Introduction

Punjab National Bank, popularly known as PNB Bank, became the third bank in the public domain to reach a market valuation of Rs. 1 lakh crore on 15 December 2023. While the PNB share price was not at an all-time high on Friday, the government’s equity aid to revive the public sector banks from the claws of NPAs helped the bank achieve this milestone.

However, is it just the government’s support, or is the bank also putting effort into becoming one of the largest public sector banks in the country? Let’s find out.

Overview of Punjab National Bank

In 1894, members from different parts of the country established the Punjab National Bank with a vision of offering the citizens a true national bank that would benefit the people and the economy. The first board members included some eminent personnel such as Sardar Dayal Singh Majithia, Kali Prosanna Roy, Lala Harikrishna Lal, and others. On 12 April 1895, the bank started operating, and Lala Lajpat Rai was the first PNB customer to open an account with the bank.

Business Overview: PNB is a full-service bank offering various financial products for different uses. From loans to insurance to deposits, government financial schemes under its banking wing. It offers loans for retail, business, and agricultural needs. It has multiple schemes for MSMEs and SMEs. Apart from personal banking, corporate banking services are available, including cash management services, forex services for exporters and importers, and more. It also offers international banking facilities from foreign exchange and NRI accounts to world travel cards and others. That’s not all; Punjab National Bank has a capital services segment, which offers Mutual Funds, Merchant banking facilities, Depository services, and more.

Key Management Personnel

- Shri Atul Kumar Goel became the CEO and MD of Punjab National Bank on 1 February 2022. Before joining PNB, he held the same position at UCO Bank. He is a qualified CA and has a rich professional banking experience of more than 30 years. His expertise revolves around more or less all the banking segments, including handling large corporates, risk management, treasury management, financial planning, and investor relations.

- Atul Kumar Goel played a pivotal role in bringing UCO Bank to life when it was on the verge of sinking with five years of consecutive losses. In FY 2020-21, when he was the MD and CEO of UCO bank, he brought the profitability back to the bank. Apart from being in the banking industry, he also held the position of Director of New India Assurance Co. Ltd. There are several similar positions he either held in the past or still holds. Shri K G Ananthakrishnan acts as the Non-official Director and Non-Executive.

- Chairman of PNB. With over 40 years of experience in progressive leadership, he joined PNB as the Non-executive Chairman on 7 November 2022. He is known for his strategic thinking, thought leadership, and ability to build high-performing organizations. His expertise lies in general management, partnership building, strategic planning, optimization of profits and revenue, policy development, marketing tactics, and more. He started his career in 1976 as an executive in the sales and marketing team at Novartis India Ltd, and after that, his journey with the pharmaceutical industry began in 1999.

- Shri Kalyan Kumar, an Executive Director of Punjab National Bank, started this journey in October 2021. He has over 25 years of experience in the banking sector, and he started as a Rural Development Officer at Union Bank in 1995. He is known for his strategies for different training programs for public sector banks, unique leadership development, and employ-centric operations.

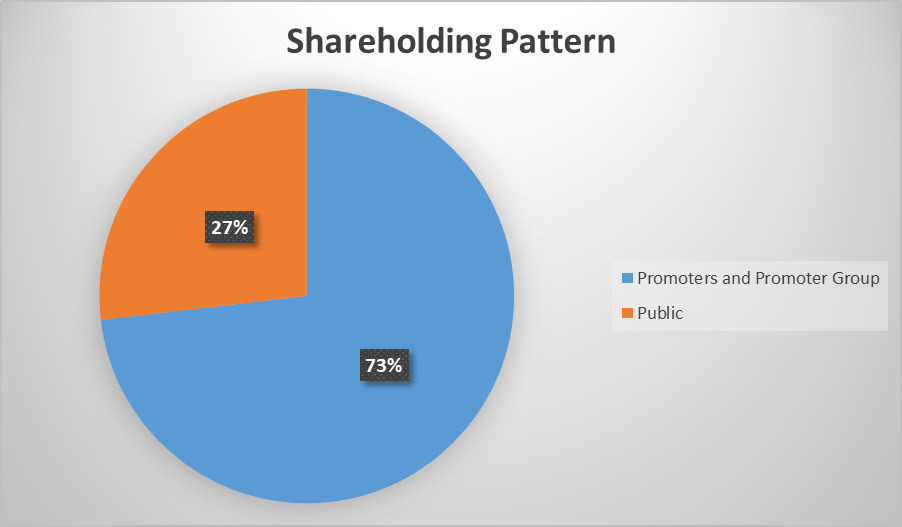

PNB Shareholding Pattern

As of 30 September 2023, the shareholding pattern of PNB was segregated into promoters and the public only. The total number of fully paid equity shares outstanding as of the said date was over 1101 crores.

Financials of PNB

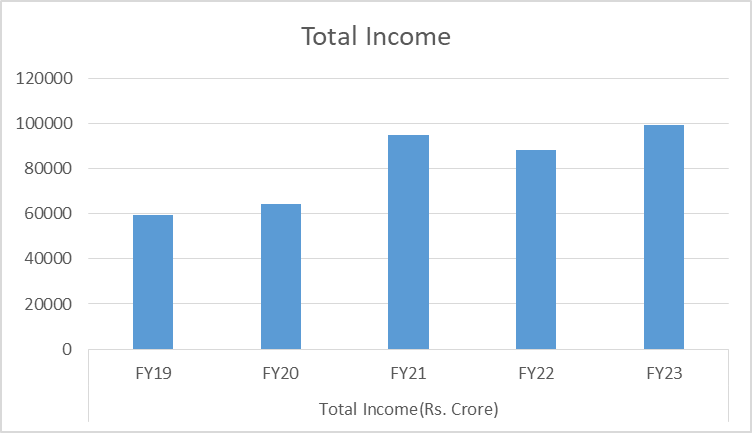

- Total Income: The total income of PNB grew over the years. Between FY19 and FY23, the total income has grown at a CAGR of 10.73%, from Rs. 59514.53 crore to Rs. 99084.88 crore. In the FY24’s second quarter, the total income stood at Rs. 29847.05 crores.

| Total Income(Rs. Crore) | |||||||

| FY19 | FY20 | FY21 | FY22 | FY23 | Q1FY24 | Q2FY24 | CAGR (%) |

| 59514.53 | 64306.13 | 94990.85 | 88339.49 | 99084.88 | 29033.11 | 29857.05 | 10.73295 |

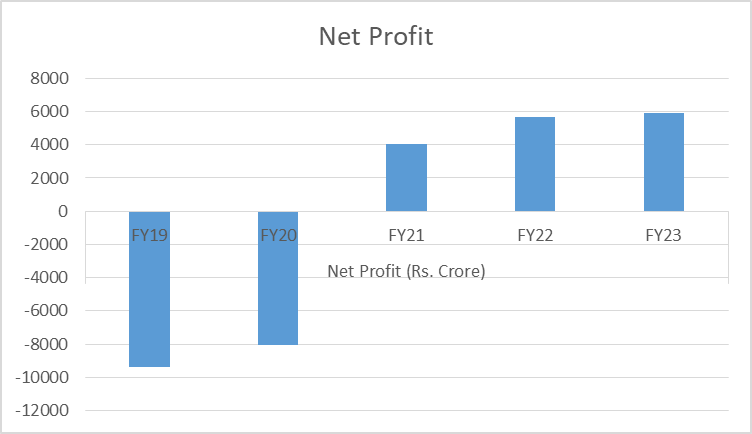

- Net Profit: Coming to The net Profit of this public sector bank, was negative during FY19 and FY20, from which it grew Rs. 5886.99 crores in FY23. During the Q1 and Q2 of FY24, the net profits stood at Rs. 1210.82 crores and Rs. 1764.54 crores, respectively.

| Net Profit (Rs. Crore) | ||||||

| FY19 | FY20 | FY21 | FY22 | FY23 | Q1FY24 | Q2FY24 |

| -9364.11 | -8050.46 | 4052.82 | 5639.24 | 5886.99 | 1210.82 | 1764.54 |

Key Financial Ratios of PNB

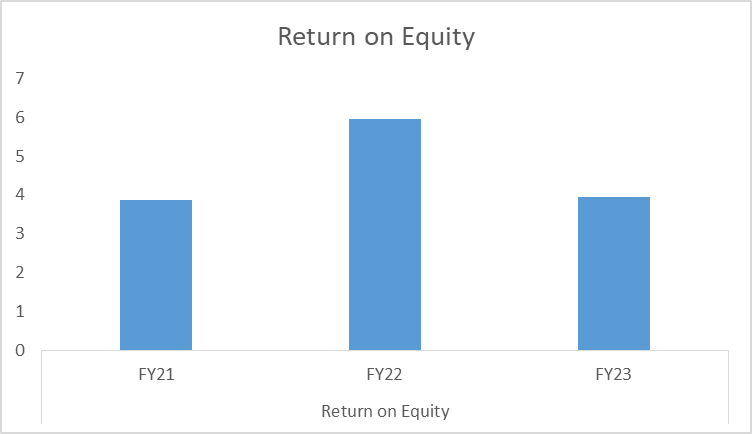

- Return on Equity: Investors who purchased PNB shares before FY21 had earned an ROE of around 3.88% in FY21, which increased to 5.96% in FY22; however, in FY23, the ROE fell as per the PNB bank share price movement.

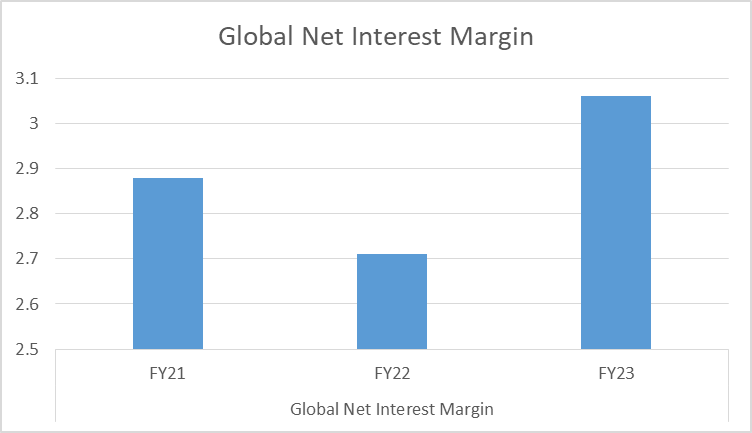

- Global Net Interest Margin Ratio: For any bank, the Net Interest Margin is a crucial metric to analyze its growth over the years. In FY21, the ratio stood at 2.88%, which declined to 2.71% in FY22, but in FY23, it rose to 3.06%.

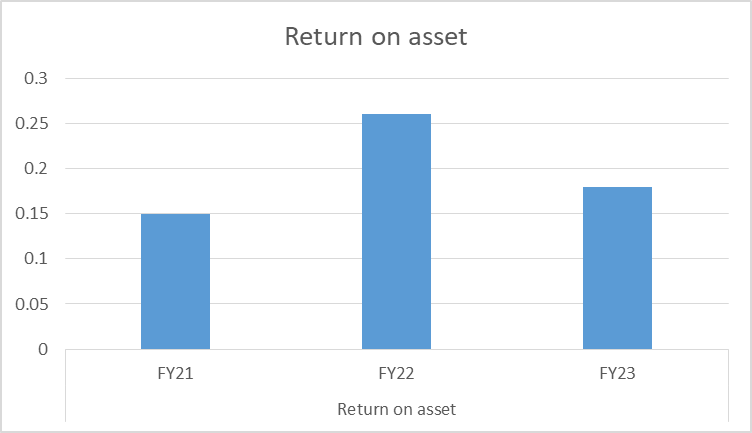

- Return on Asset: Investors who had PNB shares in FY22 gained higher than those who sold the PNB share before the said year or invested later as in FY22, the ROA of the bank rose to 0.26%, while in FY21, it was 0.15% and in FY23, it stood at 0.18%.

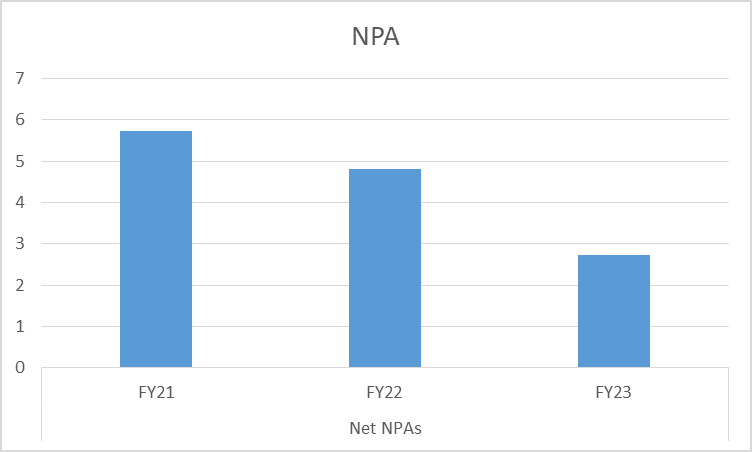

- Net NPA: Punjab National Bank has reduced its NPA over the years. If you look at the Net NPA Ratio in FY21, it stood at 5.73% while it decreased to 2.72% in FY23.

PNB Share Price History

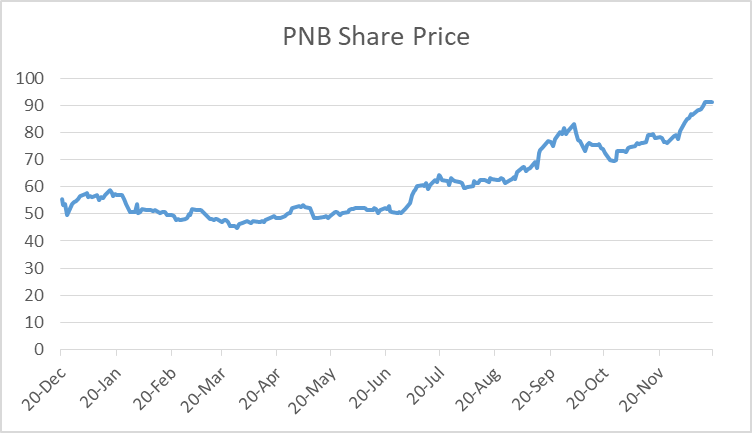

The Punjab National Bank share price has surged close to 65% in the past year, between 20 December 2022 and 19 December 2023. In the past year, the share price almost went up gradually, with minor corrections in between.

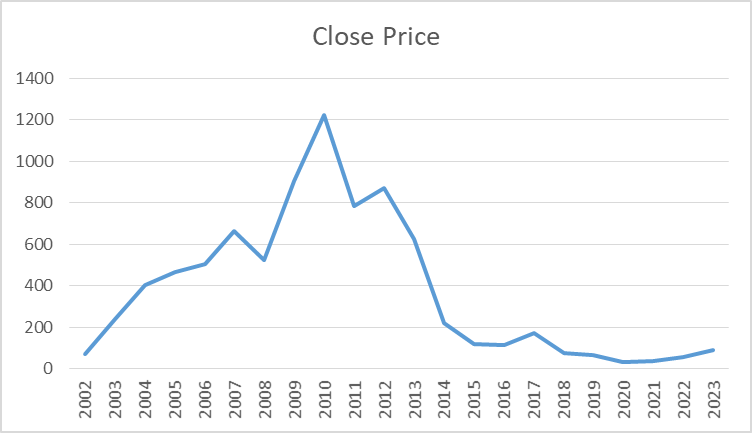

If you look back to 2002, the PNB Share price was around Rs. 72.9, which rose to almost Rs. 1221 in 2010, but then in 2020, it dropped to 33.05, which has been the lowest in these 21 years that is from FY2022 to FY2023.

PNB SWOT Analysis

From the financial information and ratios and PNB share price analysis, it can be understood that this public sector bank is again returning to business. After its share price touched the floor in 2020, in just three years, that is, on 15 December 2023, the bank ranked third as per market valuation amongst all public sector banks, a major achievement.

On the other hand, while the profits turned negative during 2019-2020, they turned positive and grew for the past three years between FY21 and FY23. Similarly, the return on equity has increased over the years as well.

Competitive Advantage

- The third largest bank in the public sector as per market valuation.

- The government of India is the largest shareholder of PNB. As of 30 June 2023, GOI had 73.15% stakes in this bank.

- Offering basic banking products as well as high-end fintech services

- Net NPAs have reduced to 2.72% in FY23, which suggests improvement in the financial health of the bank

- Strong and experienced management team

- PNB has a well-developed deposit base which increased by 14.18% on a YoY basis in Q1FY24.

- As of 31 March 2023, PNB’s network had 10080 branches nationwide.

Risks

While PNB’s share price is reviving, the profits are going up, but still, certain challenges remain which can be a hindrance to the growth of this PSU bank.

- The macro-economic situation, such as recession fear in the West, can lead to borrower’s credit servicing ability.

- The bank’s ability to generate return on its assets has dipped drastically in FY23, which can be a concern regarding its management’s efficiency.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What does PNB do?

PNB is a full-service public sector bank which offers different financial and banking products and services such as loans, deposits, insurance products, and capital market products and services.

When PNB was established?

Punjab National Bank was established in May 1894 and started its operations in April 1895.

How has PNB's share price performed?

In the past year, from 20 December 2022 to 19 December 2023, the PNB Share Price has increased by 64.61%.

How useful was this post?

Click on a star to rate it!

Average rating 3.9 / 5. Vote count: 22

No votes so far! Be the first to rate this post.