Introduction

In a fiercely competitive market, where large and multinational retail chains are struggling to dominate and be profitable, Avenue Supermarts, the operator of the D-Mart retail stores, is not only thriving but has set a benchmark in efficiency and profitability.

From its humble beginning in the early 2000s, D-Mart has become one of India’s most successful and rapidly expanding retail chains. This article will help us understand the fundamentals of Avenue Supermart.

History of Avenue Supermart

DMart, short for Damani Mart, was founded by investor and entrepreneur Radhakishan Damani and his family in 2000. The first DMart store was opened in Powai in 2002 with a straightforward vision, to provide customers with a wide range of products at affordable prices. DMart is in 10 states, one union territory, and NCR with 324 stores.

DMart initially chose to expand its store network within Maharashtra. It took eight years for the company to open its first ten stores before scaling up its operations and expanding to other states.

It followed a cluster-based expansion strategy, focusing on deepening its penetration, where it was already present before moving to newer regions. The success of DMart’s growth is attributed to multiple factors, including its everyday low pricing strategy for products, store format, supply chain management, and customer-centric approach.

Business Overview of Avenue Supermart

DMart offers its customers a mix of everyday-use items with a prudent product mix across all stores in three categories- Food, Non-Food, and General Merchandise and Apparel.

The company sells all its products through offline and online modes. Avenue Supermarts allows its customers to shop online through its mobile app and website, www.dmart.in. In accordance with the Indian Accounting Standard 108, all business activities of the company primarily fall under a single segment of “retail,” and all its revenues originate from within India.

Key Management Personnel

- Mr. Ignatius Navil Noronha is the Managing Director and CEO and has been with the company since 2004. He is a graduate of the Narsee Monjee Institute of Management Studies.

- Mr. Ramakant Baheti is the Whole-time Director and Group CFO at Avenue Supermarts and has been with the company since its inception. He is a qualified Chartered Accountant from ICAI.

- Mr. Narayan Bhaskaran is the Chief Operating Officer (COO) and oversees the company’s supply chain management. He joined Avenue Supermarts as Vice President HR in May 2008 and was promoted to COO in September 2016. Mr. Bhaskaran has done post-graduation in human resource management from XLRI, Jamshedpur, and is also a qualified Company Secretary.

- Mr. Niladri Deb is the Chief Financial Officer and joined the company in 2018. He is a qualified Chartered Accountant and also did management-related courses from IIM-Ahmedabad. Earlier, he was with The Kraft Heinz Company, ITC, and Usha International.

- Mr. Trivikrama Rao Dasu is the CEO- of Avenue E-Commerce Limited. He looks after the entire e-commerce operations of the company.

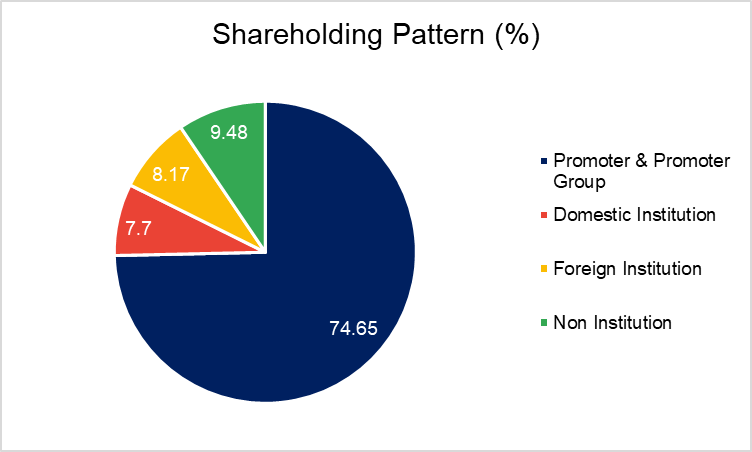

Shareholding Pattern

Financials

Revenue

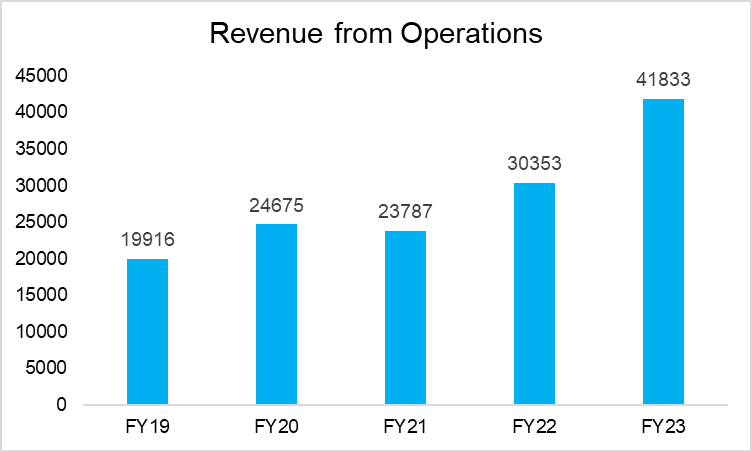

In FY23, the company reported a 38% year-on-year increase in consolidated revenue from operations to ₹41,833 crores, from ₹30,353 crores in FY22. In Q1FY24, revenue from operations came in at ₹11,865.44 crores, up 18.2% from ₹10,038.07 crores in Q1FY23.

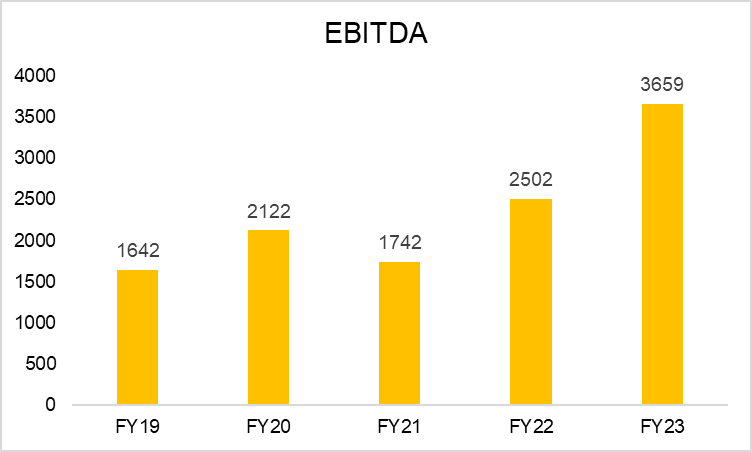

EBITDA

In FY23, the company reported a 46% year-on-year increase in EBITDA to ₹3,659 crores from ₹2,502 crores in FY22. And, in Q1FY24, DMart’s EBITDA was ₹1,035.3 crores, up 2.8% year-on-year, compared to ₹1,008 crores in the same period last year.

| FY19 | FY20 | FY21 | FY22 | FY23 | |

| EBITDA Margin (in %) | 8.2 | 8.6 | 7.3 | 8.2 | 8.7 |

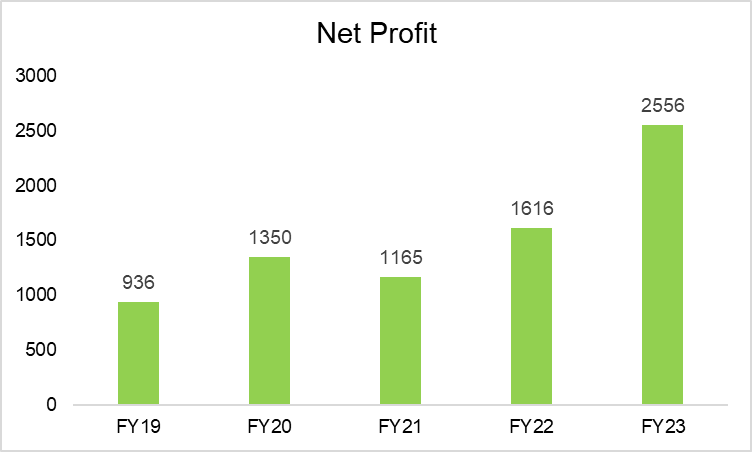

Net Profit

In FY23, the company’s net profit increased by 58% year-on-year to ₹2,556 crores from ₹1,616 crores. And, in Q1FY24, net profit increased by 2.3% to ₹658.71 crores from ₹642.89 crores in Q1FY23.

| FY19 | FY20 | FY21 | FY22 | FY23 | |

| Net Profit Margin (in %) | 4.7 | 5.5 | 4.9 | 5.3 | 6.1 |

Key Financial Ratios

Current Ratio: The current ratio increased 4 times at the end of FY23 from 3.06 times in FY22. The ratio increased because fixed deposits held with the bank last year were reclassified as a current asset in FY23.

Debt-to-equity Ratio: The company has no long-term debt on its book, and the debt-to-equity ratio is stable at 0.03 times as of 31st March 2023.

Interest Coverage Ratio: The interest coverage ratio was 68.22 times at the end of FY23, up from 56.09 times at the end of FY22.

Inventory Turnover Ratio: The inventory turnover ratio in FY23 was 14.83 times, up from 12.77 times in FY22.

Operating Profit Margin: The operating profit margin in FY23 was 7.84%, up from 7.32% in FY22.

Net Profit Margin: The net profit margin was 6.11% in FY23, up from 5.32% in FY22.

Return on Capital Employed (ROCE): The ROCE of the company improved to 21.50% at the end of FY23, up from 17.37% at the end of FY22.

Return on Equity (ROE): The ROE stands at 16.8% in FY23, up from 12.32% at the end of FY22 due to increased earnings.

DMart Share Price Analysis

DMart launched its IPO on March 8th, 2017, and was the most successful issue in the market. The IPO was issued at a price band of ₹295 to ₹299 per share and oversubscribed by 104.5 times, receiving bids for 463.61 crore shares against the total issue size of 4.43 crore. The shares were listed on March 21, 2017, at ₹604.7 per share, up 102% over the issue price.

In the last five years, DMart share price has given a CAGR return of 20%, rising from around ₹1,200 level, and as of 21st September 2023, it is trading at around ₹3,680 level. It made an all-time high level of ₹5,900 on 18th October 2021.

In its listing history, the company has not issued any dividends or bonus shares to its investors. As of 21st September 2023, the market capitalization of Avenue Supermarts is close to ₹2.4 lakh crore.

Avenue Supermarts Company Analysis

Avenue Supermarts has recovered after being severely impacted by COVID-19 in terms of sales, and both growth and demand have now surpassed pre-COVID levels in FY23. Total bill cuts in FY23 were 25.8 crores, which dropped from 20.1 crores in FY20 to 15.2 crores in FY21.

The revenue from sales per retail business area sq ft was ₹31,096 in FY23, which is still below the FY19 level of ₹35,647. During this period, the company expanded to new geographies, and the store count went up from 176 to 324, taking up the retail business area from 5.9 million to 13.4 million sq. ft.

Financial Performance

In FY23, the company showcased a turnaround in financial performance with a 38% annual increase in the top line to ₹42,839.56 crore, and the bottom line increased by 58% to ₹2,556 crores. The net profit margin improved by 210 bps from 4.9% in FY21 to 6.1% in FY23, as the company recovered from the Covid-19 pandemic slowdown and drop in demand.

However, the company’s General Merchandise and Apparel Category continues to witness sales weakness. Generally, the merchandise and apparel category is where the margin is highest compared to the foods and non-foods category.

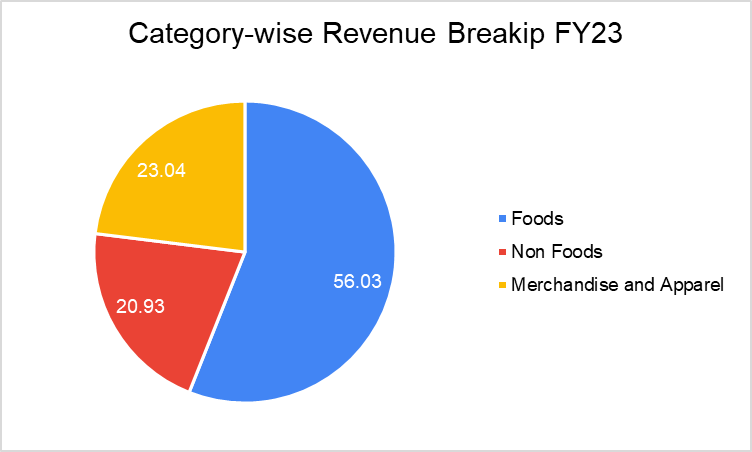

In FY19 and FY20, the revenue contribution share from General Merchandise and Apparel was 28.29% and 27.31%, respectively, which fell to 23.04% in FY23. Also, the company struggles to increase the revenue share contribution in the non-foods category, around 20%.

Operational Performance

The company in FY23 added 1.9 million sq ft, and sales revenue inched higher from ₹27,454 per sq. ft. to ₹31,096 per sq. ft. Still, it is below the pre-Covid levels, which used to be ₹35,647 per sq. ft. in FY19.

As per the management commentary, recent expansion to other states and larger store sizes resulted in a drop in revenue per sq. ft.

Inventory Days, which shows how long products are in storage before they are sold, are coming down. From 36.5 days in FY21, it has dropped to 28.8 days in FY23. The drop is due to changes in product mix in recent years. It has reduced its inventory levels in the General Merchandise and Apparel category and increased inventory levels in the Food and Non-food categories.

The company is reorganizing its merchandise and apparel businesses, focusing on less aspirational products such as daily wear and less on the fashion apparel category in the ₹500-600 price range.

E-commerce Business

DMart Ready, the company’s e-commerce division, reported a total revenue of ₹2,202.03 crores in FY23, compared to ₹1,667.21 crores in FY22. It reported a loss of ₹193.07 crores and ₹142.07 crores in FY23 and FY22, respectively. The company operates its e-commerce services in 22 cities and focuses on increasing efficiency in the Mumbai Metropolitan Region.

As per management commentary, there is little room for losing money in the e-commerce segment and the growth in the e-commerce division is not impacting the revenue growth in physical stores.

Expansion

The company follows a cluster-based expansion approach, strengthening its presence in existing areas before moving to new regions. It increases the operating leverage. The entry of other big players like Reliance results in stiff competition in existing and new regions.

DMart is currently experiencing high real estate costs and a lack of availability of large store sizes that impact store sizes. The company has also ventured into the pharmacy business, opening its first outlet in Mumbai. And looks to scale it up as it requires less shelf space and high productivity.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

How has DMart share price performed in the last five years?

As of 21st September 2023, DMart share price has given a CAGR return of 20% in the last five years. It made an all-time high of ₹5,900 on 18th October 2021.

When was DMart founded?

DMart was founded in the year 2000 by Radhakishan Damani. It opened its first store in 2002 in Mumbai. As of 21st September 2023, the company has 327 stores across 10 states, one union territory, and NCR.

Are Avenue Supermarts and DMart the same?

Yes, they both are the same. Avenue Supermarts owns and operates the DMart supermarket chain.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 15

No votes so far! Be the first to rate this post.