Introduction

The gems and jewelry sector in the Indian stock market is gearing up for another addition, as Senco Gold is looking forward to listing its shares on 14th July 2023. Senco Gold IPO is opening on 4th July 2023 with an issue size of ₹405 crores. The IPO will combine a fresh issue of equity shares (Rs. 270 Cr) and an Offer From Sale (Rs. 135 Cr) from existing investors.

This article will help you understand everything about the Senco Gold IPO.

Senco Gold IPO Details

Senco Gold filed DRHP with SEBI on 15th April 2022 for an issue size of ₹525 crores that comprises issuance of fresh equity shares aggregating up to ₹325 crores and OFS of ₹200 crores, where existing investor SAIF partner would be selling its stake in the company.

SEBI issued its in-principle approval for the IPO on 5th July 2022. However, the company downsized its issue and refiled RHP with SEBI on June 28th, 2023.

| IPO Status | Approved |

| IPO Date | 4th -6th July 2023 |

| Total IPO Size | ₹405 (270 cr fresh issue and 135 cr OFS) |

| Issue Type | Book Built |

| Issue Price Band | ₹301 to ₹317 |

| Lot Size | 47 |

| IPO listing at | NSE & BSE |

| Listing Date | 14th July 2023 |

| Face Value per Equity Shares | ₹10 |

Senco Gold Business Overview

Senco Gold is a renowned pan-India jewelry retail player from Kolkata and is the largest organized retail player in eastern India. It has a rich history of over 75 years and was started by Late Shri Shankar Sen in 1938. In 1994, the company was originally incorporated as Senco Gold Private Limited by merging existing proprietary and partnerships.

The products are sold under the trademark Senco Gold and Diamonds through multiple channels, including company-operated showrooms, franchisee showrooms, and the company’s website- www.sencogoldanddiamonds.com.

As of 31st March 2023, the company has a presence across 13 Indian states through 75 company-owned showrooms and 61 franchisee showrooms.

The company has received a total funding amount of ₹155 crores from two investors, as per the Crunchbase database. On October 9, 2014, Saif Partners, now rebranded as Elevation Captial invested ₹80 crores, and on April 11, 2022, Oman India Joint Investment Fund invested ₹75 crores into the company.

Key Management Team

- Mr. Suvankar Sen (39 years old) is the Managing Director and Chief Executive Officer of Senco Gold and is a fourth-generation entrepreneur. He holds a Bachelor of Science degree with honors in Economics from St. Xavier’s College, Calcutta, and a post-graduate diploma in management from IMT Ghaziabad.

- Mrs. Ranjana Sen, Mr. Suvankar Sen’s mother, is the Chairperson and Whole-Time Director.

- Mrs. Joita Sen (the wife of Mr. Suvankar Sen) is the Whole-time director.

- Mr. Sanjay Banka is the Chief Financial Officer, a CA and CS, and an accomplished finance professional with over 28 years of diverse experience managing multinational companies’ finances.

- Mr. Surendra Gupta is the Company Secretary & Compliance Officer, and Legal Head of the company. He holds a B.com degree from Calcutta University, an LLB degree from Magadh University, and a Master of Business Laws from the National Law School of India University.

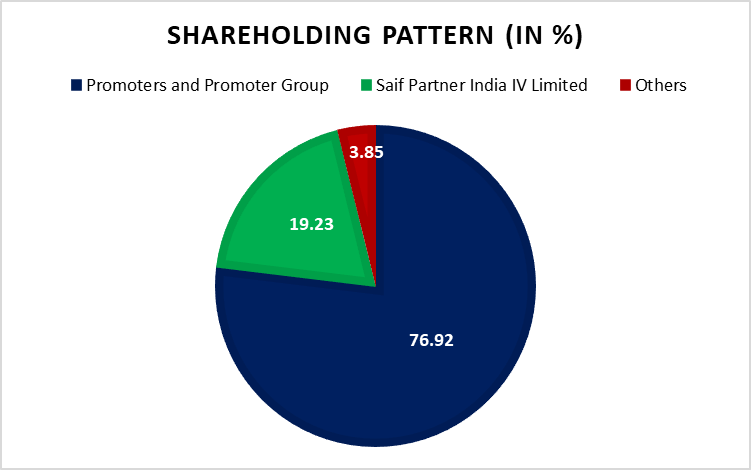

Senco Gold Pre-IPO Shareholding Pattern

Senco Gold Financials

Revenue

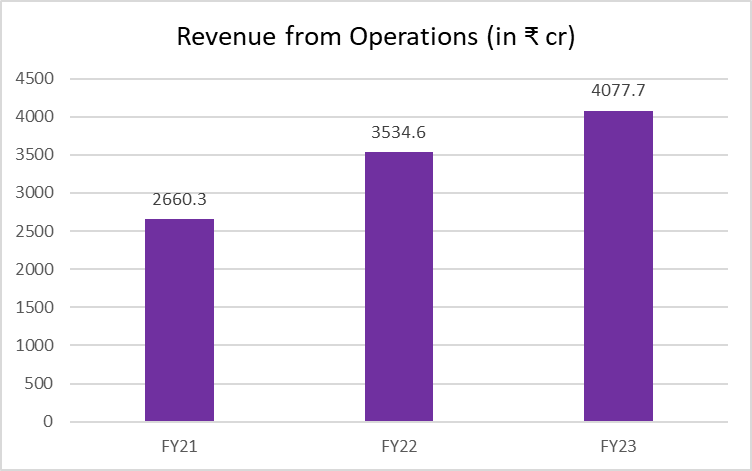

In FY23, total revenue from operations came in at ₹4077.7 crores, a growth of 15.36% compared to the previous fiscal. The sale of gold jewelry accounted for 89.6% of the company’s total revenue from operations, while diamonds and precious stones accounted for 6.77%. In the last three fiscal years, the revenue share from the sale of diamond jewelry has increased by 171 basis points.

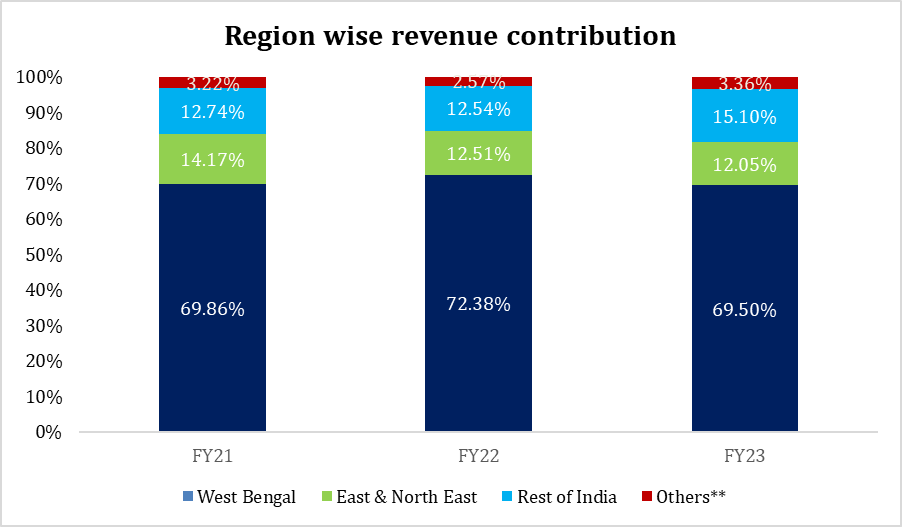

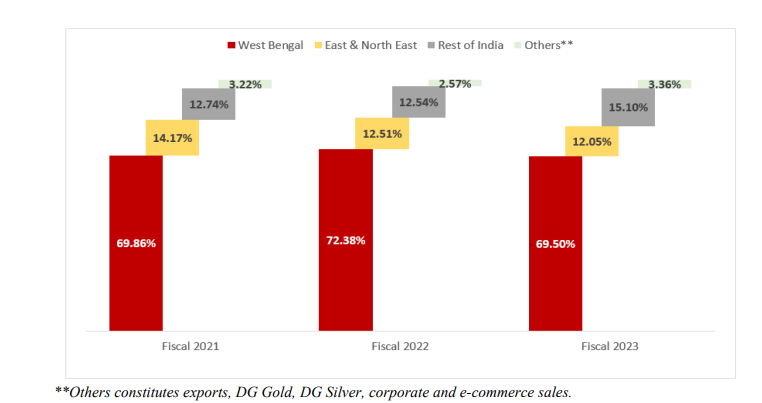

Senco Gold earned over 80% of its revenue from West Bengal and other eastern and northeast states in FY23. The percentage revenue contribution from other states has not changed significantly over the last three fiscal years.

**Others constitute exports, DG Gold, DG Silver, Corporate, and e-commerce sales.

EBITDA

| EBITDA (in ₹ cr) | EBITDA Margin | |

| FY21 | 189.8 | 7.10 |

| FY22 | 289.9 | 8.17 |

| FY23 | 347.7 | 8.46 |

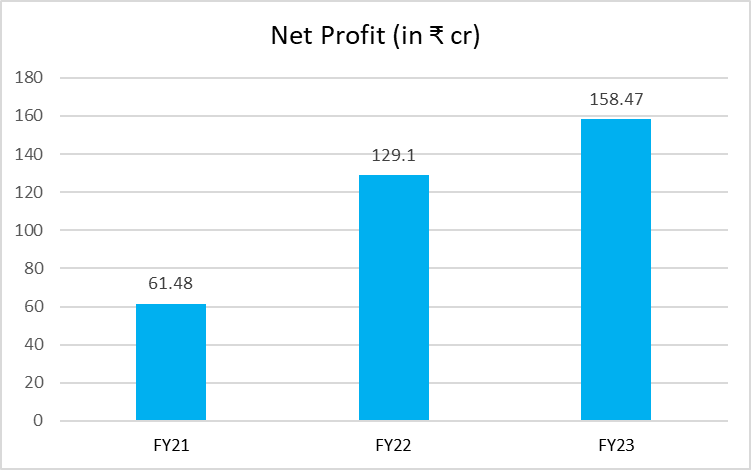

Net Profit

In FY23, the net profit came in at ₹158.47 crores, a growth of 22.7% compared to the previous fiscal.

Key Financial Metrics

Operating Profit Margin: Senco Gold’s operating profit margin in FY23 is 8%. During the period, other well-known players, such as Titan and Kalyan Jewelers, had operating profit margins of 13.9% and 7.9%, respectively.

Net Profit Margin: Senco Gold has a net profit margin of 4% in FY23, while Titan has 9.2% and Kalyan Jewelers has 3.2%.

Return on Capital Employed (ROCE): Senco Gold has a ROCE of 26% in FY23. Titan has a ROCE of 31.9%, while Kalyan Jewelers has a ROCE of 10.5%.

Objectives of the Senco Gold IPO

Out of the total proceeds of ₹405 crores, ₹135 crores is an Offer for sale in which existing investors, Saif Partners, will sell their stake in the company.

₹270 crores is coming from fresh issue of equity shares, in which ₹196 crores will be utilized for working capital purposes and ₹75 cores will be used for other general corporate purposes.

SWOT Analysis of Senco Gold IPO

Senco Gold is a well-established gold jeweler retailer in West Bengal that is currently expanding into other states, but it has not had much success outside of the country’s eastern region. The share of revenue from outside the eastern and northeast states is hoveringhas hovered around the 3% in the last three financial years.

Let’s look at some of the strengths, opportunities, and key risks of Senco Gold.

Strengths

- ● The strong legacy of over five decades thatdecades ensures trust, transparency, and strong brand recollection among customers. Has in-house jewelry design and production capabilities.

- Targeting diverse customer segments with a focus on light and affordable gold jewelry (1 to 10 gm) and having an active product catalog of more than 120,000 designs.

- Senco Gold has delivered revenue and profit growth in the past three years. The top line increased by CAGR of 15.36%, and profit increased by a CAGR of 22.75% between FY21 and FY23.

Risks

- High geographical concentration of operations with the most number of stores present in West Bengal.

- Operates in a highly fragmented market and faces strong competition from established national, regional, and unorganized players. Not much control over purchasing power as have to offer products at highly competitive prices to maintain leadership.

- Highly working capital-intensive business. In FY23, working capital days increased to 161 days from 119 days in FY22.

- Increasing customer preference towards artificial and fashion jewelry on the back of the increasing price of gold and lower price of storage.

The market size of Indian gems and jewelry was estimated at ₹4700 billion in FY23, of which 66% of the market was dominated by gold jewelry and the remaining was bars and coins.

One of the key trends emerging in the Indian gems and jewelry market is that organized players are growing faster than unorganized players. Between FY17-23, organized listed players grew at a CAGR of 20%, compared to the 14% growth rate of the overall gems and jewelry industry.

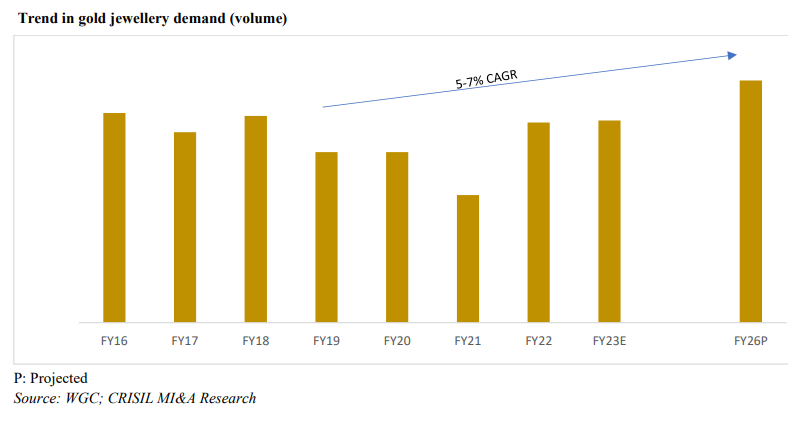

Also, the demand for gold jewelry by volume is expected to grow at a rate of 5 to 7% in the next three to four fiscal years.

It is also estimated that organized retail gold jewelers’ market share will increase to 42-47% by FY26, up from 33-38% currently, where Senco Gold, with its strong brand recall, may gain significantly.

Senco Gold appears to be a fundamentally strong company with good growth metrics at first glance. However, before investing in Senco Gold IPO, you should exercise caution, conduct thorough research, and conduct a peer comparison.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considerea d as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

FAQ

How much Senco Gold is raising through IPO?

Senco Gold is raising ₹405 crores through IPO in a combination of a fresh issue of equity shares and an offer for sale (OFS). Out of the total proceed, ₹135 crores is OFS.

What is the revenue of Senco Gold?

In FY23, Senco Gold reported revenue from operations at ₹4077 crores. In the last three years, total income has increased by a CAGR of 15.36%.

Who owns Senco Gold?

Senco Gold is a Kolkata-based gold jeweler retailer owned by Mr. Suvankar Sen, Mrs. Ranjana Sen, and Mrs. Joita Sen, together holding a 76.92% stake in the company.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/