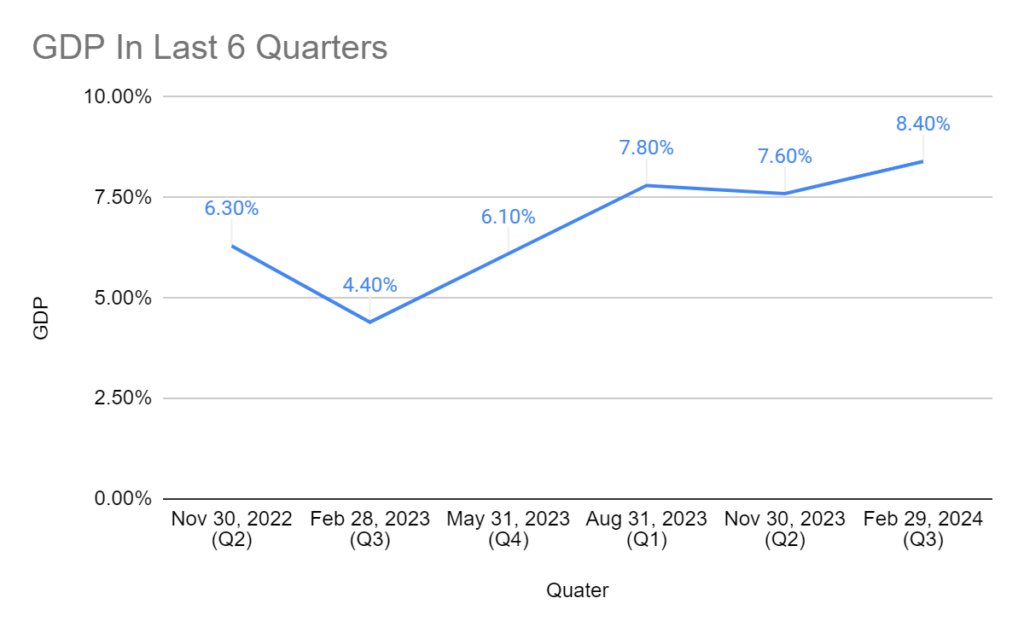

India’s economy has been growing strongly recently, and the recent GDP figures prove this. The country’s Q3 GDP growth rate of 8.4% surpassed estimates and marked the fastest pace in six quarters, retaining India’s position as the fastest-growing major economy.

Key Drivers of Growth

The remarkable GDP growth can be attributed to robust manufacturing and construction performance. Manufacturing, which accounts for a significant portion of the economy, expanded by 11.6% year-on-year. The construction sector also saw a healthy growth rate of 9.5%, contributing to the overall economic momentum.

Sectoral Insights

Manufacturing: India’s manufacturing sector is experiencing a significant upswing, with projections indicating a compound annual growth rate (CAGR) of over 4% from 2023 to 2028. This sector, a cornerstone of the Indian economy, contributes around 16-17% to the nation’s GDP and employs nearly one-fifth of the workforce.

The pandemic initially halted manufacturing activities, but the sector has rebounded strongly, showcasing resilience and adaptability. Attracting foreign investments has become a strategic focus, with India emerging as a preferred destination for global manufacturing firms.

Construction: India’s construction industry has been pivotal in the nation’s economic growth, contributing approximately 8.7% to the GDP. The industry is valued at USD 639 billion and is projected to grow at a CAGR of over 6% in the coming years. This growth is spurred by increased demand for residential spaces near urban areas and significant investment opportunities across various sectors. Government initiatives focusing on rural development and infrastructure projects have further accelerated the industry’s expansion.

Additionally, the shift towards hybrid work models has led to a rise in commercial real estate demand. The construction sector’s robust performance is a key driver of economic activity and a major employment generator, with projections indicating it will employ over 66 million people and contribute around 14% to the GDP by 2040. This underscores the sector’s vital role in shaping India’s economic landscape.

In-Depth Analysis of Expenditure Trends

- Private Consumption: The rise in private consumption indicates the increased confidence of the Indian consumer, buoyed by improved employment rates and wage growth.

- Investment: The jump in investment signals a robust business environment, with corporate India embarking on capacity expansion and modernization.

Challenges and Outlook

While the agriculture sector faced a slight contraction due to adverse weather conditions, the services sector continued to grow at 6.7%. The Chief Economic Advisor highlighted the structural transformation of the Indian economy, suggesting that global agencies might need to adjust their growth estimates upward.

Other Considerations

- Agriculture: India’s agricultural sector is vital to its economy, contributing 18.3% to the GDP in 2022-23 and employing 43% of the workforce. Despite challenges such as adverse weather conditions, the sector has shown resilience and growth, with a 3.3% increase in GVA at constant prices. Government initiatives and technological advancements in agritech will further boost the sector’s economic contribution. By 2030, agriculture is projected to contribute approximately $600 billion to India’s GDP, marking a significant increase from its contribution in 2020.

- Services: India’s service sector, the fastest-growing economy sector, contributes over 50% to the country’s GDP. It has experienced a growth of 10.8% in the first half of 2021-22 and is estimated to grow at 9.1% in FY23. Despite its substantial contribution to GDP, the service sector employs only about 25% of the labor force. This sector’s growth reflects India’s rapid economic development and modernization, leap-frogging traditional models of economic growth and positioning the country as a key player in the global service industry.

In conclusion, India’s robust growth figures reveal its economic resilience and potential. The country’s ability to maintain a strong growth trajectory amidst global challenges showcases the strength of its economic policies and the vibrancy of its key sectors.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

FAQs

What contributed to India’s Q3 GDP growth rate of 8.4%?

The growth rate was primarily driven by strong manufacturing and construction performance, with manufacturing expanding by 11.6% year-on-year and construction by 9.5%.

How has the manufacturing sector contributed to the economic surge?

The manufacturing sector’s growth is due to increased production in consumer durables, capital goods, and intermediate goods, reflecting a resurgence in domestic consumption and export demand.

What are the revised GDP projections for India?

The Statistics Ministry revised the full-year GDP growth projection to 7.6%, up from the earlier estimate of 7.3%, indicating strong domestic demand and investor confidence.

What does the rise in private consumption indicate?The 3.5% increase in private consumption suggests increased confidence among Indian consumers, likely due to improved employment rates and wage growth.

How significant is the investment surge for the Indian economy?The 10.6% surge in investment signals a robust business environment and indicates that corporate India is embarking on capacity expansion and modernization.

What challenges does the Indian economy face?

The agriculture sector faced a slight contraction due to adverse weather conditions, but the services sector continued to grow at 6.7%, suggesting a structural transformation of the Indian economy.

What is the outlook for India’s economy?

Despite some sectoral challenges, the overall outlook is positive, with strong growth figures showcasing the country’s economic resilience and the vibrancy of its key sectors.

How useful was this post?

Click on a star to rate it!

Average rating 2 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/