Introduction

In the last 10 years, Adani Group has emerged as a leading infrastructure and utility company in India, and its foundation for excellence was laid around 1995 when it forayed into the ports business. Through various organic and inorganic strategies, Adani Group has become a force to reckon with in the Indian power sector.

The group has some leading companies in the power sector, such as Adani Power, India’s most significant private thermal power producer, and Adani Green, India’s largest renewable energy company.

This article will analyze another company of the Adani Group in the power sector, Adani Transmission, now known as Adani Energy Solutions Limited, India’s largest private power transmission company.

Let’s get started.

History of Adani Transmission

2006: Adani Group’s journey in the power transmission sector began in 2006, but not as a business unit to earn profits. It had to put transmission lines in place to evacuate power from its Mundra thermal power plant to the substation. The dedicated transmission lines spanning more than 3800 cKMs were commissioned between Mundra – Dehgam, Mundra – Mohindergarh, and Tiroda -Warora. It laid the groundwork for Adani’s future foray into the power transmission business.

2014: The group had to put another transmission line spanning over 1200 CKMs in place to generate power from the Tiroda power plant.

2015: After studying the enormous business potential in the transmission sector, Adani Transmission Limited was carved out of Adani Enterprise Limited (AEL) in 2015.

2016: Adani Transmission pursued inorganic and organic ways to grow its transmission network. It acquired GMR’s transmission assets in Rajasthan.

2017: Adani Transmission bought Reliance Infrastructure’s transmission assets in Gujarat, Madhya Pradesh, and Maharashtra.

2018: It acquired Reliance Infrastructure’s power generation, transmission, and distribution businesses, ushering the group into the power distribution business. Through its subsidiary, Adani Electricity Mumbai Limited (AEML), the company currently serves 3 million customers in Mumbai suburbs.

2019: Adani Transmission bought KEC’s transmission assets in Rajasthan in 2019.

2023: In July 2023, Adani Transmission Limited changed its name to Adani Energy Solution Limited (AESL). Presently, AESL is the largest private power transmission company with a network of more than 19,820 CKMs of transmission lines with a network availability of 99.7%.

Adani Transmission (AESL) Business Overview

AESL has divided its business into four divisions:

- Transmission

- Distribution

- Smart Metering

- District Cooling

Transmission: AESL owns and operates various high voltage AC and DC transmission lines, substations of 132KV to 756 KV voltage level. At the end of Q1FY24, it had a transmission network length of 19,778 circuit KM with a power transformation capacity of 46,000 MVA. It has targeted increasing the transmission lines network to 30,000 cKM by 2030.

Distribution: It distributes electricity to over 3 million customers in Mumbai sub-urban regions and the Mundra-SEZ region. It meets nearly 2000 MW of power demand with more than 99.9% supply reliability.

Smart Metering: The company is undertaking projects in select regions in Mumbai, Andhra Pradesh, and Assam and has yet to generate revenue and profits.

District Cooling: Under the India Cooling Plan (2019) developed under the Ministry of Environment, Forest & Climate to encourage efficient cooling methods, such as District Cooling and Thermal Energy Storage, AESL has ventured into the district cooling domain.

Under the Indian AS-108, AESL has three reportable operating segments:

- Transmission

- Trading

- Generation, Transmission, and Distribution (GTD) Business- This segment covers the revenue from AEML.

Key Management Personnel

- Mr. Anil Sardana has been the Managing Director of Adani Energy Solutions Limited since May 2018 and was recently appointed as Managing Director of Adani Power, effective July 2020. He has over 40 years of experience in the power and telecommunications industries. Mr. Sardana was the MD of Tata Power for over seven years before joining AESL, and he has also worked for NTPC for over 15 years.

- Mr. Bimal Dayal is the CEO of AESL Transmission Business. He brings 35 years of rich experience in the Telecom Network Industry, handling multiple business functions. Mr. Dayal worked as MD & CEO of Indus Towers Limited before joining AESL. He has also worked with Ericsson India and Qualcomm in leadership roles.

- Mr. Kandarp Patel is the CEO of AESL Distribution Business and has more than two decades of experience in Power Trading, Fuel Management, Legal and Regulatory, and Commercial aspects of Power business. He started his career with Gujarat Electricity Board (GEB) and joined Adani Enterprise Limited (AEL) in 2004 to spearhead the company’s power trading business.

- Mr. Rohit Soni is the CFO at AESL. He is a qualified Chartered Accountant and Harvard Business School, Boston, USA alumnus. Before joining AESL, he was in various leadership roles with Vedanta Group.

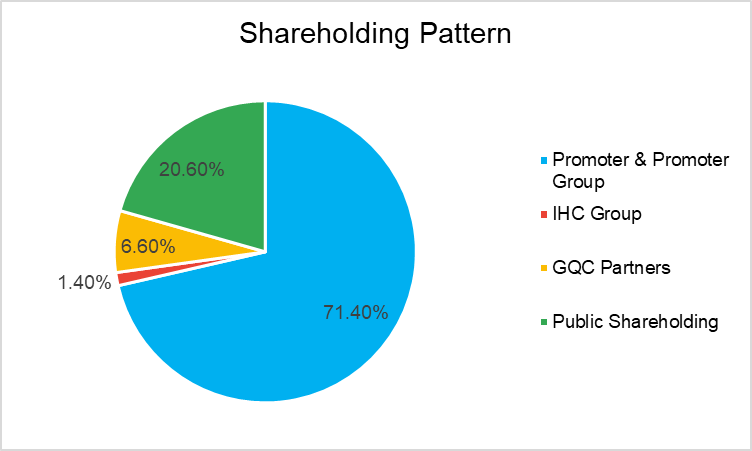

Shareholding Pattern

Financials

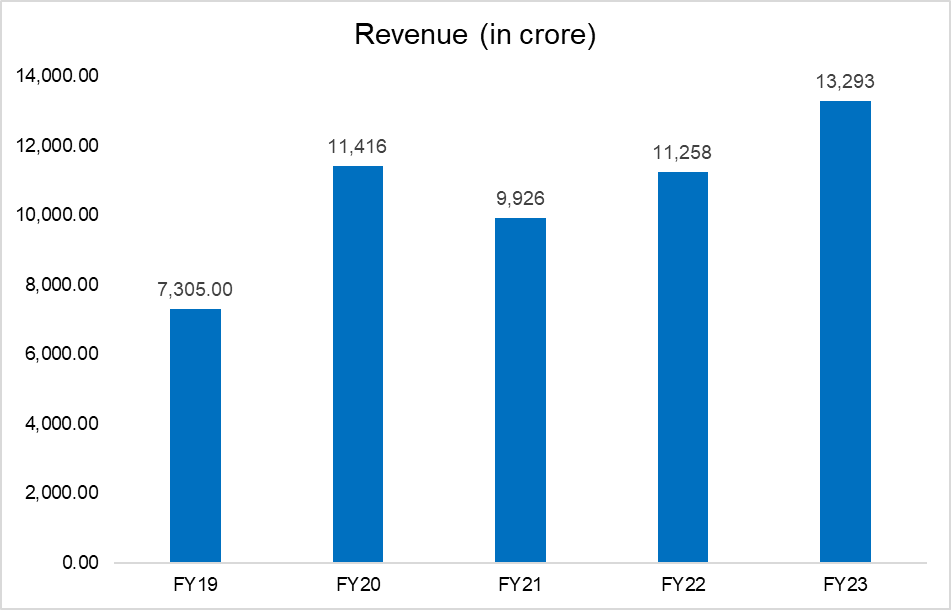

Revenue

In FY23, AESL reported an 18% year-on-year increase in revenue to ₹13,293 crores from ₹11,258 crores in FY22. And, in Q1FY24, the company reported a 16% increase in total income to ₹3,772 crores from ₹3,249.74 crores in Q1FY23.

Operating Segment-wise Revenue

| FY22 (in ₹ cr) | FY23 (in ₹ cr) | Q1FY23 (in ₹ cr) | Q1FY24 (in ₹ cr) | |

| Transmission | 3,469.33 | 3,945.16 | 835.94 | 926.19 |

| GTD Business | 6,966.28 | 8,591.91 | 2,212.74 | 2,737.71 |

| Trading | 821.91 | 755.65 | 83.20 | 0.01 |

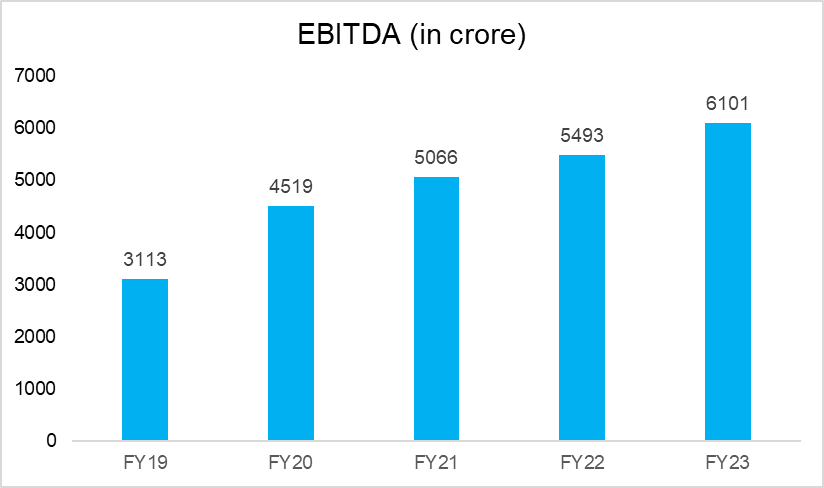

EBITDA

During FY23, consolidated EBITDA increased by 11% to ₹6,101 crores from ₹5,493 crores in FY22. In Q1FY24, the consolidated EBITDA increased by 4% to ₹1,378 crore from ₹1,326 crore in Q1FY23. In the last five years, EBITDA has grown at 14.08% CAGR.

EBITDA Margin

| FY20 | FY21 | FY22 | FY23 | |

| EBITDA Margin (in %) | 40 | 51 | 49 | 46 |

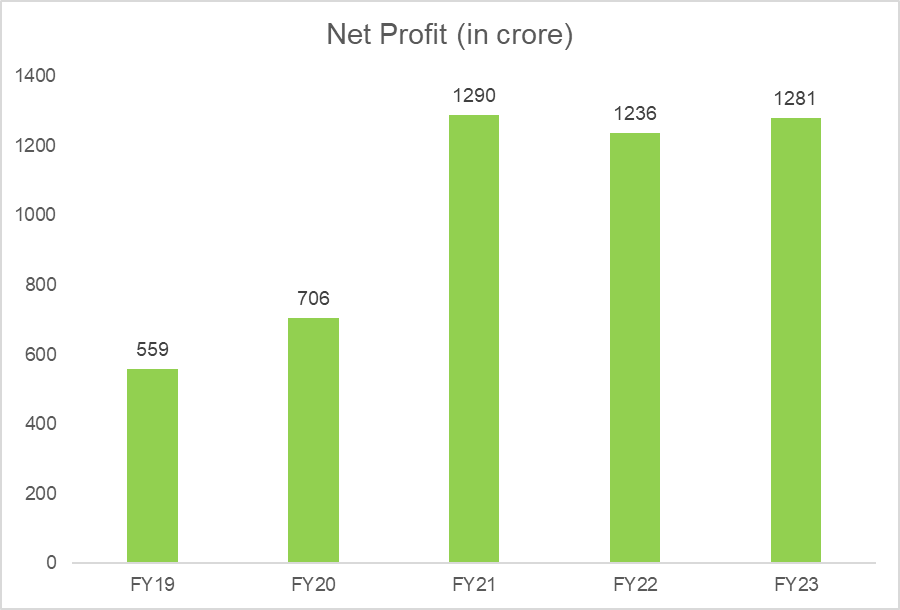

Profit After Tax

In FY23, AESL reported a 4% year-on-year increase in net profit to ₹1,281 crores from ₹1,236 crores in FY22. And, in Q1FY24, net profits increased by 8% to ₹182 crores from ₹168 crores in Q1FY23.

Key Financial Ratios

Current Ratio: The current ratio at the end of June 2023 improved to 1.08 times from 0.88 at the end of June 2022.

Debt-to-equity Ratio: The debt-to-equity ratio stood at 2.74 times at the end of June 2023, compared to 2.72 times at the end of June 2022.

Debt Service Coverage Ratio: At the end of June 2023, the debt service coverage ratio increased to 1.19 times, 1 time at the end of Q1FY23.

Interest Service Coverage Ratio: In Q1FY24, the interest service coverage ratio improved to 1.56 times from 1.27 at the end of Q1FY23.

Return on Capital Employed (ROCE): In FY23, ROCE declined marginally to 9.57% from 9.72% in FY22.

Net Profit Margin: At the end of Q1FY24, the net profit margin declined to 4.82% from 5.18% at the end of Q1FY23.

Adani Transmission(Adani Energy Solution Limited) Share Price History

Adani Energy Solution Limited (erstwhile Adani Transmission) was listed on the stock exchanges by demerging the transmission business from Adani Enterprise Limited on 31st July 2015.

As of 1st September 2023, Adani Transmission share price has given a CAGR of 31% and 44% in the last five and three years, respectively. However, the stock has underperformed heavily in the previous year due to extreme volatility in Adani Group stocks after the release of the Hindenburg report. Adani Transmission share price has dropped from its all-time high of ₹4,326 level, and as of 1st September 2023, it is trading at ₹825 level.

Since listing on stock exchanges, the company has not announced dividend payments to shareholders or bonus issues. The market cap of Adani Energy Solutions Limited is ₹92,017 crores as of 1st September 2023.

Adani Energy Solutions Limited Fundamental Analysis

Transmission

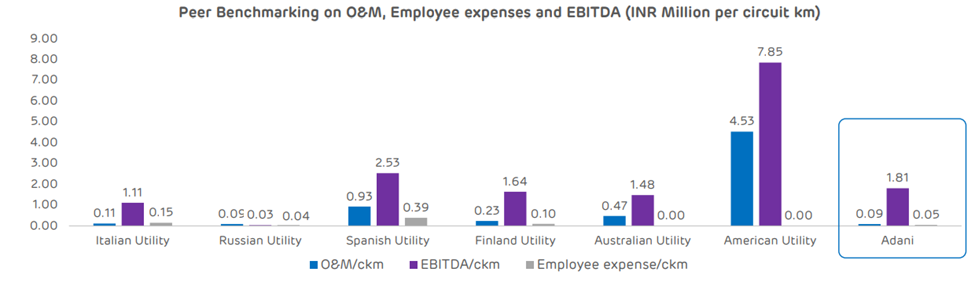

AESL is the largest private player in the power transmission business, with its assets in 14 states. The company has the lowest O&M cost per CKM among Indian power utilities companies, with solid efficiency and system availability in line with global standards.

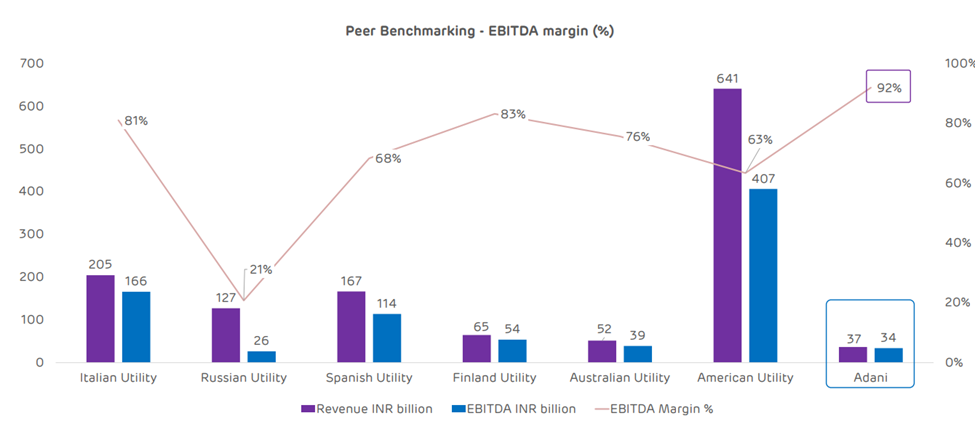

It has the highest EBITDA margin in transmission business across global utilities. Compared to American utility companies, which recorded an average EBITDA margin of 63% in 2022, AESL’s transmission business averaged 92%.

AESL has divided its transmission assets into two categories:

Section 63 (Fixed Tariff): Under it, AESL has 20 operating assets and 9 under-construction assets. From 20 operational assets, it gets a level tariff of ₹1,800 crore per annum. And, from under-construction assets, it expects to get ₹1,500 crores in level tariff.

Section 62 (RAB Assets): Under it, AESL has five transmission assets, four operating and one under construction. The combined worth regulatory asset base (RAB) is ₹17,900 crores.

The group has secured long-term annuity incomes with assets commissioned to last decades (35 years of concession life + 30 years). Also, the company has efficiency-linked incentives, which help to generate higher returns for its highest network availability.

Furthermore, the company has more than 50% sovereign-rate counterparties and no-throughput risks. This has given multi-year revenue visibility and predictability.

It helped the company to efficiently plan its capital management program. AESL has synced its debt to asset life, which has helped reduce the debt cost. The average debt maturity in the company’s books is 8.1 years in FY23. In the power transmission business, there is a business opportunity of more than ₹2,28,000 crores for the private sector in the next 10-15 years.

Distribution

AESL distributed electricity in the Mumbai region through its subsidiary AEML and to the Mundra SEZ zone through MPSEZ Utilities Limited (MUL).

The key characteristics of AESL’s distribution business are it has a pool of over 12 million consumers with a perpetual license period, no throughput risk due to RAB-based returns, and O&M costs are passed to customers.

It services 85% of Mumbai, touching two-thirds of households in the city with the lowest distribution losses in the country at 5.9%. And, in Mundra, it was 3.12%. The company also focuses on parallel distribution, where consumers can choose multiple power distributors. It has planned a capital outlay of ₹20,000 crores over 8 years and is targeting more than 20% of the total market size or 4.5 million customers.

Smart Metering

AESL’s smart metering initiative is currently in the implementation phase and encompasses seven contracts spanning three states. These contracts involve the installation of an impressive 16.2 million smart meters, with a total contract value of ₹19,700 crores.

The smart metering market presents enormous growth potential, with the government aiming to deploy a staggering 250 million meters by 2026, necessitating a significant capital investment of ₹2.2 lakh crores. Notably, AESL has secured a 31% market share from the 109 million smart meters that have been tendered thus far, positioning itself as a critical player in this emerging sector.

District Cooling

AESL has recently expanded its operations into the district cooling sector. This innovative approach involves the centralized production of chilled water, which is then distributed to various buildings through an underground network of pipes to facilitate the cooling process. The system is expected to save 80% electricity and 60% water compared to conventional cooling systems.

Given the massive demand for cooling services in the residential, industrial, data center, and airports, the growth prospects for district cooling is up-and-coming. AESL strategically targets the commercial real estate and industrial cooling segments, with the highest demand for cooling services.

Adani Transmission, or AESL, has a robust operational business performance. However, with a PE ratio of 74.6 (as of 1st Sept 2023), its stock may be relatively expensive compared to its peers. Deleveraging its balance sheet could help Adani Transmission improve its profitability metrics and ROE.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When were Adani Transmission shares listed on stock exchanges?

Adani Transmission share was listed through demerging from its parent company, Adani Enterprise Limited (AEL), on 31st July 2015.

How has Adani Transmission share price performed in the last five years?

As of 1st September 2023, Adani Transmission share price has given a CAGR return of 31% in the last five years.

Is Adani Transmission a profitable company?

Yes, Adani Transmission is a profitable company with India's highest operating efficiency. Its transmission business has generated an EBITDA of 92%, and profit after tax is ₹1,281 in FY23.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 11

No votes so far! Be the first to rate this post.