In engineering, ball bearings find applications in various industries and machinery where rotational movement is essential. The bearing cage is the component that houses the ball bearings, which helps achieve low-friction, smooth, and high-precision rotational movement. As simple as it may appear, it is the crucial component of any machinery with rotational movement.

Harsha Engineers, a listed company, is the leading manufacturer of precision bearing cages in the world, with a market share of approximately 5-6% in the organized segment of global brass, steel, and polyamide bearing cages in terms of revenue.

Since the IPO launch in September 2022, the company has witnessed higher investors’ interest, and Harsha Engineers share price has given superior returns to its early investors.

In this article, we will check the factors affecting Harsha Engineers share price growth, but first, a quick overview of the company’s operations and finances.

Brief Overview of Harsha Engineers

Harsha Engineers was incorporated in 1986 and is the largest manufacturer of bearing cages in the organized market in India in terms of capacity and operations. India’s largest precision bearing cage manufacturer has a 50% and 6% market share globally.

The company has four manufacturing facilities in Gujarat: Changodar and Moraiya in Gujarat, Changshu in China via a subsidiary, and Ghimbav Brasov in Romania through a step-down subsidiary. It supplies products to over 25 countries on five continents, including the top six bearing manufacturers in the world.

Over the years, Harsha Engineers has developed expertise in tooling, design development, and automation, helping offer a diversified suite of precision engineering products. After a successful IPO, the company went public on September 26, 2022.

Business Overview of Harsha Engineers

Harsha Engineers is primarily engaged in the business of manufacturing high-precision bearing cages and solar.

The company’s solar division was previously known as Harsha Abakus, a global entity founded in 2013. This subsidiary provides comprehensive turnkey solutions for all solar PV requirements and executed work on 500 MW+ solar installation projects.

According to AS-108, the company has two reportable business segments:

- Engineering & Others

- Solar-EPC and O&M

Financials

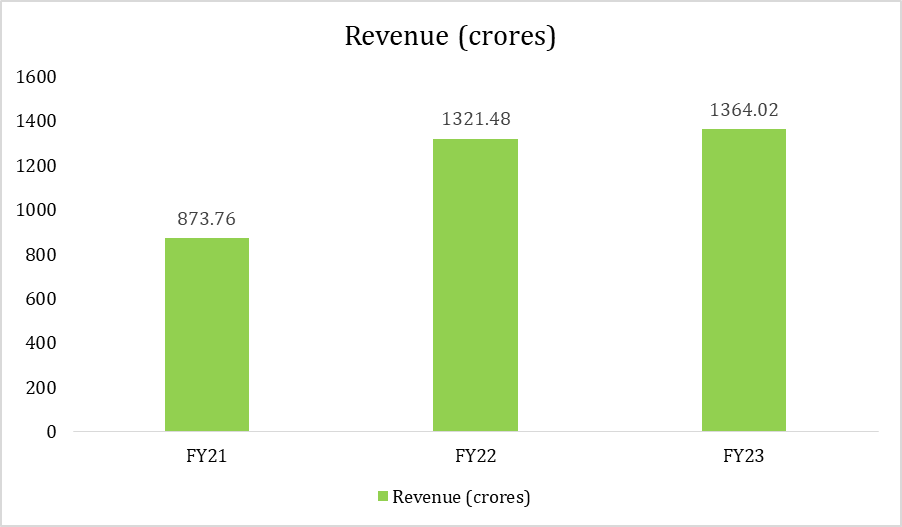

Revenue

In FY23, the company’s revenue from operations reached ₹1,364.02 crores, an increase of 3.22% compared to ₹1,321.48 crores in FY22. In H1FY24, the revenue from operations was ₹687.45 crores, compared to ₹719.6 crores reported in H1FY23, a fall of 4.67%.

Segment-wise Revenue

| FY22 (in ₹ crores) | FY23 (in ₹ crores) | H1FY23 (in ₹ crores) | H1FY24 (in ₹ crores) | |

| Engineering & Others | 1,238.53 | 1,298.66 | 676.70 | 628.58 |

| Solar-EPC and O&M | 82.95 | 65.36 | 42.95 | 58.87 |

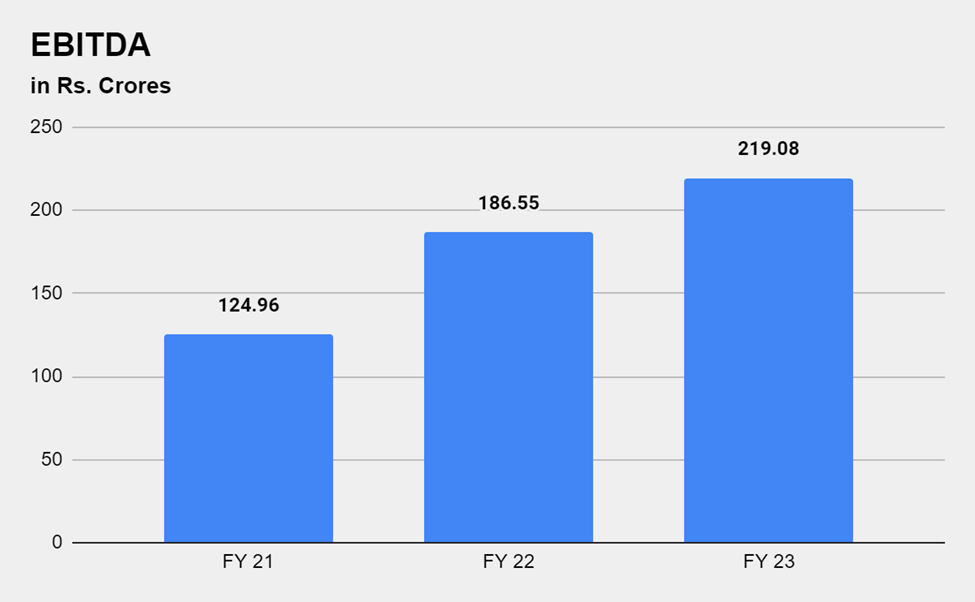

EBITDA

In FY23, the company reported an EBITDA of ₹219.08 crores from ₹186.55 crores in FY22. The EBITDA margin was 16.06% in FY23 and 14.12% in FY22. And, for the six-month period that ended on 30th September 2023, the company’s EBITDA came in at ₹107.94 crores compared to ₹87.71 crores during the same period the previous year.

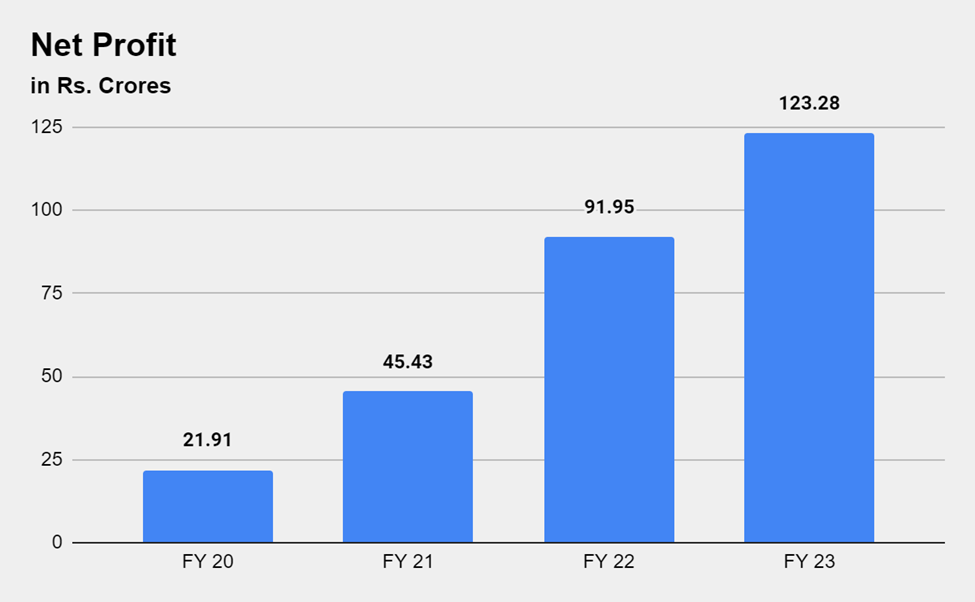

Net Profit

In FY22, Harsha Engineers reported a net profit of ₹123.28 crores, a 34% increase compared to the previous fiscal from ₹91.95 crores. In H1FY24, the company’s net profit came in at ₹44.97 crores, compared to ₹58.92 crores reported in H1FY23.

Harsha Engineers IPO

Harsha Engineers IPO was launched on September 14th, 2022, and ended on September 16th, 2022. During the period, the IPO was oversubscribed by a whopping 74.70 times.

The IPO size was ₹755 crores, comprising a fresh issue of ₹455 crores and an offer for sale of ₹300 crores. The IPO price band was set at ₹314 to ₹330 per share. Harsha Engineers IPO allotment was made at a higher price band, and the stock was listed at ₹450 on NSE, with a listing gain of 36.36%. The stock ended its first day of trading almost 10% higher at ₹485 per share.

1-year Performance

Harsha Engineers share price has failed to provide positive returns to investors since its listing despite a stellar debut in the market. The stock fell to a low of ₹309 and has yet to rise above its listing price.

The probable factors that are affecting the Harsha Engineers share price growth are as follows:

Decline in Operational Efficiency

In the first six months of FY24, the company experienced a notable decrease in operational efficiency, with EBITDA margin falling from 15% in H1FY23 to 12.76% in H1FY24. The Earnings per Share during the same period fell from ₹7.55 to ₹4.94.

The Return on Average Equity (ROAE) went from 15.29% in H1FY23 to 8.23% in H1FY24, impacting investors’ sentiment and the company’s market valuation.

A Slowdown in Key Markets

Romania and China are the two most important markets for the company, which is experiencing double-digit degrowth. In addition, the company’s growth strategy is being impacted by a softening global wind market and steep inflation in Europe. The company’s management has expressed concern about improving operational and profit margins in Romania and China.

Degrowth in Engineering & Others Segment in India

The company’s stand-alone engineering segment has witnessed a revenue degrowth of 4-5% in Q2FY24 as exports to Europe and China were impacted.

Harsha Engineers share price has been impacted by the market cycle’s contraction, which has affected its profitability and operational metrics in the short term. However, the bearing cage market is expanding due to increased usage in key fast-growing end-user industries. It is expected to grow at a CAGR of 6.4% to $8.5 billion by 2029.

Bearing companies globally are steadily shifting towards outsourcing the production of critical components to dependable suppliers. With its cost-effective solutions and global presence, Harsha Engineers enjoys a long-term advantage in this evolving landscape.

CURRENT IPOS | LISTED IPOS | UPCOMING IPOS

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the Performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.2 / 5. Vote count: 6

No votes so far! Be the first to rate this post.