Summary

The rise of Polycab India is inspiring by all means and shows the aspirational spirit of the Indians and their eagerness to achieve greater heights. In less than 40 years, the company has grown from a small-scale enterprise to a large-cap company, becoming India’s largest fast-moving consumer electrical company, manufacturing electrical cables, wires, and other electrical products. Not only that, but it exports its products to over 72 countries.

Let us understand the fundamentals of Polycab India.

History of Polycab India

Polycab India had a humble beginning in 1964 when Late Thakurdas Jaisinghani established Sind Electric Stores, which sold various electrical products such as fans, lighting, switches, and wires. Following his death in 1968, his four sons- Girdhari T. Jaisinghani, Inder T. Jaisinghani, Ajay T. Jaisinghani, and Ramesh T. Jaisinghani- took over the business.

The family founded a partnership firm “Thakur Industries”, which entered into a lease agreement with MICD in 1975 to lease a parcel of land in Andheri, Mumbai, to establish a factory to manufacture wires and cables, which remained operational until 1984.

Before closing the Mumbai unit, the four brothers formed a new partnership firm called “Polycab Industries” in 1983. They registered it as a small-scale industrial unit with the Directorate of Industries, Government of Gujarat, for a factory in Halol, Gujarat. They started manufacturing PVC insulated wires and cables, copper, aluminum, and bare copper wires.

In 1998, the company became a private limited company, and in 2018, it became a public limited company; Polycab Industries was renamed Polycab India Limited.

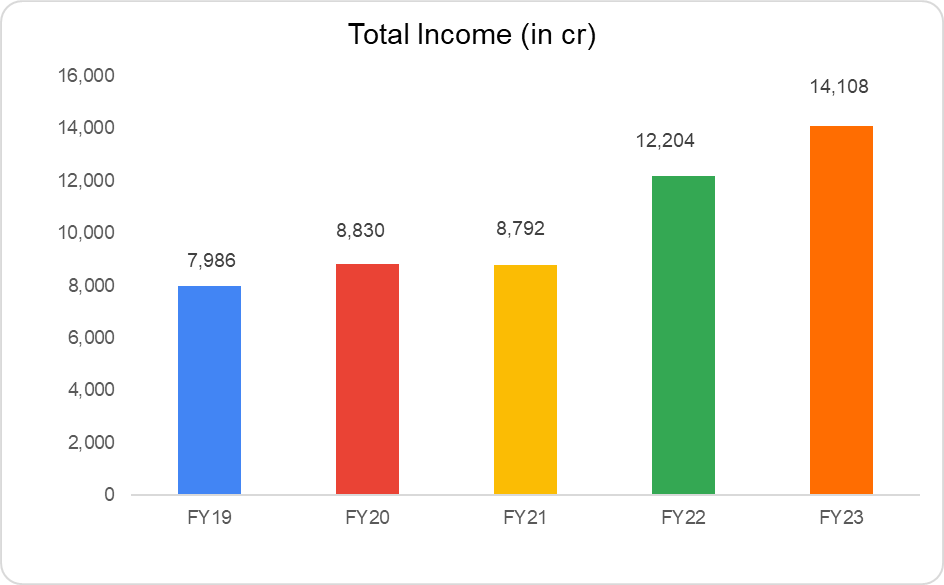

In FY23, it had a revenue of ₹14,108 crores, which has grown at a CAGR of 15% in the last four years.

Business Overview of Polycab India

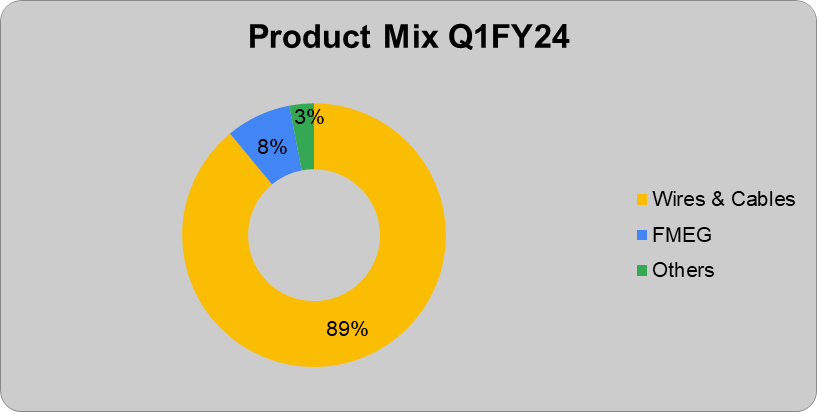

Polycab India is an undisputed market leader in the Indian wire & cables industry, commanding a 22-24% market share in the organized market. The company’s wires & cables business contributes 89% of its total product mix, and the remaining consists of FMEG products and others.

Polycab India has a retail presence in over 125,000 stores across India. It has divided its business into two operating segments:

- Wires & Cables: It manufactures and sells various wires and cables for retail and industrial use.

- FMEG: The FMEG business commenced operation in FY14, including a mix of consumer electrical products.

Key Management Personnel

Mr. Inder T. Jaisinghani is the company’s Chairman, Managing Director, and founding member. He was appointed to the position in 1997, and under his direction, the company has grown to be a leader in the wires and cables segment, with over 25 glorious years of success.

Mr. Bharat A. Jaisinghani is the Executive Director and joined the company in 2012. He holds a Master’s Degree in Operations Management from the University of Manchester and has worked in different verticals in the company. Mr. Bharat currently leads the growth initiatives of the company.

Mr. Nikhil R. Jaisinghani is the Executive Director and joined the company in 2012. He holds an MBA from Kellogg School of Management, USA. And currently leads the wires & special cable business.

Mr. Rakesh Talati is the Executive Director and has been with the company since 2014. He heads the wires & cables segment and is responsible for Greenfield and Brownfield in the country.

Mr. Gandharv Tongia is the Executive Director and Chief Financial Officer and has been associated with the company since 2018. He is a qualified chartered accountant related to Big 4 Audit firms, namely EY and Deloitte.

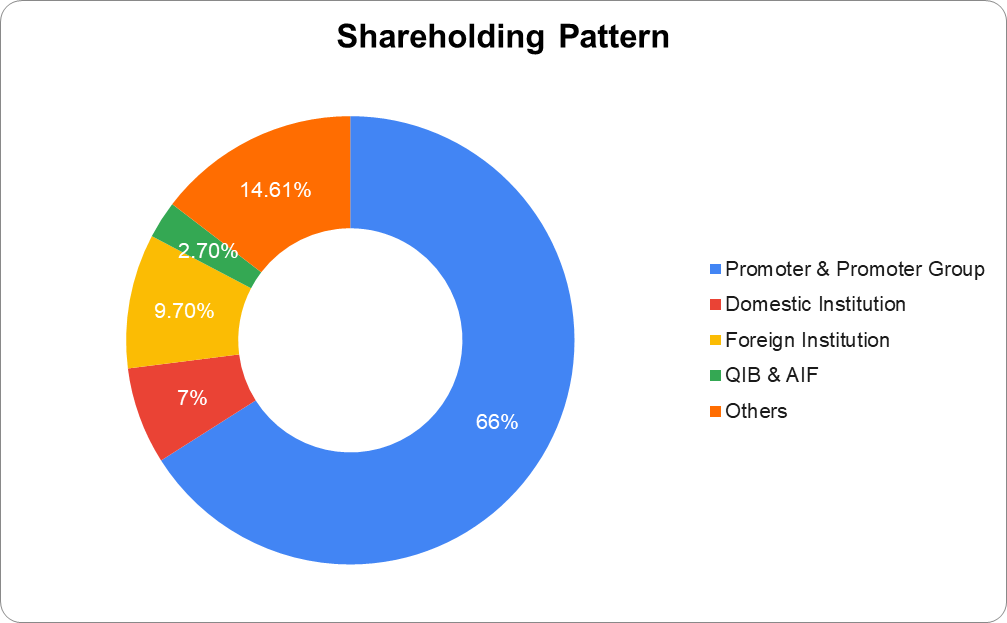

Polycab India Shareholding Pattern

Financials

Revenue

In FY23, the company reported a 16% year-on-year increase in total income to ₹14,107.8 crores from ₹12,203.8 crores in FY22. And, as per financial results in Q1FY24, total income increased 42% year-on-year to ₹3,953.3 crores from ₹2,780.9 crores in Q1FY23.

Segment-wise Revenue Breakup

| Segment | FY22 (in ₹ cr) | FY23 (in ₹ cr) | Q1FY23 (in ₹ cr) | Q1FY24 (in ₹ cr) |

| Wires & Cables | 10,695.3 | 12,536.8 | 2,405.6 | 3,533.7 |

| FMEG | 1,254.3 | 1,251.1 | 308.1 | 314.5 |

| Other | 294.2 | 358.4 | 99.8 | 152.8 |

| By Geography | FY22 (in ₹ cr) | FY23 (in ₹ cr) |

| Within India | 11,321 | 12,762.9 |

| Outside India | 922.9 | 1,383.5 |

EBITDA

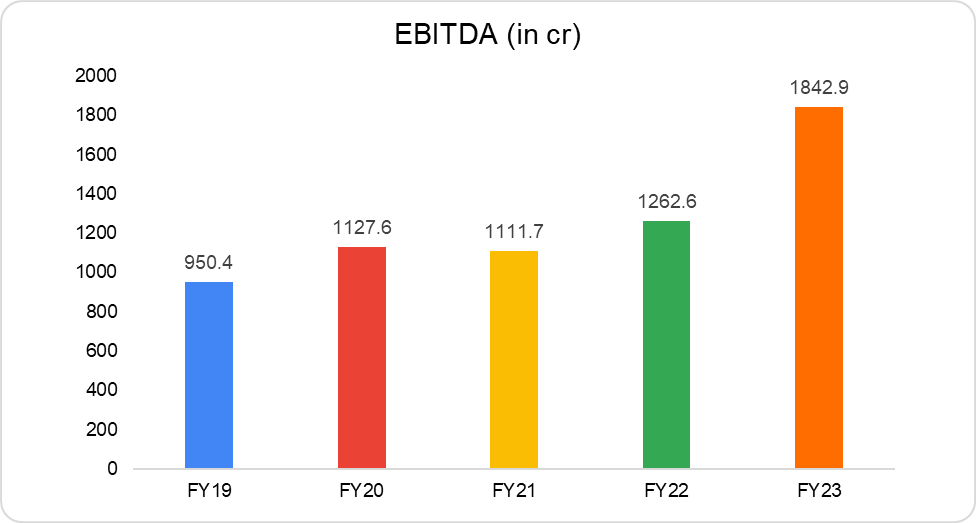

In FY23, the company reported a 45% year-on-year increase in EBITDA to ₹1,842.9 crores from ₹1,262.6 crores. And, in Q1FY24, EBITDA increased by 77% y-o-y to ₹548.6 crores from ₹309.8 crores.

| FY19 | FY20 | FY21 | FY22 | FY23 | Q1FY24 | |

| EBITDA/Net Sales Margin (in %) | 11.9 | 12.8 | 12.6 | 10.3 | 13.1 | 14.1 |

Net Profit

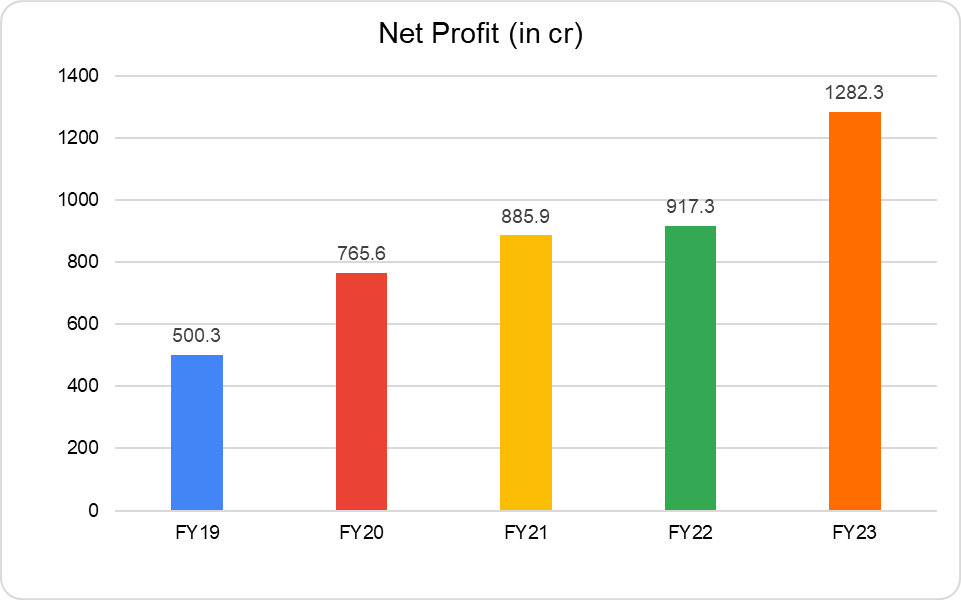

In FY23, Polycab India reported a 40% annual increase in net profit to ₹1,282.3 crores from ₹917.3 crores in FY22. And, in Q1FY24, net profits increased by 88% y-o-y to ₹402.8 crores from ₹222.5 crores in Q1FY23.

| FY19 | FY20 | FY21 | FY22 | FY23 | Q1FY24 | |

| Net Profit Margin (in %) | 6.3 | 8.7 | 10.1 | 7.5 | 9.1 | 10.4 |

Key Financial Ratios

Current Ratio: At the end of FY23, the current ratio declined by 30 bps to 2.6 times from 2.9 in FY22.

Debt-to-equity Ratio: The company has no significant borrowings on its books, and its debt-to-equity ratio remains unchanged at 0.01 times as of the end of FY23.

Return on Capital Employed (ROCE): The company improved its ROCE in FY23 to 26.1%, from 20.4% in FY22.

Inventory Days: At the end of FY23, the inventory days, meaning the average number of days the company takes to sell its inventory, stand at 102 days.

Receivable Days: At the end of FY23, the receivable days, meaning the average number of days a customer takes to pay back a business for products purchased, stand at 32 days. It was 61 days in FY19.

Earning Per Share (EPS): In the last five years, EPS more than doubled to ₹84.9 in FY23 from ₹35.4 in FY19.

Polycab India Share Price History

Polycab India launched its initial public offering (IPO) in April 2019, raising ₹1,345 crores at a price range of ₹533 to ₹538. The IPO was a success, with 51.77 times oversubscription, and listed at a 20% premium above its issue price.

Polycab share price has given a CAGR return of 76% in the last three years as of August 21, 2023, and the stock price has doubled in the previous year. The share was listed at ₹633 on April 16, 2019, and is currently trading at ₹4,850. It made an all-time high of ₹4,924 on July 20, 2023.

The company has a consistent track record of paying dividends to its shareholders. It paid ₹10 in 2021, ₹14 in 2022, and ₹20 in 2023 as dividends.

As of August 21, 2023, Polycab India has a market cap of ₹72,797 crores.

Polycab Fundamental Analysis

Polycab is the undisputed market leader in the electrical wires and cable segment, with a 22-24% market share in the organized market. And its FMEG business has been growing at a CAGR of 30% since its inception. Over the years, Polycab has evolved as a company, improving its efficiency, expanding its product line, and global presence.

In the last three financial years, the company’s EBITDA margin stayed within a range of 10-13%, with signs of improvement in the current fiscal. In the last five years, the company has halved its receivable days to 32 days and its payable days to 52 days, which has helped the company to optimize its working capital requirement and reduce its financing costs.

Wires & Cables

The wires and cables segment accounts for nearly 90% of total revenue, which increased 17% yearly to 12,536 crores in FY23. EBIT increased by 58 percent during the period, and the EBIT margin was 13.1%.

The merger of Heavy Duty Cables (HDC) and Light Duty Cables (LDC) under Project LEAP played a vital key role in the outperformance of the segment in FY23. It helped in incremental cross-selling revenue and enhanced efficiencies across sales, supply chain, and operations.

In the last fiscal, the company’s institutional business showcased accelerated growth. Polycab is also supplying cables to Indian Navy warships like INS Vikrant.

FMEG

Since its inception in FY14, the FMEG business has grown rapidly, with sales reaching ₹1,251.2 crores in FY23, with the western region, the company’s stronghold, demonstrating positive growth. The company’s FMEG growth story is led by factors like demand for premium products on the back of rising disposable income and the recent revival of the real estate sector.

However, despite rapid growth, the FMEG business does not significantly contribute to the bottom line. In FY23 and Q1FY24, the EBIT margin was negative at -0.5% and -2.3%, respectively.

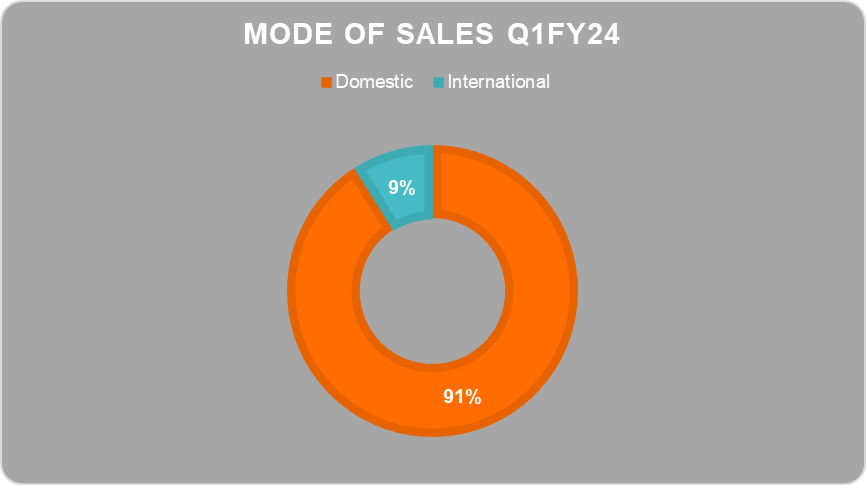

International Business

The company’s international business reached a new milestone in FY23, contributing nearly 10% of revenue, up from 7.6% in FY22, with solid demand from the United States, Europe, and key industries such as oil and gas, renewables, and infrastructure.

Project Leap

Amidst all the visible megatrends in the Indian economy, Polycab has introduced Project Leap. It is a multi-year transformational journey divided into multiple phases. Polycab 1.0 was about the successful launch of the IPO. Polycab 2.0 was about improving the efficiency metrics of the business and transforming it into a distribution-led business.

The 3.0 stage is a five-year plan (FY2126) in which the company aims to:

- Increase its revenue to ₹20,000 crores by FY26

- 1.5X market growth in core segments

- 2X market growth in emerging segments

- 2X market growth in the FMEG segment

- Achieve 10-12% EBITDA margin in the FMEG segment

- A target of ~10% of the contribution from exports

In FY24, the company is also undertaking a capex of ₹600-700 crores, of which three-fourths will go towards the wires & cables business, and the remaining to go towards the FMEG segment. The future may be positive, yet factors like raw material price volatility, weak FMEG business growth, intense competition, and high inventory are vital concerns.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When was Polycab India incorporated?

Polycab India was incorporated as a partnership firm in 1984 as Polycab Industries. It was initially engaged in the manufacturing and selling of PVC insulated wires and cables, copper, aluminum, and bare copper wires.

When was Polycab shares listed on the stock exchange?

Polycab India share was listed on April 16, 2019, and as of August 21, 2023, Polycab share price has given a CAGR return of 76% in the last three years.

Is Polycab a large or mid-cap company?

Polycab India is a large-cap company. As of August 21, 2023, its market share is ₹72,797 crores.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.6 / 5. Vote count: 25

No votes so far! Be the first to rate this post.