If you follow the stock market regularly or business-related news, you will often find companies offering bonus shares. For instance, Sonata Software recommended a 1:1 bonus yesterday after its growth in Q2FY24. So why does a company offer bonus shares to its shareholders?

What is a Bonus Issue?

As the name suggests, Bonus shares are shares that a company offers its shareholders at no cost. Often, the bonus issue of shares is used as an alternative to dividends to distribute company profits amongst its shareholders.

If you take the example of Sonata Software, a 1:1 bonus issue means that for every 1 share held by the shareholders, they will get an additional share of the company.

Suppose you hold 500 shares of Sonata Software; you will get an additional 500, and your total holding will become 1000 shares in the company. However, there is a catch.

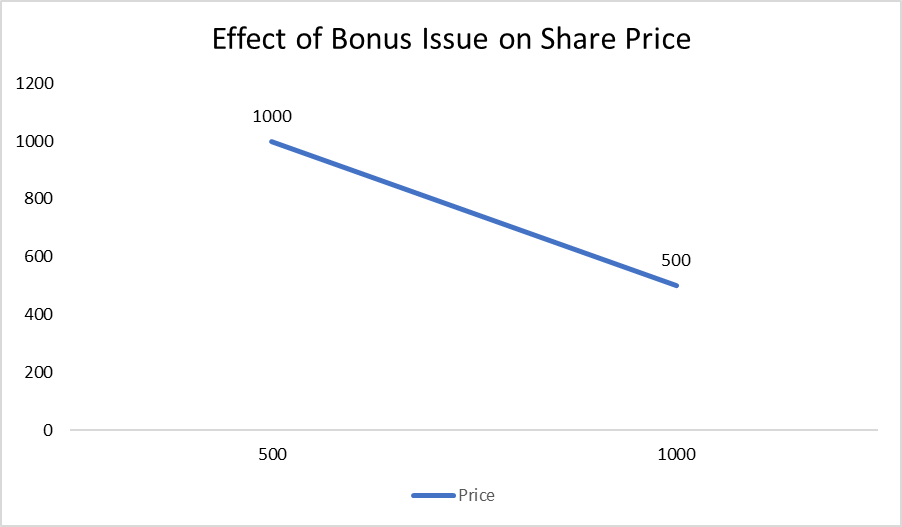

Even though the number of shares will increase in the shareholder’s portfolio, the investment value will remain the same. It is because the price of each share drops when the number of shares outstanding increases. Taking a cue from the above example of Sonata Software,

The price of each share before the bonus issue, let’s say Rs. 1000.

Therefore, the total investment value before getting bonus shares is Rs. 500*1000 = Rs.500000.

Now, once the bonus shares are issued, the price of each share will = Rs. (500000/1000) = Rs. 500

However, the value will remain the same as your investments = 1000 * Rs. 500 = Rs. 500000

This is why when a company issues bonus stocks, the price of its shares dips. The inverse relationship between share price and bonus issue of shares helps investors buy the stock at a lower price.

Seven Things to Know about Bonus Issue

- Bonus shares are issued to the existing shareholders of a company. Here comes the ‘Ex-Bonus date,’ which is the date on which the shares of the company trade without the rights of receiving bonus stocks. For instance, Company A has declared a bonus issue, and the Ex-Bonus Date is 1 November 2023. So, anyone who has purchased and holds Company A’s stock until 31 October 2023 will be considered existing shareholders for the bonus issue. If you buy the stock on 1 November 2023, which is the Ex-Bonus Date itself, then you will not be entitled to receive any bonus shares.

- The Bonus ratio determines how many bonus shares you will receive. The ratio depends on the bonus shares the companies give. For instance, if the bonus ratio is 5:1, then for every share you hold of the particular company, you will receive five additional shares.

- Often, a company issues bonus shares instead of cash dividends as it serves the purpose of distributing its profits.

- As the investment value remains the same after the bonus issue, the proportionate ownership of the shareholder also remains the same. For instance, if you held a 1% stake in a company, after a bonus issue of shares, though the number of shares you hold increases, the 1% stake will remain the same, as the market value or investment value will remain the same.

- As an investor/ shareholder, your voting power increases with bonus issues. However, the best part is that dividend income can increase significantly as dividends are usually paid per share. For example, before the bonus issue of shares, a Rs.10 dividend per share for your 500 shares would have fetched you Rs. 5000, while now, as you have 1000 shares, you can earn Rs. 10000 from it.

- The liquidity increases as the number of shares trading in the market increases of the bonus issuing company.

- There are two other dates that you need to know when waiting for the bonus issue are –

- Record Date, which is the date on which the company determines the eligible shareholders to receive the bonus shares.

- Effective Date is when the bonus shares are credited to the shareholders’ account.

The recent five companies that have declared bonus issues, apart from Sonata Software, are –

| Company | Bonus Ratio | Record date | Ex-Bonus Date |

| Venkatesh Ref | 1:1 | 28-10-2023 | 27-10-2023 |

| Maruti Interior | 1:1 | 27-10-2023 | 27-10-2023 |

| Krishana Phosch | 1:1 | 25-10-2023 | 25-10-2023 |

| Madhya Bharat A | 1:1 | 20-10-2023 | 20-10-2023 |

| Rudra Global | 1:1 | 18-10-2023 | 18-10-2023 |

Thus, the Bonus issue not only helps the company to distribute its profit without paying any cash dividends but also helps in so many other ways. From increasing the liquidity quotient to lowering the share price, which can bring in new investors, increasing the voting rights of the investors and dividend earnings. All these purposes are served without disturbing the investment value or market capitalization.

FAQs

What is a bonus share?

These are extra shares offered to the existing shareholders without any cost to distribute the company's profits.

Are bonus shares good or bad?

Bonus shares are good for investors as they increase the chance of earning more dividends, increasing the voting power without affecting the investment value.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 24

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/