Introduction

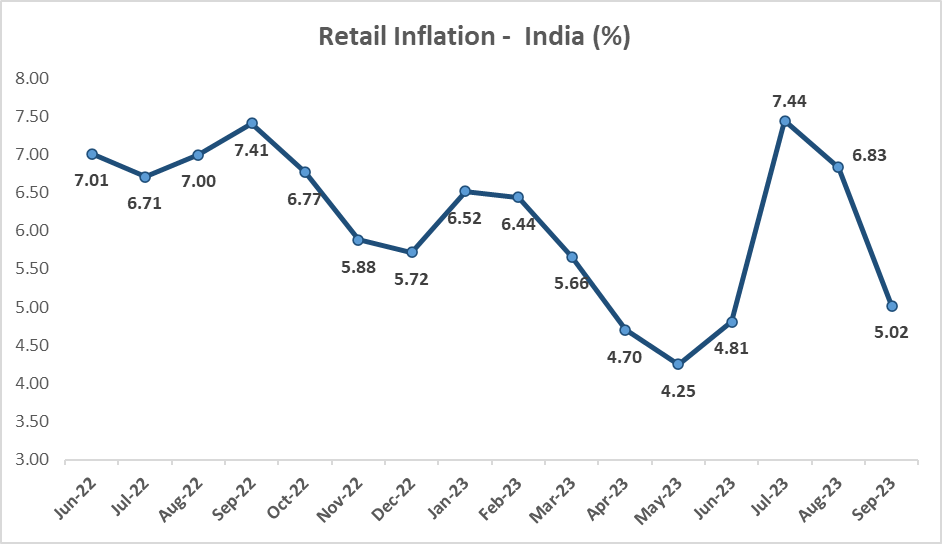

In July and August, India’s Consumer Price Index (CPI) inflation surged above the Reserve Bank of India’s (RBI) tolerance limit of 6%. This raised concerns and prompted a closer examination of the economic situation. In September, however, there was a welcome shift as India’s retail inflation rate dropped to 5%, falling below the 6% upper tolerance level for the first time in three months.

Let’s delve into the specifics and implications of these fluctuations.

Analyzing Q2 CPI Inflation

1. Averaging 6.4% in Q2

When we assess the inflation numbers for September, it’s evident that the CPI inflation averaged around 6.4% for the second quarter of the fiscal year 2024. This aligns closely with the RBI’s initial estimates.

2. Impact of Food Price Fluctuations

The recent volatility in inflation is primarily attributed to fluctuations in food prices. A detailed analysis shows a significant correlation between food price movements and inflation rates.

3. Food Inflation at a Three-Month Low

In September, food inflation witnessed a notable decline, reaching a three-month low of 6.56%. This can be attributed to a substantial drop in vegetable prices, which decelerated significantly to just 3.4%. Notably, there was a 16% decline on a month-on-month basis.

4. Core Inflation Below 5%

Core inflation, which excludes volatile food and energy components, fell below 5%. This was driven by a broad easing in various segments, including housing, clothing, footwear, and other services.

| SEP 2023 INFLATION | Y/Y | M/M |

| CPI | 5.02% | -1.10% |

| Food | 6.56% | -2.20% |

| Cereals | 10.95% | 1.20% |

| Meat, fish | 4.11% | 1.70% |

| Oils, fats | -14.04% | -0.40% |

| Vegetables | 3.39% | -15.80% |

| Pulses | 16.38% | 4.10% |

| Fruits | 7.30% | -1.10% |

| Clothing, footwear | 4.61% | 0.30% |

| Housing | 3.95% | -0.10% |

| Fuel, light | -0.11% | -3.90% |

| Miscellaneous | 4.77% | 0.20% |

Key Takeaways

Impact of Food Price Correction

The correction in food prices, especially for vegetables, has substantially brought down inflation rates. This indicates the sensitivity of inflation to specific commodities.

Uncertain Future Path

Despite the recent corrections, the future trajectory of inflation remains uncertain. One crucial factor is the monsoon, which has been uneven recently. Its impact on agricultural production and food prices is a critical variable.

Near-Term Inflation Risks

Another factor adding to the uncertainty is the unpredictable fluctuations in global crude oil prices. These fluctuations can have cascading effects on various sectors of the economy.

In conclusion, the recent correction in food prices, particularly in the vegetable segment, has stabilized inflation. However, the future remains uncertain, with the monsoon and global crude oil prices posing near-term risks. A balance between these variables will be crucial for India’s economic stability.

FAQs

How does the RBI monitor inflation levels?

The RBI closely tracks inflation levels through various economic indicators, with the Consumer Price Index (CPI) being a key metric.

How do global crude oil prices impact India's economy?

Fluctuations in global crude oil prices can have far-reaching effects on India's economy, affecting sectors ranging from transportation to manufacturing.

Are there other factors that contribute to inflation?

Besides food prices, factors such as energy costs, monetary policy, and global economic trends can also influence inflation rates.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.