Consistency is the key; be it a journey of a million miles or 1 million dollars, they all take one step at a time. While the allure of quick gains and the excitement of market fluctuations often grab headlines, the steady and disciplined approach to investing can truly build wealth over time.

The Compound Effect of Consistency

Consistency in investing is akin to the power of compound interest. As compound interest grows your wealth exponentially over time, consistent investing allows you to benefit from the market’s natural ebb and flow.

By regularly contributing to your investments, you harness the concept of dollar-cost averaging, buying more shares when prices are low and fewer when they are high. This disciplined approach mitigates the risk of market timing and can lead to substantial growth as your investments compound.

To put it in perspective, let’s take an example considering an investment in a mutual fund with an average annual return of 12%, which is a reasonable expectation for the Indian market. Suppose you start a SIP of Rs 10,000 every month. Here’s how your investment could grow over time:

- Your total contribution would be Rs 6,00,000 after 5 years. With compound interest, the investment would grow to approximately Rs 8,24,964.

- After 10 years, your total contribution would be Rs 12,00,000. With compound interest, the investment would grow to approximately Rs 23.13 lakhs.

- Your total contribution would be Rs 24,00,000 after 20 years. With compound interest, the investment would grow to approximately Rs 99.91 lakhs.

| Year | Monthly investment | Amount Invested | Growth rate | Profit | Total Revenue |

| 1 | 10,000 | 120,000 | 12% | 8,093 | 128,093 |

| 2 | 10,000 | 240,000 | 12% | 32,432 | 272,432 |

| 3 | 10,000 | 360,000 | 12% | 75,076 | 435,076 |

| 4 | 10,000 | 480,000 | 12% | 138,348 | 618,348 |

| 5 | 10,000 | 600,000 | 12% | 224,864 | 824,864 |

| 6 | 10,000 | 720,000 | 12% | 337,570 | 1,057,570 |

| 7 | 10,000 | 840,000 | 12% | 479,790 | 1,319,790 |

| 8 | 10,000 | 960,000 | 12% | 655,266 | 1,615,266 |

| 9 | 10,000 | 1,080,000 | 12% | 868,215 | 1,948,215 |

| 10 | 10,000 | 1,200,000 | 12% | 1,123,391 | 2,323,391 |

| 11 | 10,000 | 1,320,000 | 12% | 1,426,148 | 2,746,148 |

| 12 | 10,000 | 1,440,000 | 12% | 1,782,522 | 3,222,522 |

| 13 | 10,000 | 1,560,000 | 12% | 2,199,311 | 3,759,311 |

| 14 | 10,000 | 1,680,000 | 12% | 2,684,180 | 4,364,180 |

| 15 | 10,000 | 1,800,000 | 12% | 3,245,760 | 5,045,760 |

| 16 | 10,000 | 1,920,000 | 12% | 3,893,782 | 5,813,782 |

| 17 | 10,000 | 2,040,000 | 12% | 4,639,208 | 6,679,208 |

| 18 | 10,000 | 2,160,000 | 12% | 5,494,392 | 7,654,392 |

| 19 | 10,000 | 2,280,000 | 12% | 6,473,254 | 8,753,254 |

| 20 | 10,000 | 2,400,000 | 12% | 7,591,479 | 9,991,479 |

Dodge The Fluctuation Market Risk

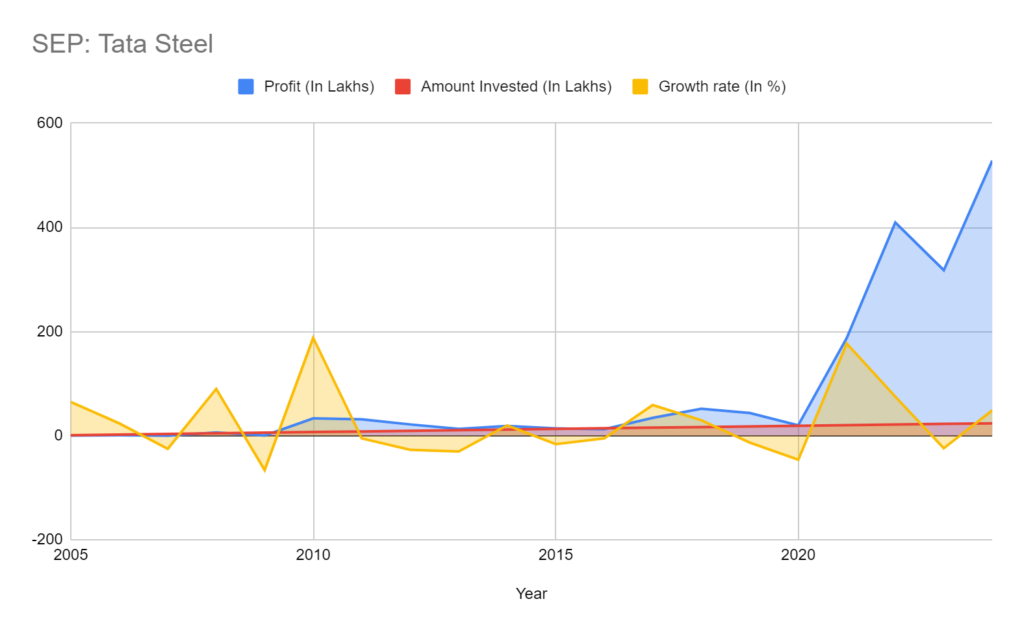

Unlike daily trading, consistent investment doesn’t fall victim to market fluctuation. Your investment stays safe and multiplies over time. If you had started SEP on the stock of Tata Steel on 27-03-2004, this is what the returns would have looked like:

| Year | Monthly investment | Amount Invested | Growth rate | Profit | Total Revenue |

| 2005 | 10,000 | 120,000 | 65.25% | 52,138 | 172,138 |

| 2006 | 10,000 | 240,000 | 23.80% | 114,534 | 354,534 |

| 2007 | 10,000 | 360,000 | -24.66% | 21,448 | 381,448 |

| 2008 | 10,000 | 480,000 | 89.93% | 625,947 | 1,105,947 |

| 2009 | 10,000 | 600,000 | -65.92% | 46,098 | 646,098 |

| 2010 | 10,000 | 720,000 | 188.33% | 3,345,848 | 4,065,848 |

| 2011 | 10,000 | 840,000 | -4.68% | 3,156,400 | 3,996,400 |

| 2012 | 10,000 | 960,000 | -27.13% | 2,181,162 | 3,141,162 |

| 2013 | 10,000 | 1,080,000 | -30.01% | 1,340,080 | 2,420,080 |

| 2014 | 10,000 | 1,200,000 | 19.99% | 1,884,663 | 3,084,663 |

| 2015 | 10,000 | 1,320,000 | -16.06% | 1,414,131 | 2,734,131 |

| 2016 | 10,000 | 1,440,000 | -5.06% | 1,275,659 | 2,715,659 |

| 2017 | 10,000 | 1,560,000 | 59.28% | 3,450,270 | 5,010,270 |

| 2018 | 10,000 | 1,680,000 | 29.96% | 5,197,131 | 6,877,131 |

| 2019 | 10,000 | 1,800,000 | -12.58% | 4,372,527 | 6,172,527 |

| 2020 | 10,000 | 1,920,000 | -46.25% | 2,025,351 | 3,945,351 |

| 2021 | 10,000 | 2,040,000 | 176.59% | 18,778,331 | 20,818,331 |

| 2022 | 10,000 | 2,160,000 | 74.60% | 40,952,758 | 43,112,758 |

| 2023 | 10,000 | 2,280,000 | -23.60% | 31,796,455 | 34,076,455 |

| 2024 | 10,000 | 2,400,000 | 48.97% | 52,827,566 | 55,227,566 |

By investing Rs 10,000 every month for 20 years, you create a corpus of Rs 24 lakhs, on which you get a 2102% return, a profit of Rs 5.28 Cr. Your investments stay profitable even when the market crashes and suffers severe losses.

This profit can multiply even further if you know when to pull your money out and reinvest to have maximum returns.

The Psychological Advantage

Investing consistently also offers a psychological advantage. It establishes a habit, making investing a regular part of your financial routine. This habit-forming behavior is crucial because it helps investors stick to their plans, even during market downturns. The emotional rollercoaster of investing can lead to impulsive decisions, but consistency acts as a buffer, providing a sense of control and stability.

The Bottom Line

Ultimately, consistency may not be glamorous, but it’s effective. The daily grind, incremental improvements, and unwavering commitment to a strategy pave the way for financial prosperity. In a world that’s often chasing the next big thing, it’s the investors who appreciate the power of consistency who find themselves ahead in the long run.

FAQs

Why is consistency important in investing?

Consistency is crucial because it allows investors to benefit from the market’s ups and downs. Regular contributions lead to dollar-cost averaging, reducing market timing risk and contributing to compound growth.

How does consistency contribute to compound interest?

By investing a fixed amount regularly, you buy more shares when prices are low and fewer when they are high. This can increase the value of your investments significantly as the returns generate further returns over time.

What psychological benefits does consistent investing provide?

Consistent investing helps form a habit, making it a regular part of your financial routine. This can help investors maintain their strategy during market downturns, providing emotional stability and control.

Can organizational consistency affect investment outcomes?

Yes a consistent investment team and strategy can accumulate knowledge and experience essential for navigating market complexities and achieving steady growth.

Is it better to chase market trends or maintain a consistent investment approach?

While chasing market trends can be tempting, a consistent investment approach is generally more effective for long-term financial prosperity. It avoids the pitfalls of frequent strategy changes and aligns with the principle of compound growth.

How does consistency help during market downturns?

Consistency acts as a buffer during market downturns. It helps investors stick to their plans and avoid making impulsive decisions based on short-term market movements.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/