Introduction to HAL

Hindustan Aeronautics Ltd. (HAL) is one of the oldest Indian companies specializing in aircraft and helicopter manufacturing and related services, and it plays a strategic role in India’s defense program. It is also one of the world’s oldest and largest aerospace and defense manufacturers.

Let us understand what the company does and analyze the share price of HAL.

HAL Overview

Hindustan Aeronautics Ltd. (HAL) is a government-owned aerospace and defense company. They design, develop, manufacture, and supply aircraft, helicopters, avionics, and communications equipment for military and civil markets. The company was founded in Bangalore in 1940 by Walchand Hirachand and the Government of Mysore to manufacture aircraft in India.

HAL has 20 Production and 10 R&D Centres co-located with the Production Divisions. These divisions /R&D Centres are in ten locations in seven states nationwide.

These divisions are organized into five complexes with current & future operations given below:

- Bangalore Complex (BC): Production and ROH (Repair and Overhaul) of Fixed-wing Aircraft and Engines (Indian and Western origin), Spacecraft Structures, Castings, Forgings, and Rolled Rings.

- MiG Complex (MC): Production and ROH of Fixed-wing Aircraft and Engines (mainly of Russian origin), Civil MRO, and UAV Projects.

- Helicopter Complex (HC): Production and ROH of Helicopters (Indian and Western origin).

- Accessories Complex (AC): Production and ROH of Transport Aircraft. Production and ROH of Accessories and Avionics for Fixed-wing and Rotary wing Platforms (Indian, Russian, and Western origin). Depot Level Maintenance of UAVs.

- Design Complex (DC): R&D of Fixed-wing and Rotary wing Aircraft, Unmanned Aerial Vehicles (UAV), Aeroengines, Avionics, and Accessories.

Hindustan Aeronautics Ltd (HAL) Company Journey

The history and growth of HAL are synonymous with the development of the Aeronautical industry in India for more than 79 years. Here are some of the critical milestones in the company:

●: 1940:The company was incorporated on 23 Dec 1940 in Bangalore by Walchand Hirachand in association with the then Government of Mysore.

● 1941: In March 1941, the Government of India became a shareholder in the company and took over its management in 1942.

● 1951: In January 1951, Hindustan Aircraft Ltd was placed under the administrative control of the Ministry of Defense, Government of India.

● 1963: In August, Aeronautics India Ltd was incorporated as a Company wholly owned by the Government of India to manufacture MiG-21 aircraft under license. Factories were set up at Nashik (Maharashtra) & Koraput (Odisha).

● 1964: Hindustan Aircraft Ltd and Aeronautics India Ltd merged on October 1, 1964, creating Hindustan Aeronautics Ltd (HAL) as per the amalgamation Oder by the Government of India.

● 1971: The Avionics Design Bureau was established in Hyderabad to develop and manufacture components such as IFF, UHF, HF radios altimeters, and ground radars.

● 1973: A design wing was set up in Lucknow to design and develop accessories such as under-carriage and hydraulic systems, static inverters, fuel control systems, etc.

● 1979: The company began manufacturing ‘Jaguar’ aircraft after obtaining a license agreement with British Aerospace and partnering with Rolls Royce-Turbomeca for Adour engines.

● 1982: The company entered into an agreement with the USSR and started production of swing-wing Mig-27 aircraft at the Nasik Division of the company

● 1983: The Korwa Division of HAL in District Sultanpur (U.P.) was established to manufacture the Inertial Navigation System.

● 2000: An independent profit center was established to offer airport-related services in May.

● 2006: A new MRO Division was created in Bangalore to carry out ALH overhaul activities

● 2018: On 28 March, HAL was listed on BSE and NSE

Build your well-diversified portfolio

Create wealth now!

Build your well-diversified portfolio

Create wealth now!

Hindustan Aeronautics Ltd Management Profile

- Mr. C.B. Ananthakrishnan is the Chairman, Director (Finance) & CFO, and Managing Director of the company. He is a commerce Graduate with a postgraduate degree in Business Administration from Madras University. He received management and leadership training from the Indian Institute of Management in Ahmedabad and the Institut of Aeronautique et. Spatiale (IAS) in Toulouse, France. He is also a member of the Institute of Cost Accountants of India. He has over 35 years of experience in both public and private sectors. He has worked in various industries, including merchant banking, pharmaceuticals, fertilizers, and aerospace. He joined HAL in 2004.

- Mr. Jayadeva E. P. is the Director (Operations) of the company. He holds a bachelor’s degree in Electrical Engineering from the University of Visvesvaraya College of Engineering, Bangalore, and did a Master’s from IIT Madras in Aircraft Production Engineering. He joined the company in 1987 as a management trainee and has about 33 years of experience in Manufacturing, Assembly, Overhaul, Upgrades, Customer support, Indigenisation, and other Management functions.

- Mr. Shailesh Bansal is the Company Secretary and Compliance Officer of the company. He is a fellow member of the Institute of Company Secretaries of India and an Associate Member of the Institute of Cost& Management Accounts of India. He’s also a qualified Chartered Secretary from the Institute of Chartered Secretary and Administrators in the U.K. He has vast experience in both the public and private sectors in managing the overall Corporate Affairs of the companies. He was appointed Company Secretary and Compliance Officer on March 28, 2023. Before this, he worked as a Joint Company Secretary at HAL.

- Mr. Atasi Baran Pradhan is the company’s Director (Human Resources). He holds a Bachelor’s degree in chemistry (Hons.) and a PG in Personnel Management and labor Welfare from Utkal University, Bhubaneswar. He also holds a Bachelor of Law (LLB) from University Law College, Bhubaneswar. He has 35 years of experience in Human Resources, serving in both Public and private sectors with exposure to various industries such as Engineering, Metallurgy, Paper, Aerospace & Defence across India. He joined HAL in 2005.

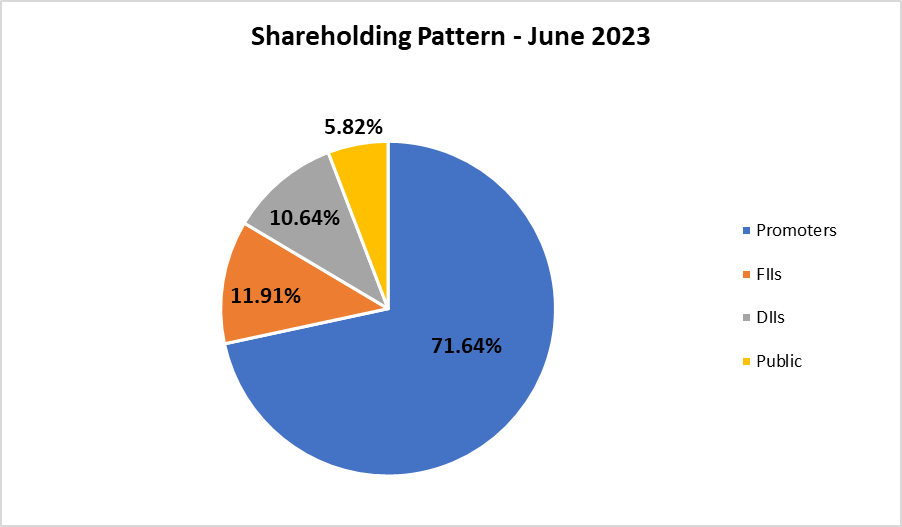

Hindustan Aeronautics Shareholding Pattern

Financial Analysis of HAL

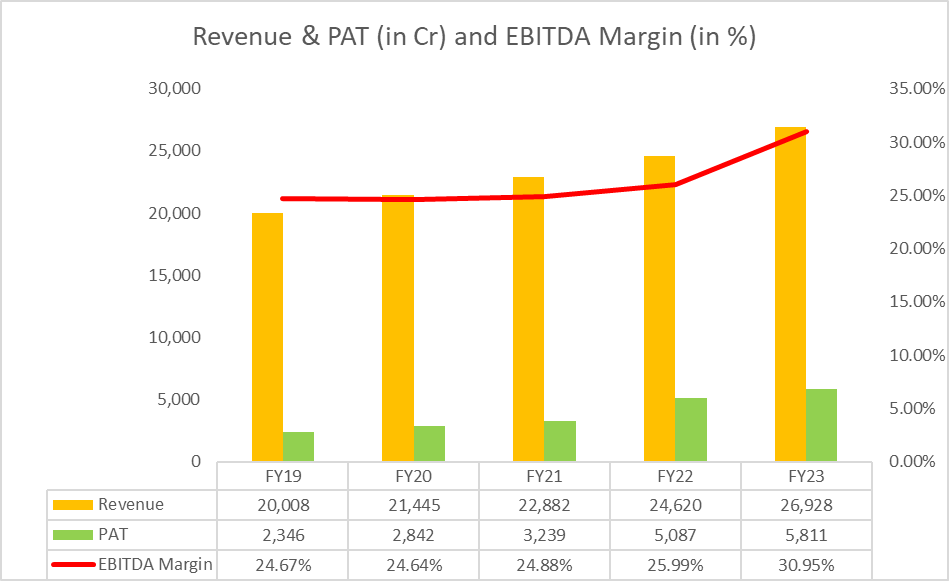

HAL posted revenue from operations of INR 26,928 Cr during FY23 compared to INR 24,620 Cr during FY22, an increase of 9.37%. On the profitability front, the company has posted a PAT of INR 5,811 Cr for FY23 as against the PAT of INR 5,087 Cr for FY22, an increase of 14.23%.

If we look at the financial performance over the Financial Year 2019 – 2023, the company has posted a Revenue CAGR of 7.71% and a PAT CAGR of 25.45%, which is relatively good. HAL has consistently delivered operating margins (EBITDA %) in the range of 24.67% to 30.95% since 2019.

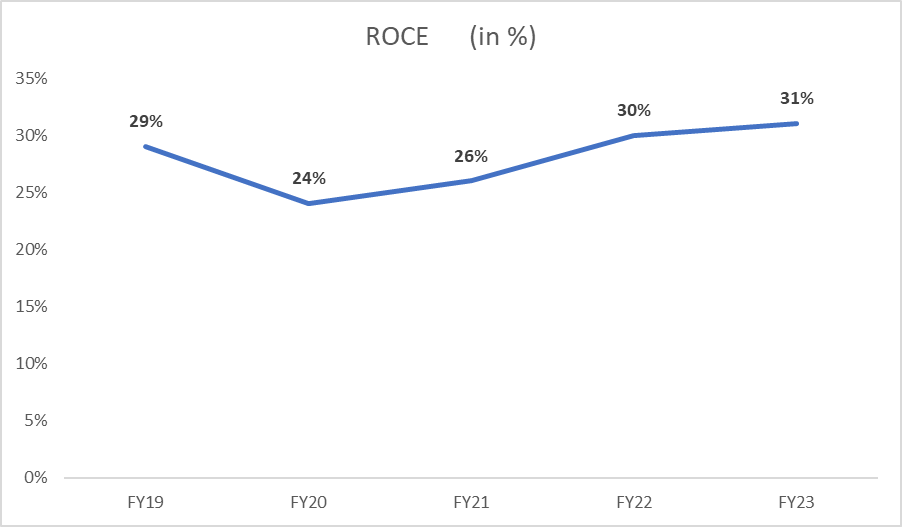

ROCE

The ROCE of HAL is 31% in FY23, which is relatively good. HAL has consistently delivered ROCE of 24% over the last five years.

HAL Fundamental Analysis

- Hindustan Aeronautics Limited (HAL), a prominent company in India’s defense and aerospace industry, has a robust long-term growth plan supported by a strong order book and promising prospects in the near and long term.

- During this year, the company secured contracts for producing and supplying 70 Nos. HTT-40 Basic Trainer aircraft and 6 Nos. of Dornier 228 Aircraft, respectively. As of March 31st, 2023, the Company’s Order Book position is INR 81,784 Cr.

- The HAL-L&T consortium was awarded an INR 860 Cr contract to develop five Polar Satellite Launch Vehicles (PSLV) for New Space India Limited (NSIL) on September 5, 2022.

- The company continues to develop new platforms, products, and technologies to enhance its capabilities and stay ahead of future technological challenges. These efforts have resulted in major achievements such as successful flights of various aircraft and the development of advanced projects like the LCA Mk II and Indian Multirole Helicopter. This will improve visibility for future platform orders.

- The company spent INR 2,494 Cr on R&D, 9.46% of the turnover. Additionally, INR 539 Cr (15% of Operating PAT) was transferred to the R&D corpus in FY 2023. HAL supplied four Gas Turbines to power INS Vikrant, India’s first indigenous aircraft carrier, commissioned by the Prime Minister in Kochi.

- In FY 2022-23, HAL spent INR 2,081.73 Cr on Capital Expenditure (CAPEX) to maintain infrastructure, develop systems/platforms for Defence Forces, and become Atmanirbhar Bharat. Investments were made towards the Green Field Helicopter project, augmentation of LCA facilities, ROH of SU-30, ROH of AL-31 FP Engine, etc.

Honorable President of India, Smt. Droupadi Murmu inaugurated HAL’s Integrated Cryogenic Engine Manufacturing Facility (ICMF) in Bengaluru on September 27, 2022. The facility will manufacture rocket engines for ISRO. - Honorable Prime Minister Narendra Modi dedicated HAL’s new helicopter factory in Tumakuru to the nation on February 6th, 2023, and unveiled HAL’s indigenously designed and developed LUH.

- The Company produced 22 new aircraft and helicopters annually, including LCA Tejas, Dornier Do228, ALH Dhruv, Light Combat Helicopter (LCH), and Light Utility Helicopter (LUH). In addition, it produced 51 new engines and accessories across its various divisions. The Company also overhauled 216 aircraft/helicopters and 535 engines during the year.

HAL Share Price History

HAL was listed on the Indian Stock Exchange on 28 March 2018 at a price per share of INR 1,130 and currently trades at 3,869.25 per share (as of 17 August 2023). HAL has delivered a stupendous three-year stock price CAGR of 46%. Over the last year, HAL’s share price grew 69 %. HAL’s share price is expected to grow over the long term due to its monopoly in the Aircraft and Helicopter manufacturing and service industry.

HAL -What’s Next?

After the COVID-19 pandemic, the Aerospace and Defense (A&D) industry is recovering in both the civil and defense sectors. The defense sector is expected to grow in 2023-24 due to global geopolitical conflicts, as many countries have significantly increased defense budgets to strengthen their military capabilities.

In the civil sector, global passenger traffic has improved significantly in 2022, and it is expected to reach 2019 levels by the end of 2023 or early 2024. This has become a driving factor for large-scale manufacturing orders and aftersales activities in the industry.

As part of the Atmanirbhar Bharat initiative, the Indian government is supporting the growth of domestic industries to decrease defense imports and reliance on foreign OEMs. This will benefit HAL as India’s sole player in this segment.

The company plans to expand its manufacturing unit, production capability, and geographical reach. It also invests in R&D for innovation, doing partnerships with other companies for future growth, thus creating shareholder value.

The company announced it had a strong order book of `81,78,400 lakh and anticipated significant revenue growth from the existing and upcoming contracts.

| Particulars | Balance as of 01.04.2022 | Fresh orders (During 22-23) | Order Liquidated (During 22-23) | Outstanding Sanction/supplies |

|---|---|---|---|---|

| Manufacturing Contracts | 61,564 | 25,990 | 26,360 | 60,470 |

| Repair & Overhaul | 8,141 | 8,537 | ||

| Spares | 11,162 | 11,192 | ||

| Design & Development Projects | 1,100 | 1,345 | ||

| Exports | 187 | 241 | ||

| Total | 82,154 | 25,990 | 26,360 | 81,784 |

HAL signed an MoU with Safran to establish a joint venture for developing, producing, selling, and supporting helicopter engines. In March 2022, they signed an MoU with IAI (Israel Aerospace Industries) to convert civil passenger aircraft to multi-mission tanker aircraft.

Key risks:

● Fluctuations in the prices of raw materials and delays in the availability of critical components may affect the execution.

● Allowing private companies into the defense sector could increase competition.

● Change in preference of Defence customers by moving from nomination to competitive procurement.

● Little presence outside India in the export market.

● Dependency on foreign OEMs for supply of critical Components and Spares required for the manufacture and overhaul of Aircraft/ Helicopters

FAQs

Is Hindustan Aeronautics Ltd. (HAL) good to buy long-term?

HAL dominates the Indian market in its business segment. It continuously increases production capabilities, invests in innovation, and launches new platforms, products, and technologies to meet future demands and drive growth. To know if it is a good buy, you must thoroughly analyze the company fundamentals before you decide.

What is the face value of HAL?

The face value of HAL is INR 10 per share.

What is the Market cap of HAL?

The market cap of HAL is INR 1,28,338 crores as of 16th Aug 2023.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.1 / 5. Vote count: 37

No votes so far! Be the first to rate this post.