The healthcare sector is one of the largest sectors of the Indian economy. According to NITI Aayog’s 2021 report, this industry has witnessed a remarkable CAGR of 22% since 2016 and is expected to reach a market valuation of $372 billion by 2022. This impressive growth is also mirrored in the stock performances of pharmaceutical companies.

As of September 29, 2023, the Nifty Healthcare Index has given a return of 18.35% over the past year. Sanofi India, one of India’s oldest pharmaceutical companies, has given an impressive return of 24% in the same period.

In this article, we understand Sanofi India and check the historical performance of the Sanofi share price.

Brief Overview of Sanofi India

Sanofi is a French multinational healthcare and pharmaceutical company headquartered in Paris. Sanofi India is the group’s Indian subsidiary, founded in May 1956 as Hoechst Fedco Pharma Private Limited.

Over the years, the company has changed its name multiple times, and in 1994 it was renamed Aventis Pharma Limited. The name change resulted from a global merger between Hoechst AG, Rhone-Poulenc, and Marion Merrell Dow.

In 2004, Aventis Pharma Limited merged with Sanofi to form Sanofi-Aventis. Consequently, it adopted the name Sanofi-Aventis India Limited. Lastly 2011, the company underwent a name change and became Sanofi India Limited. The company is counted among India’s top 4 multinational pharma companies and has over 3,000 employees across India.

Business Overview of Sanofi Limited

Sanofi operates in various segments in India, including pharmaceutical products, vaccines, and consumer healthcare. It has a large-scale manufacturing presence in Goa, and 12 contract manufacturing organizations spread across different parts of India.

The company has a wide range of medicines for treating diabetes, pain care, cardiology, allergy, epilepsy, and thrombosis, and also present in the nutritional health segment. Some popular medicines from the stable of Sanofi include Combiflam for pain care, Cardace for hypertension, Allerga and Avil for controlling allergies, Tragocid in antibiotics, and DePura for Nutritional Health.

Leadership Team

Mr. Rodolfo Horsz is the Managing Director and joined Sanofi in 2017 as General Manager of Consumer Healthcare in Brazil. In a change in leadership, Mr Horsz was appointed the Managing Director of India business in June 2022. Before joining Sanofi, he had stings with multinational companies Procter & Gamble, Pfizer, Louis Vuitton, and Heineken, serving in commercial, marketing, and general manager roles.

Mr. Ramprasad Bhat is the Head of the Foundation, India and Sri Lanka for General Medicines. He has over 25 years of experience and has held several key roles as Director of Strategic Initiatives (South Asia), Senior Director of Business Excellence, Head of Diabetes Business in India, and many more. Before joining Sanofi, Mr. Ram worked with Wockhardt for 11 years heading their specialty business unit. He is a pharmacy graduate and did his MBA from ITM, Mumbai.

Mr. Vaibhav Karandikar was appointed Chief Financial Officer in Sanofi, India, in October 2020. He joined Sanofi in 2007. Mr. Vaibhav is a qualified Chartered Accountant and Company Secretary and has held multiple responsibilities at Sanofi in business controlling, mergers & acquisitions, and accounting. Before joining Sanofi, he was with Sandoz India, Tata Power, and Hindustan Ciba Geigy.

Mr. Gaurav Bhadur joined the company in April 2013 as Senior Director- Human Resources in India and South Asia. He has over 20 years of experience in human resources and has worked for multinational corporations such as Vodafone India, Yahoo India, and Philips. Before joining Sanofi, he was Executive Vice President of Human Resources at First Source Solutions Limited.

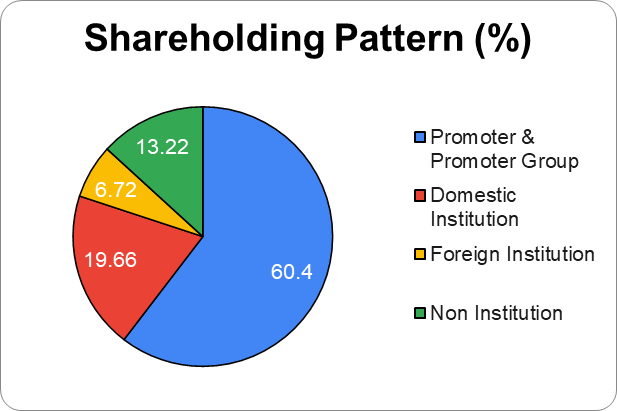

Shareholding Pattern

Sanofi, through its 100% subsidiary Hoechst GmbH holds a stake in Sanofi India.

Financial Overview

Sanofi India operates on a calendar year basis, from January to December.

Revenue

In FY2022, Sanofi India experienced a degrowth of 6.3% in revenue from operations to ₹2,770 crores from ₹2,956.6 crores in FY22. And, for the six months ending on June 30, 2023, the company reported 2.5% growth in revenue to ₹1442.6 crores, up from ₹1406.3 crores in 6MFY23.

In FY22, the company generated 85% of its revenue from the domestic market and the remaining 15% through exports. The country exports its product to more than 60 countries, mainly to the regulated markets.

EBITDA

Over the last five years, the company’s EBITDA has increased at a CAGR of 2%, rising from ₹713.2 crores in FY13 to ₹775.9 crores in FY22. However, in the last year, the company’s EBITDA fell by 7.28%, from ₹836.9 crores in FY21 to ₹775.9 crores in FY22.

Profit After Tax

In FY22, the company’s profit dipped by 34.28% to ₹775.9 crores from ₹836.9 crores in FY21. And, in Q2FY22, the company’s profit increased marginally by 2% to ₹122.9 crores from ₹120.4 crores in Q2FY23.

The financial results of FY21 and FY22 are not comparable. During FY22, Sanofi India completed its divestment in Soframycin and Sofradex business, and the financial reports also include exceptional items.

Key Financial Ratios

Current Ratio: At the end of 31st December 2022, the company’s current ratio declined to 2.17 times from 2.85 times on 31st December 2021.

Inventory Turnover Ratio: At the end of FY22, the company’s inventory turnover ratio declined by 13.5% to 2.97 times from 3.44 times in FY21.

Operating Profit Margin: The operating profit margin on 31st December 2022 was 24.37%, compared to 23.92% at the end of 31st December 2021.

Net Profit Margin: The net profit margin on 31st December 2022 was 21.84%, compared to 31.16% at the end of 31st December 2021.

Return on Capital Employed (ROCE): At the end of FY22, the ROCE of the company increased to 67.8%, compared to 56.59% at the end of FY21.

Return on Equity (ROE): The ROE of the company at the end of 31st December 2022 declined to 35.45% from 43.47% at the end of 31st December 2021.

Because the company has no debt, the debt-equity ratio and interest service coverage ratio do not apply.

Sanofi Share Price Analysis

The shares of Sanofi India were listed long back in the Indian stock market, initially under the name Hoechst India Limited in around the 1970s. Over the years, the company’s shares have traded under multiple names and are currently traded as Sanofi India in both BSE and NSE. In the last five and ten years, the company’s shares have failed to outperform and have generated 4% and 12% CAGR returns, respectively.

Sanofi India share price hit an all-time high level of ₹9,285 in August 2021. The company has a consistent track record of paying dividends to shareholders. It paid ₹377 in 2023, ₹683 in 2022, and ₹365 in 2021 as dividends to shareholders. As of 10th October 2023, the market cap of Sanofi India is ₹17,041 crores.

Peer Comparison

| Company Name | Sanofi India | Pfizer | GSK Pharma |

| Face Value | ₹10 | ₹10 | ₹10 |

| Share Price (as of 10th October) | ₹7399.50 | ₹3958.60 | ₹1547.50 |

| 1-yr Performance (as of 10th October) | 26% | -11% | 12% |

| P/E Ratio (as of 10th October) | 30.82 | 32.54 | 42.83 |

| Market Capitalization | ₹17,041.05 crores | ₹18,109.70 crores | ₹26,215.58 crores |

| Revenue | ₹2770 crores (2022) | ₹2,338 crores | ₹3,216 crores |

| Operating Profit Margin (FY23) | 24.37% (2022) | 29% | [8] 23.04% |

| Net Profit Margin (FY23) | 21.84% (2022) | 26% | [10] 18.79% |

| ROCE (FY23) | 67.8% (2022) | 31.74% | [12] 47.77% |

Key Highlights

- Sanofi India is present in the therapeutic drug segment, diabetes, cardiology, central nervous system, allergy, multi-vitamins, and supplements

- The company maintains a leadership position in the market for its diabetes portfolio. In the oral anti-diabetes drugs segment, it maintained 5th position.

- Its Allerga and Avil brands are the leaders in the allergy category, accounting for 8% market share.

- Combiflam, its heritage product in the pain care segment, reached sales of ₹200 crores in 2022.

- Some of Sanofi’s products come under the NLEM- National List Essential Medicine category related to drug pricing. It directly impacts its earnings growth.

- Sanofi India depends on the R&D conducted by the Sanofi Group for new product commercialization. The Indian unit doesn’t have direct control over new product launches or have R&D capabilities.

- The company is demerging its consumer healthcare business, for which it has got approval from the Board. It will create a new entity, Sanofi Consumer Healthcare India Limited (SCHIL), and Sanofi India shareholders will receive 1:1 equity shares of ₹10 each for each equity shares owned. The demerger process is expected to be completed by the second half of 2024.

In June 2023, Sanofi India sold its leading muscle relaxant brand, Myoril, for ₹234 crores to Ahmedabad-based Corona Remedies. Myoril had annual sales of ₹38 crores and was growing at a rate of 13% year-on-year.

Brief Industry Overview

- The Indian pharmaceutical industry is growing at an average rate of ~10%. IQVIA Prognosis Report (2022) projects that the market is expected to grow at a CAGR of ~9.2% between 2021-26 and reach a market size of ₹2,95,100 crores by 2026.

- The Government of India’s flagship program- Ayushman Bharat- Pradhan Mantri Jan Arogya Yojana health insurance scheme is likely to drive access to quality healthcare, affordability, and improve health outcomes.

- Indian generic medicine supplies accounted for ~20% of the worldwide supply by volume. It supplied ~40% of generic demand in the US, and ~25% of all medicine demand in the UK, according to the Indian Brand Equity Foundation’s Pharmaceutical Industry Report 2022.

- India has become the diabetes capital of the world. According to a study by ICMR- the country now has 100 million diabetics and 136 million pre-diabetic individuals needing prevention.

- Hypertension-related ailments are also on the rise. According to a study by WHO, one in four adults in India has hypertension, and only 12% of them have hypertension under control.

FAQ

When was Sanofi India incorporated?

Sanofi India was founded in May 1956 under Hoechst Fedco Pharma Private Limited. The company’s name has changed several times over the years, and it was renamed Aventis Pharma Limited in 1994. Aventis Pharma was later merged with Sanofi Group, a French multinational healthcare and pharmaceutical company, in 2004. As a result, the company was renamed Sanofi India Limited in 2011.

How Sanofi share price performed in the last 5 years?

As of 10th October, 2023. Sanofi share price in the last five years has given a CAGR return of 4%.

What are the products of Sanofi India?

Sanofi India is a leader in the diabetes care, allergy, cardiology, and pain care segments. Combiflam in the pain care segment and Avil in the allergy segment are some of its popular products.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.8 / 5. Vote count: 23

No votes so far! Be the first to rate this post.