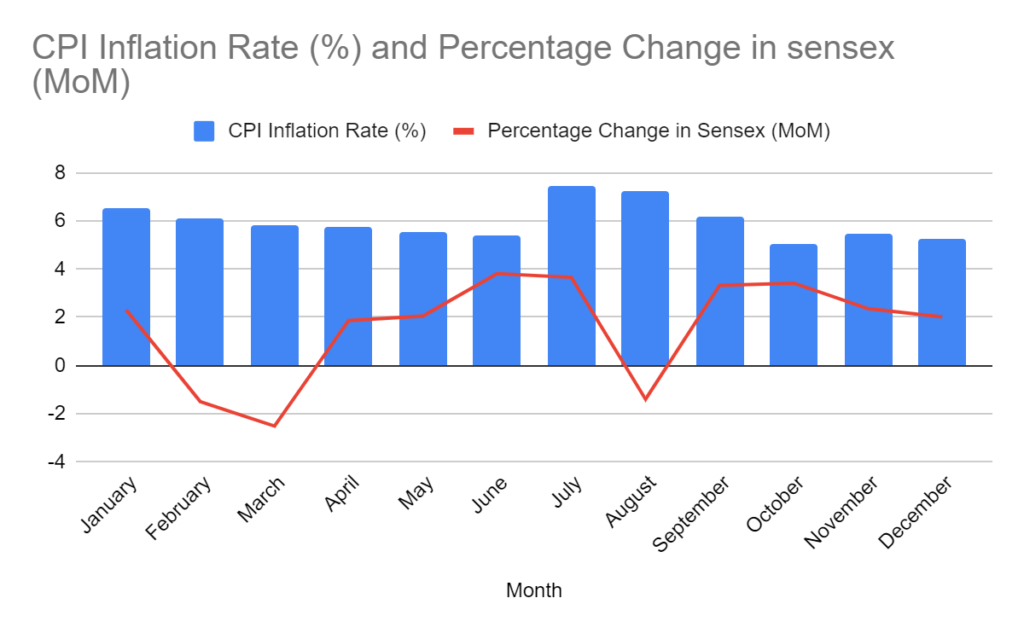

The financial landscape in India has been a rollercoaster. The news of the SENSEX crossing a record 70,000 mark coincided with the revelation of a recent surge in the Consumer Price Index (CPI) to 5.5% in November 2023. This increase is attributed mainly to soaring food prices, bringing retail inflation alarmingly close to the Reserve Bank of India’s (RBI) upper limit of 6%.

Retail Inflation to Blame

The inflation surge has been solely driven by the food and beverages segment. As vegetables registered an inflation rate exceeding 17% in November, a steep increase compared to nearly 3% in October, cereals and spices maintained double-digit inflation for the 15th and 18th consecutive months, respectively, while pulses continued this trend for the sixth consecutive month.

In July this year, inflation hit a peak of 7.44% due to skyrocketing vegetable prices during the monsoon season. Although there has been a consistent downward trajectory since then, the National Statistical Office (NSO) reported an 8.7% inflation rate in the food basket for November, much higher than October’s 6.61%.

The RBI, tasked with maintaining retail inflation at 4% with a 2% margin on either side, forecasted CPI inflation at 5.4% for the fiscal year 2023-24, expecting a 5.6% reading in the third quarter and 5.2% in the final quarter.

SENSEX Savors the 70K Milestone

Amidst the inflationary concerns in the food industry, the Indian stock market has seen an extraordinary milestone, with the Sensex crossing the 70,000 mark. This remarkable achievement comes alongside rising inflation worries, yet it underscores the inherent strength and resilience of the Indian economy.

Strategic Sectors and Stocks Leading the Charge

The upsurge has been credited to several sectors and individual stocks.

IT Sector: Powerhouses like Infosys, TCS, and Wipro continue to thrive due to the increased demand for digital transformation solutions and robust global IT spending.

Banking Sector: Major banks like HDFC Bank, ICICI Bank, and Axis Bank have benefited from increased lending and better quality of assets, resulting in significant profits.

Automobile Sector: Despite escalating input costs, companies like Maruti Suzuki, Tata Motors, and Mahindra & Mahindra have seen robust demand driven by pent-up consumer demand and innovative product launches.

Infrastructure Sector: Companies like Larsen & Toubro and UltraTech Cement have witnessed soaring share prices due to increased government spending on infrastructure and a surge in construction activity.

However, the shadow of rising inflation, especially in the food sector, remains a significant challenge. The RBI’s measures to control inflation through tightening monetary policy may impact economic growth. Investors are closely monitoring this situation and its potential effects on corporate earnings and market sentiment.

Top Gainer Stocks

While short-term concerns exist, the long-term outlook for the Indian stock market remains optimistic. A youthful population, increasing disposable incomes, and ongoing government reforms are expected to fuel sustained economic growth and corporate profitability. Stocks of companies with strong fundamentals, healthy balance sheets, and adaptability to inflationary pressures are top gainers in the market.

FMCG companies: Look at firms like ITC and Britannia Industries, equipped with strong pricing power and resilience against inflation.

IT services companies: Consider companies like Infosys and TCS, poised to benefit from continued demand for digital transformation solutions.

Automotive companies: Explore opportunities with companies like Maruti Suzuki and Tata Motors, possessing strong fundamentals and innovative products.

Healthcare companies: Companies like Apollo Hospitals and Dr Reddy’s Laboratories are catering to the growing healthcare needs of a rising population.

Alternative energy companies: Names like Adani Green and Mahindra Susten focused on renewable energy solutions.

In conclusion, while inflation poses concerns, the Indian stock market’s diversity and the presence of robust companies across various sectors present opportunities for investors. By staying vigilant, managing risks, and focusing on fundamentally strong companies, investors can participate in India’s continuing growth story despite the inflationary clouds on the horizon.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/