Introduction

In today’s digital age, linking your Aadhaar card with your PAN card has become essential for financial transactions and tax compliance. However, many individuals are unaware of the associated fees and late fees that they may incur. In this article, we will analyze Aadhaar PAN linking charges, highlight late fees of Rs 1,000, and discuss the additional costs that may arise if you opt for the offline route.

Section 139AA of the Income Tax Act provides that every person with a Permanent Account Number (PAN) issued on 1st July 2017 and eligible for an Aadhaar Number shall declare his Aadhaar Number in the prescribed manner and form.

If you have not linked it with Aadhaar by June 30, later extended to 30th July 2023, your PAN will not be valid. However, people falling within the exempted category will not be affected by the invalidity of PAN.

Aadhaar-PAN Linking Charges Explained

The Aadhaar-PAN linking process was introduced to streamline financial transactions and curb tax evasion. While linking these two vital identification documents is mandatory, it’s essential to understand the charges involved:

Online Aadhaar-PAN Linkage:

- Linking Aadhaar card with your PAN card online is the easiest and most cost-effective method.

- This process has no fee, making it a hassle-free option for individuals who want to comply with tax laws.

Offline Aadhaar-PAN Link:

- Using an offline method to link your Aadhaar and PAN cards may incur additional fees.

- The most important cost associated with offline linking is the latency fee, which is Rs 1,000. If you miss the deadline to combine these two forms, this fee will be charged. Your PAN card might have become inoperative if you did not link it with Aadhaar till 30 July 2023.

Additional Costs for Offline Linking:

- Apart from late fees, there may be other costs when linking Aadhaar and PAN offline.

- These additional fees may include visiting an Aadhaar enrollment center or a PAN activation center.

- Travel costs, photo reimbursement, and application fees may vary depending on the service.

Understanding Late Fees

The Rs 1,000 late fee is a major deterrent for individuals who miss the deadline for linking their Aadhaar and PAN cards. To avoid this penalty, it’s important to know the deadline and complete the negotiation process promptly.

Why is Aadhaar and PAN card Linking Important?

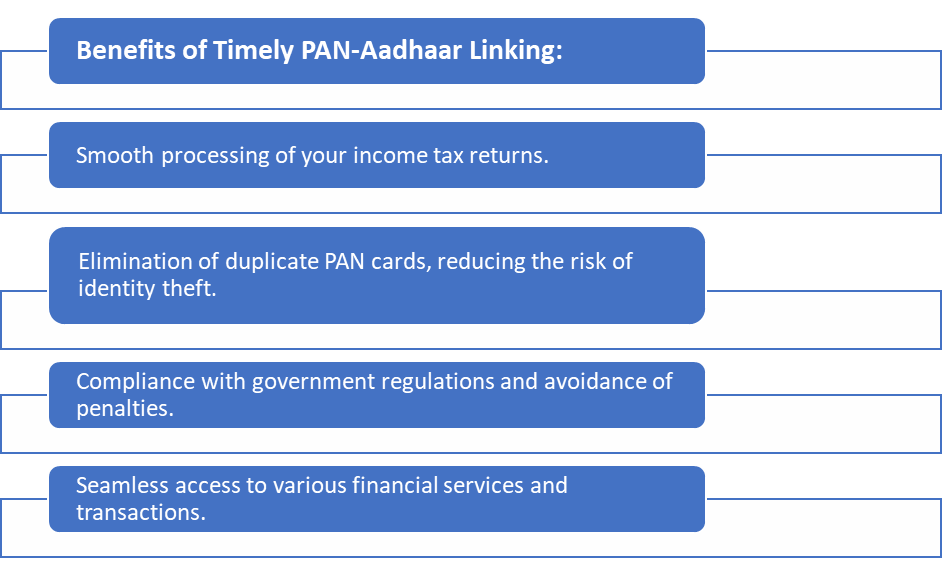

Tax Compliance: One of the main reasons for integrating Aadhaar and PAN is to enhance tax compliance. By linking their Aadhaar and PAN cards, individuals will find it easier for the government to monitor financial transactions and detect tax evasion. It helps reduce tax fraud and increases tax revenue for the government.

Prevention of multiple PANs: Linking of Aadhaar with PAN helps identify persons holding multiple PAN cards in an attempt to evade paying taxes or engage in other illegal financial activities This ensures that everyone has only one valid PAN, which is necessary for accurate taxation.

Simplify Financial Transactions: Combining Aadhaar with PAN can simplify various financial transactions, such as opening a bank account, applying for a loan, or other transactions. It helps identify individuals quickly and accurately, reducing the possibility of fraudulent activities.

Establishment of Government Benefits: Aadhaar-PAN linkage can help the government distribute targeted subsidies and welfare benefits. It ensures that benefits are delivered to the rightful beneficiaries and reduces the likelihood of resources being misappropriated or misused.

Reducing Identity Theft: Linking Aadhaar with PAN can help reduce identity theft and financial fraud. Verifying the authenticity of an individual through biometric and demographic information stored in the Aadhaar database adds an extra layer of security.

Streamlining Tax Filing: Integrating Aadhaar and PAN can make it easier for individuals to file their income tax returns online. It simplifies the verification and certification process, and reduces the possibility of errors in tax returns.

Compliance with Legal Requirements: The government of India has made it mandatory for individuals to join Aadhaar and PAN as per the Income Tax Act. Failure to comply may result in fines or difficulty in conducting financial transactions.

Here’s a step-by-step guide on how to link your PAN with Aadhaar online:

Step 1: Visit the official income tax website.

Step 2: Click on the ‘Link Aadhaar’ option.

Step 3: Enter your PAN, Aadhaar number, name as per Aadhaar, and other required details.

Step 4: Verify the captcha code and click ‘Link Aadhaar.’

Step 5: A confirmation message will be displayed, indicating successful linkage.

By following these simple steps, you can ensure that your PAN and Aadhaar are linked without incurring any fees.

Linking the Aadhaar card with your PAN card is a must to ensure seamless financial transactions and tax compliance. While online transactions are free and convenient, taking the offline route can incur a hefty late fee of Rs 1,000 if the deadline is missed.

Apart from that, internet can communication incur additional costs, such as travel expenses and application fees. It is advisable to complete the Aadhaar PAN linking process online within the stipulated time to avoid unnecessary fees and penalties.

FAQs

What is the late fee for missing the Aadhaar-PAN linking deadline?

The late fee for missing the Aadhaar-PAN linking deadline is Rs 1,000.

What additional expenses can be incurred when linking Aadhaar with PAN offline?

When linking Aadhaar with PAN offline, individuals may incur expenses such as travel costs to the service center, photocopying fees, application processing charges, and the Rs 1,000 late fee if the deadline is missed.

Is my personal information safe when I link Aadhar and PAN?

The government has implemented security measures to protect personal information. However, it's always a good practice to be cautious while sharing your personal details. Ensure that you are using official government portals or channels for linking.

Can I link multiple PAN cards to one Aadhar?

No, an individual can link only one PAN card to one Aadhar number. Multiple PAN cards are not allowed.

What should I do if there is a discrepancy in my Aadhar or PAN details?

If you notice any discrepancies in your Aadhar or PAN details, you should update them through the respective official channels before linking them.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.