As we speak, a huge crisis-like situation in the US banking sector that started with SVB (Silicon Valley Bank) has brought the entire US banking sector under the scanner. One of the reasons that led to SVB’s collapse was Moody’s downgrading their credit ratings for the US from ‘stable’ to ‘negative’.

Whenever there is a financial crisis, you will invariably see a mention of the Credit ratings and the role these ratings play in propagating or advancing the problem. So let us understand these ratings and how they affect you as investors.

What is a Credit Rating?

A credit rating evaluates a borrower’s creditworthiness, whether it’s a company or even a country. It’s an evaluation of the borrower’s ability to repay its debts based on multiple factors such as financial stability, past payment history, and other financial indicators.

The same evaluation is called a Credit Score when done for an individual. You would have heard about this term if you ever applied for a Home loan, Car loan, or even a credit card. So what is called credit score for an individual is called the credit rating for a company or country.

Who Issues These Credit Ratings?

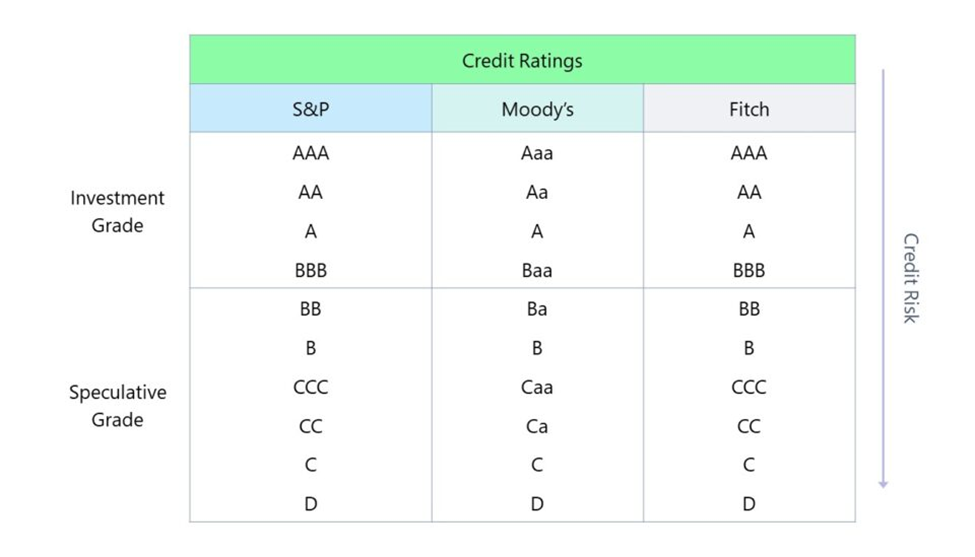

A handful of rating agencies issue credit ratings; for example, we have Crisil, Care Ratings & ICRA issuing most of the credit ratings in India. Similarly, in the US, we have S&P (Standard and Poor’s), Moody’s, and Fitch control more than 95% of the market for credit rating agencies.

Three Types of Credit Ratings

Credit rating companies typically assign three broad buckets of ratings based on the creditworthiness of the borrower:

- Investment Grade: This bucket has borrowers with the highest credit rating, indicating a low risk of default. These instruments typically have a rating of BBB- or higher by Standard & Poor and Fitch Ratings or Baa3 or higher by Moody’s.

- Speculative Grade: These are debt instruments with a high risk of default. They are also called “Junk” or “high yield” debt. Debt instruments rated BB+ or lower by Standard & Poor’s and Fitch Ratings, or Ba1 or lower by Moody’s, are considered speculative-grade.

- Default of Distressed: These are debt instruments that have already defaulted or are on the verge of defaulting. These instruments are typically rated D or C by rating agencies. Some credit rating agencies treat this as part of a Speculative grade only.

Various Advantages of Credit Ratings

A wide range of instruments starting from corporate bonds, Government bonds up to complex financial products like mortgage-backed securities and collateralized debt obligations, are rated by Credit Rating agencies.

- These ratings are meant to guide prospective investors on the riskiness of these instruments and price these products accordingly.

- Investors can demand higher interest rates for lower-rated debt instruments to compensate for the increased risk of default.

- For organizations/companies looking to raise debt, their credit rating significantly impacts their ability to access the capital markets.

- A better credit rating can make it easier and less expensive for an issuer to issue debt and attract investors, while a lower rating can make it more difficult and expensive to raise funds.

Important Factors That Decide A Credit Rating

If you read through a typical credit rating report, it will try to evaluate the following factors:

- Previous payment history of the borrower

- Quality of income streams or sources of funds that will be used to repay the loans

- Usage of the borrowed money itself

- Various financial ratios include solvency, interest coverage, debt to equity, etc.

The end rating results from all of these factors, and it is essential to note that it is an “Opinion” on the company’s current financial situation.

Can We Blindly Trust Credit Ratings?

The fact that the end credit rating issued by a rating agency is an “Opinion” makes this subjective. It is also relevant to understand how the credit rating operates and who pays for these ratings to understand further if there is scope for manipulation in these ratings.

Credit ratings are paid for by the entities that seek to obtain them. Generally, the issuer of the debt instrument, such as a company issuing bonds, will pay a credit rating agency to evaluate and assign a credit rating to their debt securities. Therefore, rating agencies may be reluctant to give very low ratings to securities issued by companies that pay their salaries.

So even if the rating is not entirely incorrect, there is still a chance that the issuer is biased in favor of his client, and hence the rating may not be completely objective.

Let us now look at some of the past famous examples where these credit rating agencies have gone wrong:

- IL&FS crisis: You would remember that in 2018 IL&FS had severe credit rating issues. IL&FS had a high credit rating before its default, and the situation led to a crisis in India’s financial markets.

- Lehman Brothers: Before its collapse in 2008, credit rating agencies rated Lehman Brothers as investment-grade. However, its credit rating was downgraded to junk status just days before its bankruptcy.

- Argentina: In 2002, Argentina defaulted on its Sovereign debt despite having a high credit rating from credit rating agencies.

Final Words

Does this mean credit ratings are not important? No, they are important. Having looked at all the aspects of credit rating, you should look at credit rating as one of the factors for making an investment decision. However, a credit rating report should never be considered as a final recommendation to buy, hold or sell any debt instrument.

You must assess the entity’s or the instrument’s financial situation independently before investing and use credit rating reports as a supporting tool.

FAQs

What are the key factors of credit rating?

The payment history of the borrower, debt-to-equity ratio, length of credit history, etc., all play a role in arriving at the credit rating or credit score.

What are the problems with credit rating?

The biggest problem is poor rating quality. This could be because of insufficient information or because the ratings may be biased.

What is the validity of credit rating?

A rating is valid until withdrawn, usually when the rated debt obligation is fully paid.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.1 / 5. Vote count: 9

No votes so far! Be the first to rate this post.