Have you ever wondered how to buy stock in a company based in another country? A brand’s innovation is wonderful; you want a piece of it. Can an Indian company, such as Tata Motors, Infosys, or Dr Reddy’s, be listed on an international exchange?

Are these questions intriguing? No, not that much.

Well, there is a way to trade in your local stock exchanges without dealing with the difficulties of cross-border transactions. It’s called depository receipts, issued by banks that hold the real shares of foreign companies and let you trade them on your local stock exchange.

But before you jump into this exciting world of global investing, there are some things you should know. In this article, we will tell you five things you must know about depository receipts: how they work, their advantages and disadvantages, and how they differ from regular shares.

What are Depository Receipts?

Depository Receipts are negotiable securities issued by Banks or Financial institutions in the form of share certificates of a foreign public company. They allow you to buy equity in those companies without trading directly on their stock exchanges.

You can buy and sell depository receipts on your local stock exchange, like any other local stock. You can also receive dividends, bonuses, and capital gains in your currency. Depository receipts are issued by the country where the foreign company wants to reach investors.

For example, American depositary receipts (ADRs) are issued for foreign stocks that trade on U.S. exchanges. European depositary receipts (EDRs) are issued for foreign stocks that trade on European exchanges. Global depositary receipts (GDRs) are issued for foreign stocks that trade on any exchange. Indian Depository Receipts (IDRs) that trade on Indian Stock Exchanges like BSE/NSE are issued in India for foreign companies having their offshoots/subsidiaries in India.

Depository Receipts – Illustration

Let us take a depository receipts example to understand this concept clearly. Say you want to invest in a company called ABC based in France. You live in India and don’t have access to the French stock exchange.

You don’t even want to deal with the issues of currency conversion, taxes, and regulations involved in buying foreign shares. So, what’s the solution to this problem?

You can approach any Bank/Financial institution in India that issues depository receipts of ABC. The bank holds the shares of ABC in a custodian bank in France and issues certificates representing one share each.

These depository receipts (DRs) or certificates are traded on the Indian stock exchange under the ABCD symbol. You can buy and sell ABCD just like any other stock on the Indian market. You can also receive dividends and other benefits from ABC in Indian Rupees after deducting any taxes or fees.

5 Things You Must Know About Depository Receipts

- Emerging market investors generally use Depository Receipts (DRs) to invest in developed markets.

- The price movements of Depository Receipts depend on the movement of the underlying stock.

- Depository Receipts are traded and settled independently in the local currency.

- DR holders are entitled to receive bonuses, dividends, or other benefits on their equity. However, their voting rights are limited by the “terms of issue” defined in the agreement between the issuer and holder of these instruments.

- The purpose of depository receipts is to raise capital from foreign markets and gain access to diverse economies.

How do Depository Receipts Work?

To understand how depository receipts work, let us first analyze the parties involved while issuing these receipts.

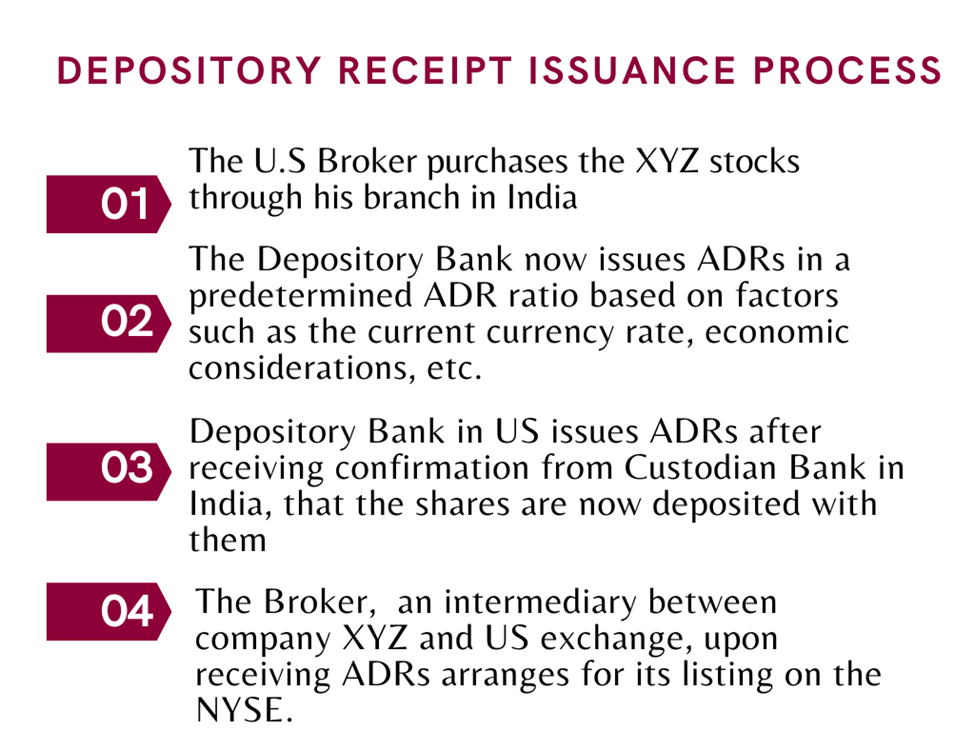

Say you own an Indian IT company, XYZ, and wish to raise funds from the U.S. markets and get listed on the New York Stock Exchange (NYSE). Your company fulfills the basic requirements for the issue of ADRs.

So, the intermediary parties involved in the process, in this case, will be

- Depository Bank- the one that issues ADRs on NYSE

- Custodian Bank- the Bank in the originating country i.e., India

- Broker – Generally situated in the country that issues ADRs, i.e U. S

- Stock Exchange- Where the stocks of XYZ get listed, i.e, NYSE

Advantages of Depository Receipts

1. Depository Receipts open before the investor an alternative opportunity to trade through an international market.

2. Depository Receipts allow the investor to hold equity shares of foreign companies without being involved in direct trading with the overseas market.

3. Depository Receipts allow an investor to diversify their portfolios by purchasing shares of companies in the global markets and economies.

4. Depository Receipts are less expensive and more convenient than buying stocks directly from the international market.

Therefore, issuing depository receipts allows companies to broaden their investor base and obtain cash without having to list on their local stock exchange. They must, however, follow the rules and regulations of the issuing country, as well as comply with their home country’s securities market laws.

Disadvantages of Depository Receipts

- Depository Receipts have poor liquidity i.e., buyers and sellers in this market are limited therefore, you may face some delay in realizing your money.

- Depository Receipts are sensitive to exchange rate changes, political instabilities, and upheaval in the foreign country’s economic environment.

- Higher processing and transaction costs gobble up much of your profits.

- Changes in rules in home and foreign countries impact Depository Receipts, contributing to their volatility.

Key Takeaways

Global investment in Depository Receipts climbed by 35% between 2012 and the first quarter of 2022, indicating that more investors are migrating into this market.

Depository Receipts provide immense opportunities to invest in International Stocks and mint profits. Some of the most reputed Indian companies, like Infosys, Reliance Industries, and ICICI Bank, have invested in Depository Receipts to access the international markets to raise capital.

But investors must also be aware of a fair amount of risks. Depository Receipts are susceptible to market fluctuations in the respective country’s market. Hence investors must carefully study the market fluctuation graph, economic and political conditions, and tax implications before investing.

FAQs

What are the types of depository receipts?

Depository receipts are divided according to where they are issued and traded. Like American depositary receipts (ADRs), issued by US banks trade on US exchanges. European depositary receipts (EDRs), issued by European Banks, trade on European exchanges. Global depositary receipts (GDRs), issued for countries other than the US, trade on any market.

How are depository receipts taxed?

The taxation of depository receipts depends on the laws and regulations of both the issuer’s and the investor’s countries and the type and terms of the depository receipt. Investors generally must pay taxes on their capital gains and dividend income, either in their home country, the issuer country, or both, depending on the tax agreements between both countries.

How do Depository Receipts differ from traditional shares?

Depository receipts differ from ordinary shares in several ways, such as:

● Ownership: Depository receipts represent an indirect ownership of the foreign company’s shares, while ordinary shares represent direct ownership.

● Voting rights: Depository receipts may or may not have voting rights, depending on the type and terms of the depository receipt. Generally, American Depositary Receipts (ADRs) have voting rights. In contrast, Global Depositary Receipts (GDRs) do not (even if depository receipts have voting rights, they may be limited or restricted by the depository bank).

Ordinary shares usually have full voting rights unless they are non-voting or preference shares.

How useful was this post?

Click on a star to rate it!

Average rating 3.3 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/