The Indian Railways (IR) is on track to invest ₹1 trillion in acquiring new trains over the next few years. Wonder who will benefit from this upgrade? The 7 billion passengers whom the Indian Railways aims to ferry annually.

These are the Indians for whom trains were never a mode of transportation but emotion. Who settled in the cushy seat with Tinkle comics, listening to the tinkling sound of openers running against cola bottles. Many also waited in anticipation of the train ticket being confirmed.

From the days of going to the reservation counter to booking tickets on the phone, the page timing out has replaced long queues, but the waiting list remains.

However, Union Railways Minister Ashwini Vaishnaw states that the investment will cater to the growing demands and end the waiting list in the long run. Besides the passengers, will this investment also mean a ticket to profits for investors considering investing in the railway sector?

Changing Tracks for Efficiency

The Indian Railways aims to ferry seven billion passengers annually and increase it to 10 billion by 2030. As passenger travel shoots up, so do the railway’s efforts. Union Railways Minister Ashwini Vaishnaw states that the investment will cater to the growing demands and end the waiting list in the long run.

Going the Extra Mile

While the Railways plan to acquire 7,000-8,000 new train sets over the next 15 years, the travel sector may also become the 5th largest outbound travel market by 2027. The railways boast 10,754 trips daily, with a plan to bump it up by 3,000 more. Part of the project is closing 5,500 to 6,000 kilometers of new tracks, 16 kilometers a day, by the end of FY 2023–2024.

As tracks free up, travelers can expect passengers and goods trains to move faster.

5 Companies that Will Steam Ahead

In the wake of this massive fund allocation, you can ‘train’ your eyes on the companies that will reap the rewards. Here’s a rundown…

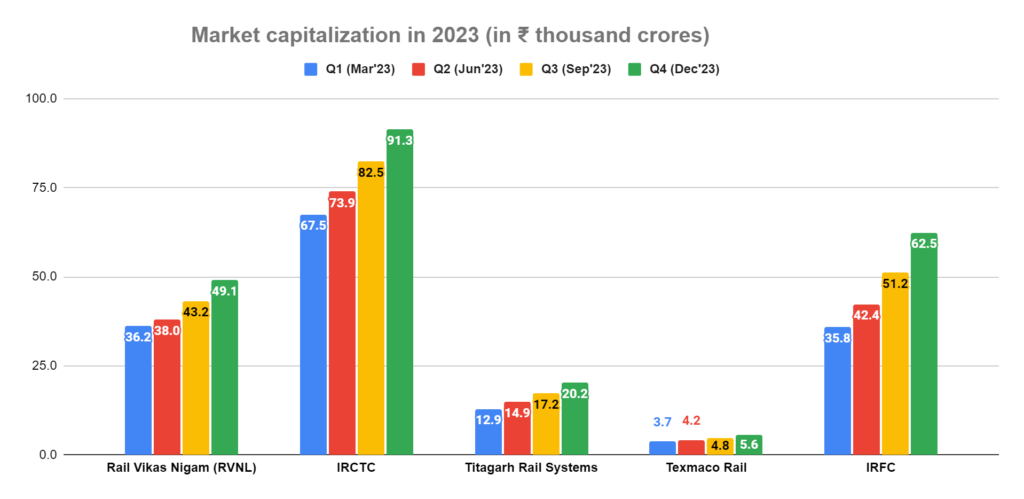

Business in Numbers for the Five Top Players in the Railway Sector

| Company | Market Cap (INR Billion) – Sep 2023 | Net Profit Margin (INR Crores) – Sep 2023 | Current Share Price (INR) |

|---|---|---|---|

| Rail Vikas Nigam (RVNL) | 362.68 | 8.02% | 173.90 |

| IRCTC | 687.34 | 29.61% | 857.80 |

| Titagarh Rail Systems | 138.02 | 7.55% | 1,025.05 |

| Texmaco Rail | 64.21 | 3.06% | 167.50 |

| Indian Railway Finance Corporation (IRFC) | 1.26 trillion | 97.75% | 96.15 |

Rail Vikas Nigam (RVNL)

Starting its journey in 2003, RVNL is executing diverse railway infrastructure projects assigned by the Ministry of Railways (MoR).

Its portfolio includes:

- Doubling

- Gauge conversion

- Constructing new lines

- Pivotal bridges

- Electrification of railways

- Setting up metro lines in urban centers and suburban networks

With 120 projects and another 72 active ones, RVNL will likely benefit from its focus on new lines, station redevelopment, and developmental initiatives. Besides robust government support, expertise in project management, and a commendable ‘track’ record in project execution, the recent Navratna award status backs up its leadership.

IRCTC

The Indian Railway Catering and Tourism Corp (IRCTC) entered the primary markets through listing in October 2019 and commands a 100% market share within the rail network.

Solely authorized by Indian Railways for online railway ticketing, it exclusively manages catering services on trains and major static units at railway stations, besides monopolizing packaged drinking water under the ‘Rail Neer’ brand.

Although the ₹1 trillion investment majorly targets infrastructure enhancement, expanding its fleet will increase the demand for catering services at stations and trains, which could help IRCTC.

Titagarh Rail Systems

One of India’s leading wagon manufacturers, Titagarh Rail Systems, manufactures and vends for passenger coaches, metro trains, ships, etc, with an annual capacity of 8,400 wagons. The investment in procuring new trains aligns with its core business of stock manufacturing.

Increased orders, revenue growth, and potential diversification prospects should solidify Titagarh Rail Systems’ role in strengthening the Indian rail network.

Texmaco Rail

The primary supplier of wagons to the Indian Railways, Texmaco has strong in-house capabilities for designing purpose-built wagons catering to core sectors like cement, coal, chemicals, etc. The increased demand for wagons poses an excellent opportunity for Texmaco Rail to strengthen its wagon manufacturing leadership.

Texmaco anticipates a notable increase in production while exploring opportunities in related areas such as ‘Modern Train Communication System’ and ‘Kavach.’

Indian Railway Finance Corporation (IRFC)

The financing arm of the IR specializes in borrowing funds from financial markets to fund railway asset acquisition. The capital-intensive project will benefit the IRFC in project financing and risk management accumulated through prior railway ventures.

The company’s solid financial standing and expertise match the immense funding requirements of the new initiative. IRFC also aims to diversify its financing portfolio, venturing into new dimensions of railway projects.

The tracks for railway development have already been laid. Before the gigantic ₹1 trillion investment, the government allocated ₹2.4 trillion to IR for the FY 2023-24, with 70% already utilized, underscoring the need for funds.

Indian Railways aims to eliminate waiting lists by increasing daily train trips, which could benefit the railway sector’s companies. However, it’s essential to be cautious while investing in railway stocks and conduct thorough research to make informed investment decisions, even under favorable circumstances.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 53

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/