Have you ever noticed how your favorite brands sometimes disappear from the shelves at the grocery store? It can be because the store manager decided to stock something different. Something similar is happening in the stock market with midcap stocks – companies bigger than startups but not quite giants yet.

Big investors like mutual funds, PMS funds, and ULIPs are making strategic moves, buying new stocks and selling some of their midcap holdings. Let’s look at what’s happening, why, and what it might mean for you and the companies involved.

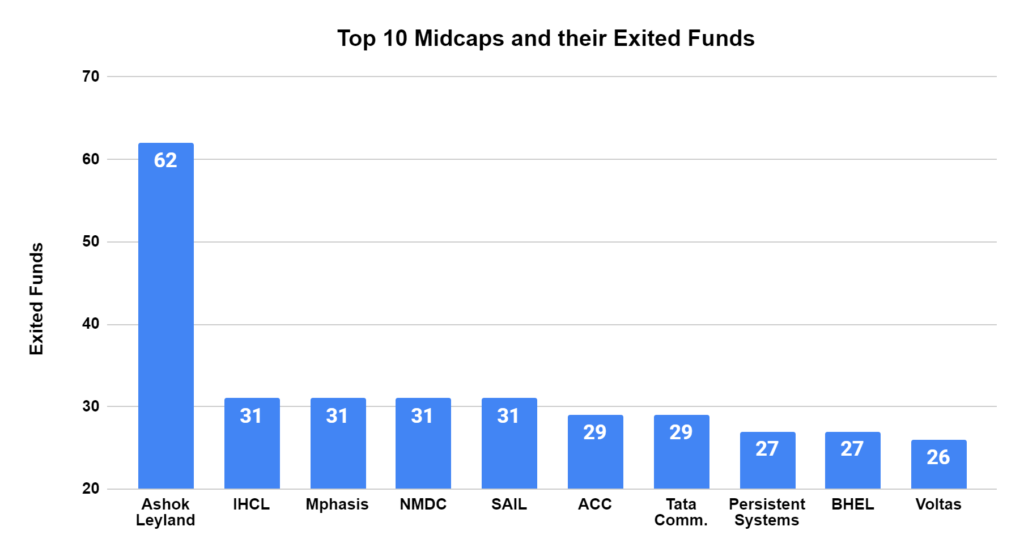

The Big Exits: Which Midcaps Are Out?

Let’s get straight to the point. Here’s a list of the top 10 midcap stocks that a significant number of these big investors decided to sell last month:

As you can see, some big names are on this list. It’s interesting to note that this comes after a fantastic year for midcap stocks in 2023. So, what’s the story?

Why the Change of Heart?

There are a few reasons why these big investors might be hitting the brakes on midcaps. Here’s what some analysts are saying:

- Earnings worries: Companies might not be making as much money as they used to. The cost of things they need to operate (like materials) is increasing, and it’s taking them longer to sell more stuff (revenue growth is slowing). This is dampening investor enthusiasm.

- Expensive stocks: Some midcap stocks might be priced a bit high compared to how much money the company is actually making. Investors are looking for stocks that offer good value for their money.

- Uncertain future: The overall market is a bit jittery right now. Concerns about a potential economic slowdown could hurt companies, especially those in cyclical industries (like automakers).

Here Today, Gone Tomorrow?

This is a fair question. Will this trend of selling midcaps continue? It’s tough to say for sure. Here’s what some analysts believe:

- Shifting focus: Investors might be looking towards different sectors expected to perform better in a slowdown, like banks, insurance companies, and consumer goods companies (FMCG). These sectors are typically seen as more stable during economic ups and downs.

- Long-term potential: While there might be some short-term challenges for midcaps, the long-term growth potential for the Indian economy is still strong. This means midcap stocks could still be a good investment in the future, but investors might be waiting for a better entry point.

What This Means for You

You might not notice these changes if you’re invested in mutual funds, PMS, or ULIPs. These funds are managed by professionals who make investment decisions based on their research and outlook for the market.

What This Means for Companies

For the companies themselves, this selling could put some downward pressure on their stock prices in the short term. However, a solid overall economy could still help them grow in the long run.

The Bottom Line

The Dalal Street party might be a little less crowded for midcaps. But this doesn’t necessarily mean the party’s over. The Indian economy is still on an upward trajectory, and midcaps could come back in favor. As always, stay informed and research before making any investment decisions.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.7 / 5. Vote count: 7

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/