The Indian stock market has been scaling up for the past few years. Could it possibly be a sign that corrections are waiting to happen? Lately, the promoters – the founders and major shareholders of companies have been making headlines for offloading a significant chunk of their holdings.

So, what’s the story here? Are they sensing a market correction and exiting, or are they simply taking advantage of a hot market to lock in some profits? Let’s take a closer look at this trend.

Talking Numbers

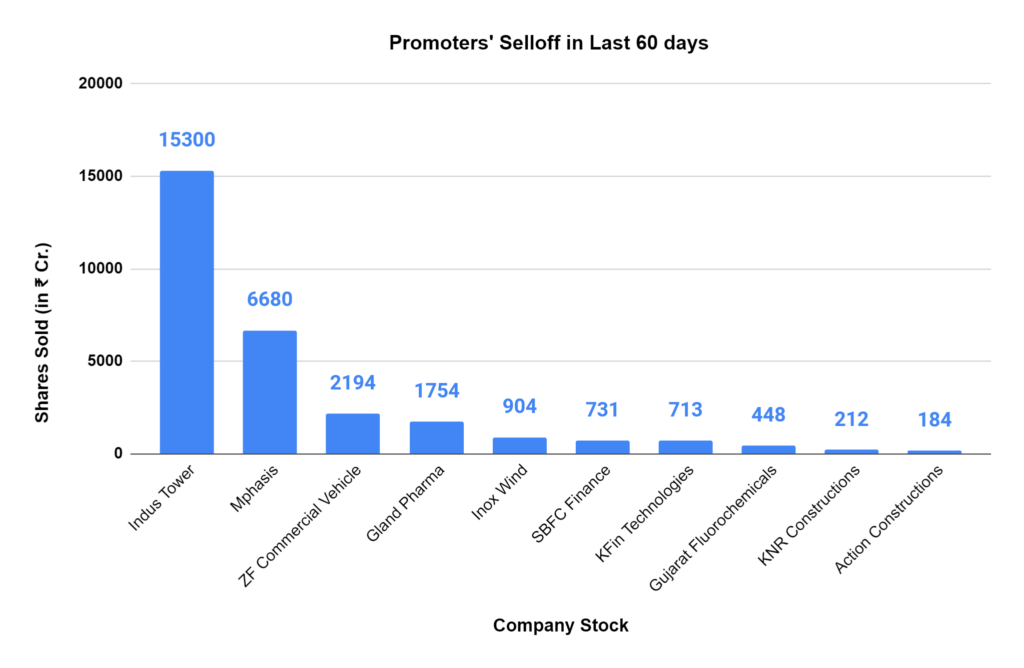

Promoters across more than 200 companies have sold over ₹33,000 crore shares in just the past two months! That’s a staggering number, and it easily surpasses the sales figures from 2023 (₹48,000 crore). If this pace continues, we might witness promoters break the record for stock dilution set back in the volatile year of 2020 (₹78,500 crore).

This aggressive selling spree has some folks worried. They see it as a potential red flag, a sign that promoters are losing faith in the current valuations and bracing for a market correction. The logic goes: if the people who know these companies inside-out are selling, shouldn’t that give us pause?

Profit Taking or Caution?

Of course, promoters can’t predict the future with certainty. However, they do deeply understand their businesses and the market environment, so their actions can be interpreted in a few ways.

Maybe they see the current market valuations as frothy and want to lock in some profits while the getting’s good. After all, running a business requires continuous investment, and this cash infusion could fuel future growth initiatives.

8 Factors Why Promoters May be Selling

- Profit-taking: If the market is optimistic and valuations are high, promoters may see this as an opportune moment to sell some of their shares and lock in profits.

- Funding Growth: The funds from selling shares can be used to invest in the company’s growth initiatives, research and development, or acquisitions.

- Debt Reduction: Promoters can sell shares to raise capital to pay down the company’s debt.

- Portfolio Diversification: Promoters might want to diversify their holdings by selling some company shares and investing in other assets.

- Correction Fears: If promoters believe a market correction is imminent, they might sell shares to avoid potential losses.

- Overvalued Market: Promoters might feel the market is overvalued and see selling shares as a way to mitigate risk.

- Personal Funding Needs: Promoters may need cash for personal reasons like estate planning or other ventures.

- Retirement: Founders approaching retirement might sell shares to secure their financial future.

Pros and Cons of the Phenomenon

Pros

- Market Confidence: Promoters selling shares could indicate confidence in the current market. They might believe valuations are attractive, encouraging them to offload some of their holdings while retaining control. This confidence could translate to a continued bull run.

- Increased Liquidity: Promoter selling injects liquidity into the market, making it easier for investors to buy and sell shares. This can improve market efficiency and potentially attract new investors.

Cons

- Profit Taking or Fear of Correction?: Promoter selling could also indicate profit-taking or a fear of an impending correction. They might be cashing out while the market is hot, anticipating a potential drop in stock prices. This could signal a lack of long-term confidence and trigger a domino effect, causing other investors to sell.

- Information Asymmetry: A key concern is information asymmetry. Promoters understand their companies’ inner workings more than most investors. If they’re selling a significant portion of their holdings, it could be a sign of undisclosed problems the market isn’t aware of. This lack of transparency can lead to investor uncertainty and market volatility.

The Global Promoter Shuffle

This trend isn’t limited to domestic players. Foreign promoters are also joining the selling party. We saw Vodafone offload an 18% stake in Indus Towers, and Blackstone divest 15.08% of their holding in Mphasis, amounting to ₹6,735 crore. This suggests a broader sentiment, perhaps a global rebalancing of portfolios by major investors.

Mid-Caps Seize the Opportunity

Interestingly, it’s not just large-cap companies where promoters are cashing in. Many mid-and small-cap companies are also witnessing promoter selling. This could be a sign that these promoters, with their fingers on the pulse of their smaller, often more volatile businesses, are taking advantage of the current bull run to increase their liquidity.

What Does This Mean for You?

Promoter selling, by itself, isn’t necessarily a guaranteed sign of an impending market crash. It’s just one data point to consider when making your investment decisions. It’s crucial to do your research, understand the fundamentals of the companies you’re interested in, and not unthinkingly follow the actions of others, be they promoters or market pundits. The market is complex, and a cautious approach is always recommended.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/