Every parent shares the same goal: to save money for their child’s future. A corpus of one crore can give your child a lot of financial security and flexibility, whether for their child’s education, marriage, or any other purpose.

However, saving this massive corpus of one crore will be a challenge. Particularly when the effects of inflation and increased costs are weakening the roots of your ambitious tree. Regardless of the obstacles, you must save money for your child’s future. You cannot give up.

Now that we’ve set our sights on our goal, an important question arises: How to save 1 crore in 20 years? Well, don’t get bogged down. We will cover every possible question in this article to keep you from the arduous process of calculating yourself. For example, what are the investment options and methods to use? What amount should you save each month, and how can you improve your savings over time? We will also share examples and calculations to assist you better grasp the process.

So, if you want to save money and put up a 1 crore corpus, pay close attention to this article.

Why saving 1 crore for your child’s future is important?

Saving 1 crore for your child’s future is not just a number; it is a vision. A vision of providing your child with the best possible opportunities and experiences in life. A vision of securing your child’s financial well-being and happiness. A vision to save money to fulfill your parental responsibilities and aspirations.

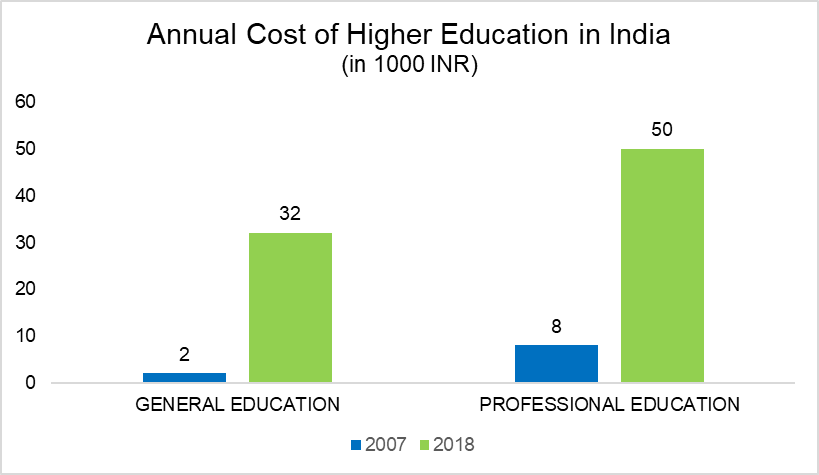

But why 1 crore? Why not save money more or less? Well, 1 crore is not a random figure; it is a realistic estimate of the amount you will need to cover your child’s significant expenses in the future, such as education, marriage, health, and any other contingencies. Let us see how. Let me share with you a chart on the annual cost of education in India has changed from 2007 to 2018, which will make this discussion all the more relevant-

Considering the inflation rate in education of 4.46% (in 2021) to prevail over the next 20 years. Let us assume the average cost of higher education in India today as Rs. 10 Lacs. Then, in the next 20 years, you will need Rs. 24.17 Lacs for the same course. According to GOI, If you want to send your child to a reputed college or university in India, you must save Rs.24.17 lakh by 2043.

We have used the future value formula in the above calculation-

Future value = Present value x (1 + Interest rate) ^ Number of periods

Future value = 10 x (1 + 0.0446) ^ 20 Future value = 10 x (1.0446) ^ 20

Future value = 10 x 2.417 Future value = 24.17

Similarly, applying the same formula to calculate the average cost of marriage in India in the next 20 years. We have considered a CPI (Consumer Price Index) of 5% (as of September 2023) to remain constant over these years. And the average cost of an Indian marriage today is 15 Lacs. According to the government, you must save money to the tune of Rs.39.80 lakh for your child’s marriage by 2043.

Future value = 15 x (1 + 0.05) ^ 20 Future value = 15 x (1.05) ^ 20

Future value = 15 x 2.653 Future value = 39.80

Explore: Financial Calculators

Apart from these two major expenses, there are other costs that you will have to bear for your child’s future, such as health care, travel, hobbies, emergencies, etc. These costs may vary depending on your lifestyle and preferences, but they can quickly add up to another Rs.20-30 lakh over the next 15 years.

So, if you add up all these expenses, you will get a rough estimate of Rs.80-90 lakh that you will need for your child’s future by 2035. However, this is not the final amount, as you also have to factor in the impact of inflation and taxes on your savings and investments.

Depending on your income bracket and investment type, you may have to pay different rates of taxes on your earnings and returns. If we assume that the tax rates remain constant for the next 15 years, then you will have to pay a certain percentage of your savings and investments as taxes to the government every year.

Therefore, considering the effect of inflation and taxes on your money, you will realize that you will need more than Rs.80-90 lakh for your child’s future by 2035. You will need around Rs.1 crore or more to meet your child’s future needs comfortably.

Hence, saving 1 crore for your child’s future is essential because it is a realistic and achievable goal that can help you provide your child with a bright and secure future.

How to Save 1 Crore: 5 Best investment options

Here, we will go through some of the best investment options to save money to build Rs. 1 Crore-

Stock Investment: To save money over a long term of 20 years, you can invest in stocks or shares of consistent or stable companies. If you are a beginner, the safest bet is to pick companies that you see on a day-to-day basis, like some biscuit brands like Parle G, Britannia, Sunfeast, Cadbury, etc. If the products have reached your home, these companies have deeply impacted a regular household and are considerably more reliable than choosing new companies we know less about. This way, you can benefit from the growth potential and dividends of the businesses.

However, stock investing also involves high risks, as the prices of stocks can fluctuate due to various factors such as market conditions, company performance, news, etc. Therefore, study the fundamentals and technicals of the companies before risking your money. You must also have a long-term horizon and patience to withstand the market’s ups and downs.

Mutual Funds

To save money, mutual funds also are a good option. Mutual funds expose you to various asset classes, such as equity, debt, gold, etc., without managing them yourself.

Mutual funds are managed by professional fund managers who invest your money in a basket of securities according to the objective and strategy of the fund. You can choose from different types of mutual funds, such as large-cap, mid-cap, small-cap, multi-cap, sectoral, thematic, index, balanced, hybrid, etc., depending on your risk-return profile and goals. You can either make one-time payments or make regular investments through systematic investment plans (SIPs). SIPs allow you to invest a fixed amount every month and benefit from the power of compounding and rupee cost averaging.

EXPLORE OUR SIP CALCULATOR

Commercial Real Estate

Investing in commercial real estate, such as office spaces, shops, warehouses, etc., can give you high returns in rental income and capital appreciation. Commercial real estate is a booming industry these days, drawing the interest and attention of investors worldwide. The returns are generally more stable and profitable than residential real estate, as it has higher occupancy rates, longer lease terms, lower maintenance costs, and better tax benefits.

However, commercial real estate also requires a significant initial investment, which may not be affordable for everyone. Therefore, you can also invest in commercial real estate indirectly through real estate investment trusts (REITs), which are listed entities that own and operate income-generating properties. You can buy and sell REIT units on the stock exchange like shares and earn regular dividends and capital gains.

Bank Fixed Deposits

Traditional bank deposits can help you save money if you are a conservative investor with a limited risk appetite. Bank FDs provide set or guaranteed returns ranging from 6-8% based on the period and the bank/institution you invest in.

Some small finance institutions offer greater interest rates of up to 8-8.5%, but as the phrase goes in the finance sector, more rewards imply higher risk, so choose prudently. FDs, on the other hand, are safe and guaranteed by the Deposit Insurance and Credit Guarantee Corporation (DICGC) up to Rs. 5 lakh per depositor per bank, so you can save money by using these financial instruments as well.

Public Provident Fund (PPF)

PPF is a government-backed scheme that offers guaranteed returns. PPF has a fixed maturity of 15 years that can be further extended for 5 years. The ROI is decided by the Government of India and revised every quarter. As an icing on the cake, you also get a tax rebate of up to Rs. 1.5 Lacs on PPFs, which makes it a palatable investment option to save money for the long term.

EXPLORE OUR CAGR CALCULATOR

How to Save 1 Core With These Investment Options?

Formula Used: Future value = Present value x (1 + Interest rate) ^ Number of periods

| Investment in Shares | Mutual Funds | Commercial Real Estate | Fixed Deposits | PPF | |

| ROI | 15% | 12% | 10% | 6% | 7.1% |

| Min. investment amount (per month) to save Rs. 1 crore in 20 years | Rs. 13,492/- | Rs. 16,760/- | Rs. 20,462/- | Rs. 33,214/- | Rs. 30,544/- |

| Investment Amount | Rs. 32.38 Lacs | Rs. 40.22 Lacs | Rs. 49.11 Lacs | Rs. 79.71 Lacs | Rs. 73.31` Lacs |

| Interest amount | Rs. 67.62 Lacs | Rs. 59.78 Lacs | Rs. 50.89 Lacs | Rs. 20.29 Lacs | Rs. 26.69 Lacs |

Key Takeaways

To save money for your child’s future is a noble and achievable goal that can give you peace of mind and your child a bright and secure future. However, it demands meticulous planning, consistent saving, and intelligent investing.

You must consider your income, expenses, inflation, taxes, and returns and choose the best investment options and strategies that suit your risk-return profile and time horizon.

You must also monitor and review your progress regularly and make necessary adjustments to stay on track. If you go through these options given in this article, your question “How to Save 1 crore?” will be aptly answered.

Investments are also like your plants that bear beautiful fruits and flowers if water regularly. So, tips to save money would be to save regularly and be patient. Regular investment gives you the magical power of compounding, and patience helps you stride through rough market situations. Don’t underrate the importance of starting early, it always gets rewarded.

ALSO READ:

How to invest money like a pro?

Benefits of long-term investing

FAQs

Why is monitoring and reviewing my portfolio important to save money?

When you regularly monitor and assess the performance of your portfolio, you can see how well it is performing compared to its competitors in the market and take appropriate corrective adjustments. It assists you in aligning your investments with your investment goals and rebalancing as needed. You can use numerous internet calculators to see whether your portfolio return is adequate to save enough money to develop Rs. 1 crore in 20 years.

How can I increase my savings over time to reach 1 crore in 20 years?

You can increase your savings over time by cutting down unnecessary expenses, increasing your income, reviewing your budget regularly, and investing in compounding instruments.

How much must I save monthly to reach 1 crore in 20 years?

Check the rate of return you can earn on your investments first to save money to Rs. 1 crore in 20 years. For example, if you can earn 10% per annum, you need to save Rs. 20,462 per month. If you can earn 15% per annum, you need to save Rs. 13,492 per month.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 19

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/