Lately, the tech world has been buzzing about Nvidia, a big player in the semiconductor and AI industries. Nvidia’s rapid rise, driven by its cutting-edge products and innovative business moves, had a considerable impact everywhere, including India.

Nvidia’s ongoing tech revolution in Artificial Intelligence has helped companies use their chips to process vast amounts of data and improve their operations. This high demand for Nvidia’s chips caused its revenue to triple in the last quarter, reaching $26 billion compared to the previous year.

However, Nvidia’s climb to the top of the market has drawn both fans and critics. With its staggering market value exceeding $3.3 trillion—surpassing giants like Microsoft, Apple, Walmart, Meta, and Google—investors are now looking for the next Nvidia. While everyone is excited about Nvidia’s success, it’s also a reminder for investors and policymakers in India to tread carefully.

Nvidia’s Rise: A Quick Recap

- Nvidia, founded in 1993, has grown from a niche graphics processing unit (GPU) manufacturer to a titan in the tech world. Its GPUs have become essential for gaming and AI, data centers, and autonomous vehicles. The company’s strategic focus on AI has propelled it to new heights, making it one of the most valuable semiconductor companies globally.

- In 2020, Nvidia made headlines with its acquisition of ARM Holdings, a move aimed at solidifying its position in the AI and data center markets. This acquisition, along with consistent innovation and expansion into new markets, has made Nvidia a darling of investors, with its stock price reflecting this enthusiasm.

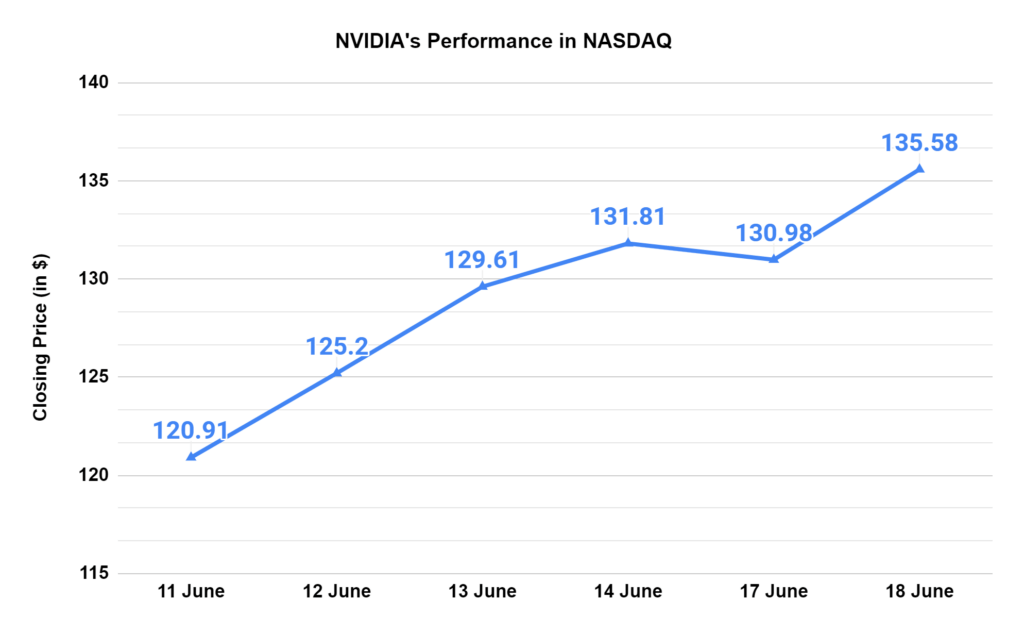

- Unsurprisingly, Nvidia’s stock has tripled in value over the past year. Its market value increased by a trillion dollars in four months—the equivalent of seven HDFC Banks. Many investors have benefited from this surge in US tech stocks through mutual fund plans that invest in international companies.

The Nvidia Effect on India

India, a booming tech hub, has not been immune to Nvidia’s influence. The Indian stock market, ever sensitive to global tech trends, has seen a surge of interest in semiconductor and AI-related stocks.

Those who missed out on Nvidia’s boom seem to have turned their attention to a local semiconductor stock: Moschip Technologies Ltd. This company, which received early backing from private equity firms, specializes in “semiconductor and system design services.”

On 19th June, Moschip’s stock jumped 13% to Rs. 231.35, resulting in a market capitalization of Rs. 4,700 crore. Over 7 million shares were traded on the BSE, making its value more than 21 times its revenue from last year.

However, this fervor has brought with it a sense of caution. While inspiring, Nvidia’s success story has led to an overheated market in India. It reminds us of past market bubbles, where too much speculation and excitement from investors caused prices to rise too high, leading to later market corrections.

Investor Caution: Learning from the Past

The excitement around Nvidia and its impact on the Indian market shows how markets can sometimes get carried away. In the past, tech bubbles have formed when investor expectations exceeded the actual growth and potential of the technology, like the dot-com bubble of the late 1990s.

While Nvidia’s future looks bright, the market must stay realistic about growth and profits. Investors need to distinguish between real, sustainable growth and mere hype. The rise in Indian tech stocks driven by Nvidia’s success might result in overvalued companies that may not last in the long run.

Policy Implications for India

The Nvidia effect has important lessons for Indian policymakers. The Indian government has been boosting the semiconductor and AI sectors because of their crucial role in the country’s tech and economic future. However, the current market excitement shows the need for a balanced approach.

Policymakers should create a regulatory environment that encourages innovation and controls market bubble risks. It means supporting research and development, encouraging domestic semiconductor manufacturing, and stabilizing capital markets.

Encouraging Sustainable Growth

India needs to focus on sustainable growth to capitalize on opportunities in AI and semiconductors. This means creating a strong ecosystem that helps startups and established companies. Key components include access to funding, talent development, and partnerships between industry and academia.

The Role of Institutional Investors

Institutional investors are pivotal in shaping market trends. Their decisions can heavily influence company strategies and market dynamics. Given Nvidia’s impact, these investors need to be cautious to avoid fueling speculative bubbles.

Taking a long-term view and using thorough analysis, institutional investors can promote sustainable growth in the semiconductor and AI sectors. This involves backing companies with solid growth prospects and robust business models, prioritizing stability over quick profits.

Finding Balance

Nvidia’s success underscores the power of technology and innovation to transform markets. Its impact on global and Indian markets reveals both opportunities and risks. India must strike a balance, nurturing growth in the semiconductor and AI sectors while maintaining market stability.

Investors should stay vigilant, distinguishing between sustainable growth and speculative trends. Policymakers need to foster an environment that encourages innovation while managing risks. Both institutional and retail investors must make informed choices to ensure stable and sustainable market growth in India.

Ultimately, Nvidia’s influence offers lessons for India. By learning from past market fluctuations and adopting a balanced strategy, India can harness the potential of AI and semiconductors for long-term growth and technological progress.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

FAQs

How does Nvidia's high valuation impact India's tech sector?

Nvidia's success highlights the potential of AI and semiconductors. This can inspire Indian companies and investors to focus on these areas, potentially leading to increased investment and innovation in the Indian tech sector. However, it's essential to differentiate between sustainable growth and hype. Overinflated valuations like Nvidia's could create a bubble, leading to risky investments and potential future corrections.

Should Indian investors chase the next Nvidia?

Nvidia's success story is unique. Investors should focus on companies with solid fundamentals and realistic growth prospects, not just chase trends. Thorough research and understanding the underlying business model are crucial before investing in any company, including those in the AI and semiconductor space.

How can India capitalize on the Nvidia effect?

India can leverage this opportunity by investing in research and development of AI and semiconductor technologies, which can help create a robust domestic industry. Encouraging STEM education and training programs will create a skilled workforce to support the growth of these sectors. Creating a stable and attractive investment environment can draw global companies and capital to India's tech sector.

What are the risks associated with the Nvidia effect on India?

The main risks include excessive investor enthusiasm, which could lead to overvalued companies in the Indian AI and semiconductor space. Chasing short-term gains over long-term growth strategies could hinder sustainable development in these sectors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

-

Duwayne Dhttps://www.equentis.com/blog/author/duwayne/

-

Duwayne Dhttps://www.equentis.com/blog/author/duwayne/

-

Duwayne Dhttps://www.equentis.com/blog/author/duwayne/

-

Duwayne Dhttps://www.equentis.com/blog/author/duwayne/