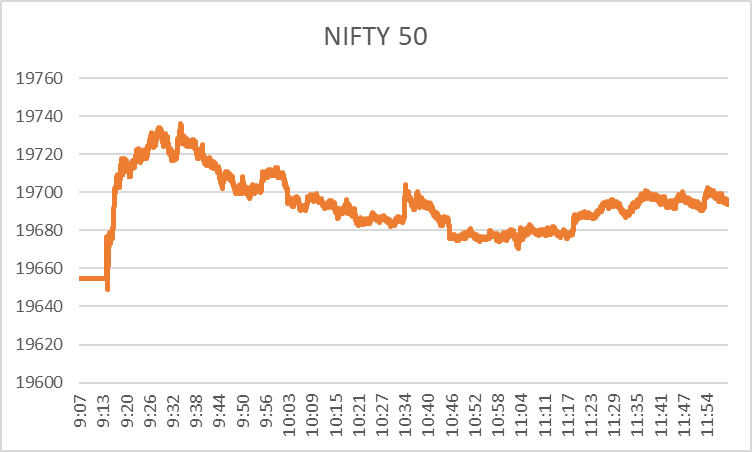

As FIIs sold Rs. 1862.57 crore investments yesterday , the domestic market came under pressure. Today, the Nifty 50 index fell by 0.59% during the first two hours of the market session. The equity index again fell below the 19700 mark, which it reclaimed earlier this week.

The sectoral indices are also in the red, except for a few with marginal gains. While FIIs withdrawing investments from the domestic market is escalating the selling pressure, it is also increasing tension between Israel and Hamas.

While yesterday, the market had mixed sentiments, today, it is purely driven by negative sentiments and selling pressure is building up.

Let’s see the sectoral performance of the stock market today.

Sectors in the Green

NSE Realty Sector Today

In a falling market like today, the sector, which is offering the highest gains, is the realty sector. The Nifty Realty Index surged by 1.24% until 11.15 a.m. with most of the gains coming from

- Phoenix Mills Ltd., which has increased by 3.93% until now. The stock has been performing well for the past few sessions especially after it came up with the quarterly results with a 20% surge in retail sales .

- DLF: This realty giant has gained 1.52% during the first hours of the share market today. The stock is currently at 575.65 up from its previous close of 567.05. This is gaining as the realty sector is overall driven by positive sentiments today.

NSE Pharma Sector Today

The pharmaceutical sector is the next sector to be in the green today. The Nifty Pharma index rose by 23.40 points or 0.23% until now.

- Torrent Pharma is the stock gaining the most until now, with a 1.34% upside in the first 2 hours of the market session. The company is about to hold its board meeting on the 23rd of this month, and investors seem positive about its quarterly and half-yearly results.

- Glenmark: This pharma company has gained 1.15% until now from its previous day’s closing price of 792.20 following the announcement that Ichnos Sciences, which is a wholly-owned subsidiary of Glenmark, has recently granted the license for OX40 Antagonist Monoclonal Antibody Portfolio with Astria Therapeutics.

Sectors in the Red

NSE IT Sector Today

The IT sector has been performing sluggishly right after the quarterly results of Accenture that came a few weeks back. The investors are sceptical about the sector as a whole as the quarterly results are in the pipeline and it seems investors are not expecting favorable returns for this quarter owing to recession fears and other geopolitical issues. The Nifty IT index has dropped by 0.93% from the day’s beginning.

- MPhasis has tanked 3.50% until now in the share market today following the acquisition of Sonnick Partners LLC, USA .

- Infosys fell today and gained for the second day in a row. Today it has dipped by around 2.56% while the company announced joint venture projects, dividends, and more.

- While these two stocks are putting the maximum selling pressure in this sector, there is also HCL Tech, which is helping the sector to gain some. The tech stock has gained 2.32% until now following its positive quarterly results released yesterday. The profit after tax of the firm has gone up on a YoY basis during the July-September quarter by around 6.5% .

NSE Metal Sector Today

The next sector, which has been dipping in the share market today, is the metal and mining sector. The Nifty Metal index has gone down by 0.72% until now.

- Adani Enterprise is the biggest loser in this sector until now, declining by 3.15%. While the overall market movement is putting selling pressure on the stock, since it has exposure in the Israeli countries, the investors are a little afraid and thus withdrawing from the same.

- Jindal Steel Ltd. is the next loser on the realty sectoral index list. The stock lost around 1.80% until now due to negative market sentiments.

Conclusion

The end of the October 2nd week doesn’t look favorable for the investors, with most sectors ending in the red. Most factors do not favor the market, like geopolitical situation, crude price volatility, late monsoon, FIIs withdrawing money from the domestic market, etc.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/