Introduction

The TVS Supply Chain IPO just closed on 14th August 2023. If there is one thing that the world is taking seriously in the aftermath of the pandemic, it is how inefficient and fragmented the supply chain systems on which they relied were. And how they can fix the entire system.

The development of an efficient global supply chain system has taken center stage. It is why companies like TVS Supply Chain Solutions are trying to address the issue with its Integrated Supply Chain Solutions and Network Solutions.

TVS Supply Chain IPO

TVS Supply Chain Solutions intends to raise ₹880 crores at the upper price band. The issue consists of up to ₹750 crores in fresh issuance of equity shares, with the remaining amount raised through the OFS route, in which 22 shareholders are selling their stakes. The IPO closed on 14th August 2023, and the issue was oversubscribed by 2.78 times.

| IPO Status | Closed on 14th August 2023 |

| IPO Date | 10th-14th August 2023 |

| Total IPO Size | ₹880 crores ( up to ₹750 cr fresh issue and remaining through OFS) |

| Issue Type | Book Built |

| Issue Price Band | ₹187 to ₹197 |

| Lot Size | 76 |

| IPO listing at | NSE & BSE |

| Listing Date | 23rd August 2023 |

| Face Value per Equity Shares | ₹1 |

The TVS Supply Chain listing price will be available only when the business lists on the exchange. The basis of allotment will be finalized on 18th August 2023, and shares will be credited to the Demat account of eligible shareholders on 22nd August.

Introduction to TVS Supply Chain Solutions

TVS Supply Chain Solutions (TVS SCS) is a part of TVS Mobility Group, which has interests in rubber, automotive components, logistics, and mobility solutions with collective annual revenue of over $2 billion. It commenced operations as TVS Logistics in 1995 before being incorporated as a separate company.

The company has developed expertise in managing large and complex supply chains across multiple industries in India and select global markets through tech-enabled solutions, enabling large-scale agile, and efficient supply chains.

TVS Supply Chain Solutions provide end-to-end capabilities in supply chain and logistics management and offers services under two segments:

- Integrated Supply Chain Solutions (ISCS)

- Network Solutions (NS)

The Integrated Supply Chain Solutions segment includes sourcing and procurement, integrated transportation, logistics operation centers, in-plant logistics operations, finished goods, aftermarket fulfillment, and supply chain consulting. And the Network Solutions segment includes global forwarding solutions (GFS).

In FY22, the company provided supply chain solutions to 10,531 customers worldwide and 1044 in India. And, for the nine months period ending in December 2022, it provided services to 8,115 customers globally and 733 customers in India.

Its clientele list includes 72 global and 25 Indian customers from the ‘Fortune Global 500 2022’ list, including Sony India Private Limited, Hyundai India, Ashok Leyland, TVS Motor, Johnson Controls-Hitachi Air Conditioning, and others. Furthermore, it provides services in 26 countries and employs over 17,600 people.

TVS Supply Chain Management Personnel

TVS Mobility Group is managed by T S Rajam family members, fourth-generation descendants of TVS Group founder T V Sundaram Iyengar.

- Mr. Mahalingam Seturaman is the Chairman and Independent Director of the company. He is an associate member of ICAI and has been associated with the company since February 2015.

- Mr. R Dinesh is the Executive Vice Chairman and the fourth generation of TVS family members. He has been with the company since its inception and is in charge of its overall operations, including strategic growth initiatives and expansion plans.

- Mr. Ravi Viswanathan is the Managing Director in charge of strategy formulation and execution. Before joining TVS SCS, he worked in the TATA group for over 33 years, holding various positions in the Tata group of companies.

- Mr. Ravi Prakash is the Global CFO in charge of Group Finance and Controlling strategy and operational functions across all global entities. He has over 25 years of diverse experience in Finance and Strategy and has worked with global companies like Pfizer, Coca-Cola, and P&G India.

- Mr. E. Balaji is the Global Chief Human Resource Officer responsible for all HR strategic and transformative functions across business units.

The company has named CEOs for each region (India, Europe, and North America) and key business units (GFS and Rico), who are all in charge of the growth of their respective regions and business units.

Financials

Revenue

In FY22, the company’s total income was ₹9,299.9 crores. The following table shows the revenue distribution by geography and percentage share of revenue from operations.

| Geography | FY20 (in ₹ cr) % of total revenue | FY21 (in ₹ cr) % of total revenue | FY22 ( in ₹ cr) % of total revenue | 9MFY23 (in ₹ cr) % of total revenue |

| India | 1,927.3 (29.18%) | 1,673.1 (24.13%) | 2,436.8 (26.34%) | 2,335.04 (29.73%) |

| Rest of World | 4,677.1 (70.82%) | 5,260.4 (75.87%) | 6,812.9 (73.66%) | 5,520.10 (70.27%) |

| Total | 6,604.5 | 6,933.5 | 9,249.7 | 7,855.1 |

| FY20 (in ₹ cr) | FY21(in ₹ cr) | FY22 (in ₹ cr) | 9MFY23 (in ₹ cr) | |

| EBITDA | 243.4 | 386.6 | 612.5 | 513.8 |

| EBITDA Margin | 3.69% | 5.58% | 6.62% | 6.54% |

Profit After Tax

The company reported a net profit of ₹54.11 crores in 9MFY23, compared to a loss of ₹63.9 crores in the same period the previous year.

| FY20 (in ₹ cr) | FY21 (in ₹ cr) | FY22 (in ₹ cr) | 9MFY23 (in ₹ cr) | |

| Profit / (Loss) | (248) | (76.34) | (45.8) | 54.11 |

Return on Capital Employed (ROCE)

| FY20 | FY21 | FY22 | 9MFY23 | |

| ROCE | (3.99%) | (4.56%) | 6.65% | 6.95% |

TVS Supply Chain Solutions Growth Potential

Supply chain and logistics management is one of the most underserved sectors of the Indian economy. The logistics cost in India is 13% of GDP, compared to 8% in the rest of the world, making Indian exports difficult to compete globally. And it’s highly fragmented and unorganized compared to developed markets.

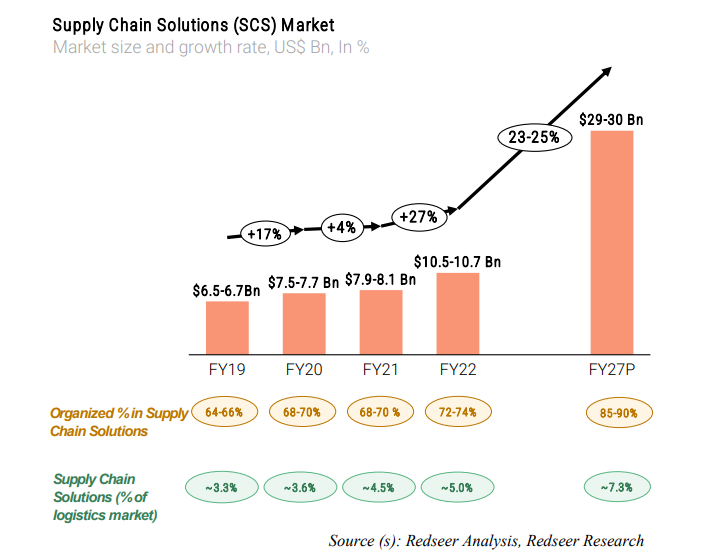

Furthermore, supply chain solutions is a nascent market in India with approximately less than 5% penetration, compared to 11% in the developed market in FY22.

TVS SCS is more focused on the supply chain solutions market, which is more organized and has better growth potential compared with the logistics market. The supply chain solutions market is projected to grow at a CAGR of 22% between FY22 and FY27, compared to 6% for the logistics market.

Key factors that will drive growth in the supply chain solutions market:

- The manufacturing industry growing more rapidly, resulting in increasing complexity of supply chains

- Favorable policy support by the government (PM Gati Shakti, National Logistics Policy)

- Increased demand for customized supply chain solutions from large industry players

- Increasing need for data insight and other value-added services provided by supply chain solutions. For example, real-time tracking of products, demand forecasting, inventory planning, procurement management, etc.

What Makes TVS Supply Chain the Right Player at the Right Time?

TVS SCS is the pioneer in developing India’s supply chain solutions market. It introduced the concept of 4PL- Solutions provider administers the entire supply chain (around 2010) and integrated supply chain solutions (around 2015).

Over the years, through developing in-house expertise and strategic acquisitions of businesses, TVS SCS has become a leading and preferred player in the market. The company has made over 20 acquisitions globally over the last 16 years and successfully integrated these acquisitions into the businesses.

Factors that differentiate TVS SCSS from other players:

● TVS Group lineage, culture, and philosophy

● Asset-light operations

● Leader in end-to-end solutions enabled by domain expertise, global network, and knowledge base

● Strong in-house technology differentiation

● Long-term customer relationship. In FY22, the top 10 revenue customers had an average relationship length of 10.9 years in the ISCS segment and 10.5 years in the NS segment.

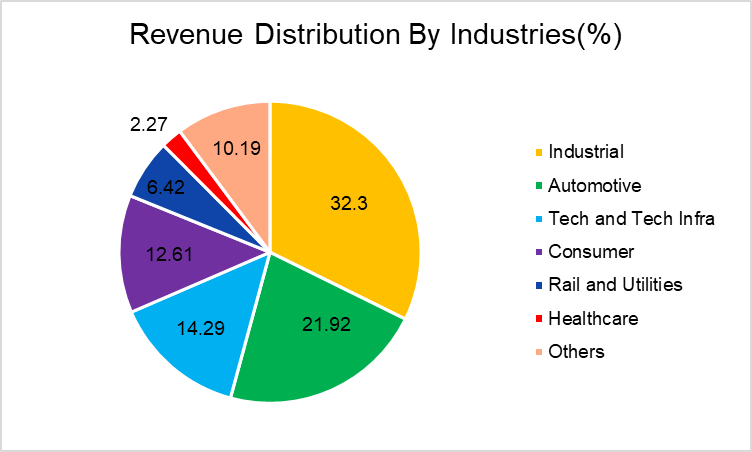

● Diversified revenue base. In FY22, the top 10 customers accounted for 25% of revenue.

Improving Margins

In the last three years, the company has registered notable improvement in margins. The ROCE has improved from negative 4.56% in FY22 to positive 6.95% in 9MFY23.

However, the company has a total debt of ₹1,860.8 crores on its book, and all the borrowings are related to working capital requirements. The debt-to-equity ratio at the end of 31st December 2022 stands at 2.42 times.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

FAQs

What is the status of the TVS Supply Chain IPO?

TVS supply chain IPO closed on 14th August 2023 and is oversubscribed by 2.78 times. The IPO will be listed on 23rd August 2023.

Is TVS Supply Chain part of TVS Group?

TVS Supply Chain is a part of TVS Mobility Group, a holding company for businesses managed by the T S Rajam family members, one of the branches of the TVS family.

What does TVS Supply Chain do?

TVS Supply Chain is involved in end-to-end supply chain management for large industry players managing complex supply chain systems, global forwarding, and last-mile solutions.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.9 / 5. Vote count: 15

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/