Who are Gen Z, and how are they affecting the stock market?

Let’s learn, Shall we?

Gen Z are people born between 1997 and 2012. Since childhood, they have experienced technology and the internet as integral parts of their daily lives. According to the 2022 update of the World Population Prospects, over half of India’s population is under 25 years old, and 65% are under 35. In 2020, the average age of an Indian was 29 years. These statistics show that most of India’s population is composed of millennials and Gen Z. It is likely Gen Z will surpass millennials in terms of population size in a few years.

Gen Z has a high level of comfort with digital tools and platforms. They are more likely to embrace digital offerings for financial products and services. The digitization of the financial industry has made access to the stock market easy.

Financial Digital Tools

Online brokers, Robo-advisors, and mobile apps have made buying and selling stocks, mutual funds, and other investment products a breeze without needing to visit a physical location. In addition, digital tools have helped Gen Z to invest in the stock market, contributing to the increasing popularity of online trading among this generation.

Introducing new financial products, such as exchange-traded funds (ETFs) and cryptocurrency, has also attracted Gen Z to the stock market. ETFs, in particular, have become popular due to their low cost, diversification, and ease of use. Cryptocurrency, while still a relatively new and volatile asset class, has gained takers among Gen Z for its potential for high returns.

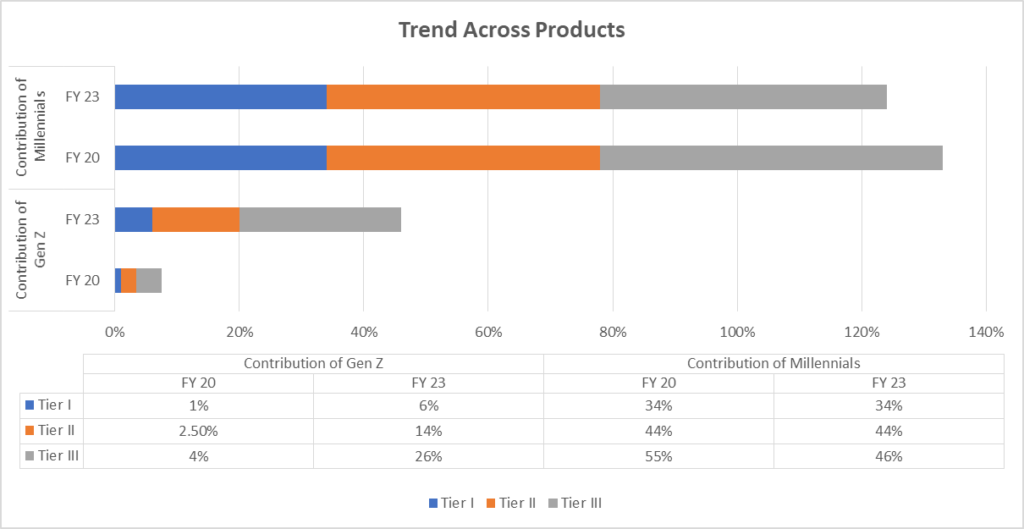

Take a look at this graph below. It shows the trends of products Gen Z and millennials have invested in during FY20 and FY23. In addition, it shows their progressive nature compared to millennials.

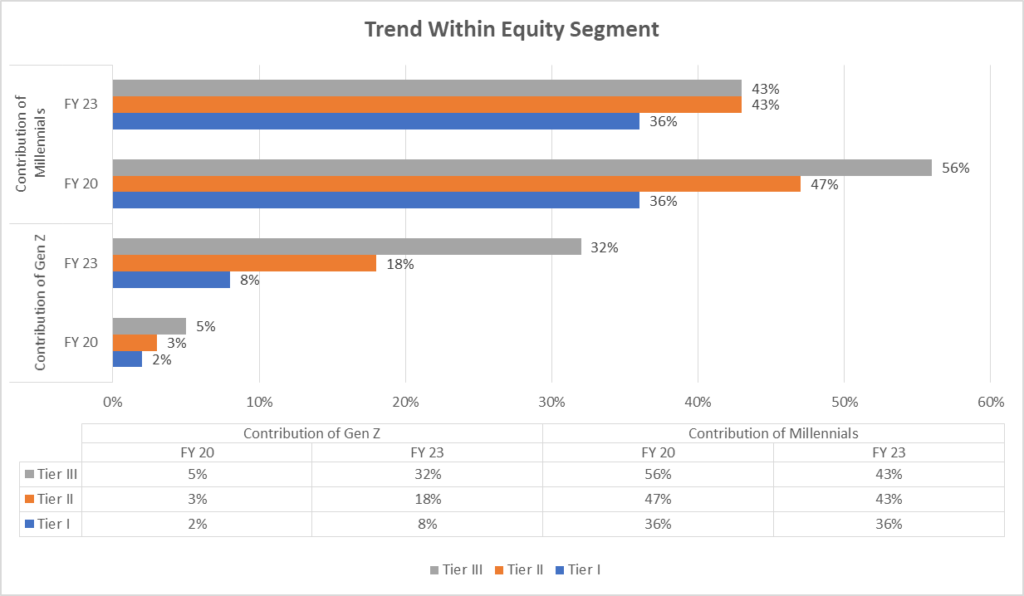

This graph shows the trend within the equity segment between GenZ and millennials during FY20 and FY23.

Gen Z is willing to embrace new technologies and financial products. For example, they are more likely to invest in the stock market using digital tools and platforms to manage their investments and make informed decisions about where to allocate their assets than the previous generations.

Factors attracting Gen Z to the stock market encourage them to invest more

- One factor is the potential for high returns on their investments. For instance, the stock market has historically provided higher returns over the long term than other asset classes, such as savings accounts or bonds.

- They are also attracted to building wealth and achieving financial independence through investments.

How has Gen Z affected the stock market?

The increasing popularity of Gen Z in the stock market has had an impact on the market itself. Gen Z’s embracing digital financial products has contributed to online investments and management growth. Their willingness to embrace risk and try new things have been crucial drivers of financial innovation creating new opportunities for investors.

How can Gen Z make the right investment portfolio to generate wealth?

The right investment portfolio tailored for Gen Z will depend on various factors, including financial goals, risk tolerance, and time horizon. Here are a few general principles that could be considered when building an investment portfolio:

- Starting early and investing consistently: It can help build wealth over time. They can take advantage of the power of compound interest and potentially increase wealth significantly.

- Diversify: One of the key principles of investing is diversifying your investments across various asset classes and individual securities to reduce risk. It can help protect against losses and smooth out returns over time.

- Consider your risk tolerance: When building an investment portfolio, it is important to consider risk tolerance. If they are comfortable taking on more risk, they can invest a larger portion of your portfolio in high-risk, high-reward assets. For the risk-averse, allocate your portfolio to lower-risk assets.

- Set financial goals: Before you start investing, it is essential to have a clear understanding of your financial goals. It can help guide your investment decisions and ensure that you invest in a way that aligns with your long-term objectives.

- Monitor and review: As you build your investment portfolio, it is essential to regularly monitor and review your holdings to ensure that they align with your financial goals and risk tolerance. You must adjust your portfolio over time to stay on track.

Final Words

The digitization of the financial industry has made it easier for Gen Z to invest in the stock market. One of the most important is educating themselves about investing, the available options, and associated risks and rewards. Consider seeking advice from a financial advisor or professional to develop a sound investment strategy.

FAQs

What is the level of Gen Z financial literacy?

According to a study conducted by Investopedia, Gen Z is a “digital-first” generation with potentially higher financial awareness but may lack an in-depth understanding of financial concepts.

What are some ways that Gen Z can increase their financial literacy?

Gen Z can increase financial literacy through education, seeking advice from financial professionals, taking online courses, reading blogs, and staying current with financial news and trends.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.