Introduction

Over the last decade, the share of credit disbursed to and by NBFCs in India has experienced significant growth, rising from approximately 10% in 2013 to slightly over 35% in the first half of 2023. This expansion highlights their continuous efforts to strengthen their presence in the credit market, posing formidable competition to traditional banks. As of September 2022, NBFCs collectively held an impressive outstanding amount of ₹31.5 lakh crores.

Several factors have contributed to the solidification of NBFCs’ position in India. These include enhanced financial inclusion, the emergence of fintech solutions, advancements in technology and digitalization, the growing popularity of financial products, and increasing income levels across various household segments.

This blog will look at the fundamentals of Mahindra & Mahindra Financial Services, one of India’s most popular NBFCs in the automobile lending space, and assess its future growth potential.

Mahindra & Mahindra Financial Services Company Journey

Mahindra Finance began operations in the early 1990s when India was gradually liberalizing its economy. Initially known as Maxi Motors Financial Services Limited, the company was founded in 1991 and rebranded to Mahindra & Mahindra Financial Services the following year.

It began as a captive financier of Mahindra Utility Vehicles and later began financing the purchase of tractors with a particular focus on semi-urban and rural areas. In 2002, it started funding non-Mahindra vehicles.

Mahindra & Mahindra Financial Services is into Vehicle Financing, SME Financing, Consumer & Personal Loans, Rural Housing Finance, Insurance Broking, Asset Management & Mutual Fund Distribution. At the end of 31st March 2023, the company has an asset under management of close to ₹1 lakh crore.

Mahindra & Mahindra Financial Services Business Overview

Mahindra Finance is a pure brick-and-mortar NBFC with a presence in every state in India and footprints in 85% of its district, catering to the financing needs of people in semi-urban and rural India. The company has divided its business into six clusters:

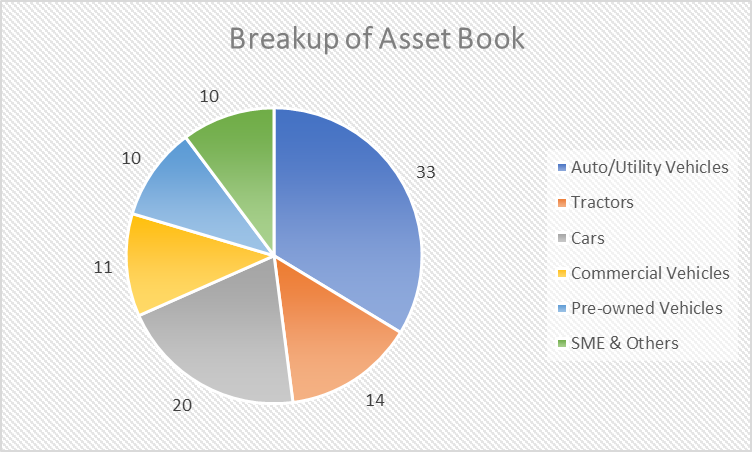

- Vehicle and Tractor Financing: It is the primary cluster of the company and contributes most to the revenue. The company is involved in diverse vehicle financing, including passenger, commercial, pre-owned tractors and construction equipment.

- Consumer & Personal Loan: It offers an innovative and tailor-made product suite that meets customers’ requirements.

- SME Financing: It offers project finance, equipment finance, working capital finance, and other specific SME financing. The group targets auto ancillary, engineering, and food/agri-processing industry sectors for SME financing.

- Insurance Broking: Under this cluster, the company provides affordable life, health, and asset protection solutions to customers as per risk profile and requirements.

- Housing Finance: Mahindra & Mahindra Financial Services, through its subsidiary Mahindra Rural Housing Finance Limited (MRHFL), offers various housing loans for purchase, construction, extension, and renovation. The company provides loans to individuals based in rural and semi-urban areas.

- Asset Management & Mutual Fund Distribution: Simple saving instruments and mutual fund investment products are housed under this cluster. The Mahindra & Mahindra Financial Services offers mutual fund investments through its AMC- Mahindra Manulife Mutual Fund. As on 31st March 2023, the AMC’s asset under management stands at ₹9,503 crores and has 20 schemes across equity, debt, tax saving, and monthly income funds.

Despite having six different clusters, the company reports all its revenue under a single segment.

Mahindra & Mahindra Financial Services Management

Mr. Ramesh Iyer is the Vice-Chairman and Managing Director at Mahindra & Mahindra Financial Services and is currently leading the company’s operation. He is associated with the company since 1994 and has played an instrumental role in building the company and its diversification across multiple product verticals.

Mr. Raul Rebello is the Executive Direction and CEO-Designate. He will take over the position from April 29, 2024, and replace Mr. Ramesh Iyer, who is set to retire. Mr. Rebello joined Mahindra Finance on 1st September 2021 as Chief Operating Officer. Previously, he was with Axis Bank as Executive Vice President and the Head of Rural Lending and Financial Inclusion.

Mr. Vivek Karve is the company’s Chief Financial Officer and has rich experience of 25 years. He has strong experience in working across different sectors like Consumer Goods, IT Consulting, and Project Finance during his previous stints at P&G, Siemens Information Systems, and ICICI. Before joining Mahindra Finance, he was Marico Limited as Group CFO.

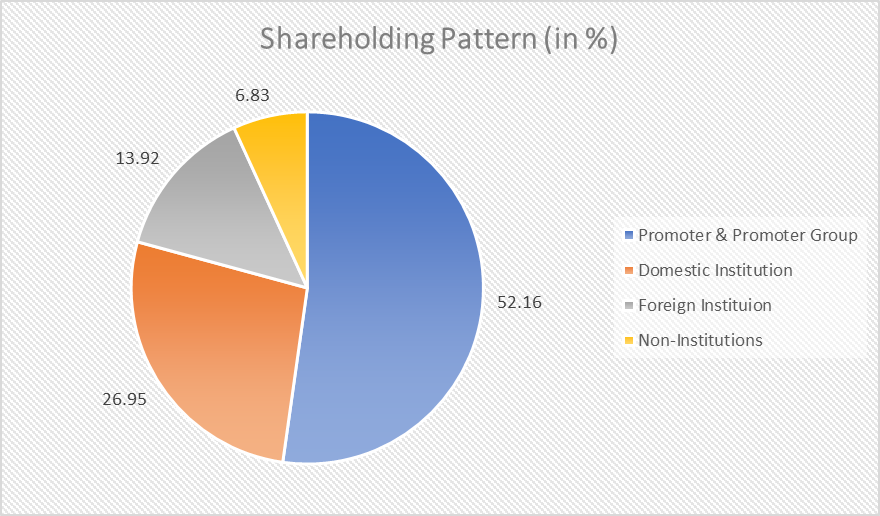

Mahindra Finance Shareholding Pattern

Mahindra & Mahindra Financial Services Financials

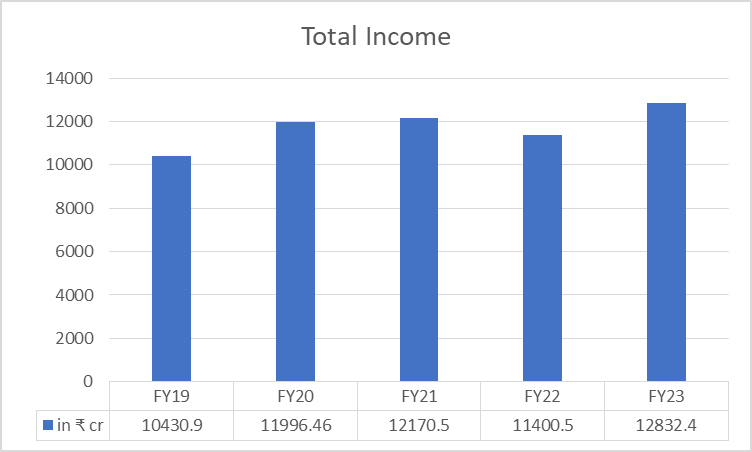

Revenue

In FY23, Mahindra Finance reported a 12.6% growth in total income at ₹12,832.4 crores, from ₹11,400.51 crores in FY22. And, in Q1FY24, the company reported a 25% growth in total income at ₹3,637 crores, from ₹2,914 crores in Q1FY23.

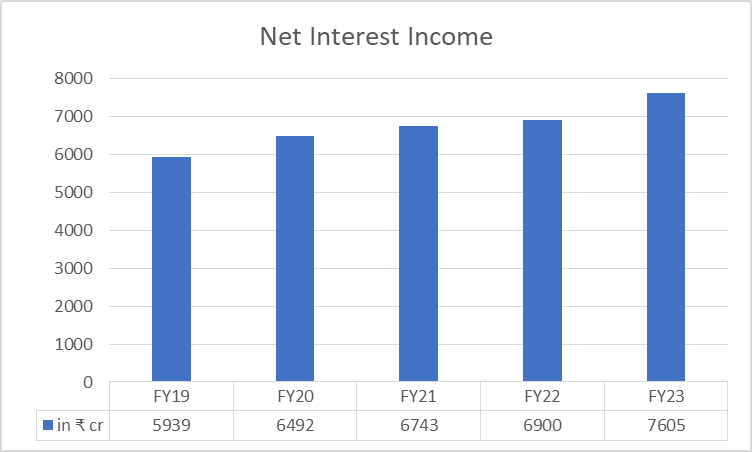

Net Interest Income (NII)

During FY23, Mahindra Finance’s NII was ₹7,605 crores, up 10.2% from ₹6900 crores. And, in Q1FY24, NII increased by 7% to ₹1,986 crores from ₹1,850 crores in Q1FY23.

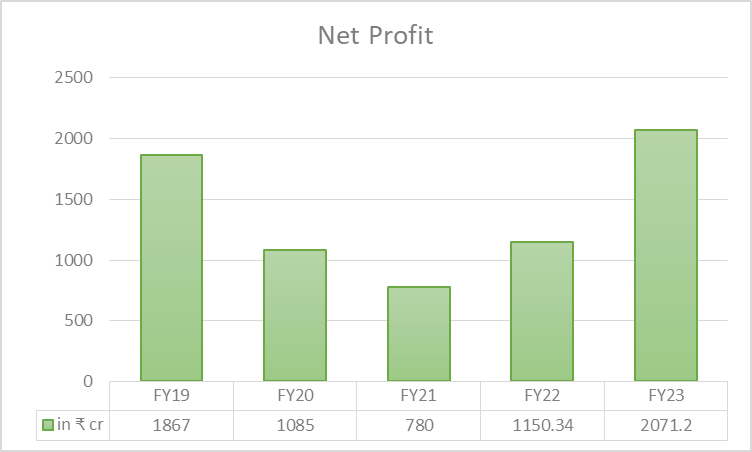

Profit After Tax (PAT)

In FY23, Mahindra Finance reported an almost 80% increase in net profit to ₹2,071.2 crores from ₹1,150 crores in FY22. And, in Q1FY24, net profit increased by 51% year-on-year to ₹362 crores from ₹240 crores in Q1FY23.

Mahindra & Mahindra Financial Services Key Financial Ratios

- Capital Adequacy Ratio (CAR): As of June 30th, 2023, the company’s CAR stood at 21.2% and is well above regulatory limits. A higher CAR indicates that the NBFC is better placed to absorb any shock of large loan defaults.

- Provision Coverage Ratio (PCR): PCR is an important metric for any lending company. It represents how much percentage of bad assets a bank or financial institution can provide for from its own funds. Mahindra Finance has a PCR of 60.1% on Stage-3 in June 2023.

- Stage-3 assets in NBFCs are loans overdue for more than 90 days.

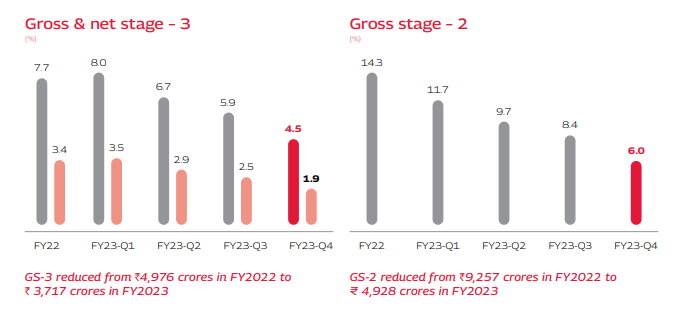

- Asset Quality: The company has reported sustained improvement in asset quality over the last year. Gross Stage-3 assets fell to 4.3% as of June 30th, 2023, from 8% in June 2022. Furthermore, gross Stage-2 assets fell to 6.4% from 11.7% in June 2022.

- Credit Cost: Credit cost during Q1FY24 was 2.1%.

- Net Interest Margin (NIM): At the end of FY23, NIM was 7.6%, which declined to 6.8% in Q1FY24.

- Cost-to-Income Ratio: In FY23, the cost-to-income ratio increased to 42.1%, from 35.8% in FY22. And in Q1FY24, the ratio increased marginally to 40.3% from 39.6% in Q1FY23.

Mahindra & Mahindra Financial Services Share Price History

Mahindra Finance launched its IPO on 21st Feb 2021, raising ₹400 crores at a maximum per share price of ₹200. And the IPO was oversubscribed by 26 times.

As of 3rd August 2023, Mahindra & Mahindra Financial Services share price has given a CAGR return of 31% in the last three years. While over the five years period, it has underperformed the market and given a negative 2% CAGR return. It reached an all-time high level of ₹346.55 on 4th July 2023.

Mahindra & Mahindra Financial Services has a consistent record of paying its shareholders dividends. It paid ₹0.80 in 2021, ₹3.60 in 2022, and ₹6 in 2023 as dividends. Its share was split once on 15th February 2013 at a 10:2 ratio, meaning each share with a face value of ₹10 was split into five and got a new face value of ₹2. As of 3rd August 2023, Mahindra & Mahindra Financial Services has a market capitalization of ₹35,325 crores.

Mahindra & Mahindra Financial Services Fundamental Analysis

- Strong Growth in the Last Two Fiscals

Mahindra & Mahindra Financial Services is one of the leading NBFCs in semi-urban and rural India and has maintained a leadership position financing M&M Auto and Tractors.

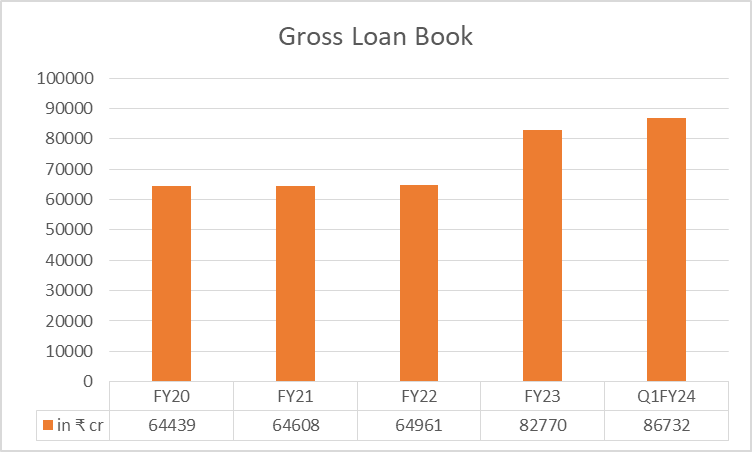

Over the last few years, it has consistently increased its presence across India with a 1,386-branch network and is steadily growing its loan book.

In FY23, the company witnessed strong growth in the vehicle financing segment and expansion of the SME financing business resulting in the highest-ever annual disbursement of ₹49,541 crores. And Q1FY24, quarterly disbursements stood at ₹12,165 crores.

- Consistent Improvement in Asset Quality

In the last five quarters, the company has showcased consistent improvement in gross and net stage-3 and stage-2 asset quality, aiding the growth of its profitability metrics.

Furthermore, FY23 collection efficiency was healthy at 96%, improving from 93% in FY22.

- Mahindra Rural Housing Finance Limited (MHRFL)

In FY23, the company disbursed loans aggregating to ₹2,004 crores, as against ₹1,602 crores the previous year. And reported ₹21.7 crores in net profit, 54.5% lower compared to the previous year at ₹47.7 crores.

MHRFL primarily focuses on serving customers in rural India, and most loans disbursed were to customers with an average annual household income of less than ₹3 lahks.

Mahindra & Mahindra Financial Services Share Price Growth Potential

Let’s look at the company’s SWOT analysis to better understand Mahindra & Mahindra Financial Services share price growth potential.

Strengths

- Strong patronage of its parent company- Mahindra & Mahindra Group

- A strong player in automotive and tractor financing in rural and semi-urban towns

- Vast distribution network, diversified product range, and robust collection system

- Provides a comprehensive range of financial products essential throughout the various stages of a person’s life cycle, including loans, insurance, and investment offerings.

- Long track record of operations, deep understanding of the automotive market, and strong understanding of the customer needs

Weaknesses

- Strong competition from banks and higher cost of funds

- A limited understanding of product segments beyond automotive lending has hindered its growth and prevented the exploration of potential opportunities in other verticals

- The company’s limited presence in urban and metro cities has caused it to miss out on a significant lending market opportunity

- Lower household income in rural India has led to smaller-ticket-size loans being offered

Threats

- Tightening regulatory norms for NBFC by RBI

- Major impact on rural consumption pattern in case of elevated inflation levels and the slowdown in the economy

- The company’s lack of diversification and high concentration of auto lending in its portfolio makes it susceptible to adverse effects from a slowdown in the automotive sector, which could impact it’s business and profitability.

Opportunities

- Strong recovery in economic activity and increasing dispensable income in rural India, helping in the revival of rural consumption

- Huge untapped potential in SME Financing and rural housing finance

- Digitalization of processes is enabling data-driven decision making

Mahindra & Mahindra Financial Services Growth Outlook

Over the past few quarters, the company has displayed robust growth, effectively rebounding from the negative impact of the pandemic. With this positive momentum, it is confidently progressing towards achieving its guided vision by FY25.

Within the next two years, the company has set ambitious targets:

- Doubling its assets under management.

- Increasing the revenue contribution of new business initiatives from the current 6% to 15%.

- Maintaining Net Interest Margins (NIMs) at 7.5%.

- Reducing the cost-to-assets ratio from the current 3.2% to 2.5%.

- Elevating the Return on Assets (ROA) from 2.3% to 2.5%.

Industry Outlook

Automobile and Vehicle Financing: In 2022 automobile sector contributed 7% to India’s GDP and 49% of its manufacturing GDP. It became the third-largest automobile market, surpassing Japan and Germany.

As per CRISIL’s analysis, the NBFC vehicle finance AUM is projected to experience a notable growth rate of 13-14% in FY2024, surpassing the estimated 12% growth observed in FY2023. This upswing is anticipated to be fueled by strong demand and the introduction of new cars and utility vehicles in the market.

NBFCs are expected to capitalize on their well-established last-mile connectivity and extensive presence in micro markets, channeling their efforts towards used-vehicle financing.

SME Financing: India’s MSME sector is the key driver of the credit offtake in the country. Several initiatives by the government and RBI, like the Digitized Loan Scheme Emergency Credit Line Guarantee Scheme (ECLGS), are helping in the revival of the MSME sector.

CRISIL predicts that the MSME sector will witness significant credit growth of 16-18% in the current fiscal year and FY25. This growth is expected to be driven by the government’s focus on self-sufficiency through the ‘Atmanirbhar Bharat’ initiative, along with the implementation of the Productivity Linked Incentive (PLI) scheme.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When was Mahindra Financial Services established?

Mahindra & Mahindra Financial Services was incorporated 1991 as Maxi Motors Financial Services. It is primarily into automotive lending, focusing on rural and semi-urban towns.

How has Mahindra & Mahindra Financial Services share price performed?

As of 3rd August 2023, Mahindra & Mahindra Financial Services share price has given a CAGR return of 31% in the last three years and reached an all-time high level of ₹346.55.

When was Mahindra & Mahindra Financial Services shares listed on the stock exchange?

M&M Financial Services launched its IPO on 21st Feb 2021, raising ₹400 crores at a maximum per share price of ₹200. The IPO was oversubscribed by 26 times.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.8 / 5. Vote count: 6

No votes so far! Be the first to rate this post.