This week continued the last week’s gains of the primary market indices, with NIFTY50 and SENSEX closing green on Monday. Joining this rally was a steel stock that rose 13% after announcing the conversion of preferential shares. This steel stock, Rathi Steel & Power Limited, also became a multi-bagger, gaining around 750% in the last five years. What fueled the price rise over the years and on Monday? Let’s understand.

Rathi Steel & Power Limited Overview:

Rathi Steel & Power Limited has been a prominent name in the Indian steel industry for over six decades. It is a part of the P.C. Rathi Group. The company has consistently focused on innovation and quality. It was among the first in North India to produce TMT bars using Thermex Technology. It played a major role in introducing CTD reinforcement rebars, improving efficiency in the construction sector.

The company has manufacturing facilities capable of producing around 2 lakh TPA of rolled products and approximately 85,000 TPA of melting capacity, and it serves both retail and industrial markets. Its latest innovation, Stainless Steel Rebars (RU SS Rebars), is designed to replace traditional MS TMT rebars, addressing durability concerns in construction. Rathi Steel markets its products under the RATHI brand and has a strong distribution network with 1,000 retail outlets across Northern India.

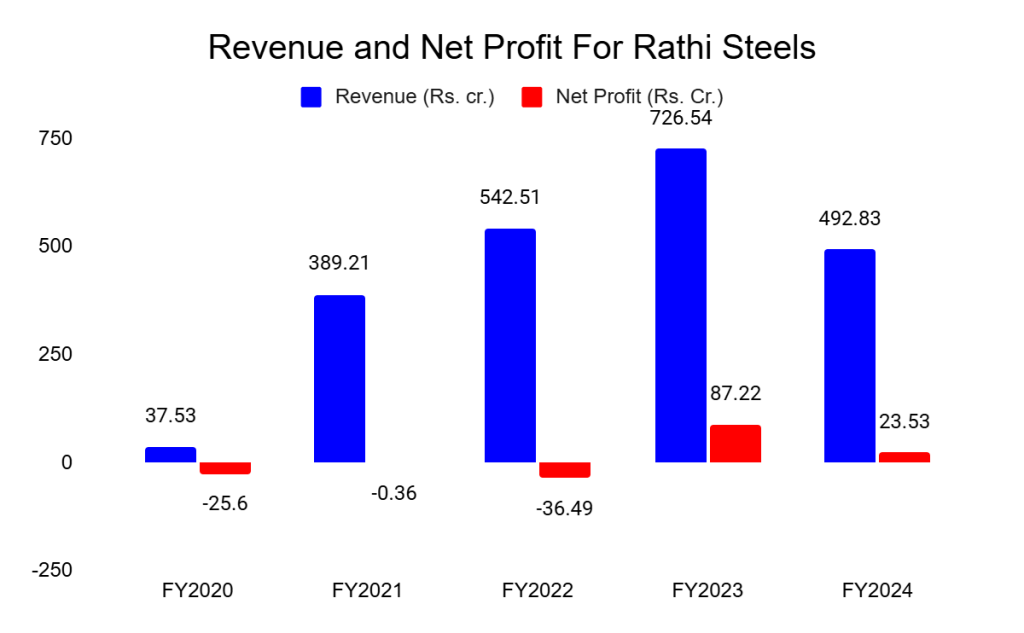

The company’s FY2024 revenue stood at Rs.492.82 crore, lower than the FY2023 figures. The net profit ratio has dropped from 0.12 in FY2023 to 0.05 in FY2024. However, the debt-equity ratio improved in FY2024, reducing from 3.19 in FY2023 to zero. Additionally, in the third quarter of FY2025, the company recorded an improvement in its quarterly net sales that increased 3.17% y-o-y and reached Rs.104.43.

The stock became a multibagger that recorded a gain of around 750% over the past five years due to the following reasons-

- Strong Financial Recovery:

Over the past five years, the company shifted from a net loss of Rs.25.6 crore in FY2020 to reporting a profit of Rs.87.22 crore in FY2023. Although profitability declined to Rs.23.53 crore in FY2024, the overall financial trajectory has significantly improved. Revenue also grew substantially, increasing from Rs.37.53 crore in FY2020 to Rs.726.54 crore in FY2023 before adjusting to Rs.492.83 crore in FY2024.

- Debt-Free Status:

A significant milestone for the company has been its transition to a debt-free status in FY2024. Reducing total debt to zero has helped lower interest expenses and financial liabilities, potentially directing more capital toward business operations and expansion. Generally, companies with minimal or no debt are often considered financially stable, which can impact investor sentiment.

- Market Revaluation Post Trading Suspension:

From December 2018 to July 2023, Rathi Steel was suspended from trading due to non-compliance with financial disclosure regulations. Once trading resumed on 3rd July 2023, the stock experienced renewed interest, leading to a significant revaluation. The relisting coincided with improvements in the company’s financial performance, contributing to changes in market perception and subsequent price movements.

Recent Share Price Changes:

On 24th March 2025, the share price jumped around 13% following the announcement that the company is converting its preferential shares, taking the total gains of the stock to 24.84% over the past five market sessions.

Preferential shares are a type of equity often with specific rights, such as fixed dividends, and are typically issued to select investors, including promoters. When these shares are converted into regular equity shares, the new shares become part of the company’s outstanding share capital, which can impact ownership structure, liquidity, and stock price movements.

The impact of preferential share conversion varies. If promoters convert their preference shares into equity at a price significantly higher than the market rate, it may indicate long-term confidence in the company. On the other hand, such conversions also increase the total number of outstanding shares, which could influence factors like earnings per share (EPS) and overall market supply.

In Rathi Steel & Power’s case, the conversion price was Rs.55 per equity share, allotted to PCR Holdings, an entity owned by the company’s promoters. This transaction resulted in an increase in the company’s paid-up equity share capital, which rose to Rs.86,36,30,040 (Rs.86.36 crore), now divided into 8,63,63,004 (8.63 crore) equity shares with a face value of Rs.10 each. Following this corporate action, the stock price increased by 13.82% the next trading day.

What It Means for Investors?

Rathi Steel & Power’s financial recovery, debt-free status, and preferential share conversion have influenced its stock movements. A debt-free balance sheet reduces financial risk, while a share conversion at a premium price signals promoter confidence, which can impact market sentiment. If you’re evaluating the stock, consider these factors, along with industry trends, future earnings potential, and broader market conditions, before making any investment decisions.

Bottomline:

While past performance has been strong, it is suggested that you evaluate future growth potential, industry trends, and market conditions before making investment decisions. Monitoring financial results and corporate actions will be important in assessing the company’s long-term trajectory.

Related Posts

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

- Archana Chettiar