Introduction

Sona BLW is a prominent Indian company with a global presence that manufactures differential gears, motors, and other components. It holds a 60-90% market share in various segments of the Indian differential gears (DG) market.

The company plans to expand manufacturing capacity and launch new products. Let’s understand more about the company.

Sona BLW Overview

Sona BLW is a global manufacturer of automotive systems and components with origins in India. The company has nine manufacturing and assembly plants across India, China, Mexico, and the USA, of which six are in India.

The company is India’s leading auto ancillary company, specializing in designing, manufacturing, and supplying highly engineered, mission-critical automotive systems and components. These include differential assemblies, differential gears, conventional and micro-hybrid starter motors, BSG systems, EV traction motors, and motor control units.

It supplies these products to automotive OEMs across the US, Europe, India, and China for use in all categories of vehicles, including conventional passenger vehicles, commercial vehicles, off-highway vehicles, electric cars, electric light commercial vehicles, and electric two-and-three-wheelers.

The company develops mechanical and electrical systems, software solutions, and components to meet customer demands. The company has nine manufacturing plants, 3 R&D Centers, and 4064+ employees.

Sona BLW Journey

Here are some of the critical milestones in the company:

- 1995: The company was incorporated as Sona Okegawa Precision Forgings Ltd. in a joint venture with Mitsubishi Metal Corporation Limited.

- 1998: The Company started manufacturing differential bevel gears at its first plant in Gurugram, Haryana, India.

- 1999: The company established a manufacturing facility in Chennai, Tamil Nadu, India.

- 2005: A new manufacturing plant was launched in Pune, Maharashtra, India, by the company. Additionally, Sona Autocomp Holding Private Limited became the company’s majority shareholder.

- 2008: Acquired Thyssen Krupp’s precision forging business (which had previously acquired the company BLW, the inventor of Warm Forging Technology).

- 2013: The company was renamed “Sona BLW Precision Forgings Limited.” It was also awarded the “North American OEM of PV’s and CV’s World Excellence Award (Silver).”

- 2016: The Company was recognized with a Gold World Excellence Award for being a leading North American OEM of PV’s and CV’s. It also established a new manufacturing plant in China and received an investment from JM Financial Trustee. Contract with Mitsubishi and Metal One has been terminated

- 2017: Two new plants commenced operations in Gurugram, India, and the Company also launched the final assembly and finishing plant in Mexico, North America.

- 2018: Acquired new land for a second plant in Chakan, Pune. It was awarded the contract for Differential Assembly supply by a renowned Global Electric Vehicle Manufacture

- 2019: The brand name “Sona Comstar” was adopted by the Company, and the differential assembly plant commenced operations in Manesar, Haryana, India.

- 2020: Achieved a production milestone of 250 million Gears and awarded contracts for BLDC (Brush Less Direct Current) motor supply by two Indian Electric 2 Wheeler Manufacturers

- 2021: The Company got listed on the Indian Stock Exchanges

Sona BLW Management Profile

- Mr. Vivek Vikram Singh is the company’s Managing Director and group CEO. He holds a bachelor’s degree in technology in computer science and engineering from HBTI Kanpur and a postgraduate diploma in management from IIM Ahmedabad. He has over 18 years of experience, including eight years of experience in the automotive industry. He is responsible for capital allocation, strategic decisions for growth, business development, managing financial stakeholders, and performance monitoring of individual business units of the company.

- Mr. Rohit Nanda is the Group Chief Financial officer of the company. He is a qualified chartered accountant with over 20 years of experience in diverse industries, including automotive, steel, engineering, pharma, chemical, and industrial goods. He is responsible for capital allocation, financial reporting, investment decisions, risk management, and information technology.

- Mr. Kiran Manohar Deshmukh is the Chief Technology officer of the company. He holds a bachelor’s degree in technology in metallurgical engineering from IIT Bombay. He has significant experience in automotive components manufacturing and has worked in the areas of, among others, manufacturing, process control, and design. He is responsible for steering the development of new technologies, establishing technology partnerships, and building competencies in manufacturing excellence in the company. He joined the company on July 1, 2019.

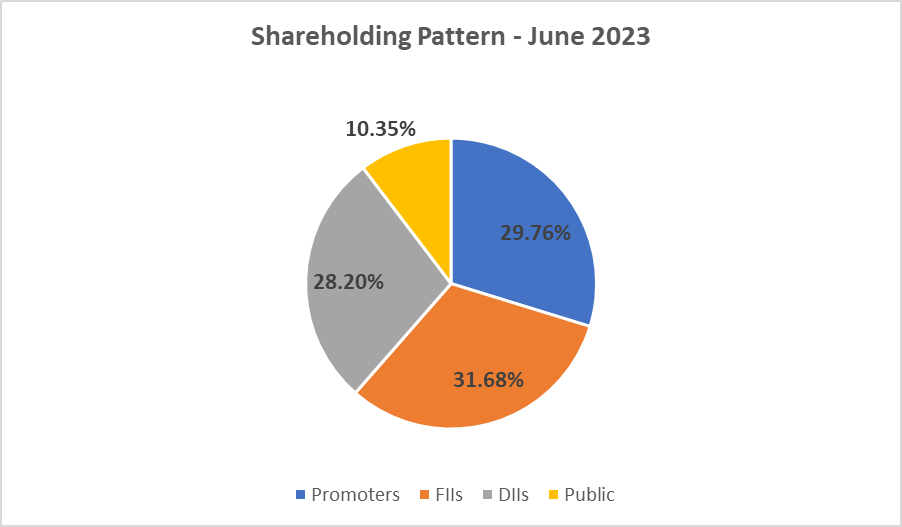

Sona BLW Shareholding Pattern

Sona BLW Business Segments

The product line of the company can be classified under two segments:

- Driveline parts – differential assembly and gears

- Motors

Driveline parts segment: The Company produces differential assemblies and precision-forged bevel gears for electric and non-electric vehicles, including passenger cars, commercial vehicles, off-highway vehicles, and three-wheelers.

Motors segment: The company produces starter motors for conventional, micro-hybrid, and EVs. It also manufactures motor control units and EV traction motors for hybrid and electric vehicles, including two and three-wheelers.

Sona BLW Fundamental Analysis

Sona BLW caters to all major automotive segments, including Passenger Vehicles, Commercial Vehicles, Tractors, and Off-Highways. Sona BLW is the largest manufacturer of differential gears for PVs, CVs, and tractors in India. They are also ranked among the top 10 global suppliers of differential bevel gears and starter motors for PVs.

In CY22, Sona BLW has a 7.2% market share in global differential gears and 4.1% in starter motors globally. In the domestic market, the company holds 80-90% market share in commercial vehicles, 75-85% in tractors, and 55-60% in passenger vehicles.

The company operates in various vehicle segments, including PVs, CVs, OHVs, and E2W/E3W, with a revenue mix of 69%, 15%, 12%, and 4%, respectively. However, it has a high dependency on the passenger vehicle segment.

The company has a solid clientele base. Almost all well-known automotive manufacturers are customers of SONA BLW, like Maruti Suzuki, Renault, Nissan, Volvo, etc. In FY 2022-23, the top 5 customers contributed 55% of the revenue, while the top 10 contributed 77% to the total revenue for the company.

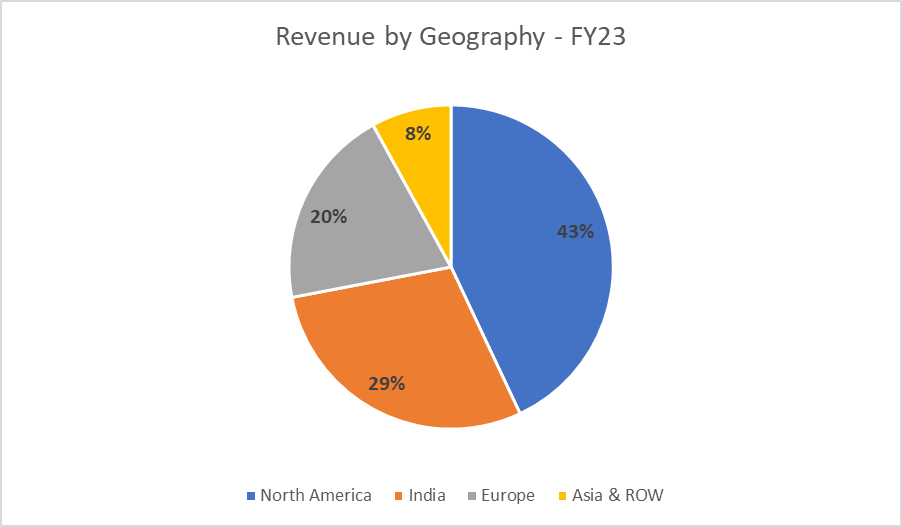

The Company generated 29% of its revenues from India. The remaining revenue came from overseas operations in North America (43%), Europe (20%), and Asia/Others (8%).

The company continues to focus on R&D to develop new innovative systems and components. In FY 2023, the company invested INR 73.1 Cr rupees in R&D with 273 on-roll employees across three centers in India located in Gurugram and Chennai.

The company has increased its focus on the electric vehicle segment, and its revenue contribution is 26%. The company operates 46 EV programs across 27 customers, and BEV (Battery Electric Vehicles) revenue contributes 26% share in FY 2022-23.

The company plans to focus on light passenger, commercial vehicles, and electric buses over the next three years. It aims to expand in Europe for differential assemblies and gears and in China for micro-hybrid starter motors and 48V BSG systems.

In FY 2023, the Company announced its entry into the sensors and software market by acquiring a 54% stake in Novelic.

Revenue & Profitability

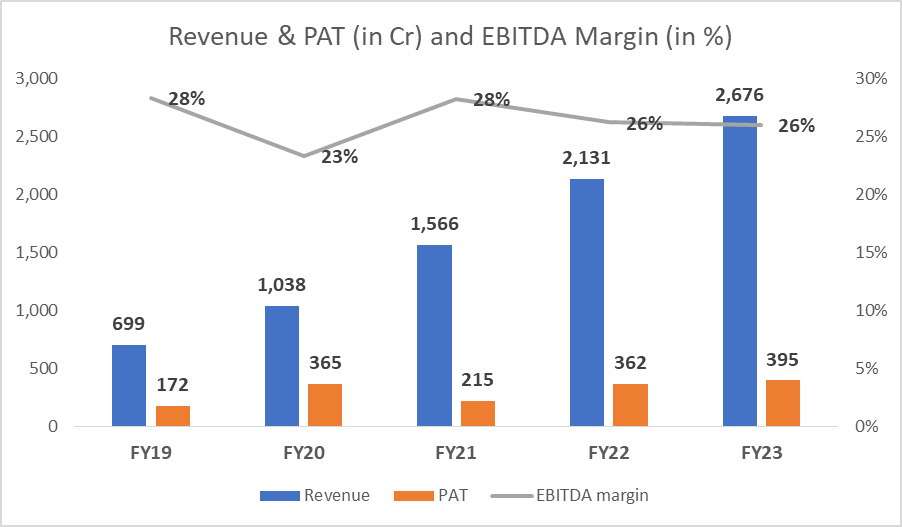

Sona BLW posted revenue of INR 2,676 Cr during FY23 compared to INR 2,131 Cr during FY22, an increase of 25.57%.

On the profitability front, the company has posted a PAT of INR 395.3 Cr for FY23 as against the PAT of INR 361.5 Cr for FY22, an increase of 8.5%.

If we look at the financial performance over the Financial Year 2019 – 2023, the company has posted a Revenue CAGR of 39.86% and a PAT CAGR of 23.16%, which is relatively good.

Sona BLW has consistently delivered operating margins (EBITDA %) in the range of 26% to 28% since 2018, which is relatively high for an auto ancillary manufacturer. The company has done reasonably well on execution and delivered well on Revenue growth, profitability growth, and margins.

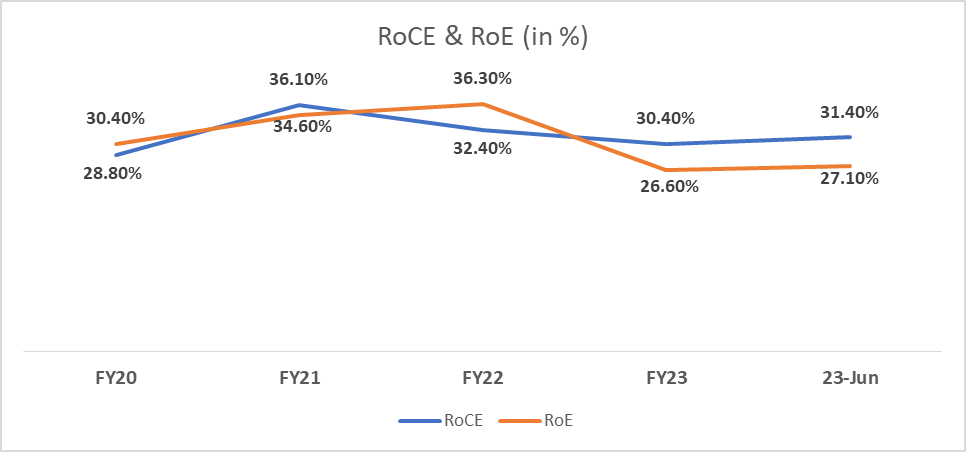

Return on Equity & Return on Capital Employed

Sona BLW has consistently delivered ROCE and ROE of over 25% over the last five years. This can be credited to the existing manufacturing facilities’ high operating margins and asset turnover.

The company can generate high ROCE on the back of innovative products being launched to cater to the requirements of auto manufacturers globally.

Sona BLW Share Price History

Sona BLW was listed on NSE & BSE in June 2021 at a price per share of INR 302.4 and currently trades at INR 555.6 per share (as of 13 August 2023). During this period, the company achieved an all-time high price of INR 835 per share on 14th Dec 2021.

Key risks:

Undertrial products may not get acceptance – It is also possible that the hybrid technology that uses a 48V BSG motor may not find acceptance globally, or BV penetration increases much faster. In that case, SONA will have to develop alternative products.

Volatility in critical raw materials – The Company’s business could be affected by commodity price volatility, which could affect the firm’s overall cost of manufacturing operations. Though it has adequate mechanisms to monitor and manage various market risks, the effects of changes in commodity prices cannot always be predicted, hedged, or offset with price increases to eliminate the impact on the Company’s overall profitability.

Change in regulations and industry trends -The automotive industry is subject to environmental and other laws. Therefore, any adverse impact on the industry and the Company’s customers due to any change in such rules can affect its business. Further, there has been a gradual shift in the industry from pure ICE-dependent vehicles. An acceleration in this trend will adversely affect the ICE-dependent business of the Company.

Overdependency on top five customers- The top 10 customers contributed 77% of the revenue. If top existing clients cancel the order, it may affect the finances.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is the face value of Sona BLW?

The face value of Sona BLW is INR 10 per share.

What is the Market cap of Sona BLW?

The market cap of Sona BLW is INR 32,742 crores as of 8th Aug 2023.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 35

No votes so far! Be the first to rate this post.