Introduction

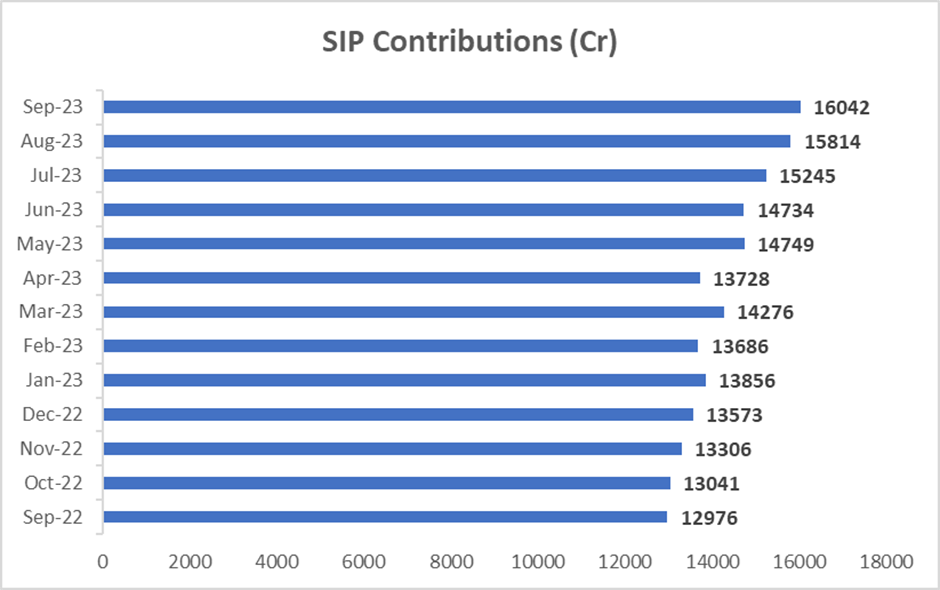

In recent times, there has been a surge in investments flowing into mutual funds, with investors keen on leveraging market fluctuations. Systematic Investment Plans, commonly known as SIPs, have emerged as a favored route for many. Notably, September witnessed a historic milestone, as SIP contributions surpassed the 16,000 crore mark for the first time. You can also check our SIP calculator for more details on SIP.

The AMFI Report

The Association of Mutual Funds in India (AMFI), the regulatory authority for Mutual Fund houses, divulged significant insights. The data for September revealed a noteworthy increase in contributions, amounting to 16,042 crores. This marked a substantial rise from the 15,814 crores recorded in August. Additionally, the mutual fund industry saw a remarkable achievement, with the number of unique investors surpassing 4 crores.

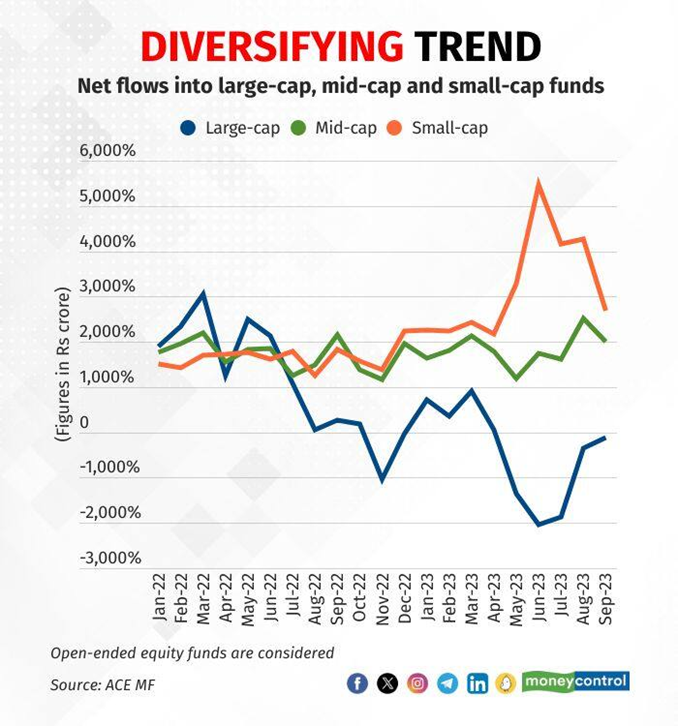

However, amidst this positive trend, there was a noticeable dip in equity mutual fund inflows. September saw a 30% decline, with figures dropping from 20,245 crores to 14,091 crores. This reduction was attributed to investors booking profits.

Key Takeaways

Despite the turbulent global market, local equity funds have sustained positive net inflows for 31 consecutive months. The milestone of SIP contributions crossing the 16,000 crore mark underscores the robustness of the Indian markets.

Furthermore, the inflow of SIPs from individual and domestic institutional investors has served as a significant counterbalance. This contrasts sharply with Foreign Portfolio Investors (FPI), who withdrew a substantial 14,767 crores in September and an additional 8,000 crores in the initial week of October.

In conclusion, the upswing in SIP investments signifies a collective vote of confidence in the Indian market’s resilience. Despite the ups and downs, the consistent positive net inflows demonstrate a strong foundation. Individual and institutional investors are navigating the market fluctuations astutely through SIPs.

FAQs

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.