Several brands have ingrained themselves so deeply in our lives that they have become nearly irreplaceable or synonymous with their product category. One such brand is Good Knight, a mosquito repellent from the house of Godrej Consumer Products. Several other products from the same company, such as Cinthol, Hit, Aer, Godrej expert hair color creme, etc., have high brand recall among customers.

In this article, we will understand more about Godrej Consumer Products and Godrej Consumer share price.

Brief Overview of Godrej Consumer Products

The Godrej brand needs no introduction in India and has over 125 years of rich history. The roots of the company date back to 1897, when Ardeshir Godrej, the company’s founder, became successful in the locks business after a few failed ventures. In the following years, Godrej ventured into multiple product categories, and in 1918, it launched the world’s first vegetable oil soap, Chavi.

Over the years, Godrej emerged as a diversified conglomerate interested in food, chemicals, agriculture, FMCG, real estate, etc.

Godrej Consumer Products Limited (GCPL) was created in 2001 through the demerger of Godrej Soaps Limited. The company was demerged into a chemical business- Godrej Chemicals, and a focused FMCG business, Godrej Consumer Products. Today, GCPL is a global company with over 85 countries and a revenue of $1.6 billion in FY23. The company has a strong presence in Indonesia, Sub-Saharan Africa, the USA, and Latin America.

Business Overview of Godrej Consumer Products

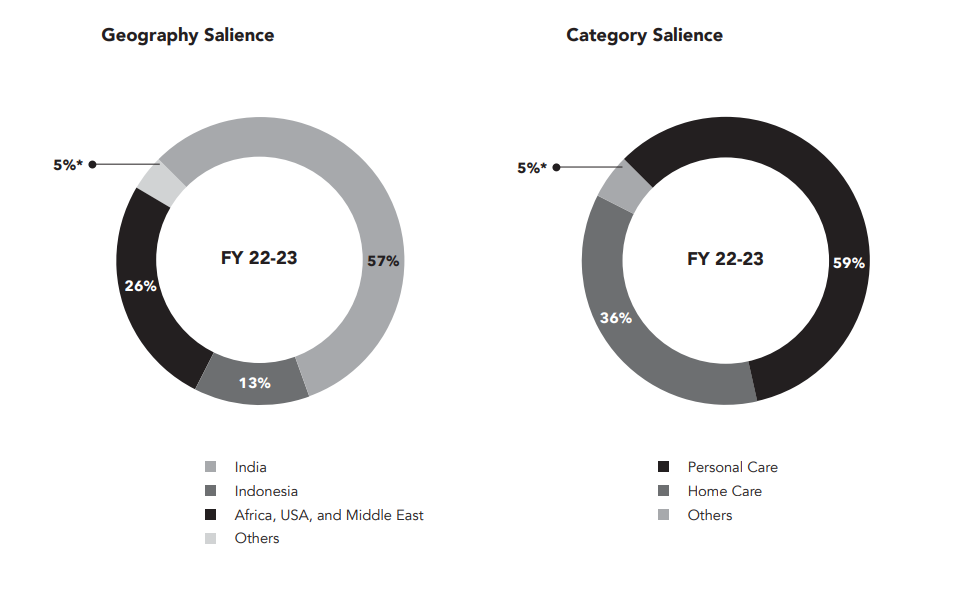

GCPL has divided its business into two categories:

- Home Care

- Personal Care

The home care category includes household insecticides, air care, fabric care, and home hygiene. The personal care category includes personal washing and hygiene, hair care, and premium beauty and professional products. As reported in the AS 108 by the company, it has identified geographical segments as reportable segments, which are as follows:

- India

- Indonesia

- Africa

- Others

The company’s top brands include Good Knight, Cinthol, Godrej No. 1, Darling, Hit, Godrej Expert, Stella, Ezee, Mitu baby wipes, and Godrej Aer. These 11 brands have contributed around 75% of revenue in FY23.

Key Management Personnel

- Ms. Nisaba Godrej is the Executive Chairperson of GCPL and has been a key architect of the company’s strategy and transformation in the last decade. She has a BSc degree from The Wharton School at the University of Pennsylvania and an MBA from Harvard Business School.

- Mr. Sudhir Sitapati is the Managing Director and CEO of GCPL and joined the company in October 2021. He was with HUL as Executive Director- Foods and Refreshments and has been with the company for 22 years. Mr. Sudhir has an MBA from IIM-Ahmedabad and a B.Sc in Maths with Economics from St. Xavier’s College, Mumbai.

- Mr. Aasif Malbari is the Chief Financial Officer at GCPL and joined recently in August 2023. Earlier, he was CFO at Tata Passenger Electric Mobility Limited and Director at Tata Motors Passenger Vehicle Limited. He is a qualified Chartered Accountant and Company Secretary.

- Mr. Sumit Mitra is the Head of Human Resources at GCPL and group companies. He joined the company as a management trainee and has spent over 25 years working across different business verticals of the group.

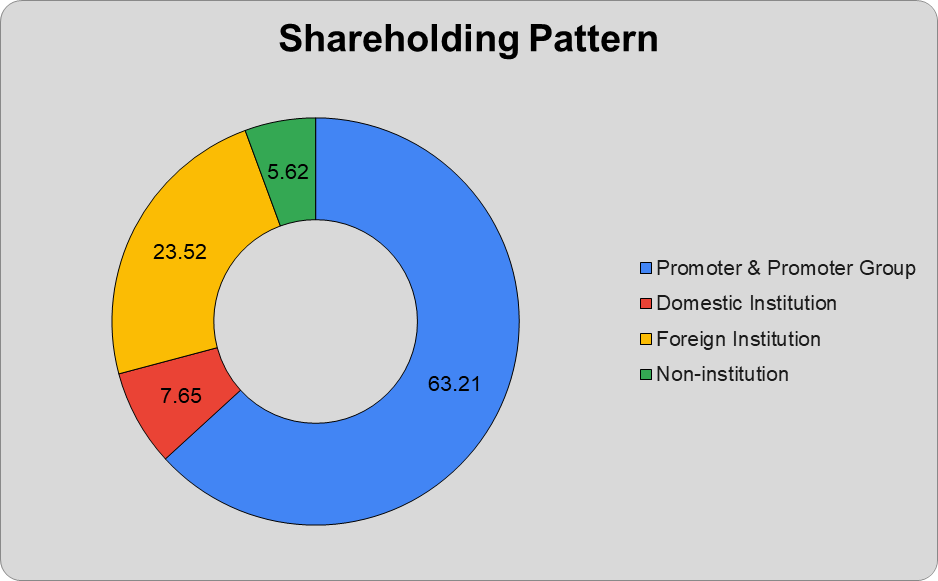

Godrej Consumer Product Shareholding Pattern

Godrej Consumer Product Financials

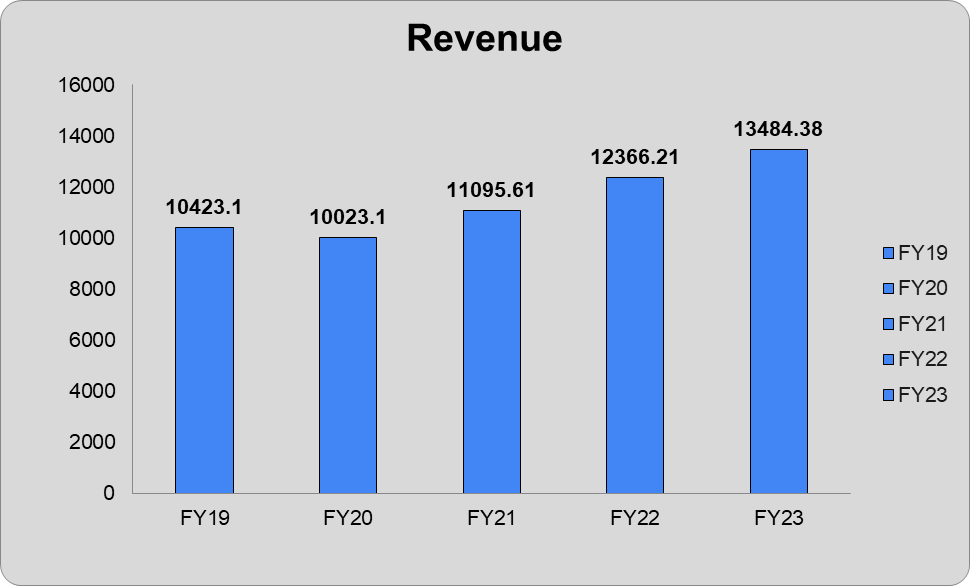

Revenue

In FY23, GCPL reported a 9% year-on-year increase in total revenue to ₹13,484.38 crores from ₹12,366.21 crores. In Q2FY24, the company reported a 6.9% increase in revenue to ₹3.667.88 crores from ₹3,431.79 crores in Q2FY23.

Segment-wise Revenue

| FY22 | FY23 | H2FY23 | H2FY24 | |

| India | ₹6,951.56 | ₹7,667.16 | ₹3,834.44 | ₹4,173.69 |

| Indonesia | ₹1,705.19 | ₹1,653.03 | ₹785.17 | ₹923.65 |

| Africa | ₹3,049.74 | ₹3,414.67 | ₹1,637.53 | ₹1,664.37 |

| Others | ₹750.77 | ₹717.83 | ₹328.45 | ₹363.39 |

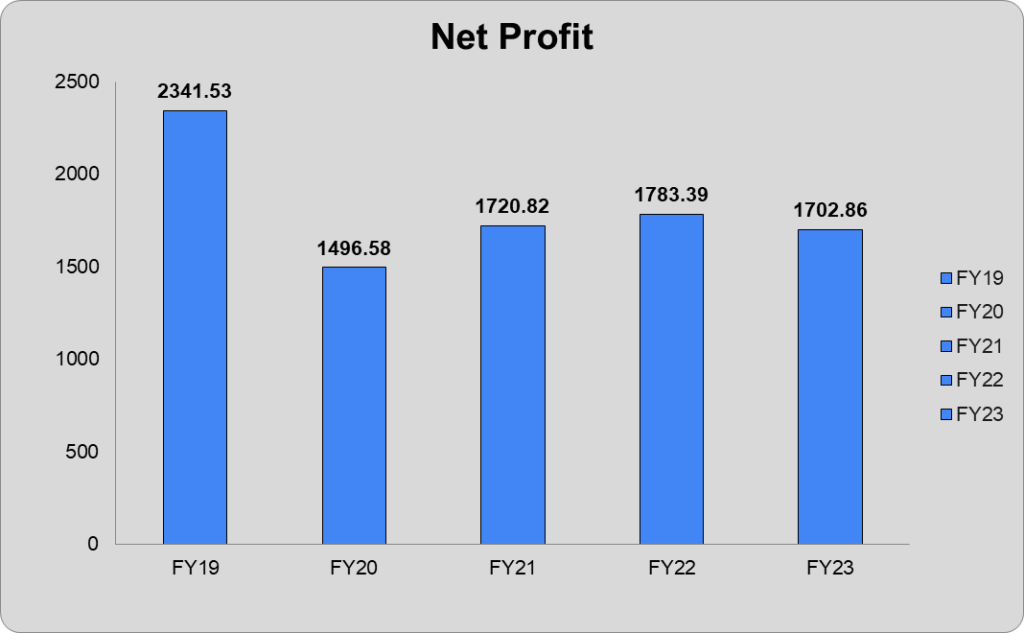

Net Profit

In FY23, the company reported a 4.5% fall in net profit to ₹1,702.86 crores from ₹1,783.39 crores in FY22. In Q2FY24, the company’s net profit increased 20.6% to ₹432.77 crores from ₹358.66 crores during the same period the previous year.

Key Financial Ratios

Current Ratio: On 31st March 2023, the company’s current ratio increased by 16% to 1.76 times from 1.43 at the end of 31st March 2022.

Inventory Turnover Ratio: The inventory turnover ratio during FY23 increased by 19% to 7.20 times from 6.33 in FY22.

Trade Receivable Turnover Ratio: The company’s trade receivable turnover ratio declined marginally by 2% to 22.90 times in FY23 from 23.34 at the end of FY22.

Trade Payables Turnover Ratio: At the end of FY23, the company’s trade payables turnover ratio increased by 8% to 5.28 times, from 4.87 at the end of FY22.

Net Profit Margin: The company’s net profit ratio during FY23 was 12.9%, down from 14.65% during FY22.

Return On Capital Employed (ROCE): The ROCE of the company declined by 18% during FY23 to 14.9% from 18.1% in FY22.

Debt To Equity Ratio: The company has no significant debt. Therefore, the debt-to-equity ratio is zero, and the debt-service coverage ratio is almost 100%.

Godrej Consumer Share Price History

Godrej Consumer Products Limited was listed in the stock market through way of a demerger in 2001 and has been a consistent performer. As of 6th November 2023, the stock of GCPL has given a CAGR return of 15% and 8% over the last three and five years, respectively.

Godrej Consumer Products has done two bonus issues and split its shares once. 100 shares of GCPL issued in 2001 are now 1200 shares.

| Announcement | Face Value | Ratio | Number of Shares |

| Pre-bonus and split share | ₹4 | – | 100 |

| Split- 24 August 2006 | ₹1 | 4:1 | 400 |

| Bonus Issue- 22 June 2017 | ₹1 | 1:1 | 800 |

| Bonus Issue- 12 September 2018 | ₹1 | 1:2 | 1200 |

The company paid ₹6 in 2019, ₹2 in 2020, and ₹5 in 2023 as dividends to its shareholders. Godrej Consumer Products share price has hit an all-time high level of ₹1119 on 3rd September 2021. As of 6th November 2023, the market cap of Godrej Consumer Products Limited is ₹1,04,823 crores.

Peer Comparison

| Company Name | GCPL | Dabur | Marico |

| Face Value | ₹1 | ₹1 | ₹1 |

| Share Price (as of 6th November 2023) | ₹1025 | ₹537.4 | ₹533.20 |

| P/E Ratio (as of 6th November 2023) | 57.1 | 55 | 48.82 |

| Market Capitalization | ₹1,04,823 crores | ₹95,229 crores | ₹68,968.64 crores |

| Revenue | ₹13,484.38 crores | ₹11,529.9 crores | ₹9,908 crores |

| Operating Profit Margin (FY23) | 19.07% | 18.8% | 18.5% |

| Net Profit Margin (FY23) | 12.9% | 14.8% | 12.9% |

| ROCE (FY23) | 14.9% | 26.95% | 44% |

| Distribution Network (FY23) | Global operations with a presence in over 85 countries | 7.7 million retail stores | 5.6 million retail stores |

Acquisition of Raymond Consumer Care Limited

In April 2023, the management of Godrej Consumer Products announced the acquisition of Raymond’s FMCG business, which houses brands like Park Avenue, KS, Kamasutra, and Premium. With this acquisition, the company aims to strengthen its product portfolio beyond soaps and insecticides. It will help GCPL to operate in the highly competitive deodorant market, where HUL, ITC, and other small players are active.

In FY23, Raymond’s FMCG business reported a revenue of ₹622 crores, and the deal was closed at 4.5 times the revenue, i.e., ₹2,825 crores. With this acquisition, Godrej wants to repeat the success of the acquisition of Transelektra in 1994, which made the GoodKnight and Hit brands. Godrej acquired the brand for ₹100 crores, now with an implied value of ₹30,000 crores.

Key Highlights

The company’s three big markets are India, Indonesia, and Africa, and it has employed distinct product strategies for each region that helped it to become a leader in their respective product category.

- India & SAARC countries: The company is the leader in household insecticides, air care, and hair color. It stands second in the market share for fabric care, personal wash, and hygiene products.

- Indonesia: Godrej is the market leader in household insecticides, air care, and baby wipes in the country and is in third position in the hair color segment.

- Sub-Saharan Africa & USA: In these regions, GCPL is the market leader in the hair color segment, with the second spot in premium beauty and professional products.

- Latin America: The company is the leader in hair color premium beauty and professional products in Latin American countries.

- In Q2FY24, the company’s consolidated EBITDA margin was 19.7%, with the company’s India business leading the growth. During the quarter, the company reported a 980 bps year-on-year expansion in gross profit margin. GCPL has taken multiple strategic cost reduction initiatives expected to enhance the EBITDA level in the coming quarters.

- The company’s revenue from the e-commerce segment witnessed 33% CAGR growth in the last two years and is currently renewing its focus on the quick commerce segment. Also, with a strong e-commerce focus in the US, accounting for 6% of the e-commerce business.

- The sharp improvement in newly acquired Raymond’s FMCG business performance, with sales clocking at ₹142 crores in Q2FY24. Integration of the brands is completed with GCPL, and cost synergies may flow from H2FY24.

Brief Industry Overview

- The creme segment dominates the global hair color market and may grow from $23.6 billion in 2022 to $35.2 billion by 2028, with an estimated CAGR growth of 6.2%. Regarding demand, Asia-Pacific accounted for the most significant global market share in 2021.

- Increased demand from the aging population will likely boost hair color market growth. The overall increase in population in China and India and the aging population in Japan and South Asian countries are generating a high demand for hair color.

- As per estimates, the global household insecticide market has witnessed sales of $15.12 billion and is expected to double to $31.67 billion by 2033, with an estimated CAGR growth of 7%.

- Urbanization and changing lifestyles, increased demand for natural & eco-friendly household insecticides, convenience and ease of use, raising awareness about health and hygiene, and rising consumer disposable income are currently driving the market growth.

- The deodorant market is one of the high-growth markets in India and is valued at $1.35 billion in 2023. It is estimated that through 2029, the market size may grow at a CAGR of 11.3%.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When was Godrej Consumer Products Limited established?

Godrej Consumer Products Limited was established as a legal entity in April 2001 and was demerged from Godrej Soaps Limited, with headquarters in Mumbai. The company entirely focuses on the FMCG vertical.

How has Godrej Consumer Products share price performed in the last five years?

As of 6th November 2023, Godrej Consumer share price has given a CAGR return of 8% in the last five years. Godrej Consumer share price has hit an all-time high of ₹1119 on 3rd September 2021.

What are the consumer products of Godrej Consumer Products Limited?

Godrej Consumer Products Limited houses brands like Good Knight, Hit, Aer, Ezee, etc. The company has a strong presence in Indonesia, the Saharan sub-Africa, the USA, and Latin America.

How useful was this post?

Click on a star to rate it!

Average rating 3.9 / 5. Vote count: 11

No votes so far! Be the first to rate this post.