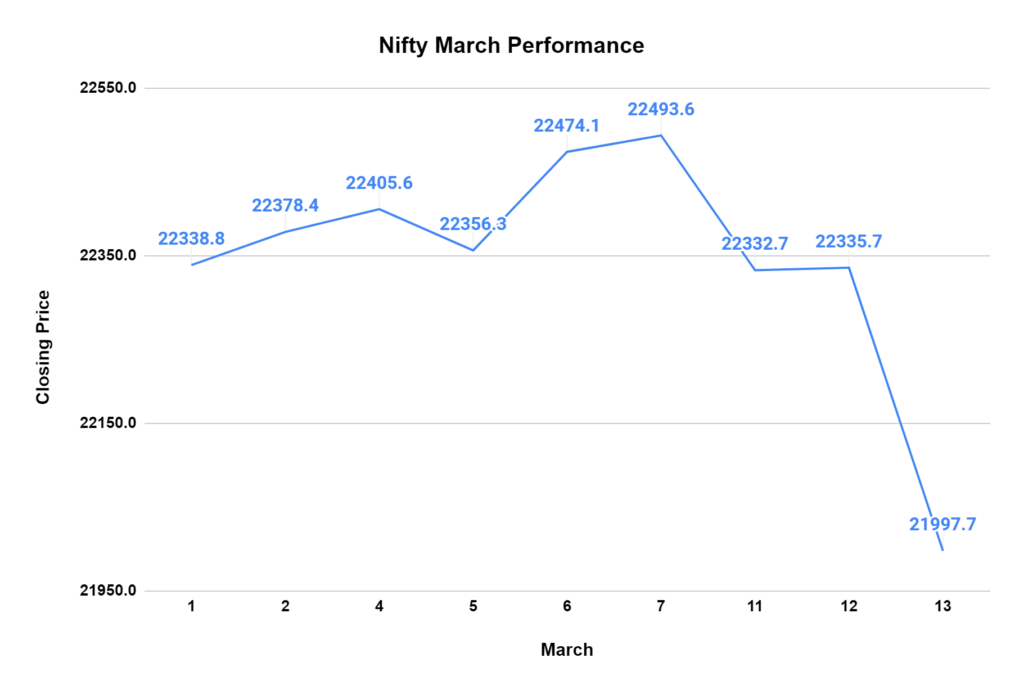

Remember that feeling of cautious optimism we had last week? The one where the stock market seemed to be on a steady climb, fueled by positive economic reports and a hopeful outlook? Well, yesterday, things took a sharp U-turn.

The Sensex and Nifty 50 took a significant tumble, with the Sensex declining 1.23% at 21,997.70 and Nifty 50 closing down a steeper 1.51% at 21,997.70. This might seem like a small percentage on the surface, but it can translate to a significant loss for investors, especially those heavily invested in the market.

Let’s break down the numbers:

The Drop: The Nifty 50 started the day slightly positive at 22,432.20 but quickly went downhill, hitting an intraday low of 21,905.65. That’s a fall of over 500 points! It eventually closed 338 points lower than the previous day.

Major Losers: Of the Nifty 50 companies, 43 ended in the red. The biggest losers were Power Grid (down a considerable 7.07%), Coal India (down 7%), and Adani Enterprises (down 6.81%).

The Broader Market: Things weren’t much better for mid-cap and small-cap stocks. These segments, which represent smaller companies, suffered even steeper losses. The BSE Midcap index ended down 4.20%, while the BSE Smallcap index took a significant hit, closing a staggering 5.11% lower.

Sectoral Impact: Almost all sectors felt the pain yesterday. Nifty Metal, Media, Realty, Oil & Gas, and PSU Bank were among the biggest losers, dropping over 4%. The Nifty Bank and Private Bank indexes, usually considered relatively stable, couldn’t escape the decline, falling by 0.64% and 0.70%, respectively.

A Lone Survivor: There was just one bright spot – the Nifty FMCG index, which includes companies that sell everyday consumer goods. This index remained almost flat, ending with a minimal gain of 0.05%.

So, what exactly happened? The reasons behind the market’s fall are multifaceted, and analysts are still piecing together the puzzle.

5 potential factors that might have led to the crash:

1. Concerns Over Rich Valuations: After a strong run that started in November, the market might simply be getting too expensive. Stock prices have risen significantly, but there haven’t been many major new developments to justify this upward climb. This disconnect between price and fundamentals has some investors worried that the market is entering a “bubble” zone, particularly in the small-cap segment. With high valuations, even a slight pullback in investor confidence can trigger a sell-off, which we might be witnessing now.

2. Tricky Market and Lack of Fresh Triggers: The market might have simply become overheated after a strong run earlier this year. Investors were chasing gains, but no significant new positive developments could justify continued upward movement. This lack of fresh “fuel” for growth led to a period of consolidation, which can manifest as a pullback in prices.

3. Interest Rate Confusion: Rising US inflation surprised everyone, putting interest rate cuts on hold. This made the dollar stronger and boosted the US stock market. However, for the Indian market, this news wasn’t so positive. Prolonged high-interest rates in the US could discourage foreign investors from putting money into emerging markets like India, potentially leading to capital outflows. This fear of reduced foreign investment contributed to yesterday’s decline.

4. Disappointing Domestic Macro Numbers: India’s economic data wasn’t inspiring yesterday. While showing a slight improvement, the February retail inflation figures remained stagnant compared to the previous month. Additionally, factory output for January came in weaker than expected. This dull economic performance might be causing some investors to worry about the health of the Indian economy and its future growth prospects.

5. The “March Effect”: Some market observers believe that March often brings a period of weakness due to profit-booking activities. As the financial year nears its end, companies and institutional investors may choose to sell off some of their holdings to show profits on their balance sheets. The March deadline for advance tax payments could also lead some entities to liquidate stocks to raise cash, putting downward pressure on prices.

So, what does this mean?

It’s hard to say for sure. The stock market is a complex beast; a single day’s drop doesn’t necessarily predict a long-term trend. However, it’s a good reminder that the market can be volatile, and investors should know the factors influencing its ups and downs.

Conclusion:

Don’t panic if you’re a long-term investor. Stay informed, diversify your portfolio, and make informed investment decisions. The market has a history of recovering from crashes, but talking to a financial advisor can be helpful if you’re concerned.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.7 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/