Summary

Gautam Adani’s rise to become one of India’s most successful industrialists in recent years can be traced back to the success of his ports and logistics company, Adani Ports & Special Economic Zone Ltd. Since its inception, the company has become a benchmark in India for efficiency in port operations and logistics management.

Adani Ports SEZ (APSEZ) is the central component of his business empire. Compared to his other businesses, this company is a cash cow playing a pivotal role in improving the country’s unorganized supply chain and logistics channels.

This article will look at the businesses of APSEZ and analyze its growth potential, including Adani Ports SEZ share price.

Overview of Adani Ports SEZ

The foundation of the Adani Ports was laid in 1995 when the Gujarat state government started inviting applications from private companies to set up and develop port projects as a joint venture.

Receiving the contract to develop Mundra Port on the northern shores of the Gulf of Kutch, Adani established Gujarat Adani Port Limited in 1998 as a joint-sector company. Initially promoted by Adani Port Limited and Gujarat Port Infrastructure Development Company, an undertaking company of the Gujarat government, the company began phase-wise operations in October 1998, with commercial operations starting in October 2001. Later, the Gujarat Government diluted its stake in Mundra Port and ultimately exited the JV.

Today, Adani Ports is India’s largest private port operator with a network of 14 ports and terminals, handling 24% of India’s cargo volumes together. Its Mundra port and Krishnapatnam port in Andhra Pradesh are ranked in the top 10 ports in India. Mundra Port has the highest annual cargo handling capacity of 250 MMT.

Special Economic Zone Business

The SEZ (special economic zone) unit was set up in 2003. It was incorporated as Mundra Special Economic Zone Limited -India’s first multi-product port-based SEZ and currently covers an area of over 15,000 hectares.

The SEZ allows different companies to set up manufacturing units of various products such as textiles, garments, plastics, chemicals, metal, engineering goods, and so on, and it benefits from different tax breaks such as exemption from excise duty, GST, and income tax.

It also offers warehousing and logistics services for the domestic and international markets through the Free Trade Warehousing Zone units, which allows duty-free storage and handling of goods. Mundra SEZ was merged with Adani Chemicals Limited in 2006, and its name was changed to Mundra Port and Special Economic Zone Limited (MPSEZ) before being renamed Adani Ports SEZ Limited in 2012.

Business Overview of Adani Ports SEZ

APSEZ consists of three business verticals- Ports, SEZ, and Logistics.

The company’s Ports business consists of 14 ports across the national coastline and two ports outside India in Colombo, Sri Lanka, and Haifa, Israel. It specializes in handling different types of cargo, such as crude oil, coal, food grains, and containers.

The SEZ vertical has an industrial land bank of 12,000 hectares at Mundra, Dharma, and Krishnapatnam, allowing companies to set up manufacturing and business facilities.

APSEZ is India’s largest integrated logistic player, with a private rail network, multi-modal logistics park (MMLP), and warehousing connecting ports to customer gates. It has the largest private rail network of 620 KM in India with 93 trains, 9 MMLP, 1.6 mn Sq. Ft. of warehousing and 1.1 MMT of grain silos.

Despite having a wide array of business activities, the company reports all its revenue under one segment, i.e., Port and SEZ activities. The operating activities are developing, operating, and maintaining the Ports services, Ports-related Infrastructure development activities, and development of infrastructure at contiguous Special Economic Zone.

Build your well-diversified portfolio

Create wealth now!

Build your well-diversified portfolio

Create wealth now!

Key Management Personnel

- Mr. Karan Adani is the CEO of APSEZ and is responsible for developing the Adani Group and overseeing its day-to-day operations. He holds a degree in economics from Purdue University, USA, and started his career at Mundra port in 2009, learning the intricacies of port business.

- Mr. D. Muthukumaran is the Chief Financial Officer and joined the company in July 2022 from ReNew Power. He is a qualified chartered accountant and started his career at Deloitte in August 1992.

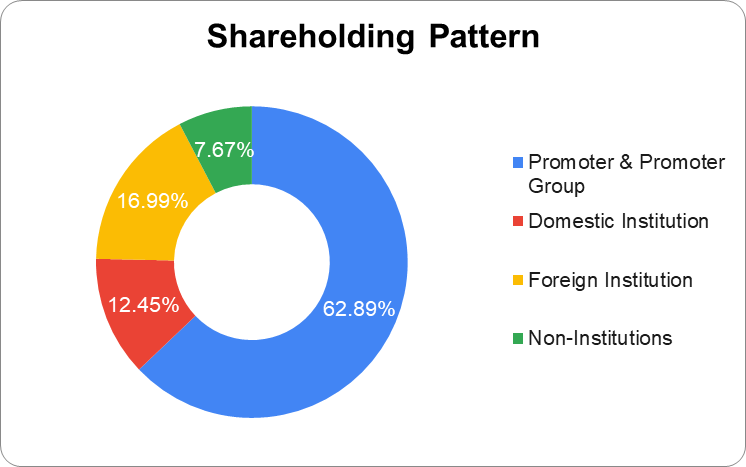

Shareholding Pattern

Financials

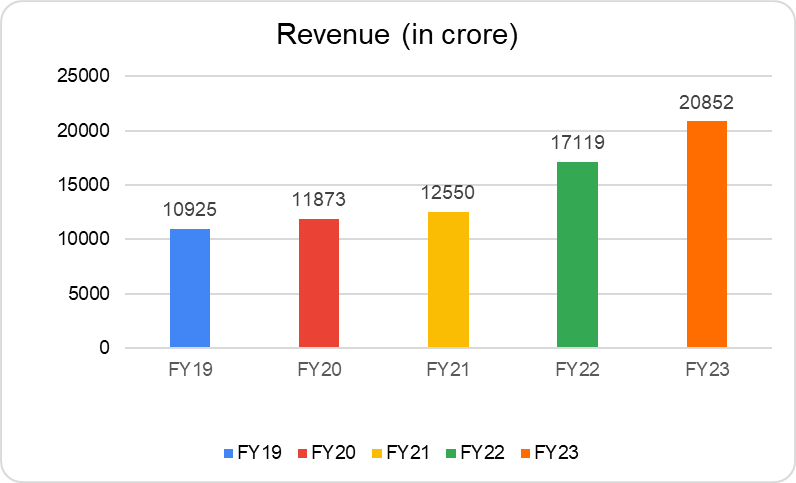

Revenue

In FY23, consolidated revenue grew by 22% to ₹20,852 crores from ₹17,119 crores in FY22. The revenue grew by a CAGR of 19% in the last 10 financial years. Business-wise, revenue from logistics was ₹1,744 crores, and port business was ₹17,304 crores in FY23. And, in Q1FY24, revenue increased by 24% to ₹6,248 crores from ₹5,058 crores in Q1FY23.

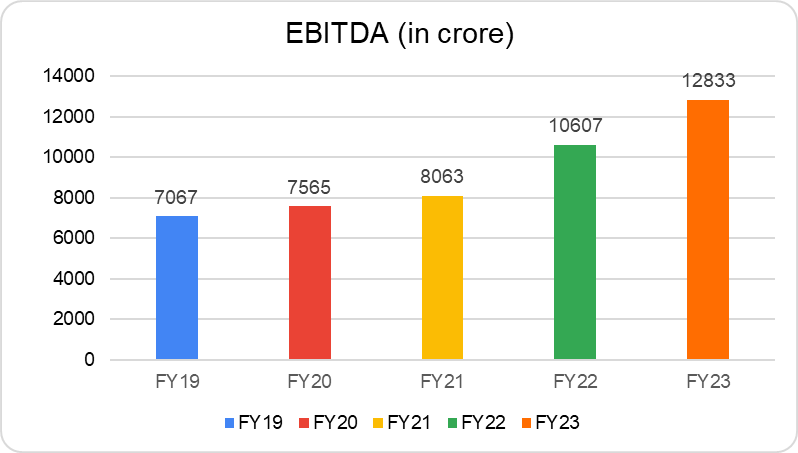

EBITDA

During FY23, consolidated EBITDA increased by 21% to ₹12,833 crores from ₹10,607 crores. In FY23, the port business’s EBITDA was ₹12,039 crores, and the logistics business’s EBITDA was ₹487 crores. With around 70% EBITDA margin for the port business, APSEZ is the most profitable port operator globally.

In Q1FY24, the consolidated EBITDA increased by 80% to ₹3,765 crore from ₹2,089 crore in Q1FY23. During Q1FY23, the company recorded a forex loss of ₹1,201 crores, which pulled down its EBITDA.

EBITDA Margin

| FY19 | FY20 | FY21 | FY22 | FY23 | |

| EBITDA Margin (in %) | 65 | 64 | 64 | 62 | 62 |

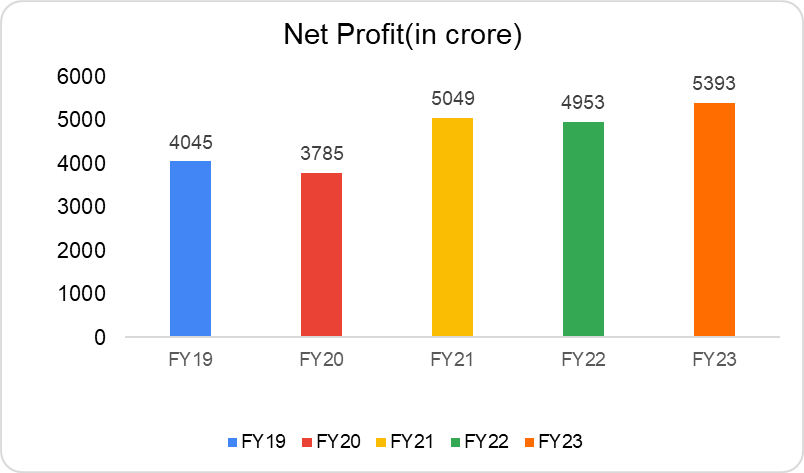

Net Profit

In FY23, APSEZ reported an approximately 9% annual increase in net profit to ₹5,393 crores from ₹4,953 crores in FY22. And, in Q1FY24, net profits increased by 80% y-o-y to ₹2,119 crores from ₹1,177 crores in Q1FY23.

Key Financial Ratios

Current Ratio: At the end of FY23, the current ratio declined by 7% to 1.36 times from 1.46 times in FY22.

Debt-to-equity Ratio: The debt-to-equity ratio improved marginally by 1% to 1.09 times at the end of FY23, from 1.08 times the previous year.

Net Debt to EBITDA: The net debt to EBITDA ratio at the end of FY23 stands at 3.1 times, increased marginally, and was 3 times at the end of FY22.

Interest Service Coverage Ratio: During FY23, it improved by 15% to 5.20 times, from 4.54 times at the end of FY22.

Return on Capital Employed (ROCE): The company improved its ROCE in FY23 to 12% from 11% in FY22.

Net Profit Margin: At the end of FY23, net profit margin declined marginally by 3% to 26% from 29% at the end of FY22.

Adani Ports SEZ Share Price History

Mundra Port and SEZ launched its IPO on 1st November 2007, raising ₹1,771 crores from the market. The IPO price band was ₹400 to ₹440 per share. The IPO was a success, and it was oversubscribed 115 times. The stock was listed at a premium of 75%.

Adani Ports share price has given a CAGR return of 17% and 33% over the last 5 and 3 years, respectively, as of 24th August 2023. It underwent a split on 23rd September 2010 at a 10:2 ratio. The stock’s all-time high was ₹987.85 as of 19th September 2022.

Adani Ports consistently pays dividends to shareholders, having paid ₹5 in the last three years. As of 24 August 2023, Adani Ports SEZ has a market cap of ₹1,77,639 crores.

APSEZ Fundamental Analysis

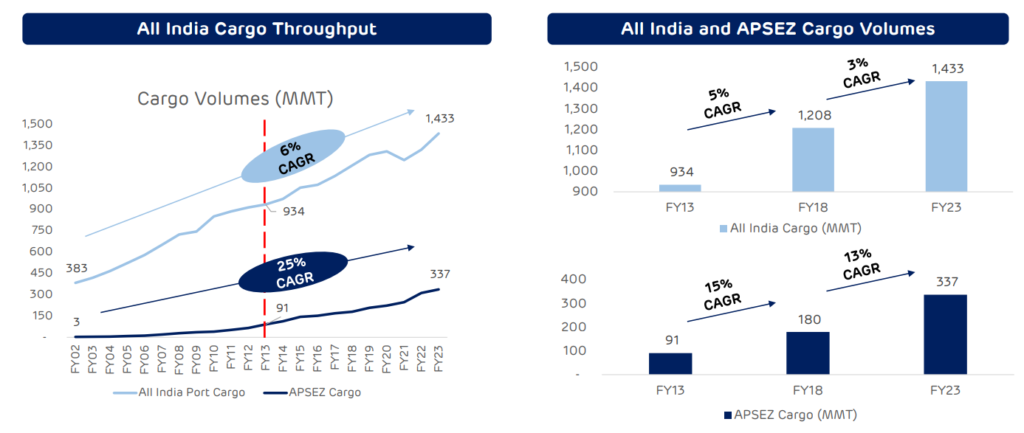

Adani Port SEZ is India’s largest transport utility company with strings of ports and an integrated logistics network. The company operates 14 ports along the country’s coastline, with a total installed capacity of 602 MMT. Compared to the national average of all India port cargo volume, which has grown at a 6% CAGR since 2002, APSEZ cargo volume has grown at a 25% CAGR over the same period.

In addition, over the last decade, the company has distributed its cargo volumes across ports and is no longer dominated by Mundra Port. From 91% of cargo volumes originating from Mundra port in FY13, the share has decreased to 46% in FY23.

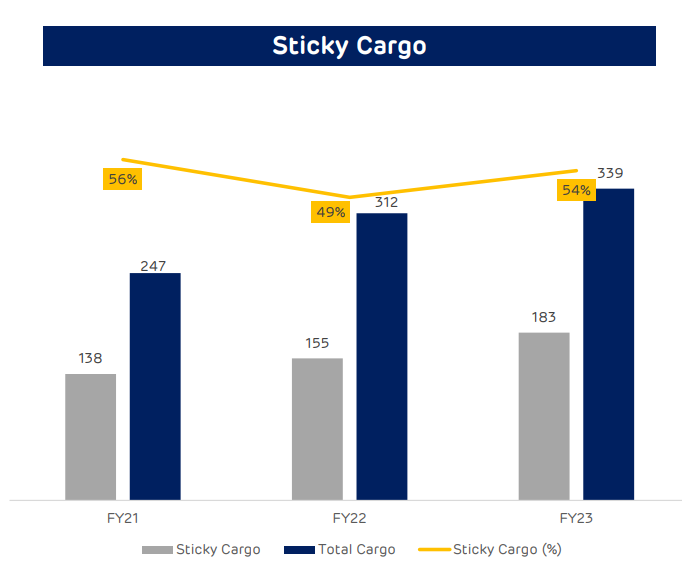

Furthermore, the share of sticky cargo of the overall cargo handled by different Adani Ports is around 50%. It was 54% in FY23. Sticky cargo is unlikely to be diverted to another port due to infrastructure constraints or a lack of facilities to handle specialized cargo such as crude oil, chemicals, and shipments from joint venture partners.

Since the Mundra Port commenced commercial operations, Adani Ports has established an operational benchmark in the industry and driven the transformation of India’s port sector. The company has an average turnaround time (TAT) for cargo ships of ~0.7 days, compared to the national average of 2 days. It was 5 days in 2011.

Adan Port’s strong organic growth of its ports business, combined with strategic inorganic acquisitions and the integration of logistics operations, has helped the company build a strong moat around the business over the years.

Adani Ports SEZ Future Growth Outlook

Adani Ports SEZ has embarked on a journey to become India’s largest transport utility company by 2030, strengthening its logistics segment from ports, warehousing, in-land transportation, last-mile delivery, etc.

The company has strategically targeted increasing its warehousing capacity by 38 times to 60 MN Sq. Ft. (15% of market capacity), have 15 MMLP covering all key markets, more than 2.5 MMT of grain silos, increase the rail network by 3 times to over 2,000 KM, and deploy 200+ trains (rakes) by FY26.

Furthermore, establishing the Dedicated Freight Corridor (DFC) connectivity to Mundra Port will provide faster port evacuation and quicker transit time. Due to the higher rail coefficient, customers preferred to export or import through Adani Ports. APSEZ’s cargo volume through rail grew by 22% in FY23 to 120.5 MMT from 98.6 MMT in FY22. And the overall rail coefficient improved to 39%.

Regarding efficiency, APSEZ ports had a capacity utilization rate of 60% in FY23, which increased from 45% in FY10. While the national average of other ports dropped from 91% in FY10 to 48% in FY23.

In FY24, Adani Ports plans to undertake a capex of ₹4000-4500 crores and reduce the Net Debt to EBITDA level from 3.1 to 2.5 times. The company also aims to deleverage its balance sheet and keep Net Debt to EBITDA level below 2.5 times over the long term.

Industry Outlook

In the fiscal year 2023, India achieved its highest-ever annual merchandise exports, reaching $447 billion, while merchandise imports climbed to $714 billion.

And, with the government’s unwavering commitment to establishing India as a global manufacturing hub, propelled by a series of policy initiatives such as the PLI Scheme, PM-GatiShakti, National Logistics Policy, and Sagarmala Pariyojana, there’s a strong expectation that India’s exports will skyrocket soon. In addition, Prime Minister Narendra Modi has set an ambitious export target of $2 trillion by 2030.

Concerning the logistics domain, India’s logistics costs as a percentage of its GDP stood at 13-14%, in stark contrast to the 8% seen in developed nations. This differential diminishes the competitiveness of Indian products on the global stage.

Ranked 38th in the Logistics Performance Index 2023, India aims to climb above 25 by 2030, underscoring its resolute commitment to enhancing logistical efficiency and promoting a more globally competitive business environment.

Adani Ports SEZ’s present business model and future plans are well-aligned to benefit from the rise of India’s global stature and trade. The company has strong fundamentals, and the long-term business outlook seems optimistic.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When was Adani Ports SEZ incorporated?

Adani Ports SEZ was incorporated in 1998 as Gujarat Adani Port Limited. It started phased-wise operations at Mundra Port in October 1998, with commercial operations beginning in October 2001.

When were Adani Port SEZ shares listed on the stock exchange?

Mundra Port and SEZ launched their IPO on 1st November 2007 and listed the shares on the stock exchanges on 27th November 2007. As of 24 August 2023, the stock has given a CAGR return of 17% and 33% over the last 5 and 3 years, respectively.

Which ports are owned by Adani Ports SEZ?

Adani Ports SEZ owns Mundra Port, India’s largest port. The company also owns 13 other ports along the country’s coastline and two ports outside India in Colombo, Sri Lanka, and Haifa, Israel.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 28

No votes so far! Be the first to rate this post.