Introduction

The Indian wearables market is set to claim the top spot by the end of 2023, supporting the global demand for smartwatches and wearables. This comes at a time when North America and China face saturation challenges due to macroeconomic headwinds.

According to Jitesh Ubrani, research manager for IDC Mobility and Consumer Device Trackers, mature markets like North America and Europe will see growth driven by replacement purchases. In contrast, emerging markets will contribute to continuous growth with a focus on first-time buyers.

Ubrani highlights India’s remarkable performance, surpassing the United States and China to become the largest market, thanks to the availability of affordable yet feature-rich devices from local vendors. Additionally, Ubrani mentions that other Asian countries, the Middle East, and Africa will lead in shipment growth. At the same time, China and the USA will remain the second and third largest markets, respectively.

According to market research firms International Data Corporation India, of the estimated 504.1 million wearables to be shipped globally this year, India is expected to account for around 130-135 million units, approximately 26% of the total.

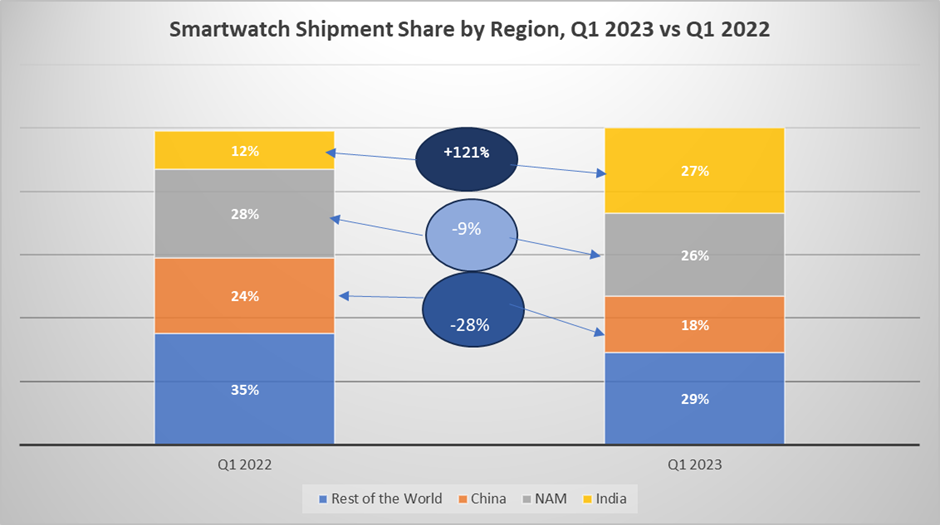

In 2022, India shipped nearly 100 million units, constituting nearly one-fifth of the global shipments of 492 million units, placing it behind China and North America. IDC India and Counterpoint Research report that the quarterly wearables market in India surpassed all other regions, accounting for 26% and 27% of global shipments, respectively, during January-March 2023.

Quantitative factors supporting Indian Wearable Market

- Lower Penetration and Affordability: The Indian wearables market has substantial untapped potential due to its lower penetration rate. This implies that a large portion of the population has yet to embrace wearables, presenting significant growth opportunities. Additionally, the affordability of wearable devices makes them accessible to a broader consumer base.

- Increasing Smartphone Usage: India’s rapidly growing number of smartphone users will act as a catalyst for the adoption of wearables. The seamless integration and compatibility between smartphones and wearable devices drive the demand for these technologies.

- Emerging Local Brands: Local brands such as Noise, boAt, and Fire-Boltt have witnessed impressive growth in the Indian market. Their success can be attributed to their ability to cater to the specific needs and preferences of Indian consumers, offering feature-rich and competitively priced wearables.

Trends in Wearables: Earwear, Smartwatches, Wristbands, and Beyond

International Data Corporation (IDC) India reported that earwear is projected to be the largest product category, driven by new users and current users upgrading from devices purchased in 2020 and 2021. Smartwatches will experience strong growth as users shift from wristbands to more advanced smartwatches.

While smartwatches may impact wristbands, wristbands will still have a presence in the market, appealing to users seeking simpler solutions. Other wearable categories like clothing, rings, and non-augmented/virtual reality glasses will also show positive growth, albeit from a smaller base.

Top 4 Wearable Device Product Categories by Shipment Volume, Market Share, and 2022-2027 CAGR (shipments in millions)

| Product | Shipment 2023 | Market Share 2023(%) | Expected Shipments 2027 | Expected Market Share 2027(%) | CAGR 2022-2027 (%) |

| Earwear | 313 | 62.10 | 390.6 | 62.10 | 4.90 |

| Smartwatch | 157.3 | 31.20 | 206.2 | 32.80 | 6.80 |

| Wristband | 32.1 | 6.40 | 30.1 | 4.80 | -3.00 |

| Others | 1.7 | 0.30 | 2.5 | 0.40 | 8.40 |

| Total | 504.1 | 100 | 629.4 | 100 | 5.00 |

Reports from Counterpoint Highlighted:

Apple’s Market Share Declines. In Q1 2023, Apple experienced a 20% YoY decline in shipment volume, marking the first time it fell below 10 million units in three years. This led to a decline in market share from 32% to 26%. The macroeconomic crisis affected accessibility to higher-priced Apple Watches, impacting their success.

Fire-Boltt’s Rise, Indian brand Fire-Boltt surpassed Samsung, becoming the second-largest global market player. Its shipments tripled YoY with a 57% growth compared to the previous quarter, reflecting the rapid growth of the Indian market along with other local brands like Noise and boAt.

Samsung’s Mixed Performance. Samsung saw a 15% increase in North American shipments but experienced declines in other major markets. Global shipments declined by 15% YoY and 21% compared to the previous quarter.

Huawei’s Moderated Decline. Huawei faced a 14% YoY decline in Chinese market shipments, its key market. However, increased shipments in India, LATAM, and MEA regions limited the global decline to 9%. Huawei’s strategy of relaunching previous models from the Chinese market internationally supported its global presence.

Take a look at this smartwatch shipping share by region.

Key Factors Driving the Indian Wearable Market Growth

- Technological advancements: Integration with smartphones and other devices drives the growth of the Indian wearable market.

- Enhanced features and functionalities: Wearable devices offer a wide range of capabilities, such as fitness tracking, heart rate monitoring, and sleep tracking, enhancing their appeal to consumers.

- Increasing health and fitness consciousness: Wearables provide valuable tools for monitoring physical activity, setting goals, and receiving real-time feedback, aligning with the growing focus on health and fitness.

- Growing adoption of smartwatches as fashion accessories: The combination of functionality and style makes smartwatches desirable fashion statements, driving their popularity in the Indian market.

Challenges and Opportunities in the Indian Wearable Market

- Competition from international brands: The Indian wearable market faces tough competition from global brands, which requires local players to innovate and establish a strong market presence.

- Addressing consumer concerns: Battery life and data privacy are important concerns for Indian consumers. Manufacturers need to focus on longer battery life and robust data privacy measures to meet customer expectations.

- Potential for innovation and customization: The Indian wearable market offers unique features and customization opportunities. Manufacturers can tailor their devices to cater to the specific needs and preferences of Indian consumers.

Final Words

The Indian wearable market shows strong growth potential with lower penetration, affordability, emerging local brands, and technological advancements. Challenges include competition, and consumer concerns lie in innovation and customization.

FAQs

What is the future of wearables in 2023?

In 2023, anticipate the rise of trending wearables equipped with biometrics, proximity, movement, and other sensors. These advanced features enable them to gather contextual information and perform functions like heart rate tracking, complemented by voice-based personal assistants.

Which brands are the most popular in the Indian wearable market?

The most popular brands in the Indian wearable market are boAt, Noise, Fire-Boltt, and Xiaomi. These brands offer a wide range of affordable and stylish wearable devices that are tailored to the needs of Indian consumers.

How useful was this post?

Click on a star to rate it!

Average rating 3.4 / 5. Vote count: 20

No votes so far! Be the first to rate this post.