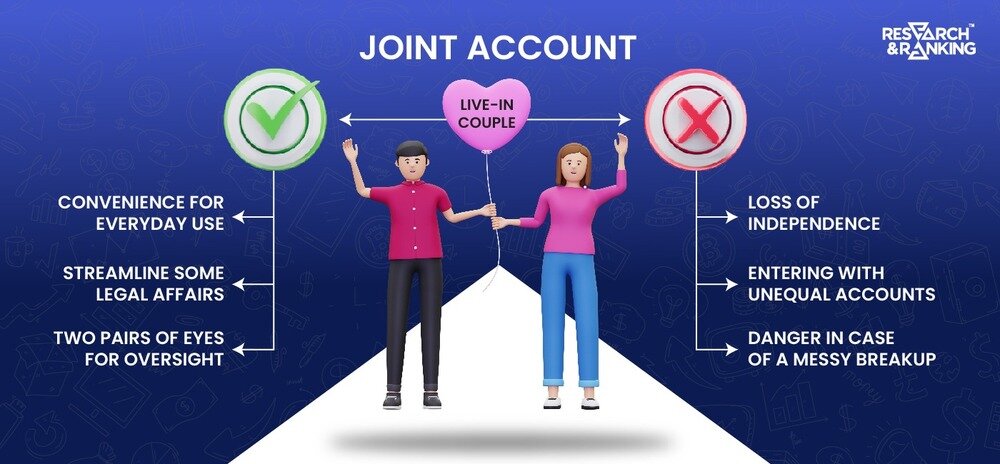

Couples, whether living together or married, share time, space, and love. But how about sharing your finances? Couples are working hard to achieve financial independence as their money awareness grows. Should you open a joint account with your partner to consolidate your finances or keep them separate to maintain financial freedom?

If you find yourself struggling with this question, we are here to help. In this article, we’ll look at the pros and cons of having a joint account as a live-in couple and what you should know before making this important decision. So, stand by until the end to find the best option for you.

Pros of Having Joint Accounts

Joint accounts have several advantages over separate accounts, such as:

Simplified Budgeting

One of the benefits of having a joint account is that it makes it easier to manage your household finances. You don’t have to assign bills or expenses to each person or keep track of who owes whom.

You can also see your total income and spending in one place and plan accordingly. Having a joint account can help you align your financial goals and values and encourage you to work together as a team.

Easy Access to Funds

Another bonus of having a joint account is that you can easily access your funds. You can withdraw cash, write checks, and make online payments without requesting permission or transferring funds from another account.

You can also use the joint account to fund emergencies, unexpected expenses, or income loss. A joint account can promote trust and transparency in your relationship.

Streamlined Bill Payment

A third benefit of having a joint account is simplifying the bill payment process. You won’t have to worry about splitting bills or missing payments.

You can set up automatic payments from your joint account to ensure all bills are paid on time and in full.

Shared Savings

The fourth perk of having a joint account is sharing your savings. You can pool your money to save towards short-term and long-term goals like vacationing, buying a home, or a car.

Greater Borrowing Power

A fifth benefit of having a joint account is that it gives you greater borrowing power. Leveraging your combined income, you can apply for loans with your joint account to increase your chances of approval. You can also qualify for higher amounts at lower interest rates.

Cons of Having Joint Bank Accounts

However, joint bank accounts also have some disadvantages that you should be aware of, such as:

Reduced Financial Freedom, Privacy, and Flexibility

A joint bank account may limit your financial liberty, privacy, and flexibility. You must compromise your financial privacy, as your partner can see your entire income and spending history and may question or judge your decisions.

You also have less flexibility because you must adhere to a shared budget and plan, and you may be unable to pursue your interests.

Potential Conflicts, Resentment, or Power Imbalance

You might disagree about how to manage your money, what to spend it on, and how much to save, which often leads to arguments. You may also resent your partner if you contribute more or less than your partner or have opposing financial values or priorities.

You may also notice a power imbalance if one partner earns more or less than the other or if one partner controls or dominates financial decisions.

Exposure to Financial Risks, such as Fraud, Debt, or Legal Issues

You are jointly liable for any transactions or debts that occur on the account, even if you did not authorize or benefit from them, which is fraught with the risk of default.

You are also vulnerable to fraud, as your partner or a third party could access or misuse your account without your knowledge or consent.

What You Need to Know Before You Merge Your Finances

Before you merge your finances, here are some things you need to know:

Be honest and transparent

The first thing you need to know before you merge your finances is to be honest and transparent with your partner. You must disclose your income, expenses, assets, liabilities, credit scores, and financial habits.

Also, share your financial values, needs, and wants and how you relate to your goals. By being honest and transparent, you can create a common vision and a mutual understanding of your financial situation and expectations.

Get on the same page.

You also need to set some ground rules, such as how much money you can spend without consulting each other, how often you will review your finances, and how you will handle any changes or challenges that may arise.

You can avoid misunderstandings, conflicts, and resentment by getting on the same page.

Prioritize and rank your goals

You must decide which goals are short-term or long-term, which are essential, and which are optional. Short-term goals are those you hope to complete within a year, such as saving for a vacation, a car, or a wedding.

You hope to achieve long-term goals in more than a year, such as saving for a house, a family, or retirement. Essential goals are those that must be met to maintain financial stability, such as debt repayment, emergency fund building, or retirement investment.

Optional goals include helping each other with their education, careers, or personal development and giving back to the community or a cause that is important to them. By prioritizing and ranking your goals, you can focus on the most important and urgent ones and allocate your resources accordingly.

Create a realistic and flexible budget

You need to plan how much money you will earn, spend, save, and invest each month and how you will balance your individual and shared needs and wants. You must track and review your income, expenses, savings, and investments regularly and compare them with your budget and goals.

Be open to each other’s feedback and suggestions and willing to make changes or compromises if necessary. Creating a realistic and flexible budget ensures you meet your goals and needs while maintaining your financial privacy.

Protect yourself and your partner

The next thing you should know before merging your finances is to protect yourself and your partner. You should be aware of the risks associated with merging your finances, such as fraud, debt, or legal issues.

You must take certain steps to protect your money and your rights, such as properly filing taxes, updating nominees in your accounts, and, most importantly, obtaining adequate insurance coverage to avoid burdening your partner in the event of an unfortunate incident. Protecting yourself and your partner can help you reduce stress, uncertainty, and vulnerability.

Key Takeaways

Merging your finances with your partner is an important move that impacts your relationship and the overall quality of life. It can provide numerous benefits, including simplified budgeting, easy access to funds, streamlined bill payment, shared savings, and increased borrowing power.

However, it may also bring challenges, such as reduced financial independence, privacy, and flexibility, potential conflicts, resentment, power imbalances, and exposure to financial risks.

Merging your finances is not a universal solution; it calls for open communication, agreements, and shared accountability. If done correctly, it can help you strengthen your bond, trust, and teamwork; however, if done improperly, it can ruin your finances.

So, be wise and remember to run the checks we recommended above to help you seamlessly merge your finances and achieve your couple’s goals.

FAQs

What are some alternatives to having a joint account as a live-in couple?

You can keep separate accounts and split the bills proportionally, have one joint account for shared expenses and separate accounts for personal spending, or use a combination of joint and separate accounts that suits your needs.

How do we open a joint account as a live-in couple?

Mostly, all banks allow you to open joint accounts by providing your personal information, proof of identity, and proof of address. But, you need to agree on the type of account, the amount of deposit, and the terms and conditions of the account.

How do we manage a joint account as a live-in couple?

You can manage a joint account by setting up online or mobile banking. You can also use online tools to track your spending and savings. You should review your account statements regularly and communicate with your partner about any changes or issues.

How do we close a joint account as a live-in couple?

You can close a joint account by giving your joint consent to close the account. You may need to withdraw or transfer the remaining balance and pay any fees or charges as the Bank mandates.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/