Introduction

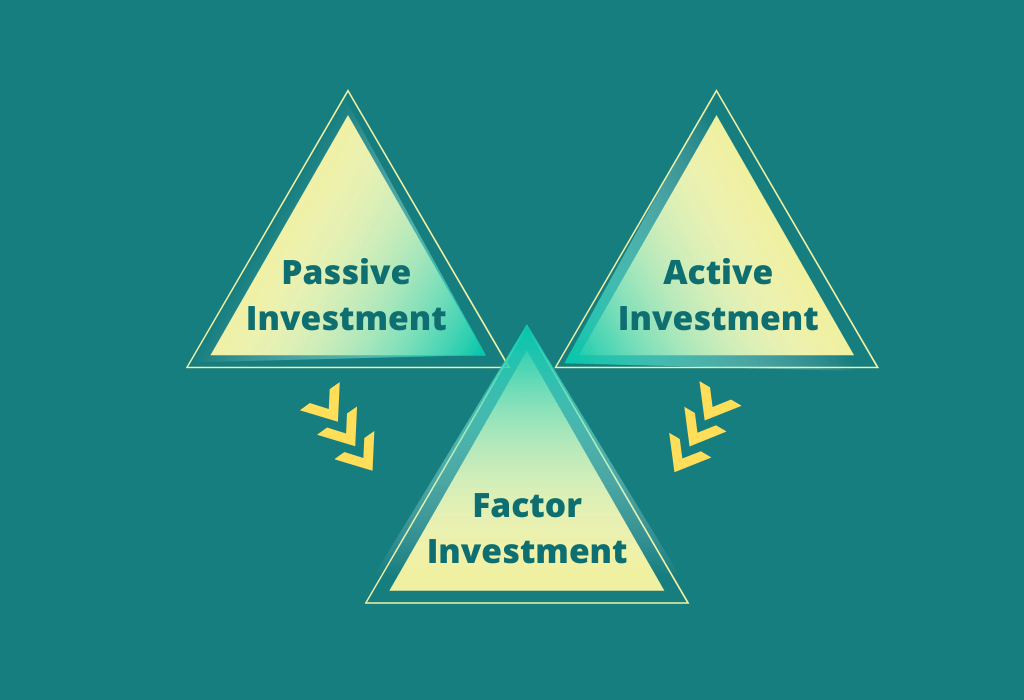

Factor Investing has been catching the attention of investors for some time now. Traditionally, investors have used active or passive investment as the preferred strategy to participate in the stock market.

Active investing is costlier as it involves greater engagement and many decisions on asset allocation, stock selection, and active entries and exits from the investments. The goal is to generate an alpha return on the overall portfolio. ‘Generating Alpha is the main objective for an active strategy.’

Against this, passive investing is a strategy many investors use, focusing and indexing the portfolio to one of the prominently used indices in the country. For instance, take the investors’ benchmark, copy the allocation logic and stock selection criteria, and replicate the portfolio to earn a stable return with minimum cost. ‘Low cost is the main objective for passive portfolio management strategy.’

Both these strategies have their pros and cons. Hence, the third eye of portfolio investing – Factor investing. Factor investing is a newly recognized strategy reaping the best of both worlds. It uses a combination of active and passive portfolio management to generate alpha (excess return compared to the return of a benchmark index, i.e. passive portfolios) at a lower cost.

What is Factor Investing?

Factor investing is an investment strategy where the fund managers identify and select stocks categorically based on specific attributes. These attributes are the driving force behind higher-than-average returns for the identified stocks.

What Are The Factors In Factor Investing?

Typically, there are two kinds of factors when it comes to factor investing -Macroeconomic and style elements.

If you take a top-down market view, macro-economic factors become significant. These factors are not directly co-related to the stocks but impact the value of the stocks tremendously. These factors include GDP growth rate, inflation, interest rate, etc.

On the other hand, style factors are directly related to the financial assets such as value stocks, deep discount stocks, quality stocks, momentum-based strategies, etc.

Most portfolio managers combine one or more factors (e.g., Momentum and low volatility) and create a multi-factor portfolio strategy focusing on creating alpha returns.

In short, a factor investing strategy is a rule-based strategy that eliminates human biases. At the same time, the stock selection focuses on attributes to combine a basket of stocks that fit into the identified characteristic.

5 benefits of Factor Investing?

There are many advantages of factor investing. Here are the five benefits that highlight the use of this strategy.

1. Better performance

Stock selection in the traditional times focused more on the individual companies’ performance than the competition and the sector. Unfortunately, doing so leaves scope for plenty of human decision-making and error. On the other hand, factor investing works on a rule-based strategy leaving no room for human bias.

For example, If the factor investing strategy focuses on deep-discount value stocks, the analysis will identify and rank all the stocks in the entire universe (irrespective of the size of the company and the sector in which the company belongs).

If you consider low volatility, the strategy will list all the top stocks with low volatility, and the portfolio allocation will depend on the ranks of the identified stocks.

2. Higher transparency

Traditional investing methods do not objectively give you reasons for failure or success. It does not attribute to the quality of the research. Factor investing is a well-thought structured approach to stock selection, and you know why you have selected a particular basket of stocks. In the future, when you evaluate the portfolio’s performance, you know precisely which factor worked well for you and which did not.

3. Lower cost

Factor investing is a rule-based coded strategy. Hence, the effort of the portfolio manager designs the rules and identifies the factors to work with initially. The rules eventually work well, as they have to refresh the stocks selected at different intervals. Moreover, human intervention is limited, so the cost and effort to run the strategy are lower comparatively.

4. Diversification

Diversification is one of the easiest and cheapest ways to reduce the overall portfolio risk. Unfortunately, one of the most common mistakes by 90 percent of the investors is focusing and investing heavily in a few selected stocks. If the stocks do not perform well, they plan to add more quantities of the same stock and put all their eggs in one basket, thereby increasing the overall portfolio risk.

Factor investing helps the investor diversify the portfolio into identified stocks, which helps reduce the risk. An inherent hedge is essential to minimize the portfolio risk for a multi-factor portfolio strategy because multiple attributes are used.

5. Eliminates biased behavior

An active investment strategy is skewed because of the portfolio manager’s personal views on the sector or stocks. It is a considerable risk given that there can be human errors in selecting stocks. The decision-making is partially based on your judgment and view of the sector. It may lead to participating heavily in the stock that is not performing because of a bias for that stock.

Finally, you should know that factor investing is a more quantifiable, objective, rule-based, systematic, and structured approach to investing compared to active or passive portfolio management strategy.

Does this mean you jump into factor investing as soon as you hear about it? No. Take the time to understand this investing strategy, do your due diligence and then decide.

In the meantime, would you like to start your wealth creation journey? Then, subscribe to the 5 in 5 Wealth Creation Strategy.

Read more: How Long term investing helps create life-changing wealth – TOI

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.