The game-changer for the personal care segment, Mamaearth, has witnessed a slow start to its IPO today. The parent company of Mamaearth, Honasa Consumer, came up with its Rs. 1701 crore IPO on the last day of October, which has been subscribed to only 12%.

Honasa divided the distribution of shares in the IPO as follows

- Retail Investors – 10%

- QIB – 75%

- Non-institutional Investors – 15%

Honasa Consumer Ltd. IPO Subscription Status

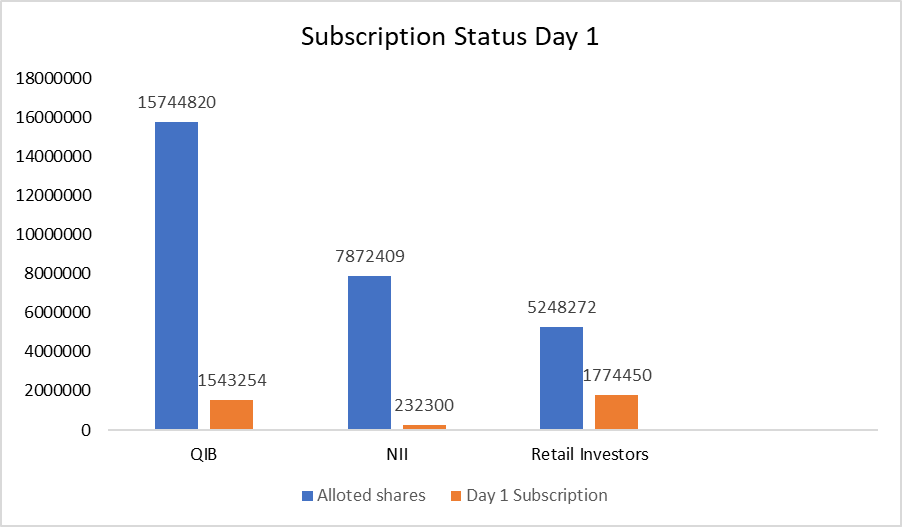

Out of the 10% allocated to the retail investors, 30% has been subscribed on day one. However, non-institutional investors didn’t turn up for the IPO, subscribing only 3% of the allocated portfolio on the first day of the Honasa Consumer IPO.

Qualified Institutional Buyers (QIBs) usually don’t turn up on the first day of an IPO, so their limited participation is nothing unusual. This segment received bids for around 1543254 shares out of the 75% of the issue allocated to them.

Honasa Consumer Ltd. IPO Allotment & Listing Date

People who are willing to subscribe to Honasa IPO must take note of these dates.

| Basis for Allotment | November 7 |

| Refunds | November 8 |

| Credit of Shares in Demat a/c | November 9 |

| Listing Date | November 10 |

Here are the details of the Honasa Consumer IPO you need to know

| Total issue size | Rs 1701 Crores |

| Face Value | Rs 10 per share |

| Price Band | Rs. 308-324 |

| Lot size | 46 shares |

How do you check Honasa Consumer Ltd. IPO allotment status?

Option 1: On the BSE Website

- Firstly, you have to visit the BSE IPO Allotment page

- In the menu, go to ‘issue type’ and click on ‘equity’.

- Then go to ‘Issue Name’ and click on ‘Honsasa Consumer Ltd.’.

- Now, enter your application number or PAN number.

- Enter the Captcha to verify

- Finally, click on the search button.

Option 2: On Link Intime India Private Limited’s Website (IPO Registrar):

- You can also open Link Intime IPO Status to check the allotment status

- First, you have to select “Honasa Consumer Ltd.” in the dropdown menu section

- Use one of these four to check the allotment status – PAN, Application Number, DPID/Client ID, or Bank Account/IFSC.

- Enter the details of the option selected above

- Click the “Search” button.

When will the basis of allotment for Honasa Consumer Ltd. IPO be finalized?

As intimated by Honasa Consumer, the basis of allotment will be on 7 November 2023, and you can expect your shares to be credited by 9 November. If you are supposed to get a refund, you can expect it by 8 November. As of now, the listing date has been confirmed as 10 November, and the stock will be listed on both NSE and BSE, which is a thing to consider.

FAQ

1. How can I check the Honasa Consumer IPO allotment status?

You can easily check the allotment status of the Honasa Consumer IPO on the BSE website or Link Intime India Private Limited by following the steps mentioned in the above section.

2. When will the basis of allotment for Honasa Consumer IPO be finalized?

The basis of allotment for Honasa Consumer IPO will be on 7 November.

3. What are the key dates for Honasa Consumer IPO?

The date for credit of shares of Honasa IPO is 9 November, and the listing date is 10 November, you can get the refunds initiated on 8 November.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/