Introduction

Since independence, Tata Steel and SAIL (The Steel Authority of India Limited) have played a key role in the country’s industrial growth. Being the oldest and foremost steel manufacturers in India, both companies have been instrumental in supplying essential raw materials for infrastructure development, manufacturing, and various sectors of the economy.

However, this article focuses on understanding the fundamentals, analyzing SAIL share price, and exploring its future growth potential. Let’s dig deeper into the company and understand if SAIL can achieve a market capitalization of ₹1 lakh crore in the next five years.

SAIL Company History

SAIL is one of the Maharatna category Central Public Sector Enterprises (CPSE) and one of the leading steel manufacturers in the country. The Maharatna status is awarded to a company that has achieved a net profit exceeding ₹5,000 crore consistently for three consecutive years, maintains an average annual turnover of ₹25,000 crore over three years, or maintains an average annual net worth of ₹15,000 crore over three years.

But, you might be too surprised to learn that SAIL, initially, wasn’t formed as an operating company but as a holding company with the primary purpose of overseeing the input and output of government-owned steel plants in the country.

- 1950: The origins of SAIL can be traced back to the establishment of Hindustan Steel Limited (HSL) in the early 1950s. HSL’s original focus was to manage the forthcoming Rourkela Steel Plant operations.

- 1954: Hindustan Steel Limited (HSL) is formed. It comprised of four plants: Bhilai Steel Plant, Rourkela Steel Plant

Durgapur Steel Plant, and Alloy Steel Plant - 1957:Subsequently, in 1957, the Iron and Steel Ministry transferred the supervision and control of the Bhilai and Durgapur Steel Plants to HSL.

- 1960: Rail & Structural mill commissioned at Bhilai Steel Plant

- 1962: January 1962 saw HSL manage a total steel production capacity of 2 MT. The Wheel & Axle plant was inaugurated at Durgapur

- 1968: Construction of Bokaro Steel Limited starts and other facilities commissioned at various HSL plants.

- 1972: On December 2, 1972, the Ministry of Steel and Mines presented a policy document to the parliament to create a new industry management model.

- 1972: First blast furnace at Bokaro Steel Plant inaugurated, Salem Steel Limited formed in Tamil Nadu and RDCIS established in Ranchi.

- 1973: SAIL was officially incorporated on January 24, 1973, with an authorized capital of Rs 2000 crore. SAIL’s role was to manage the operations of five integrated plants in Rourkela, Bhilai, Durgapur, Bokaro, and Burnpur. The Bokaro steel plant helped increase the overall crude steel production capacity to 4 MT by 1973.

- 1978: SAIL underwent significant restructuring, transforming into an operating company. The Indian Iron & Steel Company (IISCO) taken over as subsidiary.

- 1985: Inauguration of integrated trial run of Meghahataburu iron ore project

- 1986: First modernization phase initiated at Durgapur and SAIL takes over Maharashtra Electrosmelt Limited (MEL), subsequently renamed Chandrapur Ferro Alloy Plant (CFP).

- 1989: The Raw Material Division was formed and the subsidiary Visvesvaraya Iron & Steel Plant (VISL) merged into SAIL.

- 1992: SAIL gets listed in Bombay Stock Exchange

- 1995: Rourkela Steel Plant’s first modernisation commissioned

- 1997: SAIL becomes a Navratna company

- 2001: SAIL enterst into JV with NTPC to form NSPCL for captive power generation

- 2004: SAIL environment policy was released and the Bhilai plant produces first 80 meter long rail

- 2006: IISCO merged with SAIL

- 2007: Modernisation and expansion plan initiated to increase crude steel production to 21.40 MTPA

- 2010: SAIL becomes a Maharatna company

- 2013: Durga, India’s second largest blast furnace (Capacity: 4060 m3) comes up at RSP. Special grade steel from Bhilai and Rourkela used for building India’s first indigenouse aircraft carrier, INS Vikrant.

- 2015: Steel plants at Rourkela and IISCO modernised and dedicated to the Nation

- 2017: Rail Mill at BSP produced world’s longest single piece rail measuring 130 mtr

- 2018: LHB wheels developed and supplied by DSP. Steel Authority of India launched its new ‘NEX’ brand Parallel Flange Section.

- 2019: Steel Authority of India launched its new branded TMT bars SAIL SeQR.

Business Overview of SAIL

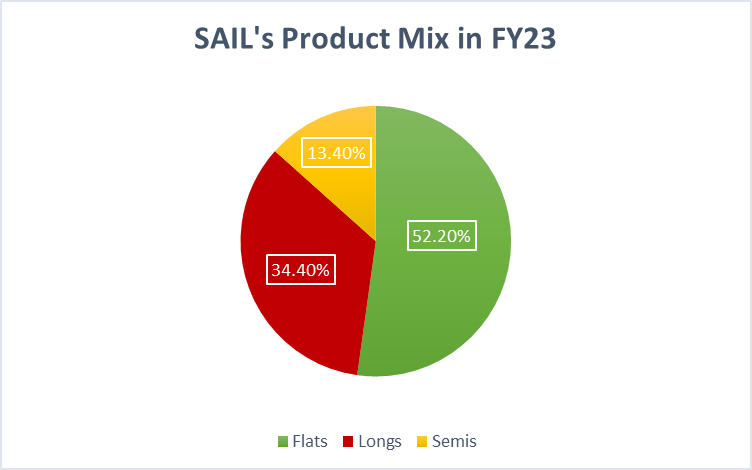

Steel Authority of India’s operating crude steel capacity is around 19.5 Metric Tons (MT), and it has a product mix of flats, longs, and semis.

Flats steel products include plates, hot-rolled & cold-rolled sheets, and coated sheets. Long products consist of rails, bars, and rods. And semis are semi-finished steel products that are further rolled or forged to produce finished steel products.

Steel produced by SAIL is primarily consumed in the country and contributes only a tiny portion of export revenue. In FY23, only 3% of the total produce was exported.

Operating Segments

The company has considered its five integrated and three alloy steel plants’ reportable operating segments.

- Bhilai Steel Plant (BSP)

- Bokaro Steel Plant (BSL)

- Durgapur Steel Plant (DSP)

- Rourkela Steel Plant (RSP)

- IISCO Steel Plant (ISP)

- Tamil Nadu and Alloy Steel Plant (ASP)

- Salem Steel Plant (SSP)

- Visvesvaraya Iron & Steel Plant (VISL

SAIL Management Personnel

- Shri Amarendu Prakash is the Chairman and Managing Director at SAIL and leads the company’s operations and initiatives. He took charge as Chairman on 31st May 2023, and previously he held the post of Director in charge at Bokaro Steel Plant. He joined SAIL in 1991 as a Management Trainee (Technical). He graduated from BIT Sindri as a metallurgical engineer.

- Shri Anirban Dasgupta is the Director of the Bhilai Steel Plant and started his career in SAIL in 1986. He is a distinguished alumnus of IIT-BHU in Metallurgy.

- Shri Atanu Bhowmick is the Director of the Rourkela Steel Plant and is a Metallurgist from NIT, Rourkela. He joined SAIL/ Rourkela Steel Plant in1988 in the blast furnace department and has worked in various capacities.

- Shri Brjendra Pratap Singh is the Director of Burnpur and Durgapur Steel Plant. He is an ISM-Dhanbad alumnus and joined SAIL in 1989.

- Shri Vijendla Srinivasa Chakravarthy is the Director (Commercial) of SAIL and joined the company’s Central Marketing Organization in 1987. He is a chemical engineer from the Laxminarayan Institute of Technology, Nagpur University.

- Shri Anil Kumar Tulsiani is the Director (Finance) and is a seasoned finance professional. During his tenure, he joined SAIL in 1988 as Junior Manager (Finance) and worked in different plants and units at SAIL. Shri Tulsiani is a qualified CMA and MBA (Finance).

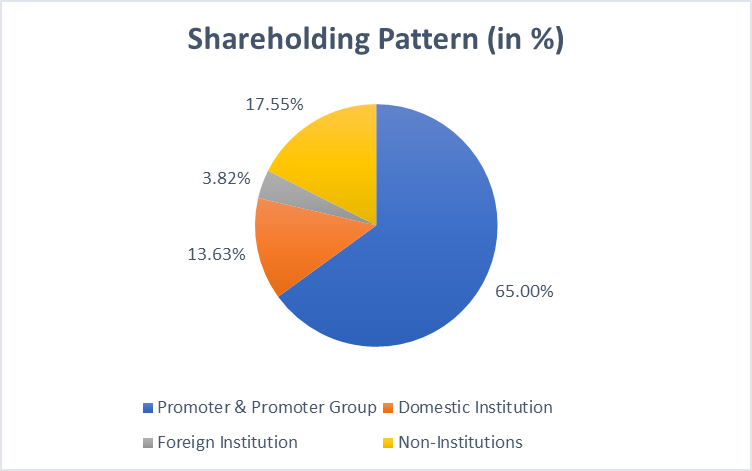

SAIL Shareholding Pattern

SAIL Financials

Revenue

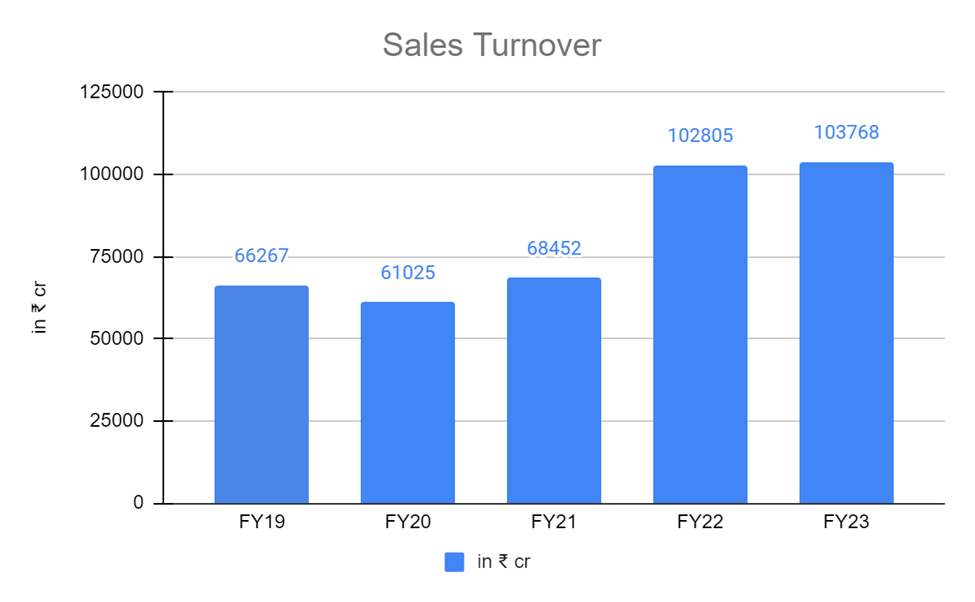

SAIL’s revenue from operations in FY23 was ₹1,04,447 crores, which increased marginally by 0.94 % from ₹1,03,4 73 crores in FY22. In Q1FY24, total income rose marginally by 1% to ₹24,800 crores from ₹24,334 crores in Q1FY23.

Segment-wise Revenue From Operations

| FY22 (in ₹ cr.) | FY23 (in ₹ cr.) | |

| Bhilai Steel Plant | 27,993.23 | 30,516.07 |

| Durgapur Steel Plant | 11,853.29 | 13,250.48 |

| Rourkela Steel Plant | 26,830.57 | 25,600.33 |

| Bokaro Steel Plant | 28,531.63 | 26,343.77 |

| IISCO Steel Plant | 12,200.78 | 13,520.93 |

| Alloy Steels Plant | 896.84 | 1,000.55 |

| Salem Steel Plant | 2,685.35 | 1,881.81 |

| Visvesvaraya Iron & Steel Plant | 377.11 | 310.86 |

| Others | 3,324.18 | 1,445.29 |

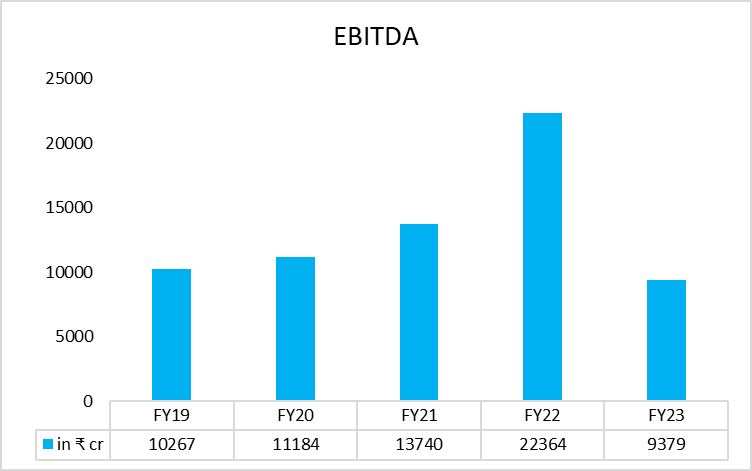

EBIDTA

In FY23, SAIL’s EBITDA came in at ₹ 9,379 crores, which declined by 58% from ₹ 22,364 in FY22. And, in Q1FY24, EBITDA declined by approximately 20% to ₹ 2090 crores from ₹ 2606 crores in Q1FY23.

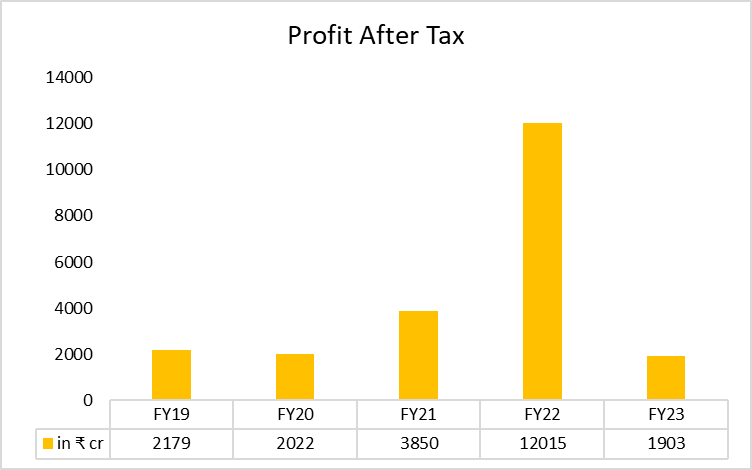

Net Profit

In FY23, SAIL’s profit after tax declined by 84% to ₹ 1,903 crores from ₹ 12,015 crores in FY22. For Q1FY24, profit after tax declined by 80% to ₹ 150 crores from ₹ 776 crores in Q1FY23.

SAIL Key Financial Ratios

- Current Ratio: At the end of FY23, the current ratio improved marginally to 0.77 times from 0.73 at the end of FY22.

- Debt-to-equity Ratio: The debt-to-equity ratio increased to 0.59 times on 31st March 2023, from 0.33 times compared to the previous fiscal.

- Interest Service Coverage Ratio: SAIL’s interest service coverage ratio declined to 2.0 5 times at the end of FY23 from 9.56 times in FY22. The decline was due to a significant reduction in profitability metrics over the last two fiscal years.

- Inventory Turnover Days: In FY23, the inventory turnover increased significantly to 99 days from 77 days in FY22.

- Operating Margin: The operating profit margin for the year ended 31st March 2023 dropped to 8.98% from 21.61% in FY22.

- Net Profit Margin: The net profit margin declined to 1.82% in FY23 from 11.61% in FY22.

SAIL Share Price History

SAIL was listed through the Government of India’s disinvestment process rather than an IPO. The company sold 1.18% of its stake to financial institutions in the first tranche of disinvestment in 1991-92. The second tranche happened in 1994 when the government offered the public up to 14.95 of the equity shares. In 2004, 10% of the equity was divested, followed by 5% in 2014. The latest disinvestment occurred in 2021 when the government successfully offloaded a 10% stake through an Offer for Sale (OFS) mechanism.

As on 12th August 2023, SAIL share price has given a CAGR return of 33% in the last three years and 12% returns in the last year.

The stock has struggled to sustain upward momentum in the past five years. SAIL’s shares reached an all-time high of ₹151.30 on May 10, 2021. However, the stock has since experienced a decline, attributed to the impact of weak macroeconomic conditions and the cyclicality nature of the metal stocks.

The company has a good track record of paying rich dividends to its shareholders. It paid ₹6.8 in 2021, ₹4.75 in 2022, and ₹1 as interim dividend in 2023. As of 12th August 2023, SAIL has a market capitalization of ₹37,629 crores.

SAIL Fundamental Analysis

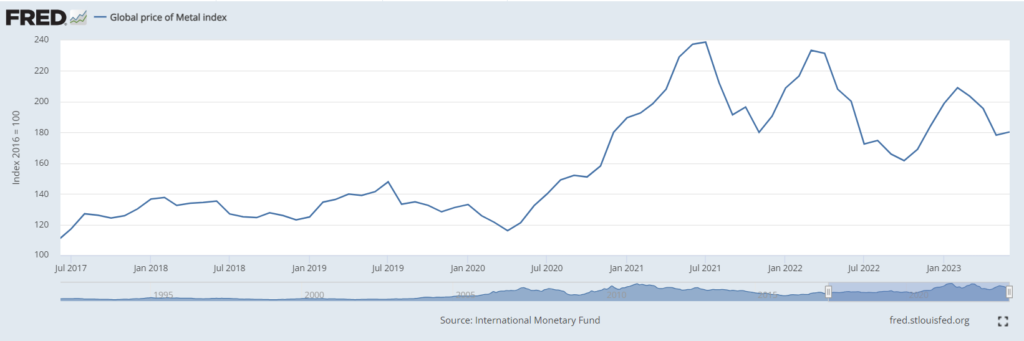

One factor that drives the stock price of most metal companies, including steel, is cyclicality. Meaning the price of metal stock swings as per the business cycle of an economy. These stocks tend to perform best when the economy is recovering or in a high-growth phase.

SAIL’s financial performance over the last two fiscal years is witnessing a downward pressure, mainly on account of a sharp fall in the global steel prices and reduced global demand. Post-pandemic, rise in global steel price, fall in fuel costs, and better-than-expected economic recovery helped steel companies to improve profitability. During the period, SAIL share price rose from around ₹20 level to ₹151.30 in less than 18 months

Global Price of Metal Index

Factors that Impacted Profitability

- The company’s sales have remained subdued in the last two fiscal years, with only 16.15 MT sold in FY22 and 16.20 MT sold in FY23.

- Increase in the cost of material consumed. During FY23, the cost of material consumed increased to ₹62,179.91 crores from ₹42,890.12 crores in FY22, an increase of approximately 45%.

- Higher inventory cost. In FY23, inventory turnover days increased by 22 days, which had an impact on working capital.

- Slowdowns in key markets, including China, the US, the UK, and Europe, adversely impacted steel prices. The steel prices remained volatile, with downward pressure during FY23.

- The company had to depend on the import of coking coal to power its steel plant. In FY22, out of the total requirement of 17.2 MT, the company had to import 15.92 MT. Supply-chain woes due to the Russia-Ukraine war, the prices of imports jumped significantly.

SAIL Share Price Growth Potential

SAIL expects a 15% year-on-year increase in sales volume to 18.7 MT in FY24. It is also expected to benefit from the lower price of coking coal.

The company is undertaking a huge capex plan of ₹1 lakh crore in the next 9 to 10 years and increasing its manufacturing capacity to 30 MT by 2030.

India’s steel sector may benefit from the country’s strong growth momentum. According to the Indian Steel Association (ISA), steel demand in India will increase by 8-9 MT per year over the next two fiscal years, owing to strong momentum in infrastructure spending and sustained growth in urban consumption.

Global Outlook

FY24 will likely be a better year for steel companies on the back of global economic recovery. The IMF has projected global real GDP growth at 3% in 2023, up 0.2% from its April forecast.

However, one of the concerns is sluggish domestic demand in China, which is likely to keep global steel prices under pressure. China’s massive steel industry has been hard hit by the country’s massive slowdown in the property sector, pushing steel prices to three-year lows in May. The country is also exporting its surplus steel. In the first five months, China’s steel exports were up by 41% compared to the previous year.

China is the world leader in steel manufacturing capacity accounting for 54% of the world’s steel production in 2022. As Indian steel prices follow international steel prices, the sector may remain under pressure until there is a strong global recovery, particularly in China’s domestic demand.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When was SAIL established?

SAIL was incorporated in the year 24th January 1973 with an authorized capital of ₹2000 crores as a holding company to manage the government-owned five integrated steel plants in the country. In 1978, through significant restructuring of the company, SAIL transformed into an operating company.

What are the five steel plants of SAIL?

SAIL operates through five integrated steel plants at Bokaro, Rourkela, Durgapur, Burnpur, and Bhilai. The combined capacity of all steel plants is around 19.5 MT by the end of 2022.

How has SAIL share price performed in the last 5 years?

As of August 12, 2023, the SAIL share price has delivered a CAGR return of 3% over the past five years and an impressive 33% over the last three years. all-time high of ₹151.30 on May 10, 2021. The stock has subsequently experienced a notable decline and has been unable to surpass that peak.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.9 / 5. Vote count: 22

No votes so far! Be the first to rate this post.