Introduction

The Securities and Exchange Board of India (SEBI) has made significant waves in the financial realm with its latest move—introducing a set of groundbreaking disclosure norms poised to reshape the landscape for more than 200 Foreign Portfolio Investors (FPIs). These regulations, designed to amplify transparency and accountability within the Indian securities market, are anticipated to wield substantial influence over how FPIs operate and disclose their investment activities.

Gaining Insights into the Investor Landscape

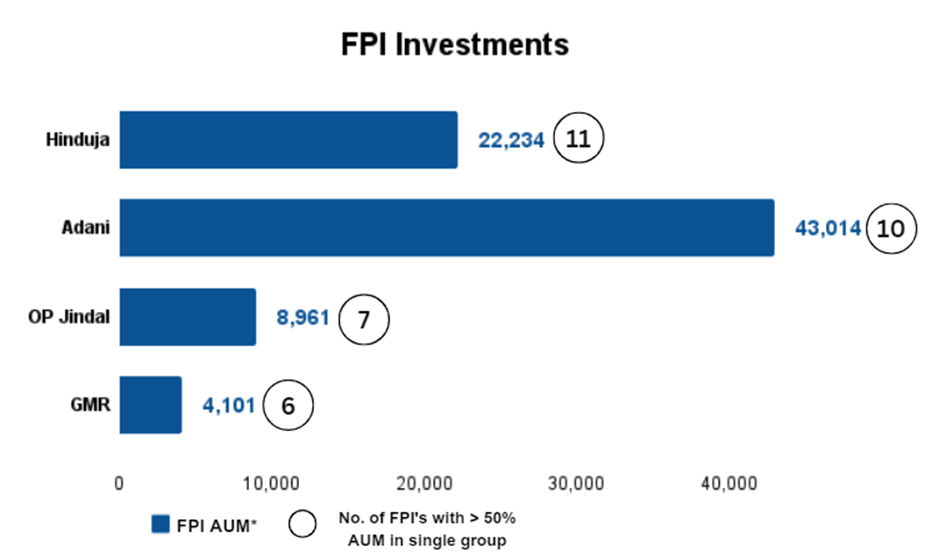

India plays host to a staggering 11,000 FPIs, each contributing to the financial fabric of the country. Among this diverse array, a subset of 227 FPIs commands attention due to their equity investments exceeding 50% concentration in either a single stock or a cluster of NSE-listed companies.

The collective investment of these FPIs amounts to a staggering 1.98 lakh crore in 140 corporate entities, with notable names including the Adani group, Hinduja group, OP Jindal, and GMR. Surprisingly, 122 FPIs boast a portfolio composed entirely of a single company or conglomerate.

A Dive into the Regulatory Reforms

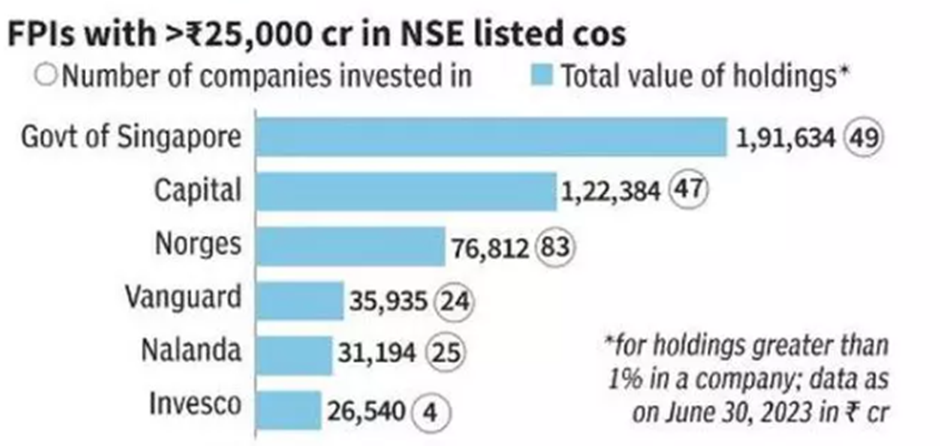

Under the newly minted regulations, FPIs that hold a majority of their equity investments within a singular Indian corporate group or manage assets worth more than Rs 25,000 crore in the Indian market are now required to divulge comprehensive information about their beneficial owners. This move, while heralding a new era of transparency, exempts government-linked investors registered as FPIs, public retail funds, and specific exchange-traded funds from the rigors of these norms.

Interestingly, six FPIs’ve invested over 25,000 crore rupees in Indian equities and are therefore granted a pass from the supplemental disclosures—a testament to the targeted nature of these norms.

Decoding the New Rules

The SEBI’s latest regulations, a result of the Hindenburg-Adani case, can be distilled into the following key components:

1. Rapid Response for Over-Concentration: FPIs holding more than 50% of their equity assets under management (AUM) in a solitary Indian corporate group have 10 trading days to downsize their holdings, a move aimed at diffusing potential market risks.

2. Strategic Rebalancing: For FPIs with an equity AUM exceeding 25,000 crore in Indian equities, there is a grace period of 90 calendar days to realign their portfolios. This measure seeks to ensure a healthier distribution of investments.

3. Disclosure Deluge: Additionally, FPIs must provide additional disclosures concerning ownership, economic interests, and control in Indian companies to heighten transparency.

Key Takeaways

- Approximately 200 FPIs are slated to be affected by these new SEBI norms, with the regulations set to take effect from November 1.

- FPIs will now be scrutinized, particularly those from jurisdictions compliant with the Financial Action Task Force (FATF) and routing funds through regulated banking channels.

- To avoid stringent measures like account blockages, restrictions, or even registration cancellations, FPIs will need to diversify their portfolios.

- The emergence of these fresh disclosure norms strongly emphasizes transparency, accountability, and adherence to regulatory frameworks within the Indian equity market.

- SEBI’s ultimate goal is to thwart any potential misuse of the FPI route while safeguarding the interests of investors in the broader securities market.

Collectively, these measures mark a pivotal turning point in the operational paradigm for FPIs within India. As the financial ecosystem braces for these transformative norms, it’s clear that SEBI’s actions will reverberate across the investment landscape, ultimately shaping a more transparent, secure, and accountable future for foreign investors.

FAQs

What is the primary objective behind SEBI’s new disclosure norms?

SEBI’s new norms aim to enhance transparency and accountability within the Indian securities market by requiring FPIs to divulge comprehensive information about their beneficial owners.

How many FPIs are expected to be impacted by these norms?

Around 200 FPIs are projected to be affected by these regulations, which are set to come into effect on November 1.

What are the implications for FPIs with concentrated investments?

FPIs with over 50% of their equity assets concentrated in a single Indian corporate group must downsize their holdings within 10 trading days to mitigate potential market risks.

How do these norms encourage portfolio diversification?

FPIs with an equity AUM exceeding 25,000 crore in Indian equities have a 90-day grace period to rebalance their portfolios, encouraging a more evenly distributed investment strategy.

Why are certain FPIs exempt from the additional disclosures?

Government-linked investors registered as FPIs, public retail funds, and specific exchange-traded funds are exempt from these norms, aligning with SEBI’s focus on targeted transparency measures.

Indian Corporate Debt Management Trends: A Positive Outlook

In Indian businesses, a notable trend emerges when we analyze their debt management prowess. Insights gleaned from a meticulous examination conducted by Mint, focusing on 382 companies listed on the BSE 500 index, reveal a promising trajectory in this domain.

Unveiling the Key Metric: Interest Coverage Ratio (ICR)

At the heart of this assessment lies the interest coverage ratio (ICR), a pivotal metric that provides profound insights into the companies’ ability to smoothly navigate interest payments associated with their debts. As a rule of thumb, a higher interest coverage ratio indicates a stronger position.

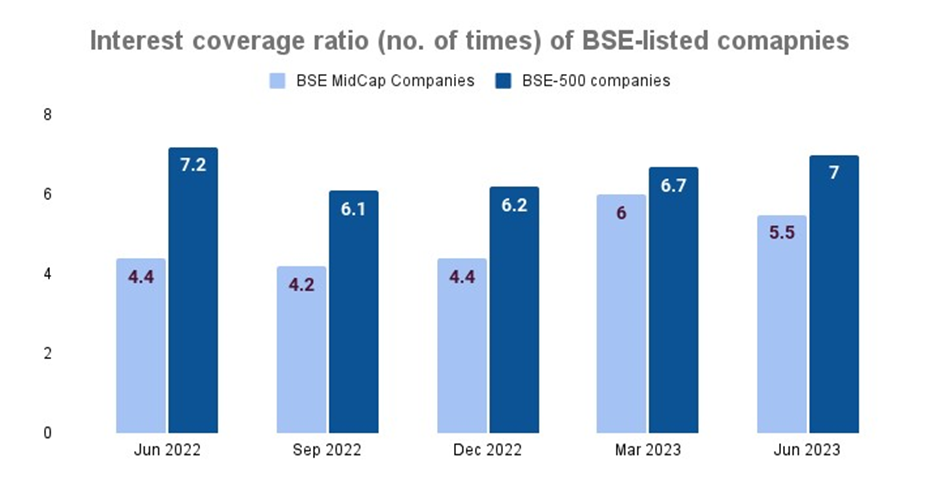

As of the recent June quarter, these enterprises demonstrated an impressive ICR of 7 times. This marks a significant advancement from the previous quarter’s ratio of 6.7 times. Notably, while this progress is encouraging, it’s marginally below the ICR of 7.2 times recorded last year.

Insights into Mid-Cap Companies

Zooming in on mid-cap companies, their ICR stood at 5.5 times during the recent quarter. While this might appear slightly lower than the 5.69 times in the preceding quarter, a noteworthy revelation awaits. This figure represents a substantial improvement from the corresponding period one year prior, during which their ICR was 4.44 times.

Catalysts Behind the ICR Enhancement

The driving forces propelling the ICR’s augmentation are intriguing and impactful. A pivotal factor is the consistent descent in the prices of raw materials. This downward trajectory has translated into heightened operational performance for these enterprises. Remarkably, the operating profits of the 382 companies witnessed a significant sequential growth of 8.1% during the quarter. In stark contrast, their interest costs registered a mere 3.6% increase over the same period.

Furthermore, the judicious financial strategies adopted by Indian companies over the past several years have played a pivotal role in this transformation. One of the cornerstone strategies has been the deliberate reduction of debt. Over the last four years, these companies have undertaken concerted efforts to deleverage their balance sheets.

Key Takeaways: Beyond the Numbers

The implications of these advancements extend far beyond numerical figures. By bolstering their operational efficiency through meticulous management of raw material costs and strategic debt handling, Indian enterprises erect a fortress against potential crises, especially amid escalating interest rates.

This proactive approach has proven instrumental in averting any unfavorable consequences that could arise from a stricter monetary landscape.

FAQs

What does ICR stand for?

ICR stands for Interest Coverage Ratio, a key financial metric used to assess a company’s ability to manage interest payments on its debt.

How did mid-cap companies perform in terms of ICR?

Mid-cap companies exhibited an ICR of 5.5 times during the recent quarter, showcasing an improvement over the same period last year.

What factors contributed to the ICR improvement?

The decline in raw material prices and strategic debt reduction initiatives drove the ICR enhancement.

Why is the ICR significant beyond the numbers?

Companies shield themselves from potential crises by enhancing operational efficiency and debt management in a changing economic landscape.

How have Indian companies prepared for rising interest rates?

Indian companies have actively reduced debt and optimized operational costs to safeguard against the impact of increasing interest rates.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.