Introduction

Adani Group is India’s largest private Energy & Utility company, with a strong presence in Renewables, Power Generation, Transmission & Distribution, and Gas Distribution.

This article explains more about Adani Gas, now known as Adani Total Gas Limited, which supplies natural gas to residential, commercial, industrial, and vehicle users through PNG and CNG. Let’s dive in.

Overview of Adani Gas

Adani Gas was incorporated on August 5th, 2005, as a subsidiary of Adani Enterprises Limited to venture into India’s natural gas distribution business.

The company was initially focused on setting up a city gas distribution pipeline network for supplying natural gas to residential, commercial, and industrial users in various cities across India.

It started operations by setting up domestic gas connections in Ahmedabad and started the development of the city gas network in Faridabad.

At the end of Q1 FY24, the company expanded its gas distribution network to 124 districts in India, with 7.28 lakh PNG home connections, 7,615 industrial and commercial connections, and 467 CNG stations. The company has completed 11,124 kilometers of gas pipeline across the country.

Adani Gas’s other business interests include E-mobility, which is building a network of EV charging points. Currently, it has 141 charging points across 40 sites. And the company’s new initiative includes setting up biomass units. It is constructing one of India’s largest Biomass projects in Barsana, Uttar Pradesh, and is expected to be functional by the end of FY24.

Induction of Strategic Investors

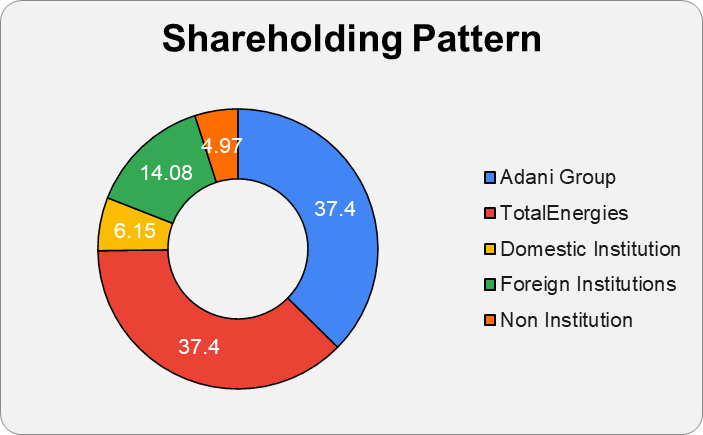

On February 29, 2020, Adani Gas inducted French energy giant Total Energies as a strategic investor in the company. Total Energies bought a 37.4% stake in the company for ₹5,512 crores.

Following the induction, the company changed its name to Adani Total Gas Limited.

Business Overview of Adani Gas

City Gas Distribution

Adani Gas is in 52 geographical areas across 17 states and two union territories. It

has four consumer types- industrial, commercial, domestic, and CNG.

Industrial users utilize boilers, thermic fluid heaters, heat treatment, casting, and forging. Commercial consumers include restaurants, hotels, shopping malls, hospitals, temples, etc.

Biogas

Adani Gas formed a wholly new subsidiary called Adani Total Energies Biomass Limited (ATBML) to focus on building CBG plants and enhancing the production of CBG. The development came after the government launched the Sustainable Alternative Towards Affordable Transportation (SATAT) scheme to increase CBG production and brought compressed biogas projects under priority sector lending.

The upcoming biogas plant in Barsana, Uttar Pradesh, will process 225 tonnes per day of feed processing with an output capacity of 12,000 KG of compressed biogas.

Build your well-diversified portfolio

Create wealth now!

Build your well-diversified portfolio

Create wealth now!

e-Mobility

The e-mobility business, which houses the company’s charging infrastructure, is being developed through its newly created subsidiary, Adani Total Energies E-Mobility Limited. It is using the existing space available at CNG stations. The company offers customers diverse fuel feed options through this arrangement- CNG, Biogas, and Electric. The company has also launched charging infrastructure at all six Adani Group-managed airports, GIFT City, and other premium hotspots.

Under Indian Accounting Standard 108, the company reports all its revenue under one segment, i.e., Selling and Distribution of Natural Gas.

Key Management Personnel

Mr. Suresh P. Manglani is the Executive Director and CEO of the company. He has diversified leadership experience of over 31 years at the CXO level. Before joining Adani Total Gas Limited in September 2018, he worked as CFO- Petroleum Retail Business- Reliance Industries Limited and worked with GAIL and Mahanagar Gas Limited.

Mr. Parag Parikh is the company’s Chief Financial Officer (CFO) and joined the company in August 2019. Earlier, he was working with GMR Group as Group Head – Finance. He has a Masters in Commerce from the University of Mumbai and an MBA-Finance from Mumbai Educational Trust, MET League of Colleges.

Shareholding Pattern

Adani Group and TotalEnergies are both promoter groups of the company.

Financials

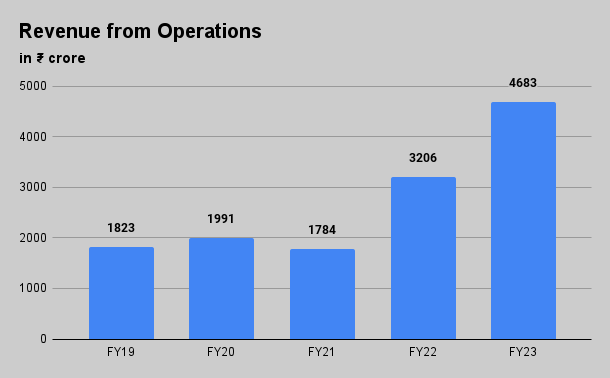

Revenue

In FY23, the company reported a 46.07% annual growth in revenue from operations at ₹4,683 crores, compared to ₹3,206 crores in FY22. And, in Q1FY24, the consolidated revenue from operations grew by 2.2% to ₹1,135 crores from ₹1,110.21 crores in Q1FY23.

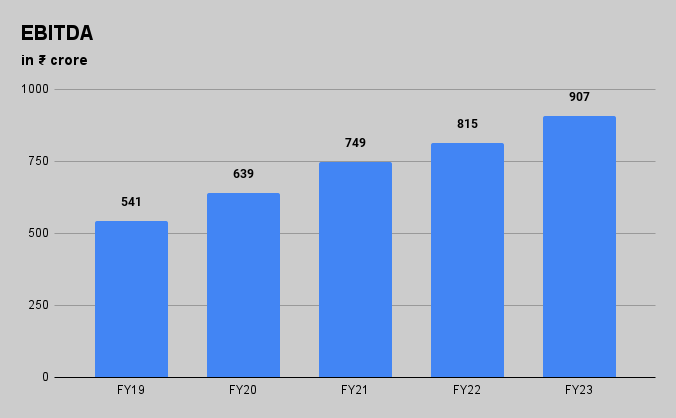

EBITDA

In FY23, consolidated EBITDA increased by 11.29% to ₹907 crores from ₹815 crores in FY22. And, in Q1FY24, the consolidated EBITDA increased by 12% to ₹255 crore from ₹228 crore in Q1FY23. In the last 4 years, EBITDA has grown by a CAGR of 14%.

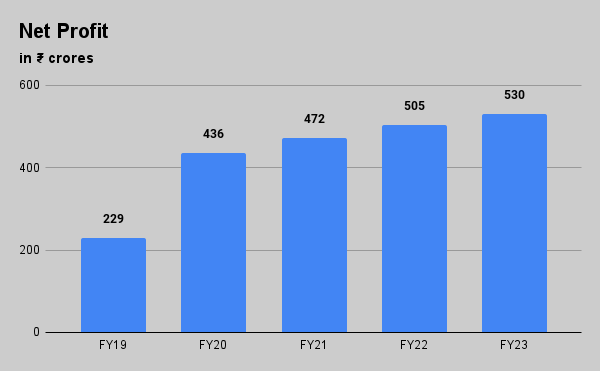

Net Profit

In FY23, Adani Gas reported a 5% year-on-year increase in net profit to ₹530 crores from ₹505 crores in FY22. The net profit margin was 11.32% in FY23 and 15.75% in FY22. And, in Q1FY24, net profits increased by 8.2% to ₹150.22 crores from ₹138.77 crores in Q1FY23. In the last four years, Net Profit of the company has grown by a CAGR of 23%.

Key Financial Ratios

Current Ratio: The current ratio improved by 59% to 0.39 times at the end of March 2023 from 0.25 times at the end of March 2022. The increase is primarily due to the rise in trade receivables and a change in the investment maturity period.

Debt-to-equity Ratio: The debt-to-equity ratio increased by 14% at the end of FY23 to 0.47 times from 0.41 times at the end of FY22.

Interest Service Coverage Ratio: At the end of FY23, the interest service coverage ratio decreased by 27% to 10.11 times, from 13.88 times at the end of FY22. Higher interest costs lead to a decrease in the interest coverage ratio.

Return on Capital Employed (ROCE): As of 31st March 2023, ROCE declined to 21.6% from 24.5% in FY22. It was 27.9% in FY21.

Return on Equity (ROE): The ROE of the company was 19.7% at the end of FY23. It was 23% at the end of FY22.

Adani Gas Share Price Analysis

Adani Gas shares were listed on the stock market through the demerger process from Adani Enterprise Limited (AEL). The shares were listed on November 5th, 2018, at ₹72 apiece.

Before listing Adani Gas, the combined entity (AEL and Adani Gas) traded around ₹210 a share in September 2018.

The company has yet to complete 5 years in the stock market, but in the initial years, it has given superior returns to investors. The last three-year CAGR return of the stock is 46%.

In recent months, after the release of Hidenberg’s report on corporate misgovernance in the Adani Group, the stock has experienced extreme volatility. The Adani Gas share price fell from its all-time high level of ₹4,000; as of 15 September 2023, it traded at around ₹640.

In the last three financial years, the company has paid ₹0.25 a share as a dividend to its shareholders. As of 15 September 2023, the market cap of Adani Total Gas Limited is ₹69,986 crores.

SWOT Analysis

Strength

- Adani Gas is India’s largest private compressed natural gas distribution company, with a presence across 17 states and two UTs.

- The company is backed by Adani Group, which has a strong reputation for executing and managing the largest and most challenging infrastructure projects. In addition, the strategic partnership with Total provides it with global expertise, technology, and resources.

- Adani Gas is a profitable company with solid growth potential. In FY23, the company’s revenue increased by 46% year-on-year to ₹4,683 crores. And net profit increased by 5% to ₹530 crores.

Weakness

- Adani Gas faces stiff competition from established CGD players such as Indraprastha Gas Limited (IGL), GAIL, Mahanagar Gas Limited, Gujarat Gas Limited (GGL), and others, all of which have established and continue to expand their networks.

- The company’s operation is limited to specific geographic locations and has lower margins than its peers.

- Adani Total Gas has high capital expenditure and debt levels. In FY23, the company has invested ₹1,150 to create additional infrastructure and plans to invest ₹18,000 to ₹20,000 crores in the next 10 years to build infrastructure for the gas distribution business.

Opportunities

- Adani Gas can leverage the increasing demand for natural gas in India. The government is looking to increase the share of natural gas in the Indian economy from 6% to 15% by 2030.

- The government has launched various schemes like Pradhanmantri Ujjwala Yojana, Pradhan Mantri Urja Ganga Project, and City Gas Distribution (CGD) bidding rounds to improve and expand the availability of natural gas in India.

- The company is also exploring new business opportunities in biogas, biofuel, biomass, hydrogen, EV charging stations, and manufacturing equipment related to CGD business.

Threats

- Adani Gas faces regulatory risks and uncertainties related to the pricing and allocation of natural gas. PNGRB determines the pricing based on factors like international prices, domestic production costs, demand & supply dynamics, etc.

- The company faces a considerable challenge in maintaining the vast pipeline network and infrastructure. Building a pipeline network for city gas distribution will require clearance and approvals at various central, state, and municipal levels. Any delay and disruption could lead to a deterioration of service quality.

- Opening geographical areas where the company operates could lead to Adani Gas losing marketing exclusivity, impacting earnings.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Why did Adani Gas change its name to Adani Total Gas Limited?

After the induction of Total Energies as a strategic investor into the company in February 2020, Adani Gas changed its name to Adani Total Gas Limited. Adani Gas and Total Energies hold a 37.4% stake in the company.

How has Adani Gas share price performed in the last three years?

As of 15 September 2023, Adani Gas share price has given a CAGR return of 46% in the last three years. The stock’s all-time high level is ₹4,000.

What does Adani Gas do?

Adani Gas distributes natural gas to domestic, industrial, and commercial customers through CNG for vehicles and piped natural gas (PNG).

How useful was this post?

Click on a star to rate it!

Average rating 3.6 / 5. Vote count: 32

No votes so far! Be the first to rate this post.