When you slip into stylish international brand footwear, you might assume they come straight from some of the world’s most developed countries. But here’s a surprise—many of these brands are manufactured in the remote villages of Tamil Nadu.

Tamil Nadu has become a global powerhouse in footwear manufacturing, producing for top brands like Nike, Puma, Crocs, and Adidas. Interestingly, non-leather footwear now makes up 86% of global footwear demand. Recognizing this shift, foreign manufacturers are pouring ₹17,550 crore into the state, a move expected to generate around 2.3 lakh jobs.

These once-quiet villages are now bustling with factories and job opportunities. But this transformation didn’t happen overnight—it took years of policy changes, strategic planning, and relentless efforts to position Tamil Nadu as a key player in non-leather footwear manufacturing. Source: LiveMint

Today, international investors are placing their confidence in Tamil Nadu, reshaping its industrial landscape and creating employment at an unprecedented scale. But how did the state achieve this remarkable turnaround? Let’s dive into the journey.

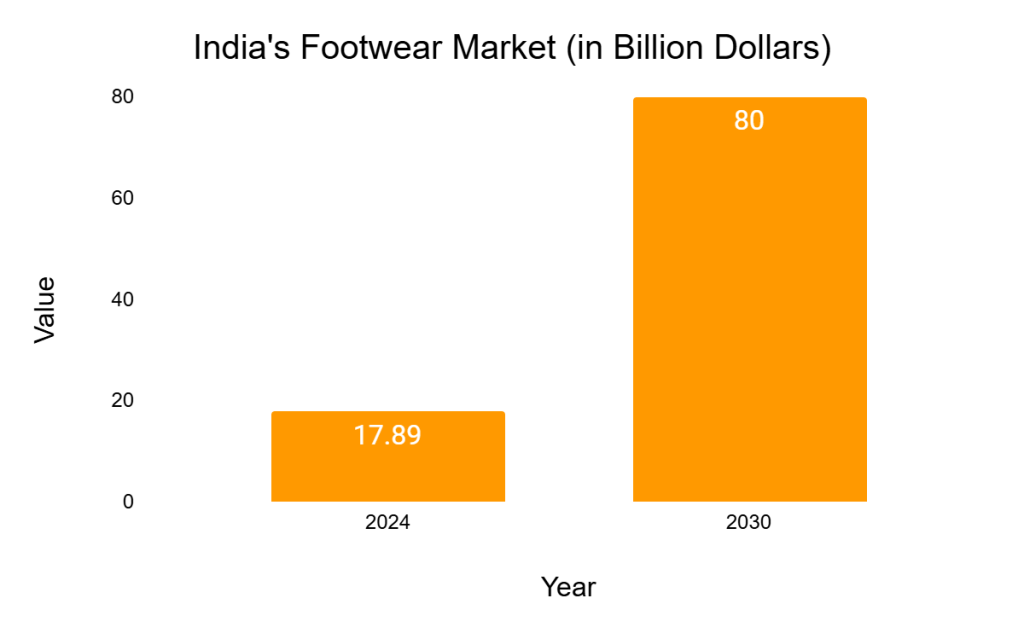

India’s Footwear Market

Before exploring the details, let’s examine the global and domestic footwear industry. India is the second-largest footwear producer, accounting for 13% of global production. China remains the leader, commanding a dominant 67% market share.

In 2024, India’s footwear market was valued at $17.89 billion and could reach $80 billion by 2030. This expansion could generate over 3 million job opportunities and significantly boost entrepreneurs in the SME sector.

The Indian footwear market is primarily driven by casual footwear, which accounts for nearly two-thirds of total retail sales. Men’s footwear dominates the market, contributing around 58% of retail sales. Additionally, non-leather footwear holds a significant share, making up approximately 1.23 billion pairs, or 56% of the overall market.

Source: CFLA.co.in/maximizemarketresearch

Why Tamil Nadu is Focused on Non-Leather Footwear

Tamil Nadu has long been known for its leather exports, accounting for 47% of India’s leather trade. However, global trends are shifting towards non-leather footwear, which makes up 86% of worldwide shoe consumption. Recognizing this opportunity, the state government pivoted towards synthetic footwear production. Source: LiveMint

Tamil Nadu’s Minister for Industries, Investment Promotion, and Commerce highlights that the non-leather footwear sector strikes the right balance—it demands minimal technical skills while creating widespread employment. This makes it a perfect opportunity for rural areas where jobs are limited.

Foreign manufacturers are responding positively, with major companies setting up facilities in the state. The influx of investment is expected to create 2.3 lakh jobs, reinforcing Tamil Nadu’s role in India’s ‘China+1’ strategy (The China+1 strategy is a business approach where companies diversify their manufacturing and supply chain operations by setting up production in countries other than China, while still maintaining a presence there).

Know More: SEBI Registered Investment Advisory | Stock Investment Advisory

Tamil Nadu Attracts Major Investments

Several global contract manufacturers have already begun operations in Tamil Nadu or are in various stages of setting up their units. Some of the key players include:

- JR One Kothari Footwear Pvt. Ltd.: A joint venture between Kothari Industrial Corp. Ltd. (KICL) and Taiwan-based Shoe Town Group. Their Perambalur facility, operational since November 2023, currently employs 2,500 workers (90% women) and has produced 2 million pairs of Crocs. With a planned investment of ₹1,700 crore, the factory aims to generate 15,000 jobs and manufacture 40 million pairs annually.

- KICL-Adidas JV: Another significant investment by KICL and Shoe Town Group, this ₹5,000 crore project near Karur and Eraiyur will create over 50,000 jobs.

- Feng Tay Enterprises: One of Nike’s largest contract manufacturers, Feng Tay set up its first Tamil Nadu factory in 2006 and has since expanded to Bargur and Tindivanam. The company employs over 37,000 workers and produces 25 million pairs of shoes yearly.

- Other Manufacturers: Companies like Pou Chen Group, Hong Fu Industrial Group, and Dean Shoes Company are also establishing their production units. Source: LiveMint

| Top non-leather footwear contract manufacturers in Tamil Nadu | ||

| Company | Location | Status |

| Feng Tay | Cheyyar, Bargur, Tindivanam | In Production |

| Shoe Town | Eraiyur | In Production |

| Karur | Construction Phase | |

| Pau Chan | Kallakurichi | Construction Phase |

| Hong Fu | Ranipet | Construction Phase |

| Dean Shoes | Jeyankondan | Foundation Laid |

Why India Had to Wait

India could have become a global footwear hub 25 years ago, but it wasn’t ready.

In the late 20th century, major global footwear brands had already moved non-leather shoe production to China due to its low wages and abundant labor. By the early 2000s, rising labor costs in China forced manufacturers to look for alternative destinations. This was India’s chance—but it failed to capitalize on it.

Instead, countries like Vietnam, Thailand, Indonesia, and Cambodia benefited as brands expanded their operations there. India’s policymakers remained focused on leather, ignoring the growing market for synthetic footwear. Feng Tay was the only global player to invest in India, but its operations remained small.

Why India is Now an Attractive Destination

A mix of economic and geopolitical factors has presented India with a second chance:

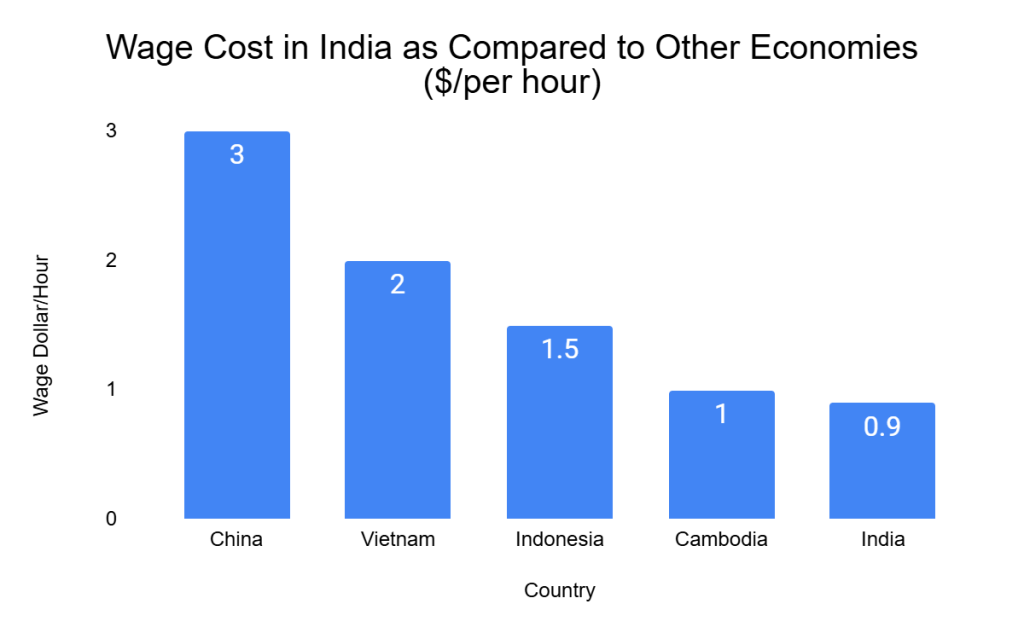

- Rising Wages Elsewhere: The labor cost in China has risen to $3 per hour, compared to $2 in Vietnam, $1.5 in Indonesia, and just 90 cents in India. This makes India highly competitive.

- Disruptions in Supply Chains: The US-China trade war (2017) and the COVID-19 pandemic exposed vulnerabilities in global supply chains. Many companies began diversifying their production, benefiting India.

- Growing Domestic Demand: India’s rising per capita income and evolving consumer preferences have made the country an attractive market for non-leather footwear.

- Proactive State Government: Tamil Nadu was the first to seize the second chance, actively courting foreign investors since 2018 and intensifying efforts post-COVID.

Building the Ecosystem for Growth

Despite its advantages, Tamil Nadu had to work hard to convince foreign companies to invest. Here’s how the state addressed key concerns:

- Land and Infrastructure: Investors wanted large land parcels with easy port access. Tamil Nadu offered locations connected to ports within eight hours, ensuring smooth logistics.

- Workforce Availability: Companies preferred women workers, who were readily available in rural Tamil Nadu. The government provided skill development programs to train them for factory jobs.

- Regulatory Support: To ease concerns over bureaucracy and corruption, the state streamlined approval processes, offering a single-window clearance system for investors.

Why Non-Leather Footwear?

While the state has long been a manufacturing hub for automobiles, textiles, and electronics, industrial growth remained concentrated in select urban centers. The government realized the need to create jobs in less-developed areas, particularly in industries that do not require highly specialized skills. Non-leather footwear emerged as an ideal sector due to:

- Growing Global Demand: Non-leather shoes comprise 86% of global footwear sales.

- Scalability: The industry requires large-scale production, ensuring employment for thousands.

- Lower Skill Barriers: Many roles do not require advanced qualifications, making them accessible to rural workers.

- Export Potential: India’s ‘China+1’ strategy encourages global companies to shift manufacturing operations.

With these factors in mind, the government aggressively promoted the sector, aiming to establish the state as India’s non-leather footwear capital.

Convincing the Investors: A Tough Battle

Despite its strategic advantages, convincing international manufacturers to invest was impossible. Investors had major concerns, such as:

- Workforce Quality: Would local laborers meet global standards?

- Bureaucratic Red Tape: Could they set up operations smoothly?

- Infrastructure Challenges: Was there adequate connectivity and logistics support?

- Cultural Differences: Would foreign companies feel welcomed and supported?

The state government tackled these concerns through a series of policy measures:

- Skilled Workforce Development: Special vocational training programs were introduced to upskill workers.

- Fast-Track Approvals: A single-window clearance system was set up to eliminate bureaucratic delays.

- Infrastructure Investment: Ports, roads, and industrial parks were upgraded to improve connectivity.

- Proactive Investor Support: Dedicated teams were assigned to assist foreign investors in navigating local regulations.

These initiatives paid off, and foreign manufacturers began to take notice.

What Lies Ahead for Tamil Nadu’s Footwear Industry

With major investments flowing in and production ramping up, Tamil Nadu is well on its way to becoming India’s non-leather footwear capital. The sector generates jobs, fostering inclusive growth, uplifting rural communities, and making India a serious competitor in global footwear manufacturing.

As global brands expand in India, Tamil Nadu’s bold vision is turning into reality—one shoe at a time.

Major Investments Pouring In

Several leading non-leather footwear contract manufacturers are now operating in the state. Companies from Taiwan, Vietnam, and China are committing massive investments to establish large-scale production facilities. Some key developments include:

- A Taiwanese manufacturer is investing ₹1,700 crore to build a facility that will employ 15,000 workers and produce 40 million pairs of shoes annually.

- Another global footwear company committing ₹5,000 crore for a joint venture, generating over 50,000 jobs.

- Multiple factories in various stages of development ensure continued growth in the sector. Source: LiveMint

The influx of such large-scale investments is boosting employment and positioning the state as a major export hub for global brands.

What Took India So Long?

Interestingly, India had the opportunity to attract these manufacturers 25 years ago but failed to do so. The global shift in footwear manufacturing began in the late 20th century when companies moved from high-cost regions to low-cost destinations like China, Vietnam, and Indonesia. While India had the labor advantage, it lacked the necessary infrastructure and policy support.

By the time global manufacturers started looking for alternative destinations in the 2000s, India had already lost out to competitors like Thailand and Cambodia. However, rising wages in those countries and geopolitical disruptions such as the U.S.-China trade war and COVID-19 supply chain challenges have given India a second chance.

India’s Competitive Edge Today

India is now an attractive destination for footwear manufacturing due to several key factors:

- Lower Wage Costs: Labor costs in India are 90 cents per hour compared to $3 in China and $2 in Vietnam.

- Growing Domestic Market: Rising per capita income increases demand for footwear in India.

- Government Incentives: Special economic zones and tax benefits are encouraging foreign investment.

- Improved Logistics: Better road networks and port access are facilitating smoother exports.

These advantages have convinced global brands that India is a viable alternative for large-scale footwear production.

Challenges and Opportunities

While the progress is commendable, challenges remain. The state must now focus on:

- Building a Local Ecosystem: Encouraging ancillary industries such as sole and material production to reduce import dependence.

- Enhancing Skill Development: Expanding training programs to create a highly skilled workforce.

- Ensuring Sustainability: Implementing eco-friendly practices to align with global environmental standards.

- Strengthening Global Partnerships: Continuing efforts to attract more international brands and investment.

Conclusion: A Success Story in the Making

The state’s journey to becoming India’s non-leather footwear capital is a story of vision, perseverance, and strategic planning. The transformation has been remarkable, from overcoming investor skepticism to creating thousands of jobs.

As global brands continue to shift their manufacturing bases, this state stands poised to become a key player in the international footwear industry. This achievement could inspire other states to follow suit.

Related Posts

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is the total investment by Nike, Adidas, and Puma in Tamil Nadu?

The combined investment is ₹17,550 crore, aimed at boosting footwear manufacturing and infrastructure, supporting India’s goal for an $80 billion market by 2030.

Why are these companies investing in Tamil Nadu?

Tamil Nadu offers robust infrastructure, skilled labor, and favorable policies, making it a strategic hub for footwear production to serve the growing Indian market.

What market size is India targeting by 2030?

By leveraging the investments, India aims to achieve an $80 billion footwear market by 2030, driven by increased domestic demand and export potential.

What kind of impact will this investment have?

It will create jobs, enhance manufacturing capabilities, and stimulate economic growth in Tamil Nadu, contributing significantly to India’s footwear industry expansion.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

- Archana Chettiar