Introduction

Over the past two decades, there has been a notable transformation in India’s power market structure. Initially, state electricity boards (SEBs) and DISCOMs used to sign long-term power purchase agreements (PPAs) for 25 years with power generation plants.

These PPAs constituted the sole source for fulfilling a region’s energy demand. However, there was a significant limitation in this structure. Accurately predicting hourly power consumption over an extended period was challenging, resulting in power shortages in some areas and an excess power supply in others.

Furthermore, power generation plants entered into power purchase agreements (PPAs) structured with a cost-plus nature, which did not lead to competition in the sector.

Setting up of Power Exchanges

The enactment of the Electricity Act 2003 in May 2004 changed the dynamics of the power sector in the country. This legislation ushered in a new era for the power industry, introducing competitive elements across all segments and implementing inter-state power transmission that paved the way for a bilateral market.

In simpler terms, the act allowed power generators to sell surplus power to DISCOMs in different states and enabled DISCOMs to procure power from generators in other states.

In December 2006, the Central Electricity Regulatory Commission (CERC) released directives for establishing power exchanges in India. These exchanges created a unified platform for power buyers and sellers to engage in transactions and effectively determine prices.

The Establishment of the Indian Energy Exchange (IEX)

n March 2007, IEX applied to set up a power exchange. Following approval, IEX commenced operations on June 2, 2008, becoming India’s first power exchange.

The exchange was promoted by Financial Technologies India Ltd. and PFS. But, due to regulatory breaches, the promoter’s stake was divested and is now a professionally managed company. FTIL exited from the company in October 2015, and PFS in March 2017.

IEX’s Power Marketplace

IEX power exchange only represents the short-term electricity markets in India and covers contracts of less than one year of electricity supply. Unlike other commodity exchanges such as MCX, where you can profit from trading commodities without taking delivery, delivering power is mandatory on IEX. The company’s electronic trading platform comprises the following contracts:

- Day-Ahead-Market (DAM): Electricity contracts in blocks of 15 minutes are offered the next day starting from midnight.

- Green Day-Ahead-Market (G-DAM): It offers a collective auction in renewable energy on the day before the market. Bids for conventional and renewable sources are done in an integrated way through separate bidding windows.

- Term-Ahead-Market (TAM): This includes electricity contracts for fixed terms in the future, including intra-day contracts, day-ahead contingency contracts, and contracts up to 11 days ahead.

- Green Term-Ahead-Market (G-TAM): It is a market segment of TAM for trading in renewable energy.

- Real-Time Market (RTM): Electricity contracts in blocks of 15 minutes are offered for same-day delivery.

- Renewable Energy Certificates: This mechanism allows the state utilities and authorized entities to purchase renewable energy.

- Energy Savings Certificates: In DAM and RTM, IEX has a market share of more than 99%, and in FY23, the overall electricity market share in DAM, TAM, RTM, and Green Market was 88.3%.

Key Management Personnel

- Mr. Satyanarayan Goel is the Chairman and Managing Director of the company, having joined it as MD & CEO on January 21, 2014. He has over 40 years of experience in the power sector and was actively involved in various power sector reform initiatives of the Government of India, including the draft preparation of the Electricity Act 2003, Tariff-based Bidding Guidelines, Tariff Policy, National Electric Policy, and so on. Mr. Goel previously worked for PTC India Limited and NTPC. He graduated from NIT Rourkela with a bachelor’s degree in electrical engineering and an MBA from FMS Delhi.

- Mr. Vineet Harlalka is the company’s Chief Financial Officer and Company Secretary. On January 16, 2010, he was named Company Secretary; on May 9, 2014, he was named CFO. Mr. Harlalka is a Chartered Accountant who is also a member of the Institute of Company Secretaries of India. He has over 20 years of experience in finance and taxation and previously worked for New Holland Fiat (India) Limited before joining IEX.

- Mr. Amit Kumar is the Head of Market Operations and new Product Initiatives. He holds a B.Tech in Chemical Engineering from the Indian Institute of Technology (BHU), Varanasi. Mr. Kumar has an MBA from the Indian School of Business, Hyderabad.

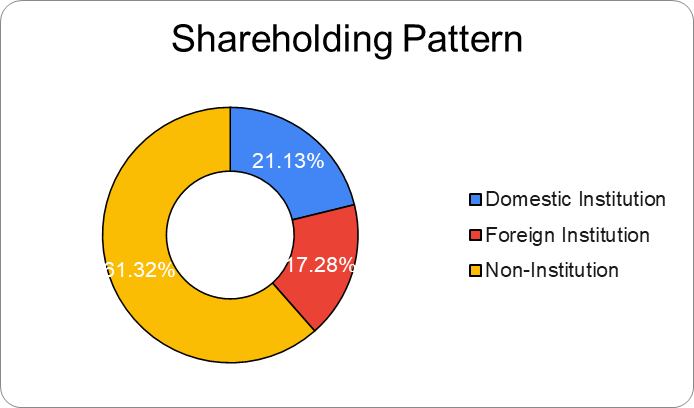

IEX Shareholding Pattern

Financials of IEX

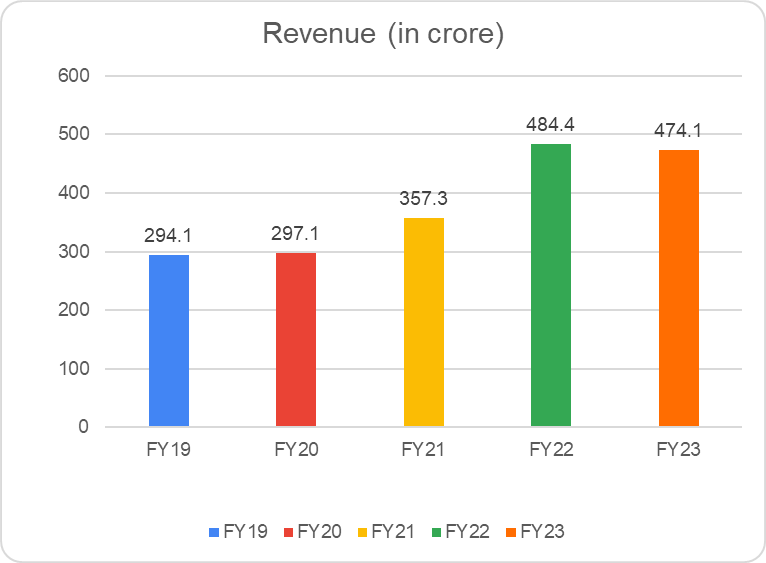

Revenue

IEX’s consolidated revenue declined by 2.1% on a Y-o-Y basis, from ₹484.4 crores in FY22 to 474.1 crores in FY23. In Q1FY24, consolidated revenue increased by 12.3% to ₹127.4 crores from ₹113.4 crores in Q1FY23.

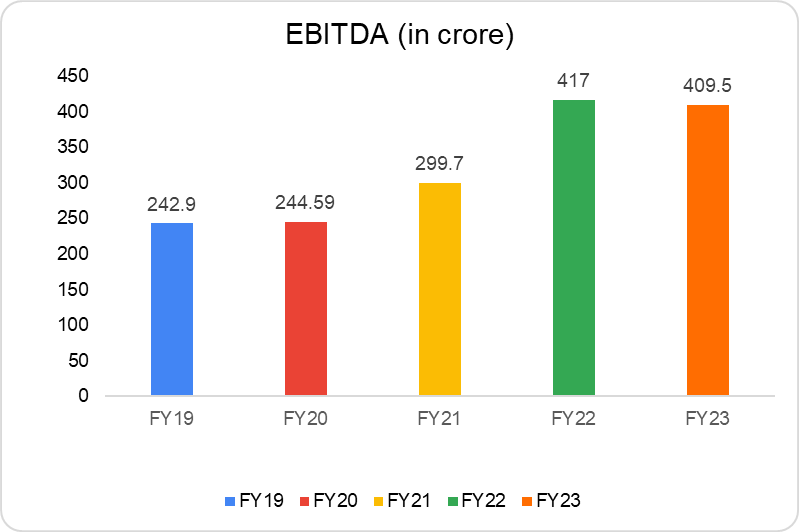

EBITDA

In FY23, the company reported a marginal decline of 1.92% in EBITDA year-on-year to ₹409.5 crores from ₹417 crores. And, in Q1FY24, EBITDA increased by 8.33% y-o-y to ₹104.9 crores from ₹96 crores.

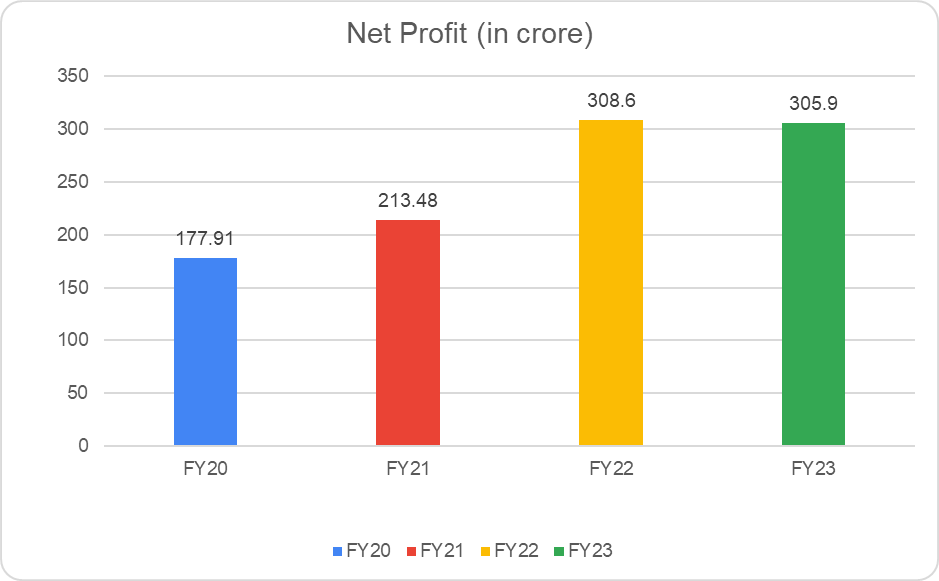

Net Profit

In FY23, the company reported a marginal decline of 0.87% in net profit year-on-year to ₹305.9 crores from ₹308.6 crores. And, in Q1FY24, net profit increased by 9.7% y-o-y to ₹75.8 crores from ₹69.1 crores.

| FY19 | FY20 | FY21 | FY22 | FY23 | |

| PAT Margin (in %) | 56.1 | 59.87 | 59.74 | 63.30 | 61.74 |

Key Financial Ratios of IEX

Current Ratio: At the end of FY23, the current ratio declined by 18.7% to 1.26 times from 1.54 times in FY22.

Return on Capital Employed (ROCE): The ROCE of the company improved to 53.45% in FY23 from 57.21% in FY22. The company has no long-term borrowing on its books. Therefore, the debt-to-equity and interest service coverage ratio is not reported.

IEX Share Price History

IEX launched its IPO in October 2017 with a total issue size of ₹1,000.73 crores at a price band of ₹1645 to ₹1650 per share and a face value of ₹10. The issue was an offer for sale (OFS) with existing promoters exiting the company.

IPO was oversubscribed by over 2.28 times, and shares were listed at ₹1,500, which was at a discount of 9.1%. On October 19, 2018, the stocks underwent a split in the ratio of 10:1. On October 21, 2021, the company issued bonus shares in the ratio of 2:1. Meaning that 100 shares allotted at IPO have now turned into 3000 shares.

| Face Value | Ratio | Number of Shares | |

| Pre-bonus and split share | ₹10 | – | 100 |

| Split- 19th Oct 2018 | ₹10 | 10:1 | 1000 |

| Bonus Issue- 21st Oct 2021 | ₹1 | 2:1 | 3000 |

The company has a consistent track record of paying dividends to its shareholders. In the last three years, IEX paid ₹2.5 in 2020, ₹4 in 2021, and ₹3 as dividends.

IEX share price has given a CAGR return of 18% and 25% in the last five and three years, respectively, as of August 28, 2023. However, it has been underperforming the market for more than one year. It reached an all-time high of ₹318.65 after the split and bonus issue on October 19, 2021, and the price has declined. As of August 21, 2023, IEX had a market cap of ₹11,137 crores.

IEX Fundamental Analysis

IEX has a near monopoly in India’s short-term power trading markets with a debt-free balance sheet and strong cash flow from operations. The company is India’s most prominent and only listed power exchange, with an overall market share of 88%.

Electricity trading volume on the exchange has grown at a CAGR of 30% since 2008; in FY23, 96.8 billion units of electricity were traded on the exchange. As of June 2023, the company has a diverse user base of over 7,500 participants across utilities, industries, renewable generators, DISCOMs, and open-access consumers.

Competitive Advantage

IEX has a significant competitive advantage over its peers due to its first-mover advantage, significant network effect, innovative product portfolio, better pricing, and superior technology.

Power Exchange India Limited (PXIL), promoted by the NSE and NCDEX, and Hindustan Power Exchange (HPX) are other power exchanges competing with IEX. HPX is supported by the BSE, PTC India, and ICICI Bank.

Risks

Market Coupling: The Ministry of Power and CERC has decided to go ahead with market coupling, where an independent third party will collect buy and sell bids for short-term electricity contracts and, choose a uniform market price, and will be intimated to exchanges. This could end the monopoly of IEX, as other exchanges will feature the same price for all short-term electricity contracts. And could potentially reduce the profitability and market share of IEX.

Regulatory Changes: As electricity falls under the essential services category, the power sector in India is subject to various regulations and policies of central and state governments, which could impact the demand and supply, tariffs, and taxes. This could pose a considerable risk to IEX’s business model and profitability margins. For instance, short-term electricity prices in India are highly volatile, and in October 2021, they reached a record high of ₹20.79/kWh. The high price prompted the regulator to put a price cap of ₹12/kWh to protect customers and grid stability.

IEX Future Growth Outlook

In the short to medium term, IEX may experience headwinds and margin contraction due to the implementation of market coupling. However, launching innovative products like long-duration base contracts in power exchanges, future derivatives contracts, and the National Open Access Registry (NOAR) will likely positively impact IEX share price.

Despite the near-term headwind, the future outlook of the short-term electricity market in India is expected to grow and evolve in the coming years. According to the report India Energy Outlook 2021 by IEA, the share of the short-term electricity market is expected to grow from 10% in 2018 to 18% in 2040 and 21% in the sustainable development scenario.

Indian Gas Exchange (IGX)

IGX is a newly launched product from the house of IEX and is India’s first natural gas trading exchange. 50.9 million mmBTU natural gas was traded on IGX in FY23 across 2355 trades, representing a 319% year-on-year increase. The exchange has 40 members and over 200 active clients.

The government’s focus on increasing the share of natural gas in the total energy basket from ~6% to ~15% by 2030 and net zero carbon emissions by 2070 will lead to opportunities for gas exchanges & other players in the market.

International Carbon Exchange (ICX)

On the road towards further diversifying its product portfolio, IEX launched ICX in December 2022 to promote a voluntary carbon market where participants can trade their carbon credits. Almost 500 million units of carbon credits are traded globally, which is expected to grow to 1500-2000 million units by 2030. And, at present, only 25-30% of trades are happening over exchanges. This presents a massive opportunity for exchanges as demand for carbon credits skyrockets.

IEX is also exploring setting up a domestic coal exchange and has appointed consultants to finalize frameworks. With the rise of green energy systems, IEX may explore diversifying its product portfolio in the green markets, like trading green hydrogen and battery energy storage systems.

Besides the short-term electricity market, IEX has a largely untapped market that can propel its growth in the future. IEX has taken steps in that direction by establishing IGX, ICX, and an exploratory phase in establishing a coal exchange in India. IEX is well-positioned to meet the changing needs of the energy market as a fundamentally strong company with solid cash flows.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What does IEX company do?

IEX, or Indian Energy Exchange, is a power exchange that facilitates trade in the short-term electricity market in India, where power generators and consumers (state electricity board, DISCOMs) can trade electricity as per the prevailing supply and demand.

When IEX was established?

IEX commenced operations on June 2, 2008, becoming India’s first power exchange.

How has IEX share price performed?

As of August 28, 2023, the IEX share price has given a CAGR return of 18% and 25% in the last five and three years, respectively.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 62

No votes so far! Be the first to rate this post.