In India, the paint industry has been long characterized by the dominance of two significant players, Asian Paints and Berger Paints. Despite aggressive marketing strategies and product launches, no other player in the industry has successfully become a market leader.

However, the paint industry is witnessing a fresh wave of disruption with the entry of two new players, Grasim and JSW Paints. This article will explain India’s oldest paint company, Berger Paints, the company and Berger share price.

Brief Overview of Berger Paints

Berger Paints has a very long history in manufacturing colors, and its origin and name date back to over two & a half centuries in England in 1760. The company was started by a young color chemist, Lewis Berger, and his innovation and creation in the world of colors impressed every designer and householder.

Now, the India division of the company was not established by Berger Paints but is a result of an acquisition.

Timeline of Berger Paints India Ltd

- 1923: Incorporated as Hadfield’s (India) Limited in Kolkata

- 1947: British Paints (Holdings) Limited took over the company. The name changed to Britsh Paints (India) Limited

- 1965: Celanese Corporation, USA, acquired the controlling interest of British Paints (Holdings) Limited, including its India division

- 1969: Celanese Corporation sold its Indian interest to Berger, Jenson & Nicholson, U.K. British Paints (India) Limited became part of Berger Group.

- 1973: British Paints (India) Limited changed its name to Berger Paints India Limited

- 1976: Foreign holding of the company diluted to below 40% by the sale of shares to the UB Group

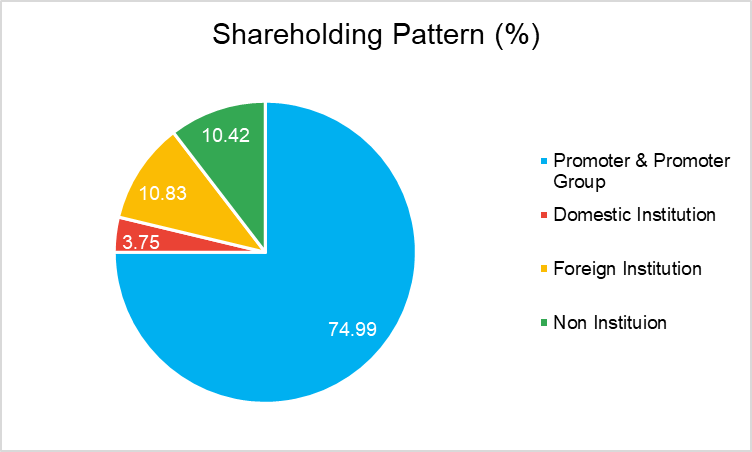

- 1991: UB Group sold its stake to Delhi-based Dhingra brothers (Mr. K.S. Dhingra and Mr. G.S. Dhingra) and their associates of the UK Paints Group. Presently, the Dhingra brothers own a majority stake in the company, almost 73%.

Today, Berger Paints India Limited is the second-largest paint company in India after Asian Paints, with a consistent track record of being one of the fastest-growing paint companies in India.

Business Overview of Berger Paints

Berger Paints is one of the leading paint companies in India and offers its products in the following categories:

Exterior Painting: In this category, the company offers paint products for painting exterior walls of houses strategically designed to cater to specific needs in different regions. Products like WeatherCoat Longlife 10 and WeatherCoat Longlife Flexo are available under this category.

Construction Chemicals: Under this division, the company offers waterproofing solutions. The division crossed ₹1,000 crores in sales in FY23.

Protection: Under this category, the company offers a wide range of coating solutions for various industrial applications, including oil refineries, power plants, railway bridges and coaches, and others. Berger Protection is the industry leader in the segment.

Automotive- General Industrial Coatings: This segment offers coating solutions for CED Coating, Commercial vehicles, heavy construction equipment, and 2-wheelers.

Powder Coatings: The company offers advanced powder coating technologies catering to various industries and applications.

Key Management Personnel

- Mr. Abhijit Roy is the Managing Director & CEO of Berger Paints and has held the position since 1 July 2012. He graduated in Mechanical Engineering from Jadavpur University and did his post-graduation in business administration from IIM-Bangalore.

- Mr. Kaushik Ghosh is Vice President and Chief Financial Officer and joined the company in June 2000. He is a qualified Chartered Accountant and Cost Accountant. Mr. Ghosh started his career in McNally Bharat Engineering Company.

- Mr. K.K Sai is Senior Vice President of Marketing and Sales and started his career as a Management Trainee in Berger Paints around 2000. He has graduated in Chemical Engineering from IIT Chennai and did his MBA from FMS Delhi.

Shareholding Pattern

Berger Paints Financial Overview

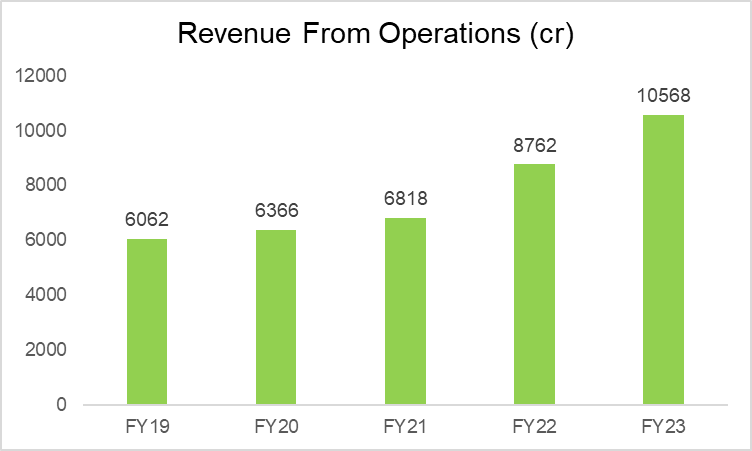

Revenue

In FY23, Berger Paints reported a year-on-year topline growth of 20.6% at ₹10,568 crores, compared to ₹8,762 crores in FY22. The revenue has grown in the last five years at a CAGR of 15.39%. And, in Q1FY24, total revenue increased by 9.8% to ₹3,029.51 crores, from ₹2759.70 crores in Q1FY23.

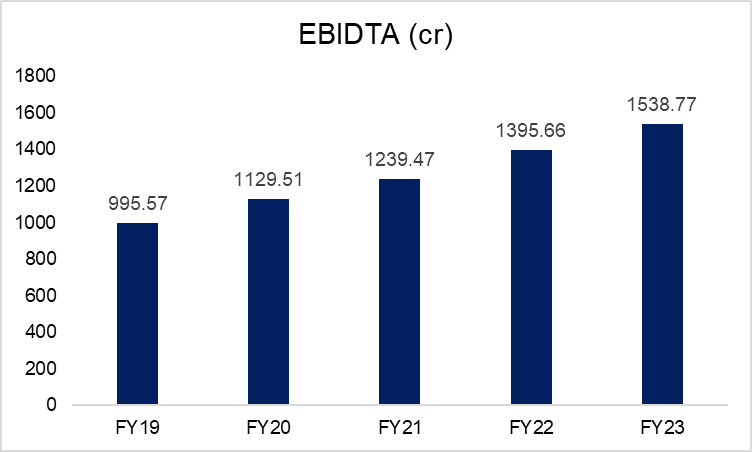

EBITDA

In FY23, the company reported a 10.2% annual growth in EBITDA to ₹1,538.77 crores, compared to ₹1,395.66 crores. And, in Q1FY23, the EBITDA was ₹556.75 crores, which increased by 37.5% every year from ₹404.84 crores over the corresponding quarter of the last year.

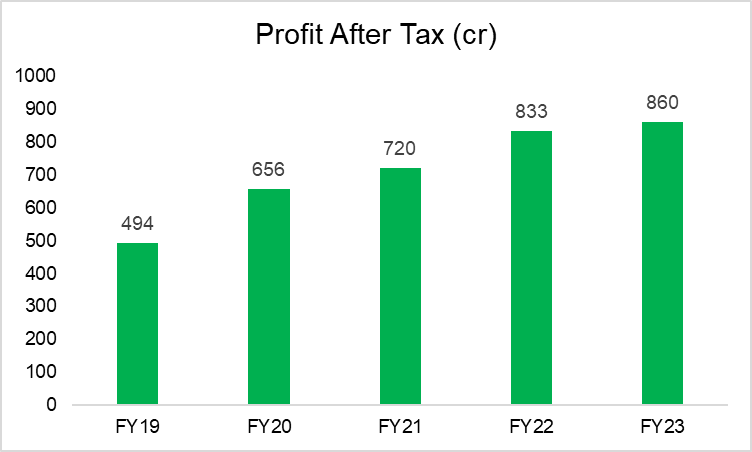

Net Profit

In FY23, the company’s net profit witnessed a year-on-year growth of 3.2% to ₹860 crores, compared to ₹833 crores in FY22. And, in Q1FY24, the company’s net profit was ₹354.91 crores, a 39.9% increase over Q1FY23’s net profit of ₹253.71 crores. The increase is because of favorable raw material costs and operational efficiencies.

Key Financial Ratios

Current Ratio: The company’s current ratio increased to 1.52 times on 30th June 2023 from 1.34 times at the end of 31st March 2023.

Debt-to-equity Ratio: The company’s debt-to-equity ratio improved to 0.16 times at the end of 30th June 2023 from 0.25 times at the end of FY23.

Debt Service Coverage Ratio: The company’s debt service coverage ratio at the end of 30th June 2023 is 10.61 times, compared to 6.76 times at the end of FY23.

Interest Service Coverage Ratio: The company’s ability to service interest expense increased to 24.71 times for the quarter ending on 30th June 2023, compared to 13.31 times at the end of FY23.

Inventory Turnover Ratio: For the quarter ending on 30th June 2023, the inventory turnover ratio increased to 0.84 times, compared to 0.67 times in the previous quarter that ended on 31st March 2023.

Return on Capital Employed (ROCE): The ROCE of the company declined marginally to 22.15% at the end of FY23, compared to 22.74% at the end of FY22.

Berger Paints Share Price Analysis

Berger Paints has generated massive wealth for investors since its listing in the 1960s. The company’s shares have been split twice, and seven bonus issues have been announced. After splits and bonus issues, 100 shares issued at public listing have now become ~17740 shares.

| Announcement | Face Value | Ratio | Number of Shares |

| Pre-bonus and split share | ₹10 | – | 100 |

| Bonus Issue- 15 June 1967 | ₹10 | 1:2 | 150 |

| Bonus Issue- 15 June 1973 | ₹10 | 7:15 | 220 |

| Bonus Issue- 7 October 1998 | ₹10 | 1:1 | 440 |

| Bonus Issue- 30 January 2004 | ₹10 | 1:2 | 660 |

| Stock Split- 13 April 2004 | ₹2 | 10:2 | 3300 |

| Bonus Issue- 6 June 2006 | ₹2 | 3:5 | 5280 |

| Stock Split- 8 January 2015 | ₹1 | 2:1 | 10560 |

| Bonus Issue- 30 May 2016 | ₹1 | 2:5 | 14784 |

| Bonus Issue- 9 August 2023 | ₹1 | 1:5 | ~17740 |

The company also has a consistent track record of paying dividends to its shareholders. It paid ₹2.8 in 2021, ₹3.1 in 2022, and ₹3.2 in 2023 as dividends.

As of 3rd October 2023, Berger Paints’ share price has given a CAGR return of 19% and 5% in the last five and three years, respectively. It has reached an all-time high of ₹727 in July 2021. The market cap of Berger Paints on 3rd October 2023 is ₹65,448 crores.

Peer Comparison

| Company Name | Berger Paints | Asian Paints | Indigo Paints |

| Face Value | ₹1 | ₹1 | ₹10 |

| Share Price (as of 3rd October) | ₹561.50 | ₹3166.85 | ₹1518.85 |

| P/E Ratio (as of 3rd October) | 68.15 | 65.21 | 50.47 |

| Market Capitalization | ₹65,448 crores | ₹303734.73 crores | ₹7233.14 crores |

| Revenue | ₹10,568 crores | ₹29,953.1 crores | ₹1,073.3 crores |

| EBITDA Margin (FY23) | 14.56% | 21.1% | 16.91% |

| Net Profit Margin (FY23) | 8.14% | 12.2% | 12.18% |

| ROCE (FY23) | 22.15% | 38% | 20.9% |

| Distribution Network (FY23) | More than 60,000 retail touchpoints | More than 1.5 lakh retail touchpoints | More than 16,000 dealers |

Key Highlights

- The company expanded its market share from 19.3% in Q4FY23 to 20.2% in Q1FY24.

- During Q1FY24, the company increased its retail touchpoints by incorporating over 1,500 stores and 1,300 color bank machines. The company closed FY23 with over 60,000 retail touchpoints.

- In Q1FY24, the waterproofing and construction chemical segment witnessed robust growth.

- In the Q1FY24 earnings con call, the management said it intends to maintain EBITDA margin within the range of 16-18% in FY24.

Brief Industry Overview

- The market size of the Indian paints and coating industry is about $8.64 billion in 2023. As per estimates by the Indian Paint Association, it is expected to be worth $12.64 billion in the next five years.

- The decorative paints segment is the mainstay of the Indian paints and coating industry and witnessed strong growth in 2022 on the back of the vibrant construction sector.

- Urbanization is the critical driver of the growth of the decorative paint segment. Currently, 34% of India’s population resides in urban areas. And by 2035, it is expected to grow to 43.2%, according to the 2022 United Nations Report.

- 30% of the revenue of India’s paint and coating industry is generated from industrial applications, which have rapidly grown over the years.

- Capex by industry stands at ₹20,000 crores, out of which ₹10,000 crores will be spent by the Grasim and about ₹8,000 crores by Asian Paints. JSW Paints has planned a capex outlay of ₹750-1000 crores in the next two to three years.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

How has Berger share price performed in the last five years?

As of 29th September 2023, Berger share price has given a CAGR return of 19% in the last five years. It has reached an all-time high of ₹727 in July 2021.

When was Berger Paints India Limited incorporated?

Berger Paints India Limited was initially incorporated in1923 as Hadfield’s (India) Limited in Kolkata. The company changed multiple hands, was acquired by Berger Group in 1969, and changed its name to Berger Paints (India) Limited in 1973. Presently, the majority stake of the company is owned by the Delhi-based Dhingra brothers, who have retained the company's name.

Is Berger Paint a good paint company?

Berger Paint is the second-largest paint company in India after Asian Paints.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 22

No votes so far! Be the first to rate this post.