Introduction

India’s GDP has witnessed a remarkable surge, surpassing all expectations and clocking a growth rate of 7.2% in the fiscal year.

In this article, let’s briefly overview India’s GDP performance and highlight its significance. Additionally, let’s understand India’s GDP growth in the global economy, shedding light on its implications for its position in the global market. Stay tuned for an analysis of GDP data and its impact.

India GDP Data Beats Expectations

India witnessed a significant GDP boost in the fourth quarter of the financial year, surpassing projections. The GDP at Constant (2011-12) Prices in Q4 2022-23 is estimated at ₹43.62 lakh crore, compared to ₹41.12 lakh crore in Q4 2021-22, which is a growth of 6.1%. This substantial increase contributed to the yearly change in Real GDP or GDP at Constant (2011-12) Prices of 7.2% or ₹160.06 lakh crore for the fiscal year 2022-23.

Union Finance Minister, Ms. Nirmala Sitharaman, said India’s GDP touched the US$ 3.75 trillion mark in 2023, up from around US$ 2 trillion in 2014. According to the Finance Ministry, India’s economy has been ranked as the fifth largest in the world from the tenth largest.

In terms of current prices, India’s GDP was US$ 3,737 billion, which ranks above the UK (US$ 3,159 billion), France (US$ 2,924 billion), Canada (US$ 2,089 billion), Russia (US$ 1,840 billion), and Australia (US$ 1,550 billion) at current prices.

Factors Contributing To India’s GDP Surge

Agricultural and construction sectors

The unexpected growth of 5.5 % in the agricultural sector during the January-March rabi months and the significant surge of 10.4 % (₹ 3.9 lakh crore) in the construction sector played vital roles in India’s outstanding GDP performance. These sectors demonstrated resilience and contributed positively to the overall growth.

- Ongoing structural reforms and favorable government policies: Continuous structural reforms and favorable government policies have enabled India to outshine other major economies. These reforms likely created an environment conducive to economic growth.

- Resilience amid global challenges: While Europe and the United States faced challenges due to the Ukraine war and financial difficulties, India managed to defy these global factors and maintain its growth momentum. This resilience showcases India’s potential to act as an engine of world growth.

Two years ago, India experienced a low-growth phase, reaching negative figures. Therefore, the current growth rate signifies a significant improvement and instills optimism for India’s future economic performance.

Private final consumption expenditure (PFCE) growth slowed down over the year, indicating a distribution challenge and a link to the decline in the quality of jobs. Additionally, there are concerns about a slowdown in key infrastructure sectors and the manufacturing sector’s contraction in three quarters. These factors may pose risks to future growth and undermine the encouraging aspects of the GDP data.

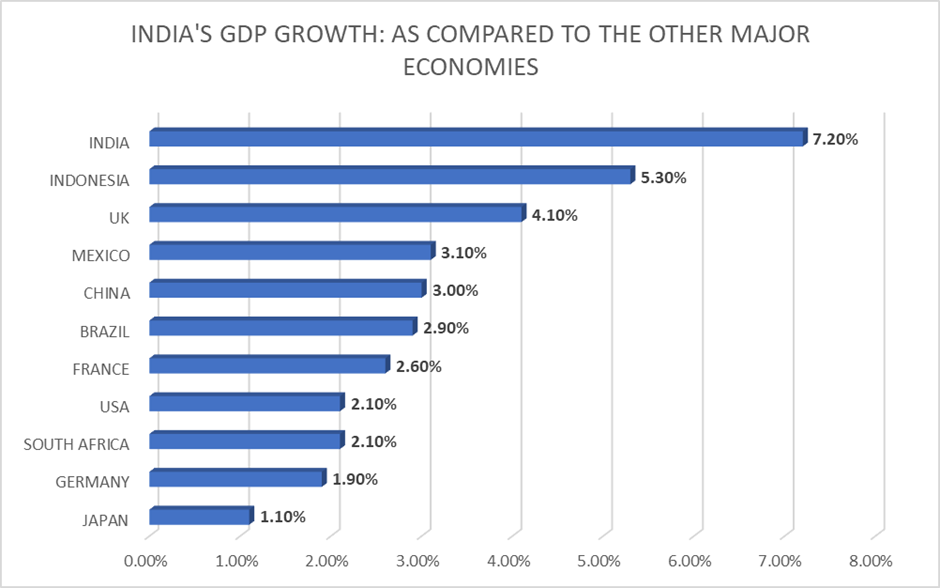

This graph shows India’s GDP growth rate in 2023 outpaces emerging and major economies.

Market Reactions and Implications: India’s GDP Exceeding Expectations

Markets reacted to India’s GDP data exceeding expectations in a mixed way. While optimism surrounds the services sector’s strong performance and improved foreign capital inflows, concerns remain regarding the slump in net exports and the manufacturing sector.

The market reactions to the GDP data have implications for investors and businesses. The strong performance of Indian companies, with top-line growth of 12% in Q4FY23 and a net profit increase of 19%, reflects positively on the market. Improved foreign capital inflows of $6 billion in FY24 also contribute to market confidence.

The implications of the GDP data on key sectors of the Indian economy are twofold. The services sector shows resilience and expects to continue driving growth, while net exports and the manufacturing sector pose challenges. Care Rating projects that the overall economic growth in FY24 will moderate to 6.1%, influenced by global economic uncertainties and potential spillovers from the external sector.

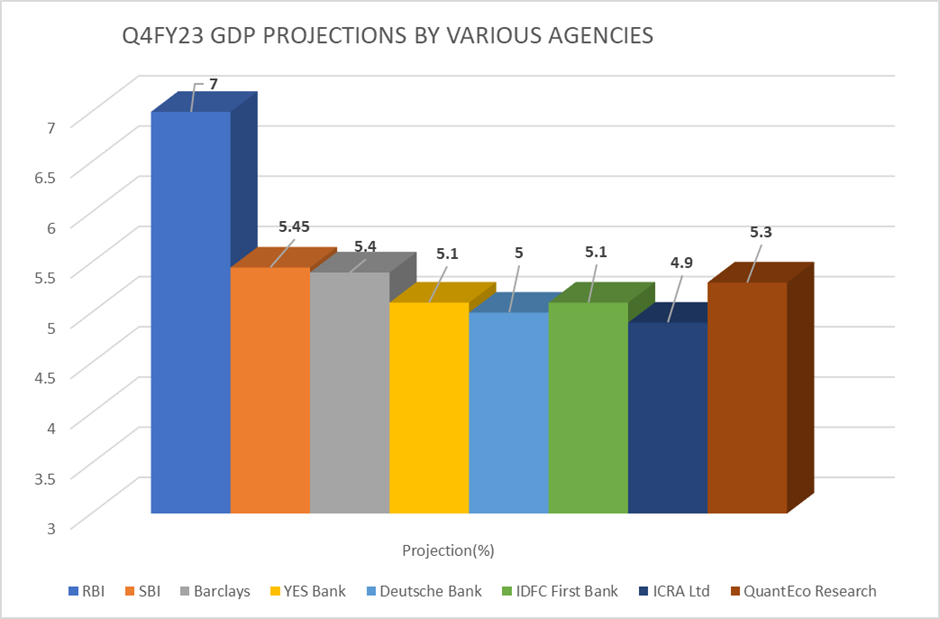

The graph below shows that India’s GDP exceeded RBI and other agencies’ expectations.

Final Words

India’s GDP has surged, exceeding expectations from RBI and other major agencies and showcasing remarkable growth. Factors such as resilient agricultural and construction sectors, ongoing reforms, and favorable government policies have contributed to this achievement.

However, private consumption, infrastructure, and manufacturing challenges pose risks. Market reactions have been mixed, with optimism for services and foreign capital inflows, while concerns persist for net exports and manufacturing. Despite uncertainties, India’s GDP growth signifies a positive economic trajectory and future potential.

FAQs

What is the outlook for India’s growth in GDP for the coming years?

Fitch Ratings downgraded its forecast for India’s GDP growth in 2023-24 from 6.2% to 6%, citing headwinds from rising inflation and interest rates and weak global demand. The agency expects the Indian economy to rebound to 6.7% in 2024-25.

What are the implications of the global economic uncertainties for growth in the GDP of India?

Global economic uncertainties are a challenge for India’s GDP growth because they can slow global trade and investment. This can hurt India’s exports and investment, dampening economic growth.

What are the implications of the slowdown in private consumption for GDP growth in India?

The slowdown in private consumption is a challenge for India’s GDP growth because it is a major driver of economic growth. When people consume less, they spend less money, which reduces the demand for goods and services. It can lead to businesses slowing down their investment and hiring, further dampening economic growth.

What are some of the risks to India’s GDP growth?

Some of the risks India faces in the context of GDP growth include:

● The global economic slowdown.

● Rising inflation.

● Geopolitical tensions.

● Natural disasters.

What are some of the opportunities for India’s GDP growth?

Some of the opportunities for India’s GDP growth include:

● The continued growth of the global economy.

● India’s expanding middle class.

● The development of new technologies.

● The opening up of new markets.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 4

No votes so far! Be the first to rate this post.