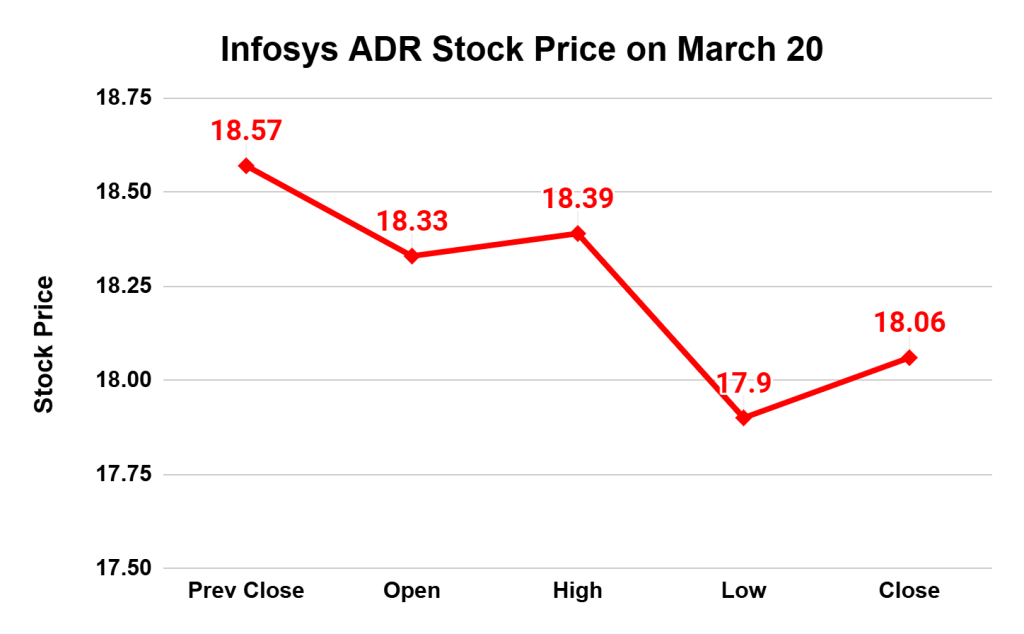

If you’ve been watching the IT sector, you might have noticed a sudden drop in Infosys and Wipro’s stock performance on the New York Stock Exchange (NYSE). On March 20, 2025, the American Depository Receipts (ADRs) of Infosys fell by 3.6% to $17.9, while Wipro’s ADRs dropped by 3.2% to $2.97. This came right after Accenture released its second-quarter earnings and raised the lower end of its full-year revenue forecast, expecting growth between 5% and 7%, up from the earlier 4% to 7% range. Source: Economic Times

So, what exactly happened, and why did Infosys and Wipro’s ADRs take a hit despite Accenture’s optimistic forecast? Let’s break it down step by step.

What is an ADR, and Why Does It Matter?

Before we dive into the details, let’s clarify what ADRs are. American Depository Receipts (ADRs) allow foreign companies to trade their shares on U.S. stock exchanges. Instead of buying shares directly from Infosys or Wipro on the Indian stock market, U.S. investors can purchase ADRs, representing a specific number of shares in the company. This allows global investors to trade these stocks without dealing with foreign exchanges.

Since Infosys and Wipro are major players in the Indian IT industry with significant business in the U.S., analysts and investors worldwide watch their ADR performance closely.

Accenture’s Earnings Report: The Key Trigger

Accenture, one of the biggest IT services firms globally, released its second-quarter earnings report, showing signs of steady growth. The company raised its full-year revenue forecast, expecting annual growth of 5% to 7%, citing strong demand for AI-powered tools and cloud migration services.

However, market expectations were slightly higher. Analysts had anticipated a more optimistic forecast, closer to 5.7%, and Accenture’s slightly conservative guidance triggered a ripple effect in the IT sector.

Some key takeaways from Accenture’s Q2 earnings report:

- Revenue: Reported at $16.66 billion, slightly above estimates of $16.62 billion.

- New bookings: Declined 3% to $20.9 billion, raising concerns about future revenue streams.

- Consulting services revenue: Stood at $8.3 billion, falling short of the expected $8.54 billion.

Despite these numbers showing overall stability, the market’s reaction was mixed. The report signaled a robust demand for AI-driven solutions and hinted at macroeconomic uncertainties affecting IT spending. Source: The Mint

Know More: SEBI Registered Investment Advisory | Stock Investment Advisory

Why Did Infosys and Wipro ADRs Decline?

Now, you might be wondering—if Accenture is reporting solid demand for AI-led digital transformation, why did Infosys and Wipro’s ADRs drop?

The answer lies in competition and investor sentiment. Accenture’s earnings reports are often viewed as an industry barometer, especially for Indian IT firms that derive a large chunk of their revenue from global IT services. With Accenture aggressively expanding its AI-driven service offerings and securing major deals in banking, telecom, and other industries, investors may have felt that Infosys and Wipro could face stiffer competition in securing future contracts.

This cautious outlook led to a sell-off in Infosys and Wipro’s ADRs, even though their performance in the Indian stock market remained stable. On the Bombay Stock Exchange (BSE), Infosys closed 1.74% higher at ₹1,614.15, while Wipro ended 0.83% up at ₹267.95. Source: Economic Times

How the Broader Market Reacted

Accenture’s earnings didn’t just impact Infosys and Wipro. The broader IT sector felt the effects as well:

- The Nifty IT index closed at 36,676.65, up 1.25%, indicating that the domestic market still had confidence in the sector.

- The Nasdaq Composite was trading at 17,830, reflecting a generally positive sentiment in the U.S. tech sector.

- Indian benchmark indices, however, opened lower on March 21, 2025, as IT stocks faced pressure, with major players like Tata Consultancy Services (TCS), Wipro, HCL Technologies, and Infosys seeing a decline of 1.5% to 2.5%.

What’s Next for Indian IT Firms?

While the immediate reaction to Accenture’s report led to a sell-off in Infosys and Wipro’s ADRs, the bigger picture remains dynamic. Indian IT giants now face both challenges and opportunities in this evolving landscape.

- AI and Digital Transformation: The IT industry is shifting toward AI-driven solutions. Infosys and Wipro must double down on AI investments to stay competitive.

- Diversifying Revenue Streams: Companies will likely focus on expanding their offerings beyond traditional IT services, including cloud security, data analytics, and industry-specific AI solutions.

- Global Partnerships: Like Accenture, Indian IT firms may strengthen partnerships with banks, telecom companies, and large enterprises to secure long-term projects.

Conclusion

The market’s reaction to Accenture’s earnings shows how connected global IT firms are. While Infosys and Wipro’s ADRs faced a temporary dip, it’s important to see this in the larger context of shifting industry trends. With AI and digital transformation reshaping the sector, Indian IT companies must adapt quickly to maintain their market position.

For investors and industry watchers, the next earnings season—starting in April with Tata Consultancy Services (TCS)—will clarify where the Indian IT sector is headed in this competitive global environment.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

- Archana Chettiar