It’s time for tax saving again, and we are sure you are racking your brain to come up with a few options to save on tax. One of the most popular options is the Equity-Linked Saving Scheme, often called ELSS. We thought understanding these ELSS funds would help you decide better.

Let’s see what Equity-Linked Saving Scheme is.

What are ELSS Funds?

ELSS funds are mutual funds that invest primarily in equity and equity-related instruments. If you choose the old regime, you can claim a deduction of up to Rs. 1.5 lakhs from your taxable income in a fiscal year under Section 80C of the Income Tax Act. These funds have a lock-in period of three years, meaning you cannot redeem your investment before completing this period.

Who Can Invest in ELSS Funds?

Any resident Indian individual or HUF (Hindu Undivided Family) can invest in these funds. You can invest either through a lump sum or a systematic investment plan (SIP), which allows you to invest a fixed amount of money at regular intervals, such as monthly or quarterly.

How to Invest in ELSS Funds?

To invest in these funds, follow these simple steps:

- Choose the right fund that matches your investment goals and risk appetite.

- Open a mutual fund account with a fund house or broker, or invest through their online or offline platforms.

- To complete KYC formalities, you must submit your identity, address proofs, and other documents like your PAN card, Aadhaar card, and bank details.

- Invest in ELSS funds through a lump sum or a systematic investment plan (SIP), which allows you to invest a fixed amount at regular intervals, like monthly or quarterly.

Avoid These Pitfalls When Investing in Tax-Saving Mutual Funds

Investing in ELSS funds can effectively save taxes and earn higher returns, but there are certain mistakes to avoid. Avoid the following to get the maximum return on your investment:

- Don’t invest only for tax-saving purposes; consider them equity-oriented mutual funds offering long-term capital appreciation.

- Diversify your portfolio across different asset classes.

- Regularly review your ELSS portfolio to ensure it aligns with your investment goals and risk appetite.

- Be aware of the lock-in period of three years and avoid investing money that you may need in the near future.

- Research the fund manager’s track record and investment style before investing in the fund.

ELSS Funds Under New Regime Vs. Old Regime

The potential consequence of shifting to the new tax regime is to abandon the ELSS funds tax benefit. According to the article, the new tax regime may not be as beneficial as it seems, as it eliminates many deductions and exemptions, including those offered by these funds. Conversely, these funds offer significant tax savings under the old tax regime and can help diversify one’s portfolio.

To illustrate the difference, consider the following example.

Ms Mala is a salaried employee at ABC ltd, earning Rs. 10 lakhs. What would her taxable income be under the old and new regimes?

| Items | Old Tax Regime (Rs.) | New Tax Regime (Rs.) |

| Annual Income | 10,00,000 | 10,00,000 |

| Less: Standard Deduction | 50,000 | 50,000 |

| Less: Section 80C (ELSS+ EPF +LIC+ Tuition Fees, etc) | 1,50,000 | NA |

| Less: House Rent Allowance | 25,000 | NA |

| Less: Insurance(Health) – self and spouse, parents (if senior citizen) | 35,000 | NA |

| Less: New Pension Scheme 80CCD (1B) | 30,000 | NA |

| Total (Deduction & Exemption) | 2,90,000 | NA |

| Net Taxable Income | 7,10,000 | 9,50,000 |

The table shows that the old regime allows section 80C deduction while the new regime has eliminated the Section 80C deduction.

Risks and Rewards of Investing in ELSS Funds

Investing in these funds can be rewarding and risky, just like any other investment. The rewards include tax benefits under Section 80C if you opt for the old regime, potentially higher returns than traditional investments, and a diversified portfolio that reduces overall risk. However, there are also risks, such as market volatility, a lock-in period of three years that limits liquidity and flexibility, and the risk of underperformance due to the fund manager’s skills and experience.

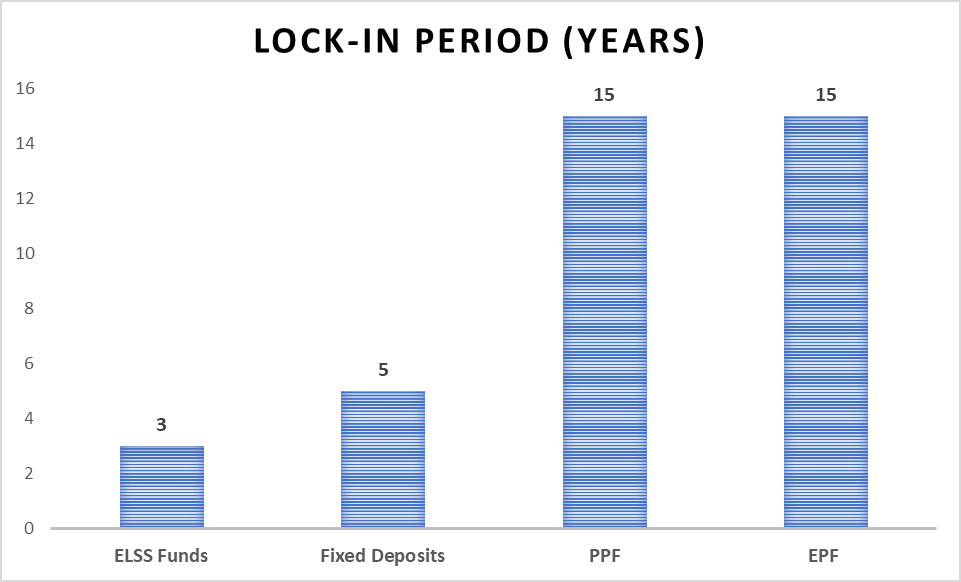

As shown in the below graph, these funds are highly liquid compared to other tax-saving instruments.

Final Words

Understanding these risks and rewards before investing in these funds is important, as carefully consider your investment goals and risk appetite. With proper research and planning, investing in these funds can help you achieve your financial goals and save on taxes under the old regime.

FAQS

Who should avoid ELSS investments?

You are seeking quick profits. Seeking rapid profits using ELSS funds may not always work. Therefore, you should avoid them if you desire quick returns. These funds may be appropriate if you have a longer investing horizon.

Can I redeem my investment in ELSS funds before the completion of the lock-in period?

No, you cannot redeem your investment in These funds before completing the three-year lock-in period. However, you can redeem your investment after the lock-in period or continue to hold it longer.

Are capital gains from ELSS subject to taxation?

The government exempts long-term capital gains from ELSS from taxes up to INR 1 lakh. Any gains exceeding that limit will attract a long-term capital gains tax of 10%. Moreover, the applicable slab rate taxes the dividends received.

What is the lock-in period for ELSS funds?

ELSS funds have a lock-in period of three years, meaning you cannot redeem your investment before completing this period. It ensures that investors stay invested longer, potentially resulting in higher returns.

What are the minimum and maximum investment amounts for ELSS funds?

Fortunately, there is no maximum limit for investing in ELSS or any other mutual fund. You can invest as much as you desire and allow your funds to grow through compounding. The minimum investment amount for ELSS varies depending on the fund house. Generally, it is Rs 500.

Is it possible to make partial withdrawals from ELSS funds?

No, it is not possible. This is good news because staying invested in the fund for at least three years is essential. The longer you stay invested in equities, the more wealth you may accumulate, depending on your investment amount.

Related investing topics

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.1 / 5. Vote count: 8

No votes so far! Be the first to rate this post.