern

Le Travenues Technology (Ixigo) is a professionally managed company with no promoters and is entirely owned by the public.

OTA Competitive Analysis of Le Travenues Technology IPO (Ixigo)

The Indian OTA industry is highly competitive, and any dynamic shift could impact Le Travenues Technology (Ixigo) IPO. The major competitors in the domestic OTA market include Make MyTrip Ltd, Yatra Online, Clear Trip, and Easy Trip Planners Ltd.

Indian OTA Players’ Key Metrics for FY 2023

| SR. No. | Key Performance Indicators | Ixigo | Easy Trip Planners | Yatra Online |

| 1 | Monthly Active Users ((mn)) | 62.83 | NA | NA |

| 2 | Gross Transaction Value (Rs in mn) | 74,524.30 | NA | NA |

| 3 | Revenue from Operations (Rs in mn) | 5,012.50 | 4,488.26 | 3,801.60 |

| 4 | EBITDA (Rs in mn) | 450.45 | 1,913.00 | 510.88 |

- Ixigo secured its position among the top five B2C airline online travel agencies (OTAs) in the fiscal year 2023.

- The number of passengers choosing ixigo witnessed a remarkable surge, climbing from 1.42 million in the first half of fiscal 2023 to 2.94 million in the same period of fiscal 2024, marking an impressive 107% increase.

- In the first half of FY24, ixigo captured approximately 5.2% of India’s total airline OTA market by volume, a significant rise from its 3.3% market share in the previous fiscal year.

Source: DRHP, Sebi Website

- The company’s market share within the OTA rail market in India expanded from 46.4% in H1Fiscal 2023 to 52.4% in H1Fiscal 2024.

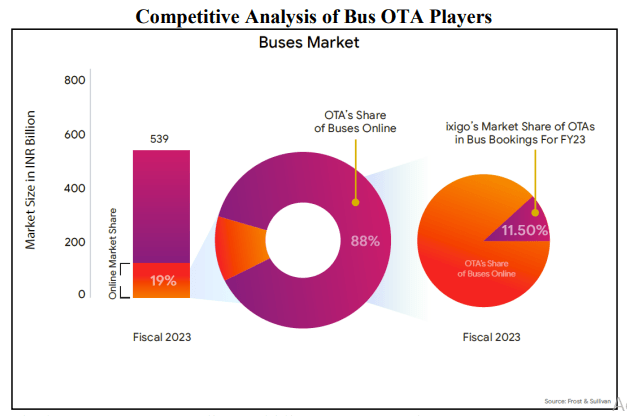

Le Travenues IPO: Competitive Analysis of Buses OTA Players

- Ixigo reported a 28% jump in bus ticket bookings, reaching 6.27 million in H1 Fiscal 2024 from 4.91 million in H1 Fiscal 2023.

- In H1Fiscal 2024, RedBus, now part of GoIbibo, dominated India’s online bus market with a 75% share, while Ixigo held a 12.5% share as of Fiscal 2023.

- AbhiBus, Ixigo’s bus division, is the second-largest player with an 11.5% market share in India’s OTA rail market as of Fiscal 2023. It aggregates services from over 2,000 private operators and State RTCs and covers more than 100,000 routes nationwide as of December 31, 2023.

Subsidiaries

As of the date of filing DRHP, the company floating the Le Travenues Technology IPO has three subsidiaries-

| Name of the Subsidiary | Year of Acquisition | Shareholding |

| Freshbus Pvt Ltd (Associate) | August 2021 | 41.40% |

| Ixigo Europe | 28th June 2021 | 100% |

| Freshbus Pvt. Ltd | August 2021 | 41.40% |

Financial Analysis of Le Travenues Technology (Ixigo) IPO Company

- Total assets increased from 1850.71 mn in 2021 to 5384.71mn in FY 2022 to 5,859.25 million in FY23.

- The profit after tax (PAT) in 2021, 2022, and 2023 were 75.33 mn, -210.94 million, and 233.96 mn, respectively.

- Adjusted Earnings before interest, taxes, depreciation, and amortization (EBITDA) degree from 82.10 mn in FY21 to 62 mn in FY22 and later increasing to 443.45 mn in FY23.

(Amounts in Rs. Mn)

| FY 2021 | FY 2022 | FY 2023 | |

| Revenue from operations | 1355.66 | 3795.8 | 5175.53 |

| Other Income | 28.40 | 53.61 | 156.23 |

| Gross Transaction Value | 21,532.97 | 56,152.49 | 74,524.30 |

| Profit after Tax (PAT) | 75.33 | 210.94 | 233.96 |

| Net Worth | 299.38 | 3426.86 | 3737.64 |

| Debt-to-Equity Ratio(%) | 7.81 | 12.53 | 7.81 |

SWOT Analysis of Le Travenues Technology (Ixigo) IPO

Strengths

- Innovative Technology: Use of AI and machine learning for personalized experiences.

- Strong Brand Presence: Ixigo is a rare, profitable tech startup in the online travel sector, having reported a net profit of ₹65 crores in Q3 of 2024.

- Financial Growth: Robust revenue generation that grew by 34.78% between 2022 and 2023.

Weakness

- Market Competition: Intense rivalry from established players like MakeMyTrip and Yatra.

- Dependence on Third Parties: Relies on other service providers for travel inventory.

- Operational Risks: Subject to fluctuations in travel industry dynamics.

Opportunities

- Market Expansion: The company has a strong foothold in the rail and bus segments, commanding a >52% market share in IRCTC bookings and a 12.5% market share in bus ticketing by H1 2024.

- Diversification: Ability to expand service offerings beyond travel bookings.

- Strategic Partnerships: Collaborations with companies like AbhiBus and Confirmtkt could enhance service quality.

Threats

Regulatory Changes: Sensitive to alterations in travel and internet regulations.

Technological Disruptions: Risk of being outpaced by new tech innovations.

Economic Downturns: Vulnerable to economic factors affecting travel frequency.

The Bottom Line

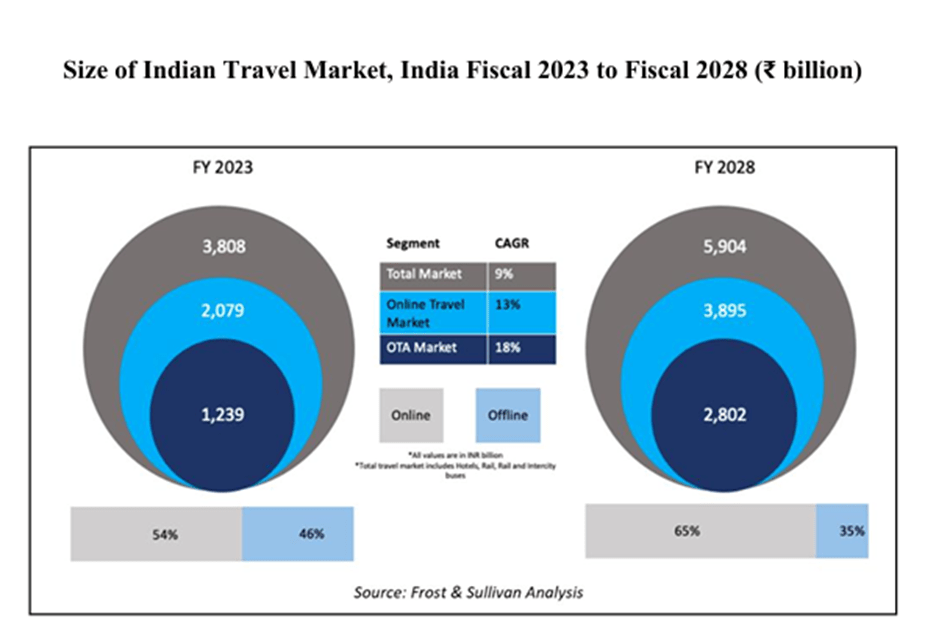

The travel sector is projected to expand at a rate of 9% between fiscal years 2024 and 2028. However, the online travel market is anticipated to outpace this with a 13% growth rate.

The year 2024 has been bustling with a deluge of IPO listings, but it presents an interesting view for smart investors. Eight of the top ten IPOs with a market capitalization of less than INR 5,000 crore point to the importance of meticulous scrutiny beyond initial listing gains. Initial gains may be inviting but not always indicative of long-term value.

You must investigate the company’s valuation, growth strategy, competitive positioning, and market dynamics. You must also assess whether Ixigo’s business model is long-term sustainable, scalable, and able to withstand market volatility. Predicting whether the Le Travenues Technology (ixigo) IPO will work is difficult, but you must do your due diligence before you decide.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What technological innovations set Ixigo apart in the OTA market?

Ixigo differentiates itself by using AI, machine learning, and data analytics to provide personalized travel experiences, which resonates well with the tech-savvy demographic.

What is the difference between a fixed-price IPO and a book-built IPO?

In a fixed-price IPO, the company sets the share price in advance, while in a book-built IPO, the final price is determined after gauging investor demand.

What is a lock-in period in an IPO?

A lock-in period is a contractual timeframe post-IPO during which major shareholders are prohibited from selling their shares, typically lasting 90 to 180 days.

How do I know if an IPO is successful?

An IPO is considered successful if the shares are fully subscribed, the stock trades above the IPO price after listing, and the company meets its capital-raising goal.

Read more: About Equentis – Research and Ranking.

How useful was this post?

Click on a star to rate it!

Average rating 3.6 / 5. Vote count: 11

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

- Archana Chettiar