The Indian real estate market is booming, and with it comes a surge in demand for furniture – particularly the luxurious kind. Stanley Lifestyles, India’s 4th largest player in this high-end segment, is looking to capitalize on this trend with its upcoming IPO. But can they translate their success from car seats to coveted living room centerpieces? We’ll explore the company’s financials, expansion plans, and the competitive landscape to see what the IPO offers.

The Stanley Lifestyles IPO opens for bidding on June 21st, 2024, and closes on June 25th. The company has set the price band at ₹351 to ₹369 per share. This is a book-built issue aiming to raise ₹537.02 crore. The issue combines a fresh issue of shares worth ₹200 crore and an offer for sale (OFS) of existing shares valued at ₹337.02 crore. The minimum investment amount is ₹14,760 for a lot size of 40 shares.

Stanley Lifestyles Limited IPO Details

| Offer Price | ₹351 – ₹369 per share |

| Face Value | ₹2 per share |

| Opening Date | 21 June 2024 |

| Closing Date | 25 June 2024 |

| Total Issue Size (in Shares) | 14,553,508 |

| Total Issue Size (in ₹) | ₹537.02 Cr |

| Issue Type | Book Built Issue IPO |

| Lot Size | 40 Shares |

Stanley Lifestyles IPO GMP

There’s some heat surrounding the Stanley Lifestyles IPO, with shares trading at a premium of ₹150 in the grey market. Considering the price band’s upper limit of ₹369 per share, some market observers estimate a listing price as high as ₹519.

If this estimate holds, it would translate to a gain of approximately 40.65% per share on the listing day. This “grey market premium” (GMP) reflects the unofficial price investors will pay for the stock before it even hits the exchange. Think of it as a temperature gauge for investor interest.

Objectives of Stanley Lifestyles IPO

The funds raised through the IPO will be used for several purposes:

- Opening new stores across all three formats (Stanley Level Next, Stanley Boutique, Sofas & More by Stanley)

- Setting up larger anchor stores

- Renovating existing stores

- Funding capital expenditure for new machinery and equipment

- General corporate purposes

Stanley Lifestyles Limited: From Car Seats to Luxury Sofas

Founded in 2007, Stanley Lifestyles has come a long way from its roots in car seat leather upholstery. Today, it’s India’s 4th largest luxury furniture brand, with a strong presence in South India (especially Bengaluru) and operating 62 stores across 25 cities. Their “Stanley” brand caters to super-premium, luxury, and ultra-luxury furniture segments.

Growth Plans: Setting Up Shop Across India

Stanley Lifestyles is ambitious. They aim to expand their retail footprint significantly, targeting 12-15 new stores annually for the next three years. This aggressive approach aims to bring them to a national presence with over 100 stores, potentially translating to a compound annual growth rate (CAGR) exceeding 25%.

Riding the Real Estate Wave:

The company sees an opportunity in India’s booming real estate market. With more people investing in new homes, the demand for luxury furniture is expected to rise. Currently, 80% of their sales come from customers furnishing new homes, making Stanley Lifestyles well-positioned to capitalize on this trend.

Financials: Consistent Profits and Growing Margins

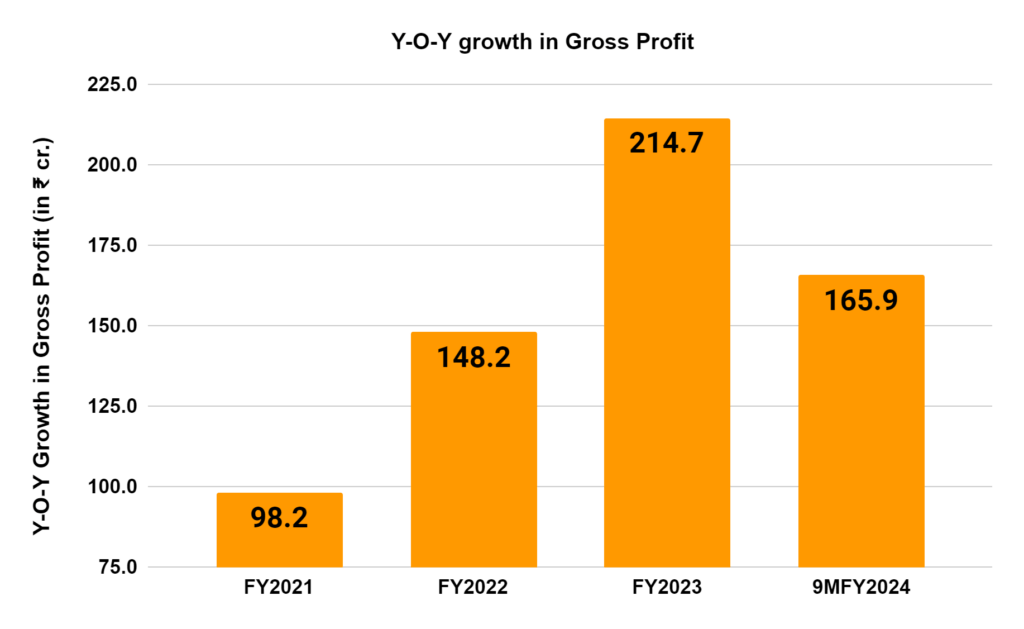

Stanley Lifestyles boasts a decade of consistent profitability. Their EBITDA margin (a measure of profitability) improved from 15% in FY21 to 18% in the first nine months of FY24. Revenue and profit after tax (PAT) also increased between FY22 and FY23, rising by 42.94% and 50.64%, respectively.

The Competition: Taking on European Giants

While Stanley Lifestyles is a major domestic player, it faces stiff competition from established European luxury furniture brands. These well-known names might be more appealing to some high-end customers.

SWOT Analysis of Stanley Lifestyles Limited

| STRENGTHS | WEAKNESSES |

| Strong brand presence in South India, particularly Bengaluru. Consistent profitability and improving margins. Capitalizing on the real estate boom and rising demand for luxury furniture. Aggressive expansion plans to achieve national reach. | Reliance on the South Indian market for a large portion of revenue. Strong competition from established European luxury furniture brands. Limited product diversification beyond furniture. |

| OPPORTUNITIES | THREATS |

| Growing demand for luxury furniture in India. Expansion into new markets and online sales channels. Potential for brand extensions beyond furniture. | Economic slowdown impacting consumer spending on luxury goods. Rising raw material costs squeezing margins. Difficulty in attracting and retaining skilled labor for furniture production. |

Wrapping up

The Stanley Lifestyles IPO is positioned at the intersection of India’s real estate boom and growing demand for luxury furniture. However, investing depends on your individual risk tolerance and investment goals.

The company’s dependence on the South Indian market and established European competition are important considerations. Carefully analyze the information presented, including the SWOT analysis, and conduct your research before making a final decision.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/