You clink glasses with a friend, celebrate a promotion, or unwind after a long week. What’s in your hand? Chances are, it’s an alcoholic beverage. The Indian Alcobev (alcohol beverage) industry is a powerhouse and is about to get even bigger.

Here’s why industry experts predict an exciting FY25 with 8-10% growth and expanding margins for Alcobev companies.

Growth on Tap: Industry Trends

According to a report by the Investment Information and Credit Rating Agency (ICRA), the Alcobev industry is expected to witness a growth rate of 8-10% in FY25. This growth is anticipated across all segments, including Indian-made Foreign Liquor (IMFL), domestic liquor, and beer.

Several vital trends fuel this positive outlook

- Moderation in Input Costs:

ICRA’s report highlights a crucial factor for industry profitability: moderation in input costs. This means that the prices of raw materials like barley (key for beer production), glass, and spirits are expected to remain stable or decline slightly. - Particularly noteworthy is a significant drop in packaging material costs, which account for around 60-65% of an Alcobev manufacturer’s expenses. This includes a correction in soda ash prices, a key component in glass bottle production, which fell by around 20% year-on-year in the first nine months of FY2024. Aluminum prices, used for beverage cans, have also softened in the current fiscal.

- Price Hikes:

Alcobev companies are also expected to exploit the buoyant market sentiment by implementing strategic price hikes. This will enable them to offset any potential rise in input costs, particularly for grains like non-basmati rice, where minimum support price (MSP) hikes and higher procurement rates keep costs elevated due to potential diversion towards ethanol production. - Increasing Disposable Income:

India’s growing economy is leading to a rise in disposable income among consumers. This increased purchasing power is expected to fuel demand for premium and super-premium Alcobev products, further propelling industry growth. - Evolving Consumer Preferences:

Indian consumers are becoming increasingly sophisticated in their drinking habits. The demand for premium and imported Alcobev products is rising, creating opportunities for companies catering to this segment.

Segment-Specific Insights

The growth story within the Alcobev industry is expected to vary across segments:

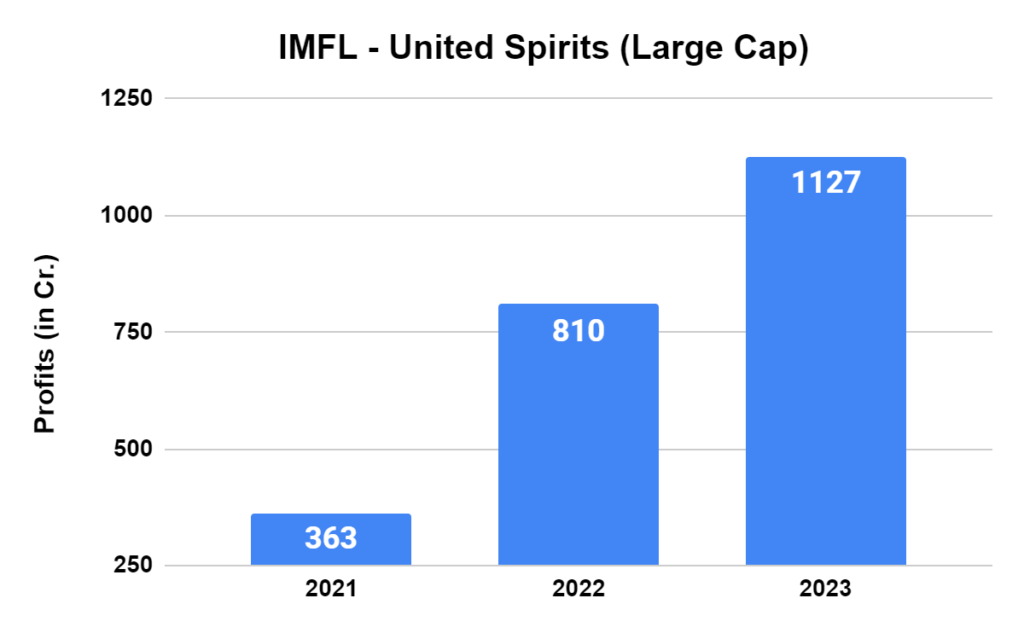

- IMFL: The IMFL segment will likely witness steady growth, driven by the rising preference for premium brands. Consumers are trading up from domestic liquor options, which is expected to continue.

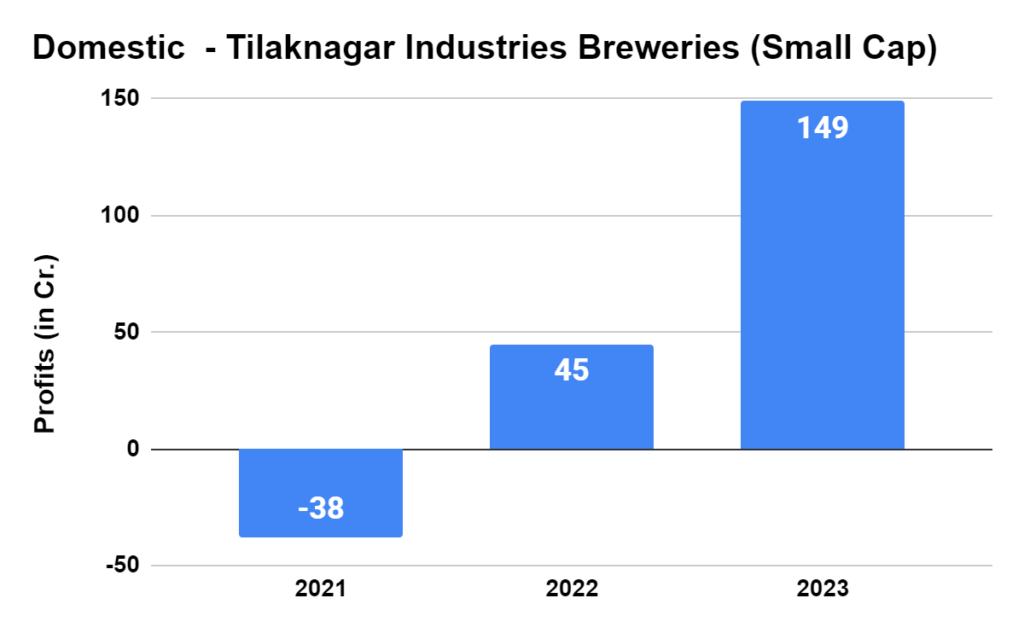

- Domestic Liquor: The domestic liquor segment is also expected to grow, albeit slower than IMFL. However, regional players with strong brand recognition are well-positioned to capitalize on this growth.

- Beer: The beer segment is poised for a solid performance in Q1 FY2025, fueled by anticipation of a hot summer compared to the previous fiscal year, which saw unseasonal rainfall dampening demand. This, coupled with stable barley prices, presents a significant opportunity for beer manufacturers.

The Road Ahead

While the future looks bright for the Indian alcobev industry, some challenges must be addressed:

Regulation: The Indian alcobev industry is heavily regulated, with complex licensing procedures and high taxes. Streamlining regulations and rationalizing tax structures could further boost industry growth.

Social Concerns: Alcohol consumption is a sensitive topic in India, and responsible drinking needs to be promoted. Alcobev companies can play a proactive role in educating consumers about responsible drinking habits.

Conclusion:

The Indian alcobev industry is like a well-chilled glass of your favorite beverage: refreshing, invigorating, and brimming with potential. The future looks bright, with an anticipated growth rate of 8-10% in FY25 and expanding margins on the horizon. This industry isn’t just about clinking glasses; it’s about economic contribution, brand innovation, and catering to evolving consumer tastes. So, raise a glass (responsibly, of course) to the exciting future of the Indian alcobev industry – cheers!

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPOs | Current IPOs | Upcoming IPOs| Listed IPOs

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/