The auto sector is a crucial driver of the Indian economy and is set for growth in the coming years. Let’s take a quick pit stop to look at some fascinating statistics that prove the auto sector is in full bloom:

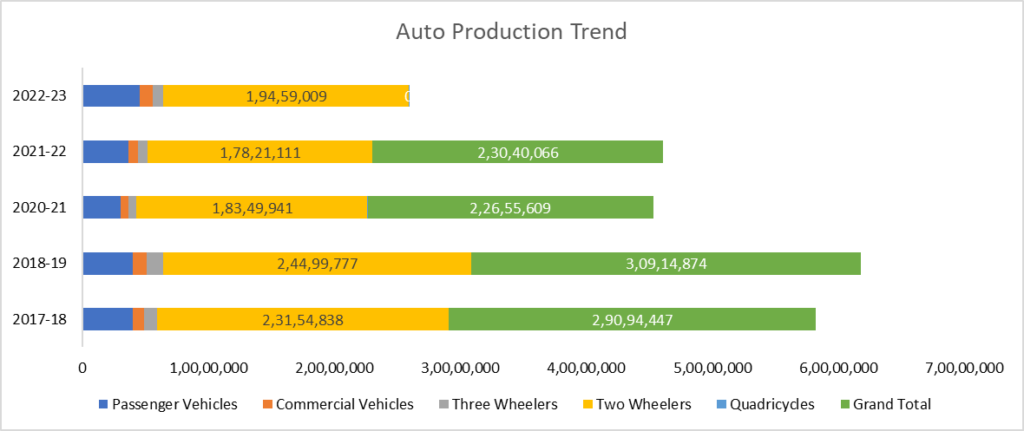

From April 2022 to March 2023, 2.59 crore vehicles rolled off the assembly lines, including passenger vehicles, commercial vehicles, Three-wheelers, two-wheelers, and quadricycles. This marks a substantial increase from the 2.3 crore units produced in the previous year.

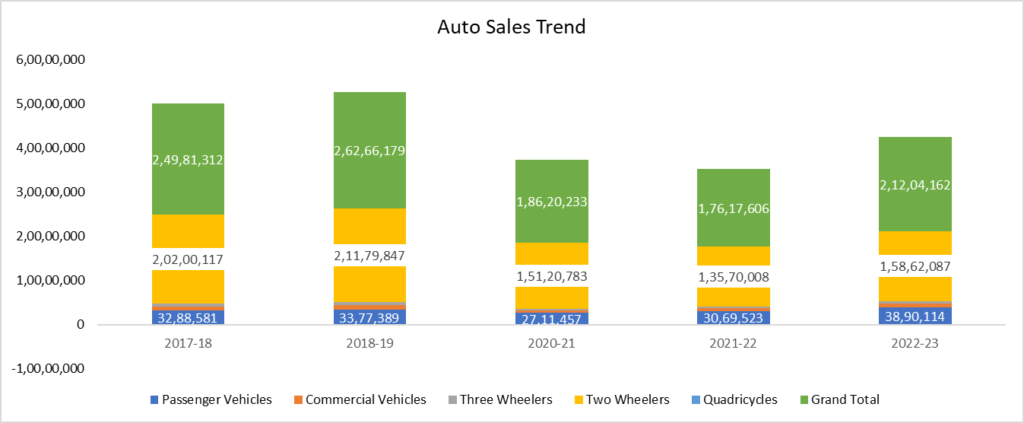

The sales of passenger vehicles have shifted into high gear, going from 30.69 lakhs to 38.9 lakhs. Passenger cars, utility vehicles, and vans are all part of this thrilling ride, showing growth in FY-2022-23.

The commercial vehicles segment has also grown, increasing from 7.16 lakhs to 9.6 lakhs. Medium, heavy, and light commercial vehicles have contributed to this impressive growth. Sales of three-wheelers have shifted into turbo mode, jumping from 2.6 lakhs to 4.88 lakhs units in FY-2022-23.

Two-wheelers have accelerated significantly, increasing from 1.35 to 1.58 crore units in FY-2022-23. SUVs now command a whopping 50% share of all passenger vehicle sales in India, doubling their market presence in just five years.

Now that we’ve sparked your interest, here are some interesting factors that make the auto sector a road worth exploring for investment:

- As urbanization spreads and incomes rise, vehicle demand may grow.

- The government is firmly in the driver’s seat, introducing policies like the Production Linked Incentive (PLI) scheme to rev up the auto sector.

- With a spotlight on electric vehicles, the auto industry is poised for a green revolution, creating fresh opportunities.

- The auto sector benefits from decreasing inflation, stable fuel prices, and reduced commodity costs.

- Increased focus on locally manufactured technology and components.

- Easy access to loans encourages more people to purchase vehicles, boosting the sector.

But before deciding, here are some key fundamentals to consider when investing in the automobile sector.

Key fundamentals to consider before buying automobile sector stocks

- Company’s financial health: Avoid companies with too much debt. Look for companies with a strong balance sheet and healthy cash flow.

- Cyclical nature: The auto sector is cyclical, meaning it goes through periods of boom and bust. Be prepared for volatility in the short term, but invest for the long term to ride out the cycles.

- Growth opportunities: Invest in companies with clear growth prospects. Look for companies that are innovating and expanding into new markets.

- Valuation: Understand the valuation of the stock before investing. Avoid stocks that are trading at a high premium to their intrinsic value.

- Regulatory changes: The regulatory environment for the auto sector is constantly changing, which can impact the profitability of auto companies.

Discuss your investment strategy with a financial expert before investing in any stock.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Is this the time to invest in the auto sector?

The auto sector is set for growth in the coming years, driven by urbanization, rising incomes, government support, and the shift towards electric vehicles. However, investors should be aware of the sector's cyclical nature and invest for the long term.

What are some key factors to consider when investing in the auto sector?

Investors should consider the company's financial health, cyclical nature, growth opportunities, valuation, and regulatory changes.

Should I talk to a financial advisor before investing in the auto sector?

Yes, it is advisable to discuss your investment strategy with a trusted financial expert.

What is the investment horizon for the auto sector?

Investing in auto funds for the long term, at least 5-10 years, is recommended. This will help you ride out the sector's cyclical nature and maximize your returns.

How useful was this post?

Click on a star to rate it!

Average rating 4.7 / 5. Vote count: 11

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/