You spend hours scrolling mindlessly through social media, then stumble upon a genuinely interesting article – a deep dive into a historical event, a hilarious meme perfectly capturing the topic, or a passionate discussion about the latest tech breakthrough. Where did you find this gem? Chances are, it was on Reddit, the self-proclaimed “front page of the internet.”

Today, Reddit is making headlines as it prepares to go public in one of the most anticipated IPOs of the year. So, what does this mean for you, the Reddit user? Can a platform known for its freewheeling discussions and tight-knit communities navigate the tough world of Wall Street?

Let’s dive into the key details of the Reddit IPO and explore the potential challenges and opportunities.

Reddit IPO Details

| Offer Price | $34 per share |

| Exchange | New York Stock Exchange (NYSE) |

| Ticker Symbol | RDDT |

| Opening Date | 21 March 2024 |

| Closing Date | 25 March 2024 |

| Total Issue Size (in Shares) | 22,000,000 |

| Total Issue Size (in ₹) | $ 748,000,000 |

- Reddit has granted the underwriters a 30-day option to purchase up to 3,300,000 shares of its Class A common stock at the initial public offering price, less underwriting discounts and commissions.

- The public offering could give Reddit the resources to further develop its platform, potentially improving user experience and content moderation. However, there’s always the risk that Wall Street pressures may lead to changes alienating the user base that made Reddit successful.

- Reddit acknowledges this in its IPO filing, warning investors that its business is “in the early stages of monetization” and future growth is uncertain.

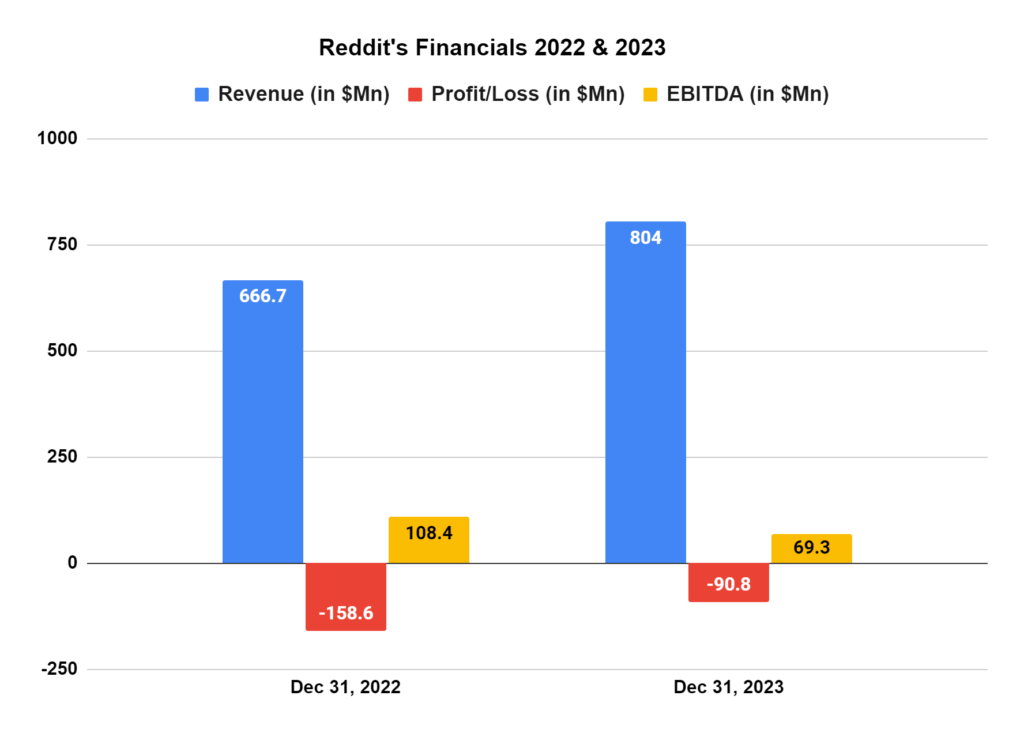

4. Despite its cultural popularity, Reddit has struggled with achieving profitability. The upcoming IPO filing reveals significant financial losses, highlighting a fundamental tension: how can Reddit generate revenue without compromising its user-centric approach?

5. Founded in 2005, just a year after Facebook, Reddit’s story is one of organic user growth. Steve Huffman and Alexis Ohanian, two University of Virginia graduates, envisioned a platform for sharing exciting content found across the web. The name, a clever play on “read it,” perfectly captures Reddit’s essence as a hub for link-sharing and online discourse.

6. Fast-forward to today. Reddit has over 1 billion posts, 16 billion comments, and a place among the top ten most visited US websites—a true digital information hub.

7. Millions of daily queries happen directly on the platform, making it a powerful research tool. What separates Reddit: subreddits are its online communities dedicated to specific interests. From funny memes to scientific discussions, there’s something for everyone. Subreddits are moderated by dedicated users, fostering active conversations, shared experiences, and a strong sense of community.

8. The company’s reliance on advertising as a primary revenue stream raises concerns. Can Reddit successfully integrate ads without alienating its user base, which often values an ad-free experience? Striking a balance between financial viability and the platform’s core identity will be crucial for Reddit’s long-term success.

9. The Company acknowledges that changes in internet search engine algorithms and dynamics could negatively impact website traffic, potentially harming the business, its results of operations, financial condition, and future prospects.

10. As an “emerging growth company,” Reddit may benefit from reduced public reporting requirements after the IPO.

One thing’s for sure: Reddit’s IPO is a pivotal moment for the platform. As Reddit ventures into the world of public trading, the coming months will test its ability to adapt and thrive while staying true to its roots. Will Reddit maintain its status as the “front page of the internet,” or will the pursuit of profits lead to a dilution of its unique identity? Only time will tell.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/