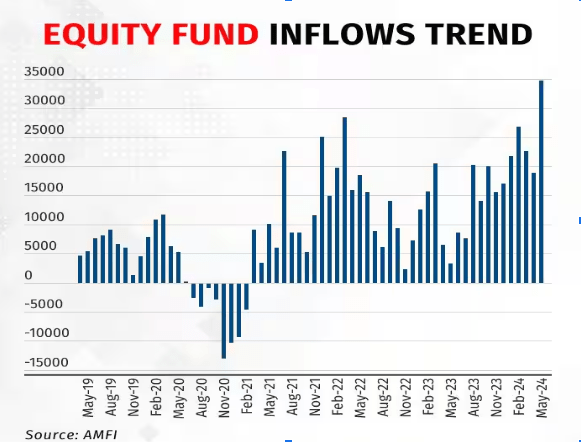

Equity mutual funds continued their winning streak in May 2024, shattering previous records with a phenomenal Rs. 34,697 crore in net inflows, as per data released by the Association of Mutual Funds in India (AMFI). This translates to a staggering 83.42% increase compared to April 2024, signifying a robust investor appetite for equities.

Net inflows into equity mutual funds surpassed the Rs. 30,000 crore mark for the first time in May 2024, breaking the previous record of Rs. 28,463 crore set in March 2022.

But what’s driving this surge? Let’s delve into the potential reasons behind this record-breaking performance.

4 Key Reasons Behind the Record Inflow of Equity Mutual Funds

- The Rise of Sectoral and Thematic Funds

A significant factor contributing to the record inflows is the growing popularity of sectoral and thematic funds. These funds cater to investors seeking targeted exposure to specific sectors or themes within the market. In May, these funds raked in a whopping Rs 19,213.43 crore, indicating a strategic shift in investor preferences. Notably, the HDFC Manufacturing Fund, launched during the month, collected Rs. 9,563 crore from investors during its new fund offer (NFO) period.This trend can be attributed to several factors.

Firstly, investors might be seeking to capitalize on specific growth opportunities within the Indian economy. For instance, with the government’s focus on infrastructure development, an investor might choose a thematic fund focused on the infrastructure sector. Secondly, these funds offer a convenient way to gain exposure to a specific industry without having to research \individual stocks.

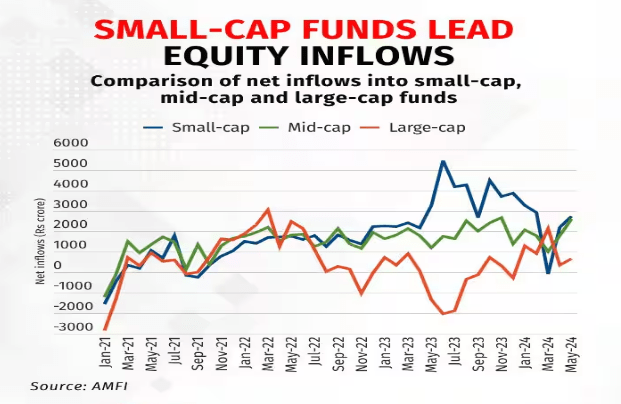

Embracing Mid and Small-Cap Funds

Another interesting observation is the rise in inflows into small-cap and mid-cap funds. Inflows into smaller-cap funds remained robust, with small-cap funds receiving net inflows of Rs 2,724.67 crore and mid-cap funds attracting Rs 2,605.70 crore. In contrast, investor interest in large-cap funds was relatively subdued, with the category seeing net investments of Rs 663.09 crore for the month.

This trend suggests that investors are becoming more comfortable with a calculated risk-reward approach. While the stock market might be experiencing volatility, some investors might see this as an opportunity to accumulate shares in companies with high growth potential at a potentially lower price point.

The Power of Consistency: Systematic Investment Plans (SIPs)

Acknowledging the continued strength of Systematic Investment Plans (SIPs) is important. SIPs allow investors to invest a fixed amount of money regularly, fostering a disciplined approach to wealth creation. In May, SIP inflows reached Rs. 20,904 crore, highlighting their significance in driving long-term investments.

The consistent inflow through SIPs indicates that investors are adopting a long-term perspective toward the equity market. This strategy helps to average the cost of investment over time, mitigating the impact of market volatility. Additionally, SIPs instill financial discipline by inculcating a habit of regular saving.

Investor Confidence and Market Volatility

While the data paints a promising picture, it’s crucial to understand the broader market context. Several factors might be influencing investor confidence.

Firstly, the Indian economy is expected to witness continued growth. This optimism might encourage investors to allocate a larger portion of their portfolios to equities.

Secondly, the recent correction in the stock market might be perceived as an attractive entry point. Seasoned investors might view this volatility as a chance to accumulate shares at a discount, anticipating future growth.

A Look Ahead

The record inflows in May 2024 signify a positive shift in investor sentiment towards equity mutual funds. However, it’s essential to maintain a cautious yet optimistic outlook. Investors should remember that equity markets are inherently volatile, and past performance does not necessarily indicate future results.

Here are some key takeaways to consider:

- Diversification is Key: Don’t put all your eggs in one basket. Investors should consider diversifying their portfolios across asset classes to mitigate risk.

- Invest for the Long Term: Equity mutual funds are well-suited for long-term wealth creation. Remain patient and avoid making impulsive decisions based on market fluctuations.

- Seek Professional Guidance: New investors can benefit from consulting a financial advisor. A professional can help assess risk tolerance and create a personalized investment strategy.

The record inflows into equity mutual funds in May 2024 signify a positive trend in the Indian investment landscape. While the reasons behind this surge are multifaceted, it’s evident that investors are increasingly recognizing the long-term potential of equity markets. By adopting a disciplined investment approach and seeking professional guidance, investors can leverage the power of equity mutual funds to achieve their financial goals.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Are these record inflows a sign of a booming market?

While the inflows are positive, they don't necessarily guarantee a booming market. Market conditions can be unpredictable, and it's essential to maintain a cautious optimism. However, the trend does indicate growing investor confidence in the long-term potential of Indian equities and their increasing sophistication in utilizing mutual funds for wealth creation.

Should I rush to invest in equity mutual funds now?

Equity mutual funds, despite their recent success, involve inherent risks. Before investing, consider your personal risk tolerance, investment goals, and overall financial situation. It's always advisable to consult a financial advisor who can help you create a personalized investment plan that aligns with your specific needs.

What types of equity mutual funds should I consider?

There's a wide range of equity mutual funds available, each catering to different investor profiles. Sectoral and thematic funds offer targeted exposure to specific areas, while large-cap funds provide stability with investments in established companies.

Mid-cap and small-cap funds offer the potential for higher returns but also carry greater risk. SIPs are a good option for long-term wealth creation and help mitigate volatility. Researching various options and consulting a financial advisor can help you choose the most suitable funds for your investment goals.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/